Stocks

Apple Music’s Price Hike Boosts Music Stocks

Universal Music Group, Hipgnosis Songs Fund and other music stocks got a much-needed boost on Tuesday (Oct. 25) following news of Apple Music’s price hike, as investors bet it would trigger a wave of streaming subscription cost increases. Universal Music Group’s stock closed 11.6% higher, Hipgnosis Songs Fund Ltd ended up 7.8% and Korean music companies SM Entertainment and HYBE finished the trading day 4.8% and 4.4% higher, respectfully, on Tuesday. On Monday, Apple announced that it was raising the standard U.S. and U.K. individual plan price to $10.99 from $9.99. This 10% price hike — Apple’s first — comes amid high inflation and a darkening economic environment in many global markets. If Apple can raise prices at a time like this, that is a sign the music industry can charge more ...

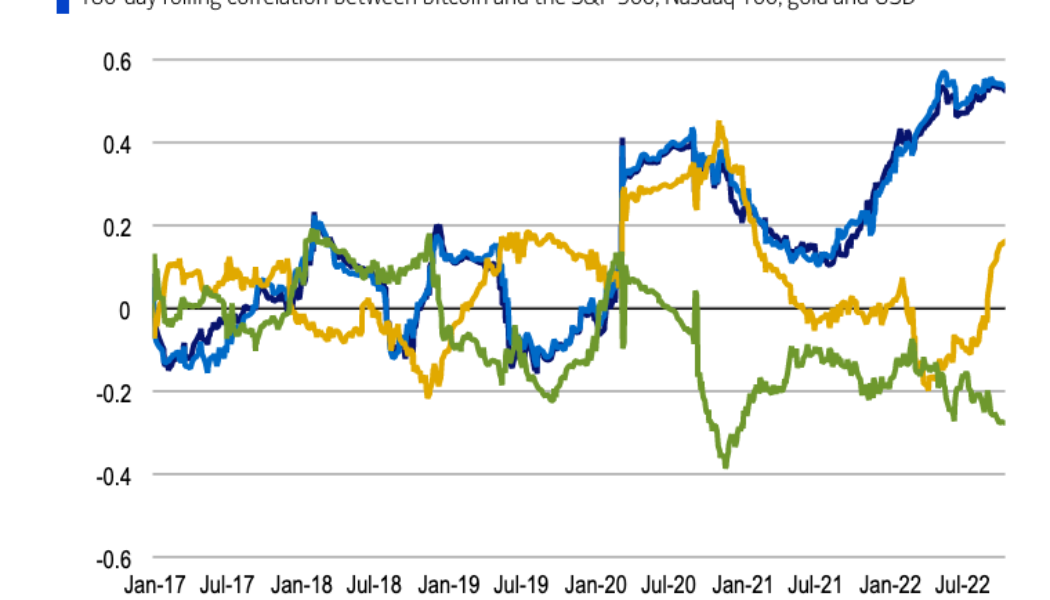

Gold vs BTC correlation signals Bitcoin becoming safe haven: BofA

Despite the ongoing cryptocurrency bear market, investors have been increasingly looking at Bitcoin (BTC) as a safe haven, a new study suggests. The rise in the correlation between Bitcoin and gold (XAU) is one of the major indicators demonstrating investors’ confidence in BTC amid the ongoing economic downturn, according to digital strategists at the Bank of America. Bitcoin’s correlation with gold — which is commonly viewed as an inflation hedge — has been on the rise this year, hitting its highest yearly levels in early October. The growing correlation trend started on Sept. 5 after remaining close to zero from June 2021 and turning negative in March 2022, BofA strategists Alkesh Shah and Andrew Moss said in the report. “Bitcoin is a fixed-supply asset that may eventually become an infl...

