Stocks

‘Worst quarter ever’ for stocks — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week still battling for $20,000 support as the market takes in a week of severe losses. What felt all but impossible just weeks ago is now a reality as $20,000 — the all-time high from 2017 to 2020 — returns to give investors a grim sense of deja vu. Bitcoin dipped as low as $17,600 over the weekend, and tensions are running high ahead of the June 20 Wall Street open. While BTC price losses have statistically been here before — and even lower — concerns are mounting for network stability at current levels, with attention particularly focused on miners. Add to that the consensus that macro markets have likely not bottomed, and it becomes understandable why sentiment around Bitcoin and crypto is at record low levels. Cointelegraph takes a look at some major areas o...

Samsung Asset Management to launch blockchain ETF in Hong Kong

Hong Kong-based Samsung Asset Management (SAMHK), a local subsidiary of Samsung’s investment arm, is moving forward with a blockchain-themed exchange-traded fund (ETF). The firm expects to launch its Samsung Blockchain Technologies ETF on the Hong Kong Stock Exchange on June 23, SAMHK announced on Thursday. The ETF seeks to achieve long-term capital growth by investing in stocks of companies actively involved in the development and adoption of blockchain technologies, the fund prospectus reads. The fund will invest in blockchain-related research and development firms, data providers, industry investment firms and others. The ETF’s composition will be managed by SAMHK’s portfolio management team, responsible for filtering out firms with “small market capitalization or low trading volume.”&n...

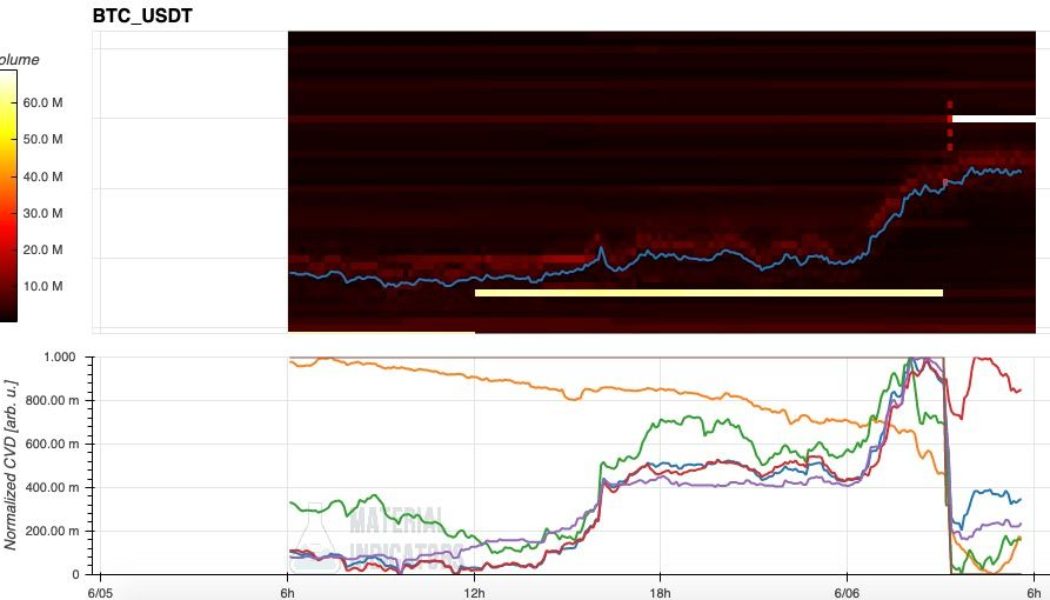

Coinbase balance drops by 30K BTC as Bitcoin price nurses 6% losses

Bitcoin (BTC) held steady at the June 7 Wall Street open after a night of losses cost bulls heavily. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Coinbase sees conspicuous outflows Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it ranged near $30,000, still down 6% versus its prior highs. After underperforming versus United States equities on June 6, the pair nonetheless managed to avoid falling further in step with stocks. At the time of writing, the S&P 500 was down 0.6% from the open, with the Nasdaq Composite Index 0.5% lower. Analyzing order book data, on-chain analytics resource Material Indicators noted that a wall of bids from a whale “spoofing” the market in recent days had finally dissipated. Earlier, that entity had posted a support li...

BTC price snaps its longest losing streak in history — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week with some fresh hope for hodlers after halting what has been the longest weekly downtrend in its history. After battling for support throughout the weekend, BTC/USD ultimately found its footing to close out the week at $29,900 — $450 higher than last Sunday. The bullish momentum did not stop there, with the pair climbing through the night into June 6 to reach multi-day highs. The price action provides some long-awaited relief to bulls, but Bitcoin is far from out of the woods at the start of what promises to be an interesting trading week. The culmination will likely be United States inflation data, this itself a yardstick for the macroeconomic forces at world globally. As time goes on, the impact of anti-COVID policies, geopolitical tensions and supply shor...

5 reasons why Bitcoin could be a better long-term investment than gold

The emergence of forty-year high inflation readings and the increasingly dire-looking global economy has prompted many financial analysts to recommend investing in gold to protect against volatility and a possible decline in the value of the United States dollar. For years, crypto traders have referred to Bitcoin (BTC) as “digital gold,” but is it actually a better investment than gold? Let’s take a look at some of the conventional arguments investors cite when praising gold as an investment and why Bitcoin might be an even better long-term option. Value retention One of the most common reasons to buy both gold and Bitcoin is that they have a history of holding their value through times of economic uncertainty. This fact has been well documented, and there’s no denying that gold has ...

