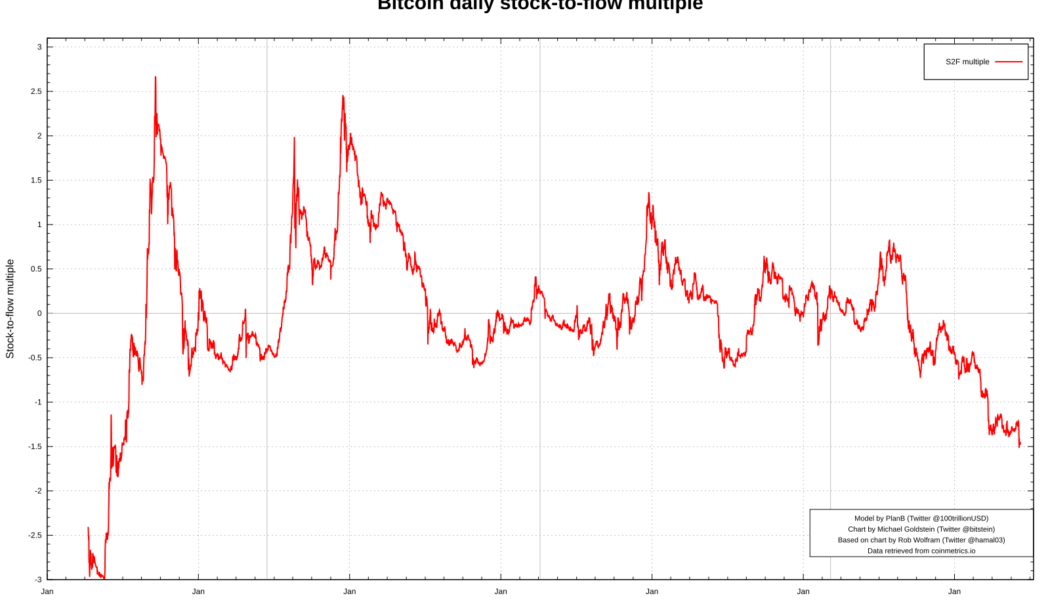

stock-to-flow

Bitcoin sees record Stock-to-Flow miss — BTC price model creator brushes off FTX ‘blip’

Bitcoin (BTC) is now further than ever from its target price according to the Stock-to-Flow (S2F) model. The latest data shows that BTC/USD has deviated from planned price growth to an extent never seen before. Stock-to-Flow sets grim new record With BTC price suppression ongoing in light of the FTX scandal, an already bearish trend has only strengthened. This has implications for many core aspects of the Bitcoin network, notably miners, but some of its best-known metrics are also feeling the heat. Among them is S2F, which is seeing its price forecasts come under increasing strain — and criticism. Enjoying great popularity until Bitcoin’s last all-time high in November 2021, the model uses block subsidy halving events as the central element in plotting exponential price growth through the ...

BTC price recovers to 3-day highs as new whale support forms at $19.2K

Bitcoin (BTC) held steady at the June 20 Wall Street open as nervous traders waited for a short-term trend decision. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader flags Bitcoin “macro bottoming period” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD climbing to just shy of $21,000 at the time of writing, a three-day high. The weekend had spooked the majority of the market and liquidated speculators with a trip to $17,600, marking Bitcoin’s lowest levels since November 2020. Now, with United States equities cool at the start of the week, comparative calm characterized the largest cryptocurrency. “Nice reaction off of the bottom of our 16K–20K demand zone,” popular trading account Credible Crypto commented on the weekend’s price action. “12...