STEPN

Nifty News: ‘Blue-chips’ halve in value, free-to-mint Goblintown NFT volume surges

“Blue-chip” nonfungible token (NFT) collections have seen their floor prices and market capitalization slide over the past 30 days, with some of the most well-recognized projects halving in value for these key metrics. Data collected on key Ethereum NFT projects by DappRadar shows the floor prices of established collections such as CryptoPunks, Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC) and Moonbirds are at most down around 55% over 30 days. The MAYC is the worst off of the four, with the floor price diving 55% to 16.7 Ether (ETH), or $31,300 at the time of writing. The more popular BAYC has fallen over 47% to 86.7 ETH, or $163,000, and CryptoPunks by almost 49% to 45 ETH, $85,000. The only collection to gain in the month was Moonbirds, up 22% with a 19.6 ETH floor...

STEPN rebounds sharply after falling 80% in a month — is GMT price bottoming out?

A massive downtrend in the STEPN (GMT) prices witnessed in the last 30 days appears to be nearing exhaustion. GMT’s price has rebounded by nearly 35%—from $0.80 on May 27 to $0.99 on May 28. Interestingly, the upside retracement started after the price fell in the same range, which had acted as support before GMT’s 500% and 120% price rallies in March and early May, respectively. GMT/USD daily price chart. Source: TradingView Additionally, the rebound further preceded an 80% drop from its record high of $4.50, established on April 27, which left GMT oversold, per its daily relative strength index reading that slipped below the oversold threshold of 30 on May 26. The technical support, in addition to oversold RSI, suggests GMT is in the process of bottoming out. GMT price levels...

Any dip buyers left? Bulls are largely absent as the total crypto market cap drops to $1.65T

The total crypto market capitalization has been trading within a descending channel for 24 days and the $1.65 trillion support was retested on May 6. The drop to $1.65 trillion was followed by Bitcoin (BTC) reaching $35,550, its lowest price in 70 days. Total crypto market cap, USD billion. Source: TradingView In terms of performance, the aggregate market capitalization of all cryptocurrencies dropped 6% over the past seven days, but this modest correction in the overall market does not represent some mid-capitalization altcoins, which managed to lose 19% or more in the same time frame. As expected, altcoins suffered the most In the last seven days, Bitcoin price dropped 6% and Ether (ETH) declined by 3.5%. Meanwhile, altcoins experienced what can only be described as a bloodbath. Below ar...

