Stocks

US stocks lose $1.25T in a day — more than entire crypto market cap

Bitcoin (BTC) and altcoins lost big on Aug. 26 after the United States Federal Reserve delivered hawkish remarks on economic policy. Across the board, risk assets took a major hit — U.S. equities shed around $1.25 trillion in a single session. Analyst: Powell retiring “soft landing” rhetoric As comments by Fed Chair, Jerome Powell, suggested that larger rate hikes were still firmly on the table despite recent data hinting that inflation was already slowing, investors rushed to cut risk. “Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy,” Powell said at the annual Jackson Hole economic symposium. The S&P 500 closed down 3.4% on the...

A bullish Bitcoin trend reversal is a far-fetched idea, but this metric is screaming ‘buy’

Bitcoin (BTC) price remains pinned below $22,000 as the lingering impact of the Aug. 19 sell-off at $25,200 continues to be felt across the market. According to analysts from on-chain monitoring resource Glassnode, BTC’s tap at the $25,000 level was followed by “distribution” as profit-takers and short-term holders sold as price encountered a trendline resistance following a 23-consecutive-day uptrend that saw BTC trading above it’s realized price ($21,700). Bitcoin total inflows and outflows to all exchanges (USD). Source: glassnode The firm also noted that the “total inflows and outflows to all exchanges” metric shows exchange flows at multi-year lows and back to “late-2020 levels,” which reflects a “general lack of speculative interest.” Stocks and crypto clearly risk off until we...

Solana (SOL) price is poised for a potential 95% crash — Here’s why

Solana (SOL) price rallied by approximately 75% two months after bottoming out locally near $25.75, but the token’s splendid upside move is at risk of a complete wipeout due to an ominous bearish technical indicator. A major SOL crash setup surfaces Dubbed a “head-and-shoulders (H&S),” the pattern appears when the price forms three consecutive peaks atop a common resistance level (called the neckline). Notably, the middle peak (head) comes to be higher than the other two shoulders, which are of almost equal height. Head and shoulders patterns resolve after the price breaks below their neckline. In doing so, the price falls by as much as the distance between the head’s peak and the neckline when measured from the breakdown point, per a rule of technical analysis....

Solana (SOL) price is poised for a potential 95% crash — Here’s why

Solana (SOL) price rallied by approximately 75% two months after bottoming out locally near $25.75, but the token’s splendid upside move is at risk of a complete wipeout due to an ominous bearish technical indicator. A major SOL crash setup surfaces Dubbed a “head-and-shoulders (H&S),” the pattern appears when the price forms three consecutive peaks atop a common resistance level (called the neckline). Notably, the middle peak (head) comes to be higher than the other two shoulders, which are of almost equal height. Head and shoulders patterns resolve after the price breaks below their neckline. In doing so, the price falls by as much as the distance between the head’s peak and the neckline when measured from the breakdown point, per a rule of technical analysis....

Coinbase posts $1.1B loss in Q2 on ‘fast and furious’ crypto downturn

Crypto exchange giant Coinbase has cited a “fast and furious” downturn of the crypto markets as the reasons behind a staggering $1.1 billion net loss in the second quarter of 2022, which also saw trading volume and transaction revenue tumbling. It’s the second consecutive quarter of loss for the crypto company and the largest loss since its listing on the Nasdaq Stock Exchange (Nasdaq) in April 2021. The results, which also missed analyst expectations, were shared in a Q2 2022 Shareholder Letter from Coinbase on Aug. 9, stating: “The current downturn came fast and furious, and we are seeing customer behavior mirror that of past down markets.” Coinbase said that Q2 was a “tough quarter” with trading volume falling 30% and transaction revenue down 35% seque...

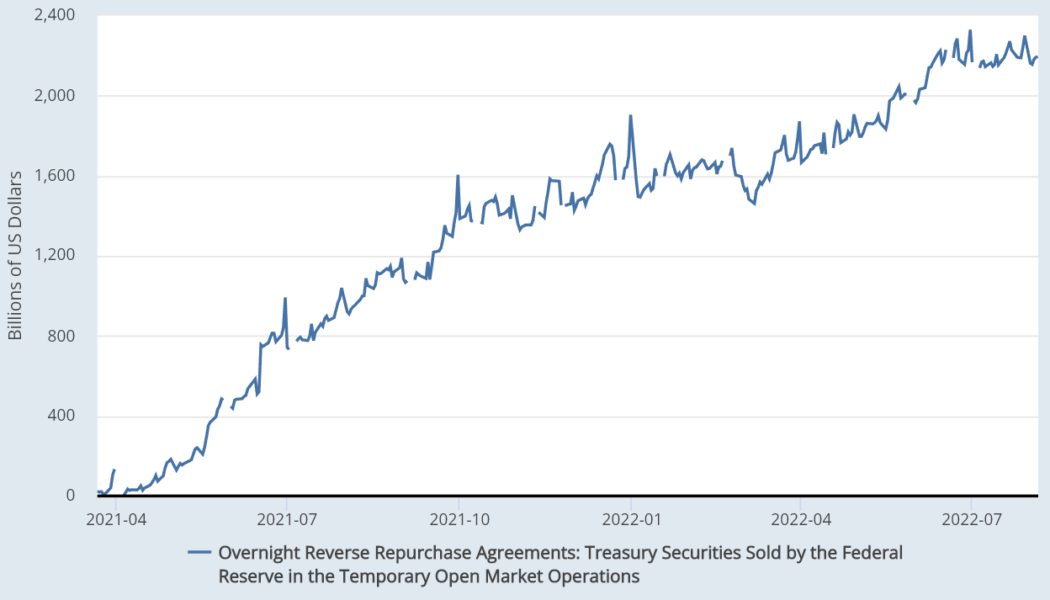

Fed reverse repo reaches $2.3T, but what does it mean for crypto investors?

