Stocks

Crypto mining stocks surge to yearly highs after Bitcoin bounces back

The Bitcoin (BTC) price rebound to a multi-month high has also positively affected mining stocks. Many crypto-mining stocks recorded their best monthly performance in a year. The surge in mining stocks also relieved the troubled miners who had to sell a significant chunk of their mined coins to boost liquidity in 2022. Bitfarms — one of the top BTC mining firms — registered a 140% surge in the first two weeks of January 2023, followed by Marathon Digital Holdings with a 120% surge. Hive Blockchain Technologies saw its stock value nearly double in the same period, while the MVIS Global Digital Assets Mining Index is up by 64% in the first month of the new year. The Luxor Hashprice Index, which aims to quantify how much a miner might make from the processing power used by the Bitcoin network...

BTC price cancels FTX losses — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week at new 2023 highs but still dividing opinion after a blistering price rally. In what is shaping up to be the antidote to last year’s slow bleed lower, January has delivered the volatility Bitcoin bulls were hoping for — but can they sustain it? This is the key question for market participants going into the third week of the month. Opinion remains divided on Bitcoin’s fundamental strength; some believe outright that the march to two-month highs is a “sucker’s rally,” while others are hoping that the good times will continue — at least for the time being. Beyond market dynamics, there is no shortage of potential catalysts waiting to assert themselves on sentiment. United States economic data will keep coming, while corporate earnings could deliver some fresh ...

’90s Hip-Hop Duo Black Sheep Sues Universal Music Over an Alleged $750M in Unpaid Spotify Stock Royalties

A prominent ’90s hip-hop duo is suing Universal Music Group for withholding royalties tied to what they’re alleging is a “sweetheart” deal the label reached with Spotify in the late 2000s. Filed Wednesday (Jan. 4) in U.S. district court in New York by attorneys representing Andres Titus (Dres) and William McLean (Mista Lawnge), members of the hip-hop duo Black Sheep, the lawsuit claims UMG owes its artists approximately $750 million in royalties deriving from the company’s stock in Spotify. Under a licensing deal they claim UMG and the streaming giant reached in 2008, the label agreed to receive lower royalty payments in exchange for equity in the then-nascent streaming company. But Titus and McLean say the label breached their contract with Black Sheep and other artists by withholding wha...

BTC price dips 1% on Wall Street open as Bitcoin miners worry analysts

Bitcoin (BTC) saw a fresh hint of volatility at the Dec. 27 Wall Street open as United States equities began the final trading week of the year. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin ekes out fresh volatility Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it dropped around 1% at the opening bell. Despite involving a move of only $150, the event was still noticeable on lower timeframes, Bitcoin having shunned any form of volatility for multiple days. The move came in response to a 0.6% drop in the S&P 500 at the open, with the Nasdaq Composite Index dropping 1.4%. The U.S. Dollar Index (DXY) responded in kind, making up for ground lost earlier to return to its position from Dec. 25. U.S. Dollar Index (DXY) 1-hour candle chart....