Bitcoin ends week ‘on the edge’ as S&P 500 officially enters bear market

Bitcoin (BTC) struggled to recover its latest losses on May 21 after Wall Street trading provided zero respite. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC price reflects drab stocks performance Data from Cointelegraph Markets Pro and TradingView showed BTC/USD trading at dipping below $28,700 into the weekend, subsequently adding around $500. Down 4.7% from the previous day’s $30,700 highs, the pair looked firmly rangebound at the time of writing after United States stocks indices saw a volatile final trading day of the week. The S&P 500, managed to reverse after initially falling at the open, nonetheless confirmed bear market tendencies, trading at 20% below its highs from last year. The S&P 500 has officially entered a bear market pic.twitter.com/N...

20% drop in the S&P 500 puts stocks in a bear market, Bitcoin and altcoins follow

Whoever coined the phrase “sell in May and go away” had brilliant insight and the performance of crypto and stock markets over the past three weeks has shown that the expression still rings true. May 20 has seen a pan selloff across all asset classes, leaving traders with few options to escape the carnage as inflation concerns and rising interest rates continue to dominate the headlines. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) taking on water below $29,000 and traders worry that losing this level will ensure a visit to the low $20,000s over the coming week. BTC/USDT 1-day chart. Source: TradingView As reported by Cointelegraph, some analysts warn that BTC could possibility decline to $22,700 based on its historical price performance fo...

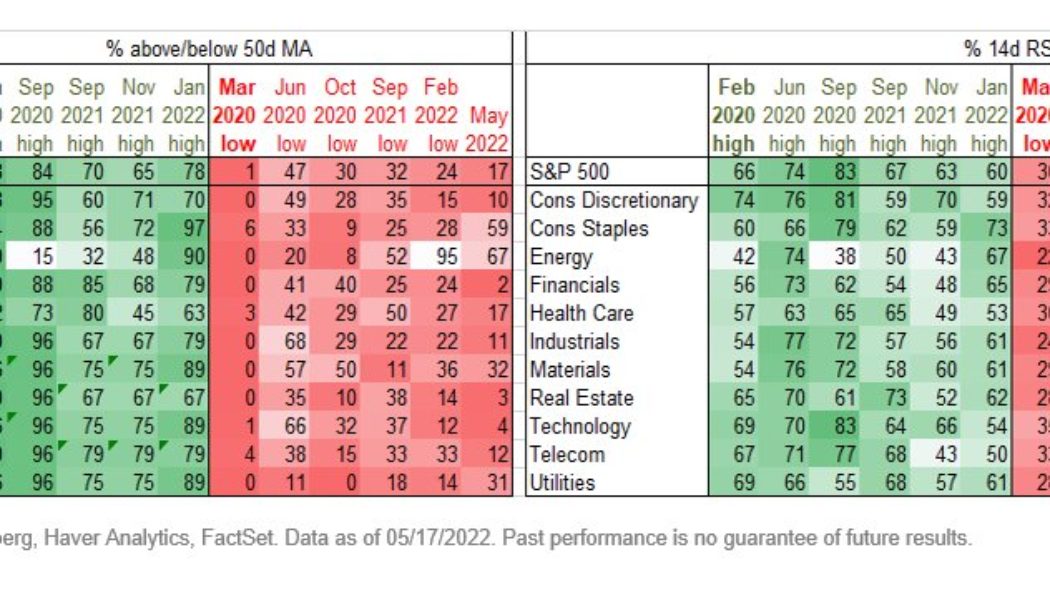

Analysts note parallels with March 2020: Will this time be different?

Analysts in both crypto and traditional markets have noted some startling similarities between the recent downturn and the one caused by a pandemic panic in March, 2020. The real question is whether it’s the start of a larger downturn or if there will be a significant bounce-back as in 2020 that led to an extended bull run in both crypto and stocks markets. Podcaster and author of The Pomp Letter, Anthony “Pomp” Pompliano is on the permabull side of the ledger, tweeting on May 18 that since March 1, 2020 when one Bitcoin cost about $8,545, “Bitcoin is up 340%.” Bitcoin is up 340% since March 1, 2020. As central banks around the world devalued their currencies at a historic rate, there is only one asset that stood out from the pack.#bitcoin is the savings technology that shields billions of...

$1.9T wipeout in crypto risks spilling over to stocks, bonds — stablecoin Tether in focus

The cryptocurrency market has lost $1.9 trillion six months after it soared to a record high. Interestingly, these losses are bigger than those witnessed during the 2007’s subprime mortgage market crisis — around $1.3 trillion, which has prompted fears that creaking crypto market risk will spill over across traditional markets, hurting stocks and bonds alike. Crypto market capitalization weekly chart. Source: TradingView Stablecoins not very stable A massive move lower from $69,000 in November 2021 to around $24,300 in May 2022 in Bitcoin’s (BTC) price has caused a selloff frenzy across the crypto market. Unfortunately, the bearish sentiment has not even spared stablecoins, so-called crypto equivalents of the U.S. dollar, which have been unable to stay as “stable” a...

Robinhood shares spike 30% after Sam Bankman-Fried buys $650M stake

Sam Bankman-Fried, the billionaire founder and CEO of cryptocurrency exchange FTX has acquired a substantial 7.6% stake in the popular online brokerage, Robinhood. The news was well received by the market, with Robinhood’s (HOOD) stock price initially soaring over 30% in after hours trading. At the time of writing the price has settled to a 24% overall gain. According to a securities filing made with the Securities and Exchange Commission on Thursday, Bankman-Fried purchased a total of $648 million in Robinhood shares at an average price of $11.52. The purchases disclosed by Bankman-Fried reportedly began in mid-March and continued through until Wednesday. In the securities filing, Bankman-Fried made it clear that he had, “no intention of taking any action toward changing or influenc...