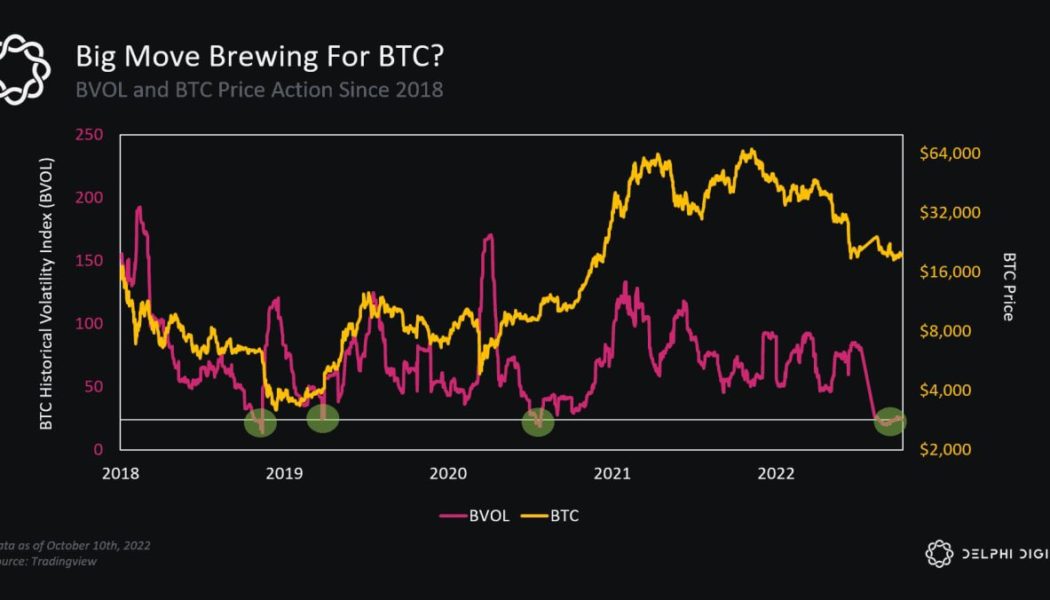

‘Get ready’ for BTC volatility — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week keeping everyone guessing as a tiny trading range stays in play. A non-volatile weekend continues a familiar status quo for BTC/USD, which remains just above $19,000. Despite calls for a rally and a run to lower macro lows next, the pair has yet to make a decision on a trajectory — or even signal that a breakout or breakdown is imminent. After a brief spell of excitement seen on the back of last week’s United States economic data, Bitcoin is thus back at square one — literally, as price action is now exactly where it was at the same time last week. As the market wonders what it might take to crack the range, Cointelegraph takes a look at potential catalysts in store this week. Spot price action has traders dreaming of breakout For Bitcoin traders, it is a ca...

Next few weeks are ‘critical’ for stock market and Bitcoin, analyst says

The stock market’s movements in the next few weeks will be critical for determining whether we are heading towards a short-term recession or a long term-one, according to forex trader and crypto analyst Alessio Rastani. During the October-December 2022 period, the analyst expects to see the S&P rallying. “If that bounces or rally fails and drops back down again, then very likely, we’re entering a long-term recession and something very close to similar to 2008”, said Rastani in the latest Cointelegraph interview. [embedded content] According to the analyst, such a recession could last until 2024 and would inevitably negatively impact the price of Bitcoin (BTC). Talking about the latest Pound sterling crisis, Rastani opined that its principal cause is the rally of...

Hot CPI report puts a dent in Bitcoin and Ethereum rally, stocks also lose ground

Crypto and stock markets are feeling the pain after the Sept. 13 inflation report printed an unexpectedly hot figure that showed headline inflation rising by 0.1% month-over-month. Even with gas prices falling to multi-month lows and a cooling housing market, core inflation saw a 0.6% month-over-month bump and year-to-year inflation sits at 8.3%. This chart from @TheTerminal shows why this #CPI number is so disappointing. The contribution of energy has declined, as expected; but services inflation is now rising sharply. Not what the #FOMC will have wanted to see. pic.twitter.com/BsfwFsuyD5 — John Authers (@johnauthers) September 13, 2022 While market participants and investors had estimated the next Federal Reserve interest hike to be a hefty 0.75 basis points, many also subscribed to a lo...

Bitcoin price cracks $21K as trader says BTC buy now ‘very compelling’

Bitcoin (BTC) circled $21,000 at the Sep. 9 Wall Street open as newly-won gains endured. Meanwhile, the total cryptocurrency market capitalization has crossed back above the $1 billion mark. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView BTC price gives “confirmation” of trend change Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as its “short squeeze” punished late bears. After a brief consolidation, the pair set new multi-week highs of $21,254 on Bitstamp, and now faced resistance in the form of an old support level abandoned in late August. For market commentators, however, the latest move had already proved decisive — and should favor bulls beyond short timeframes. “This impulse up is THE confirmation,” popular Twitter trader and ange...