The U.S. Federal Reserve (FED) recently initiated an attempt to reduce its $8.9 trillion balance sheet by halting billions of dollars worth of treasuries and bond purchases. The measures were implemented in June 2022 and coincided with the total crypto market capitalization falling below $1.2 trillion, the lowest level seen since January 2021. A similar movement happened to the Russell 2000, which reached 1,650 points on June 16, levels unseen since November 2020. Since this drop, the index has gained 16.5%, while the total crypto market capitalization has not been able to reclaim the $1.2 trillion level. This apparent disconnection between crypto and stock markets has caused investors to question whether the Federal Reserve’s growing balance sheet could lead to a longer than expecte...

Amid miner capitulation, Hut 8 maintained BTC ‘HODL strategy’ in July

Canadian Bitcoin (BTC) miner Hut 8 Mining Corp. added to its massive BTC reserves in July, as the firm maintained its long-term “HODL strategy” in the face of market volatility. The Alberta-based company generated 330 Bitcoin in July at an average production rate of 10.61 BTC per day, bringing its total reserves to 7,736 BTC. Its monthly production rate was equivalent to 113.01 BTC per exahash, the company disclosed Friday. Hut 8, which trades on the Nasdaq and Toronto stock exchanges, is one of the largest public holders of Bitcoin, according to industry data. As part of its ongoing HODL strategy, Hut 8 deposited all of its self-mined Bitcoin into custody, bucking the growing industry trend of miners selling portions of their reserves during the bear market. As Cointelegraph reported, Tex...

Best monthly gains since October 2021 — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week and a new month on a cautiously positive footing after protecting crucial levels. After an intense July in which macro factors provided significant volatility, BTC price action managed to provide both a weekly and monthly candle favoring the bulls. The road to some form of recovery continues, and at some points in recent weeks, it seemed like Bitcoin would suffer even harder on the back of June’s 40% losses. Now, however, there is already a sense of optimism among analysts, but one thing remains clear — this “bear market rally” does not mean the end of the tunnel yet. As Summer 2022 enters its final month, Cointelegraph takes a look at the potential market triggers at play for Bitcoin as it lingers near its highest levels since mid-June. Spot price snatches ...

Bitcoin price eyes $24K July close as sentiment exits ‘fear’ zone

Bitcoin (BTC) dropped volatility on the last weekend of July as the monthly close drew near. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView 200-week moving average in focus for July close Data from Cointelegraph Markets Pro and TradingView showed BTC/USD retaining $24,000 as resistance into July 30. The pair had benefitted from macro tailwinds across risk assets in the second half of the week, these including a flush finish for United States equities. The S&P 500 and Nasdaq Composite Index gained 4.1% and 4.6% over the week, respectively. With off-speak trading apt to spark volatile conditions into weekly and monthly closes thanks to thinner liquidity, however, analysts warned that anything could happen between now and July 31. “Just gonna sit back and watch the market up ...

Bitcoin price rejects at $24K as ‘classic short setup’ spoils bulls’ fun

Bitcoin (BTC) saw fresh volatility after July’s final Wall Street open as highs north of $24,000 remained solid resistance. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Resistance strikes BTC at $24,000 Data from Cointelegraph Markets Pro and TradingView reflected bulls’ continuing struggle as BTC/USD lurched around the $24,000 mark on July 29. The pair had attempted to match the week’s local top of $24,450, this ultimately failing to materialize as a resurgent U.S. dollar pressured crypto despite the gains of U.S. stocks . The U.S. dollar index (DXY) continued higher during the Wall Street trading, passing 106 after falling to its lowest levels since July 5. U.S. dollar index (DXY) 1-hour candle chart. Source: TradingView Record eurozone inflation&nbs...

Crypto Biz: Elon Musk: The ultimate crypto tourist

Elon Musk’s Tesla proved to be the ultimate paper hands after the electric vehicle maker sold 75% of its Bitcoin (BTC) holdings in the second quarter. I say, good riddance. The cult of personality isn’t good for Bitcoin, and neither is a technologist who treats the asset as his plaything. As far as we are aware, Musk hasn’t sold any of his personal Bitcoin stash and Tesla still has an estimated 10,800 BTC on its books. Still, the less we have to hear about Musk and Bitcoin, the better. In this week’s Crypto Biz, we chronicle Tesla’s sale of BTC, KuCoin’s fight against fake news and Cathie Wood’s sale of Coinbase stock. Tesla reports $64M profit from Bitcoin sale Tesla’s decision to sell most of its Bitcoin wasn’t as boneheaded as it appeared at first. The company scored a $64 million...

‘Game yet to begin’ for security token offerings, INX exec says

Despite some of the first security token offerings (STO) launching at least four years ago, the STO industry is still yet to take off, according to an executive at the INX cryptocurrency trading platform. The STO industry is still nascent compared to the overall digital asset industry as companies and individuals are just getting into the field, INX’s chief business officer Douglas Borthwick said in an interview with Cointelegraph. According to Borthwick, there is still a huge educational gap between those who are aware of STOs and those who have never heard of the term. Also known as a tokenized initial public offering (IPO), an STO is a type of public offering involving sales of tokenized digital securities, or security tokens, on security token exchanges. Security tokens can be used to ...