Stocks

ApeCoin rebounds after APE price crashes 80% in two weeks: Dead cat bounce or bottom?

ApeCoin (APE) has undergone a sharp recovery after falling to its lowest level in two months. But its strong correlation with Bitcoin (BTC) and U.S. equities amid macro risks suggests more losses could be in store. APE rebounds after 80% losses in two weeks APE rebounded by nearly 45% to $7.30 on May 12. The upside retracement move came after APE dropped circa 81% to $5 on May 11, from its record high near $27.50, established on April 28. The seesaw price action mirrored similar volatile moves elsewhere in the crypto market, led by the chaos around TerraUSD (UST) — an “algorithmic stablecoin” whose value plunged to $0.23 earlier this week, and the Federal Reserve’s hawkish response to rising inflation. APE/USD versus USTUSD. Source: TradingView Meanwhile, the correla...

Altcoins stage a relief rally while Bitcoin traders decide whether to buy the dip

The similarity in price action between the crypto and traditional financial markets remains quite strong on May 10 as traders enjoyed a relief bounce across asset classes following the May 9 rout, which saw Bitcoin (BTC) briefly dip to $29,730. Market downturns typically translate to heavier losses in altcoins due to a variety of factors, including thinly traded assets and low liquidity, but this also translates into larger bounces once a recovery ensues. Daily cryptocurrency market performance. Source: Coin360 Several projects notched double-digit gains on May 10, including a 15.75% gain for Maker (MKR), the protocol responsible for issuing the DAI (DAI) stablecoin, which likely benefited from the fallout from Terra (LUNA) and its TerraUSD (UST) stablecoin. Other notable gainers incl...

Terra price key support level breaks after 30% weekly drop — more pain for LUNA ahead?

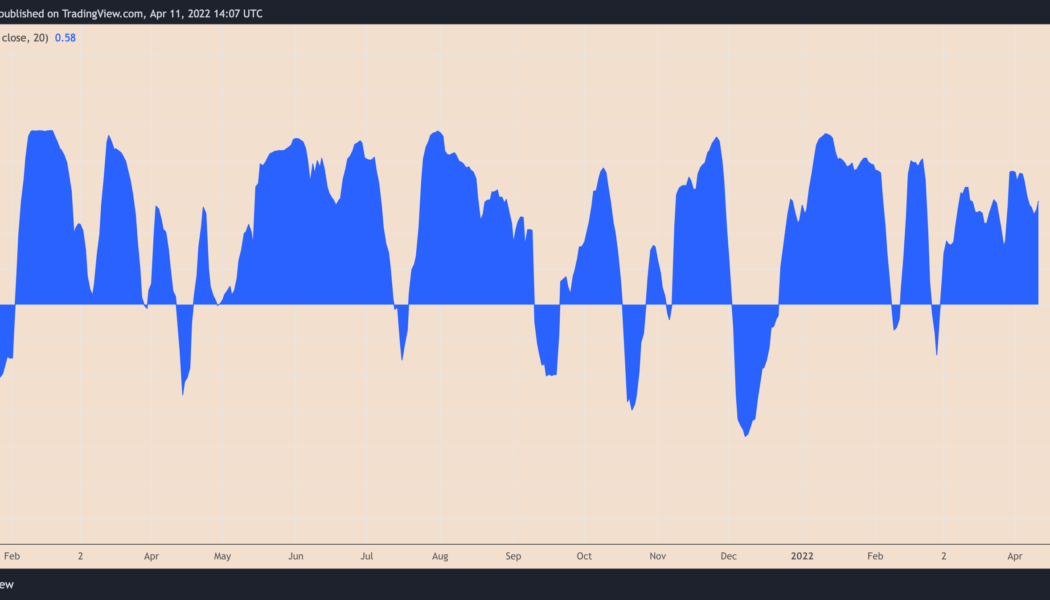

Terra (LUNA) price slid on April 11 as a broader correction across crypto assets added to the uncertainties concerning its token burning mechanism. Bitcoin (BTC) and Ether (ETH) led to a decline in the rest of the cryptocurrency market, with LUNA’s price dropping by over 8% to nearly $91.50, and about 30% from its record high of $120, set on April 6. The overall drop tailed similar moves in the U.S. stock market last week after the Federal Reserve signaled its intentions to raise interest rates and shrink balance sheets sharply to curb rising inflation. Arthur Hayes, the co-founder of BitMEX exchange, said Monday that Bitcoin’s correlation with tech stocks could have it run for $30,000 next. In other words, LUNA’s high correlation with BTC so far this year puts it at risk...

BTC stocks correlation ‘not what we want’ — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts the second week of April with a whimper as bulls struggle to retain support above $40,000. After a refreshingly low-volatility weekend, the latest weekly close saw market nerves return, and in classic style, BTC/USD fell in the final hours of April 10. There is a feeling of being caught between two stools for the average hodler currently — macro forces promise major trend shifts but are being slow to play out. At the same time, “serious” buyer demand is also absent from crypto assets more broadly. However, those on the inside show no hint of doubt about the future, as evidenced by all-time high Bitcoin network fundamentals and more. The combination of these opposing factors is price action that simply does not seem to know where to go next. Can something change in the ...

Galaxy Digital delays BitGo acquisition to later on in 2022

Cryptocurrency investment firm Galaxy Digital has not managed to finalize the acquisition of the digital asset custodian BitGo in the first quarter of 2022 as the firm originally planned. Galaxy Digital has made some changes to the terms of its acquisition of BitGo, CEO Mike Novogratz announced in an earnings call on Thursday. “We’ve adjusted the deal some, for progress that BitGo has made,” Novogratz said, noting that BitGo has hired about 150 people since the firms originally signed the deal in May last year. He added that Galaxy remains committed to “integrating BitGo and becoming an institutional crypto platform” and the companies will continue to work on integration. According to an official statement, Galaxy Digital and BitGo have renegotiated the acquisition to happen “immediately f...