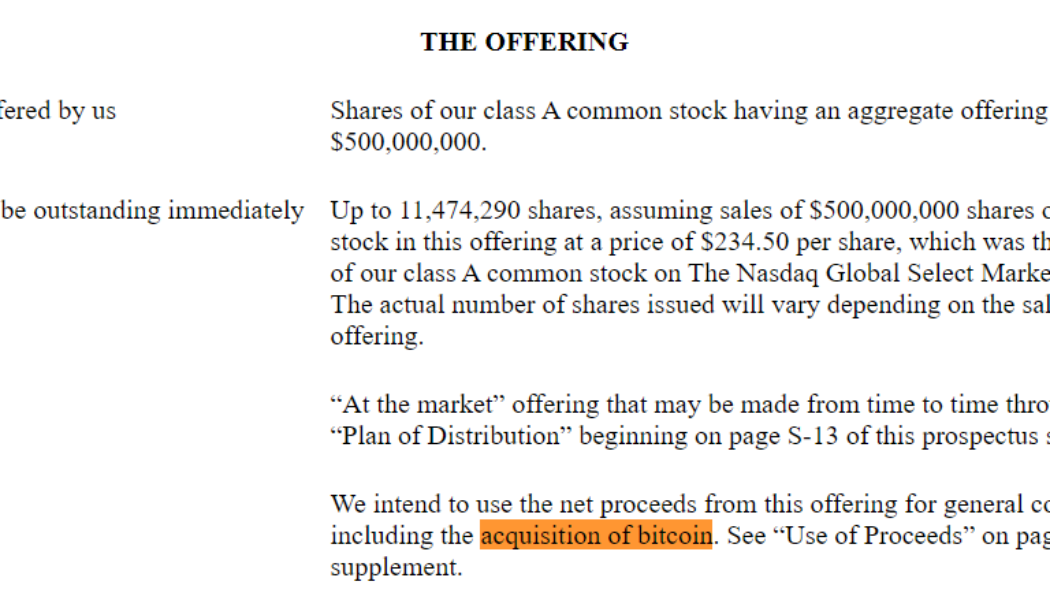

MicroStrategy to reinvest $500M stock sales into Bitcoin: SEC filing

MicroStrategy, the largest institutional Bitcoin (BTC) buyer, entered an agreement with two agents — Cowen and Company and BTIG — to sell its aggregated class A common stock worth $500,000,000, reveals Securities and Exchange Commission (SEC) filing. MicroStrategy, co-founded by Bitcoin bull Michael Saylor, amassed approximately 129,699 BTC over several years at an aggregate purchase price of $3.977 billion. Despite market uncertainties, the business analytics software firm continues to pursue its goal of acquiring more BTC by selling company stocks. The filing confirmed: “We intend to use the net proceeds from the sale of any class A common stock offered under this prospectus for general corporate purposes, including the acquisition of bitcoin, unless otherwise indicated in the applicable...

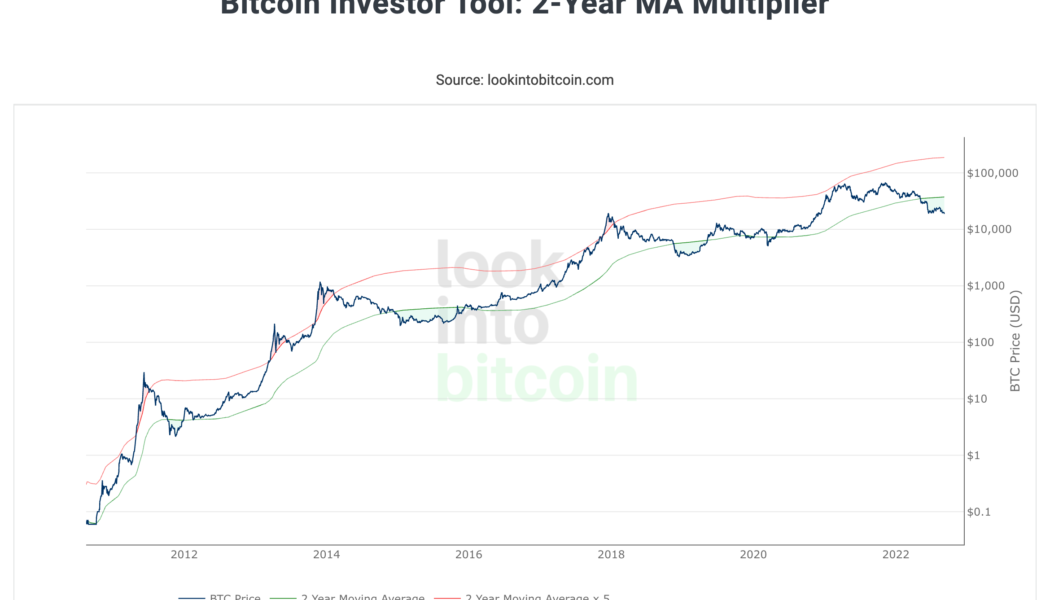

3 reasons why Bitcoin traders should be bullish on BTC

Bitcoin (BTC) has been in a rut, and BTC’s price is likely to stay in its current downtrend. But like I mentioned last week, when nobody is talking about Bitcoin, that’s usually the best time to be buying Bitcoin. In the last week, the price took another tumble, dropping below $19,000 on Sept. 6 and currently, BTC bulls are struggling to flip $19,000–$20,000 back to support. Just this week, Federal Reserve Chairman Jerome Powell reiterated the Fed’s dedication to doing literally whatever it takes to combat inflation “until the job is done,” and market analysts have increased their interest rate hike predictions from 0.50 basis points to 0.75. Basically, interest rate hikes and quantitative tightening are meant to crush consumer demand, which in turn, eventually leads to a decrease in...