‘Wave lower’ for all markets? 5 things to know in Bitcoin this week

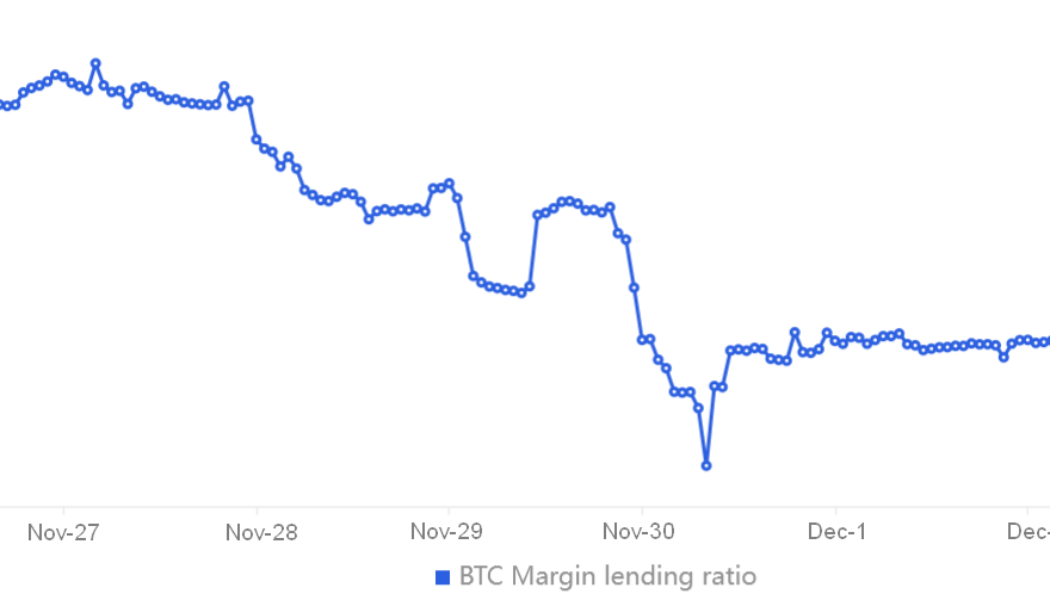

Bitcoin (BTC) starts the week before Christmas with a whimper as a tight trading range gives BTC bulls little cheer. A weekly close just above $16,700 means BTC/USD remains without major volatility amid a lack of overall market direction. Having seen erratic trading behavior around the latest United States macroeconomic data print, the pair has since returned to an all-too-familiar status quo. What could change it? That is the question on every analyst’s lips as markets limp into Christmas with little to offer. The reality is tough for the average Bitcoin hodler — BTC is trading below where it was two years and even five years ago. “FUD” is hardly in short supply thanks to FTX fallout and concerns over Binance. At the same time, there are signs that miners are recovering, while on-chain in...