ETF provider WisdomTree launches Solana, Cardano, Polkadot ETPs

The American exchange-traded fund (ETF) provider WisdomTree continues expanding its cryptocurrency products in Europe by launching three new crypto exchange-traded products (ETP) backed by Solana (SOL), Cardano (ADA) and Polkadot (DOT). WisdomTree announced Tuesday the launch of three new physically-backed crypto ETPs, including WisdomTree Solana (SOLW), WisdomTree Cardano (ADAW) and WisdomTree Polkadot (DOTW). The ETPs are already listed on major European digital exchanges like Deutsche Boerse’s Xetra, the Swiss SIX exchange and the Swiss Stock Exchange. The pan-European exchange Euronext is expected to list the crypto ETPs in Amsterdam and Paris on Thursday, the announcement notes. The ETPs are designed to offer investors in Europe another option to gain exposure to the price of Solana, ...

Cryptocurrency vs. Stocks: Key differences explained

Both the crypto and the stock markets are volatile and subject to external influences. However, there are also differences between them. When we’re talking about cryptocurrency vs. stocks, there is a big difference in how they are traded. Cryptocurrency can be bought at a cryptocurrency exchange, whereas you can buy stocks at the stock exchange. Of course, there are differences in the exchanges and opening hours, as previously described. Normally, the crypto market is more volatile than the stock market. However, the stock market is also subject to volatility due to interest rate changes and uncertain situations like war, inflation rate and monetary policy changes. But, what about trading costs in cryptocurrency vs. stocks? Basically, transaction fees do not a...

Crypto miner Hut 8 posts record revenue as BTC holdings surge 100%

Canadian cryptocurrency miner Hut 8 posted mixed financial results on Thursday, as revenue and mining profitability soared while overall net income declined — underscoring a volatile end to the year for Bitcoin (BTC) and the broader digital asset market. The Toronto-based company, which trades publicly on the Nasdaq and TSX, saw its revenues surge to $45.69 million ($57.901 million CAD) in the fourth quarter of 2021, up from $10.25 million ($12.986 million CAD) the year before. Full-year revenues were $137.1 million, up 326% compared with 2020. Despite generating a large profit from mining activities, the company posted an overall loss of $0.53 ($0.67 CAD) per share in the fourth quarter. Losses amounted to $0.43 ($0.54 CAD) per share in all of 2021. Shares of Hut 8, which trade unde...

Exodus crypto wallet starts trading on SEC-registered platform

Major software cryptocurrency wallet Exodus has gone public on the digital asset securities firm Securitize Markets following a $75 million crowdfund capital raise. Exodus’ shares started trading on Securitize on Wednesday, allowing investors from all across the United States and international investors from more than 40 countries to trade the Exodus Class A common stock. Trading under the ticker symbol EXOD, the Exodus Class A common stock is digitally represented on the Algorand blockchain via common stock tokens. Tokenized shares in @Exodus_io are now trading on Securitize Markets. Retail investors included! With 24-7 order placement, 8am-8pm ET trading hours, near-instant deposits and promotional $0 fee trading, get started here: https://t.co/h55WEoAQMr pic.twitter.com/JasA5C7Qbx — Sec...

Crypto-related stocks jump in positive reaction to executive order

The stock prices of crypto-related companies have jumped as the broader market reacted positively to President Joe Biden’s long-awaited executive order requiring US federal agencies to create a regulatory framework for digital assets, as well as exploring a future digital dollar. Coinbase (COIN) surged, up 10.5% at market close, while shares in Bitcoin-evangelist Michael Saylor’s MicroStrategy (MSTR) posted a 6.4% gain, according to TradingView. Blockchain-related exchanged-traded funds (ETFs) also enjoyed the markets’ renewed confidence in crypto, with ProShares Bitcoin Strategy ETF (BITO) gaining 10% and Valkyrie Bitcoin Strategy ETF (BTF) closing up 10.3%. Cryptocurrency mining companies enjoyed the largest gains with Riot Blockchain Inc. (RIOT) shares up 11.2% and Marathon Digital Hold...

Bitcoin stuck under $40K, but BTC price hits another all-time high vs. Russian ruble

Bitcoin (BTC) recovered from one-week lows on March 8 after a lack of progress in Russia-Ukraine talks that sent markets tumbling. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Commodities “trading like meme stocks” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD bouncing at $37,170 on Bitstamp after Monday‘s Wall Street open. Overnight progress maintained support with the pair trading at around $38,500 at the time of writing. Crypto and stocks reacted badly to the lack of consensus that ended the third round of negotiations to end hostilities between Russia and Ukraine. “There are small positive subductions in improving the logistics of humanitarian corridors… Intensive consultations have continued on the basic political block of the regulations, alo...

Bitcoin heading to 36K, analysis says amid warning global stocks ‘look expensive’

Bitcoin (BTC) headed lower into the weekly close on March 6 with geopolitical tensions and associated macro weakness firmly in focus. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Could 2022 bring a “Greater Depression”? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting its lowest levels in over a week Sunday after volatility returned overnight. The pair was in the process of testing $38,000 support at the time of writing, with three-day losses approaching 12%. Despite the “out of hours” trading environment, the trend was clearly down for the largest cryptocurrency, as the mood on global equities wobbled among analysts. “Global equities have lost $2.9tn in mkt cap this week as war could trigger major stagflationary sh...