Bitcoin’s in a bear market, but there are plenty of good reasons to keep investing

Let’s rewind the tape to the end of 2021 when Bitcoin (BTC) was trading near $47,000, which at the time was 32% lower than the all-time high. During that time, the tech-heavy Nasdaq stock market index held 15,650 points, just 3% below its highest-ever mark. Comparing the Nasdaq’s 75% gain between 2021 and 2022 to Bitcoin’s 544% positive move, one could assume that an eventual correction caused by macroeconomic tensions or a major crisis, would lead to Bitcoin’s price being disproportionately impacted than stocks. Eventually, these “macroeconomic tensions and crises” did occur and Bitcoin price plunging another 57% to $20,250. This shouldn’t be a surprise given that the Nasdaq is down 24.4% as of Sept. 2. Investors also must factor in that the index’s historical 120-day vo...

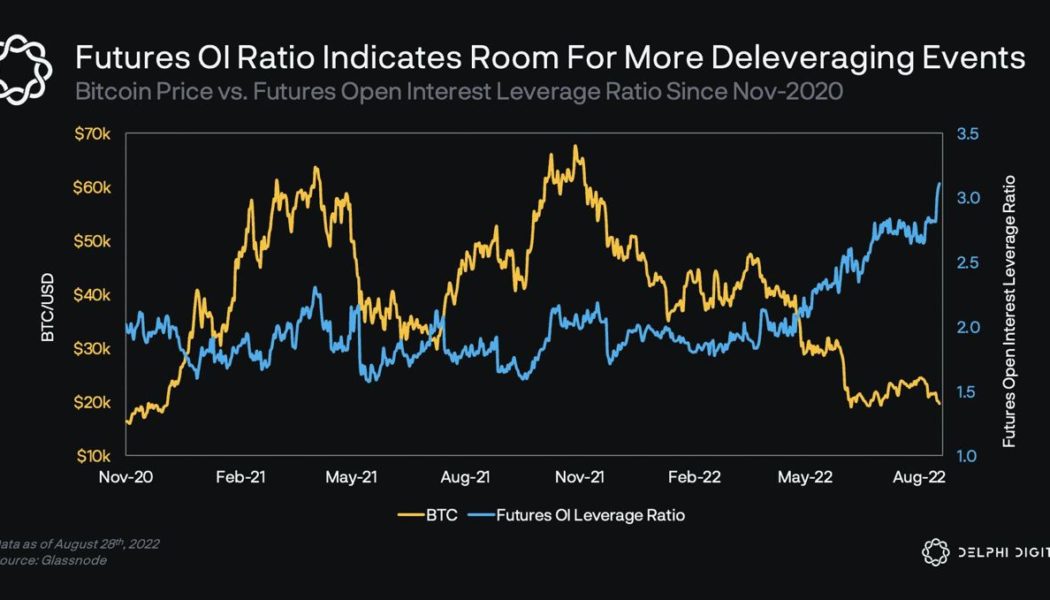

Bitcoin holds $20K, but analysts say BTC open interest leaves room for ‘more deleveraging’

Bitcoin (BTC) price continues to struggle at $20,000 and repeat dips under this level have led some analysts to project deeper downside in the short-term. Earlier in the week, independent market analyst Philip Swift tweeted that the Crypto Fear and Greed Index had dropped back to back to “Extreme Fear,” reflecting softening sentiment among investors. The market is not enjoying $BTC hanging around $20k. Back into Extreme Fear today. Live chart: https://t.co/Jr5151zN7I pic.twitter.com/UnztrZP7FP — Philip Swift (@PositiveCrypto) August 31, 2022 On Aug 29, analytics firm Delphi Digital highlighted Bitcoin open interest hitting a new record-high and said: “The Futures Open Interest Leverage Ratio for BTC reached its highest level ever recorded at more than 3% of BTC market cap, following ...

UBS raises US recession odds to 60%, but what does this mean for crypto prices?

On Aug. 30, global investment bank UBS increased its view on the risk of the United States entering a recession within one year to 60%, up from 40% in June. According to economist Pierre Lafourcade, the latest data showed a 94% chance of the economy contracting, but added that it “does not morph into a full-blown recession.” Partially explaining the difference is the “extremely low levels” of non-performing loans, or defaults exceeding 90 days from credit borrowers. According to Citigroup Chief Executive Jane Fraser, the institution “feels very good about” liquidity and credit quality. Furthermore, Reuters states that the financial industry wrote off merely 0.1% of its loans in the 2Q. The problem is that even in the now-improbable scenario of avoiding a...