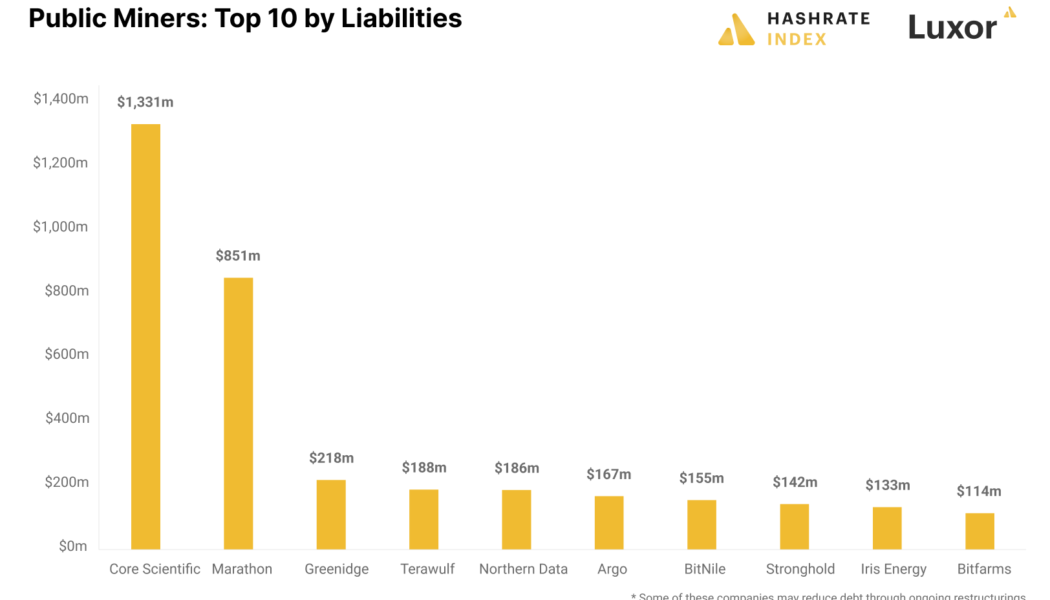

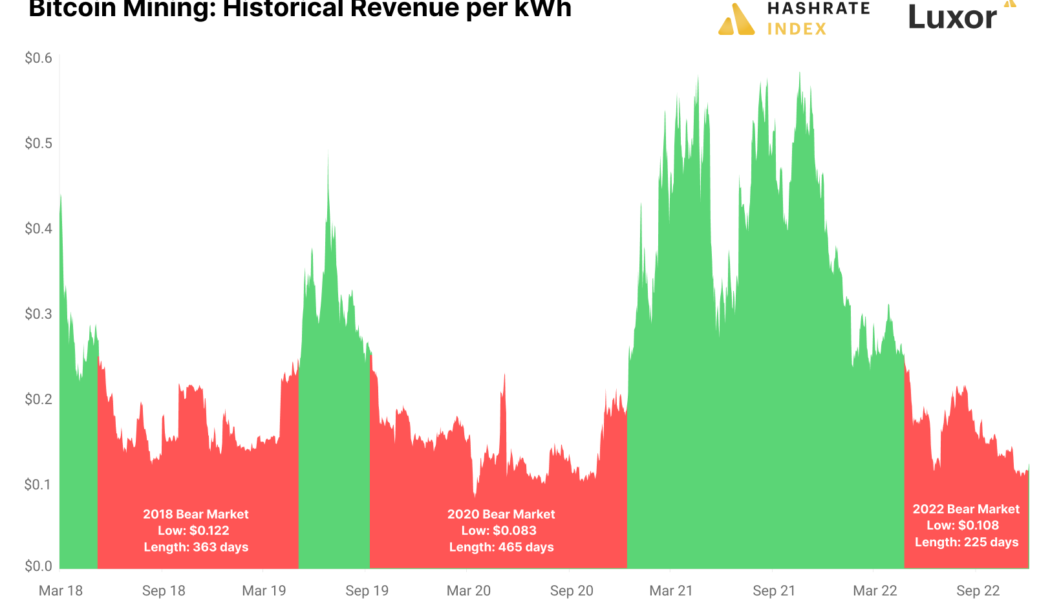

Data shows the Bitcoin mining bear market has a ways to go

Bitcoin (BTC) mining is the backbone of the BTC ecosystem and miners’ returns also provide insight into BTC’s price movements and the health of the wider crypto sector. It is well-documented that Bitcoin miners are struggling in the current bear market. Blockstream, a leading Bitcoin miner recently raised funds at a 70% discount. Current mining activity shares similarities to historic BTC bear markets with a few caveats. Let’s explore what this means for the current Bitcoin cycle. Analysis shows that based on previous cycles the bear market may continue Bitcoin mining profitability can be measured by taking the miner’s revenue per kilowatt hour (kWh). According to Jaran Mellerud, a Bitcoin analyst for Hashrate Index, a BTC mining bear market has a sustained period of revenue per kWh of les...

‘Imminent’ crash for stocks? 5 things to know in Bitcoin this week

Bitcoin (BTC) starts its first full week of December at three-week highs as bulls and bears battle on. After a weekly close just above $17,000, BTC/USD seems determined to make the most of relief on stocks and a weakening U.S. dollar. As the United States gears up to release November inflation data, the dollar looks to be a key item to watch as BTC price action teases a recovery from the pits of the FTX meltdown. All may not be as straightforward as it seems — miners are facing serious hardship, data shows, and opinions on stocks’ own ability to continue higher are far from unanimous. As the end of the year approaches, will Bitcoin see a “Santa rally” or face a new year nursing fresh losses? Cointelegraph presents five areas worth watching in the coming days when it comes to BTC/USD perfor...

Bitcoin is now less volatile than S&P 500 and Nasdaq

Bitcoin (BTC) held gains above $21,000 into Nov. 5 as the U.S. dollar posted a rare major daily decline. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Dollar dives 2% as risk assets recover Data from Cointelegraph Markets Pro and TradingView showed BTC/USD building on prior strength to hit highs of $21,473 on Bitstamp — a new seven-week high. The pair had benefited from the latest United States economic data, while the dollar conversely suffered. The U.S. dollar index (DXY) lost 2% in a day for the first time in years, helping fuel a risk asset rally. U.S. dollar index (DXY) 1-day candle chart. Source: TradingView “And, just like that, Bitcoin took out all the highs, volume is increasing and it’s back above $21K,” Michaël van de Poppe, CEO and founder of trading firm Eig...

Singapore bank DBS uses DeFi to trade FX and state securities

DBS Bank, a major financial services group in Asia, is applying decentralized finance (DeFi) for a project backed by Singapore’s central bank. DBS has started a trading test of foreign exchange (FX) and government securities using permissioned, or private, DeFi liquidity pools, the firm announced on Nov. 2. The development is part of Project Guardian, a collaborative cross-industry effort pioneered by the Monetary Authority of Singapore (MAS). Conducted on a public blockchain, the trade included the purchase and sale of tokenized Singapore government securities (SGS), the Singapore dollar (SGD), Japanese government bonds and the Japanese yen (JPY). The project has shown that trading on a private DeFi protocol enables simultaneous operations of instant trading, settlement, clearing and cust...

Crypto exchange Coincheck plans Nasdaq listing in July 2023

Japanese cryptocurrency exchange Coincheck has confirmed plans to pursue a public stock offering in the United States through Nasdaq — a move that would give the company access to the country’s lucrative capital markets. In documents filed with the U.S. Securities and Exchange Commission on Oct. 28, Coincheck’s majority owner, Monex Group, confirmed that it is proceeding with Nasdaq listing procedures through a merger with special purpose acquisition company (SPAC) Thunder Bridge Capital Partners IV. If all goes according to plan, Coincheck’s Nasdaq listing will take place on July 2, 2023. Coincheck said the SPAC merger would allow the exchange to expand its crypto-asset business and gain direct access to U.S. capital markets. The technology-rich Nasdaq is one of the world’s lar...