Top 5 cryptocurrencies to watch this week: BTC, LUNA, NEAR, VET, GMT

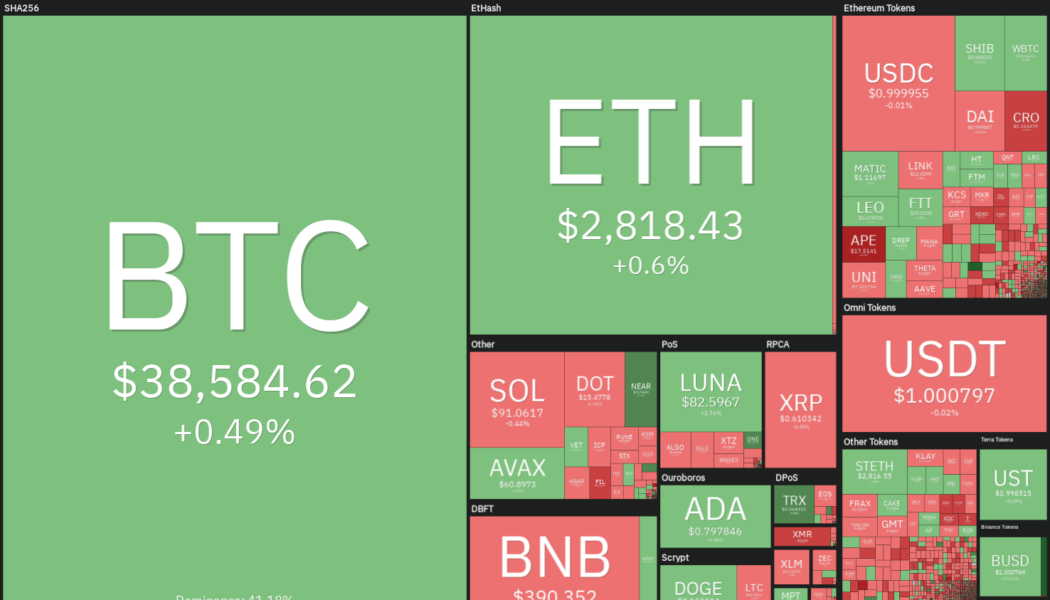

The month of April has been a forgettable one for equities and cryptocurrency investors. Bitcoin (BTC) plummeted 17% in April to record its worst ever performance in the month of April. Similarly, the Nasdaq Composite plunged 13.3% in April, its worst monthly performance since October 2008. However, a major positive for crypto investors is that Bitcoin is still above its year-to-date low near $33,000. In comparison, the Nasdaq 100 has hit a new low for 2022 while the S&P 500 is just a whisker away from making a new year-to-date low. This suggests that Bitcoin has managed to avoid a major sell-off, indicating demand at lower levels. Crypto market data daily view. Source: Coin360 Along with Bitcoin, Ether (ETH) has also managed to sustain well above its year-to-date low. Accor...

2 key metrics point toward further downside for the entire crypto market

The total crypto market capitalization has been holding a slightly ascending trend for the past 3 months and the $1.75 trillion support was most recently tested on April 27 as Bitcoin (BTC) bounced at $38,000 and Ether (ETH) at $2,800 on April 27. Total crypto market cap, USD billion. Source: TradingView The crypto market’s aggregate capitalization showed a 3.5% decrease in the last 7 days and notable losers were a 18.8% loss from XRP, a 10.2% loss from Cardano (ADA), and 9.7% drop in Polkadot (DOT) price. Analyzing a broader range of altcoins provides a more balanced picture, that includes 25% gains from some gaming and Metaverse projects in the same time period. Weekly winners and losers among the top 80 coins. Source: Nomics Apecoin (APE) rallied 44% due to the upcoming Otherside metave...

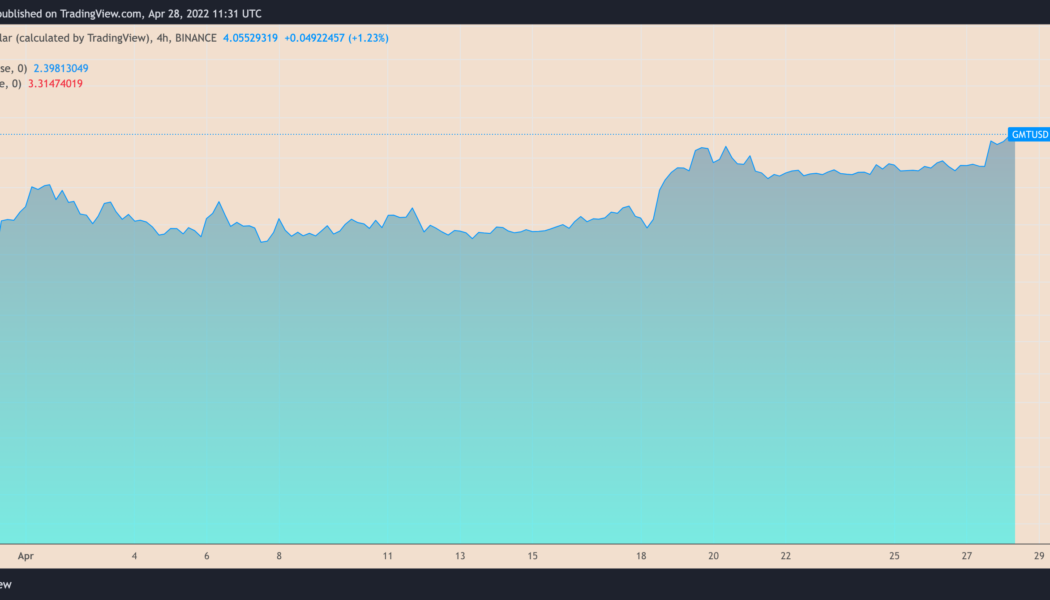

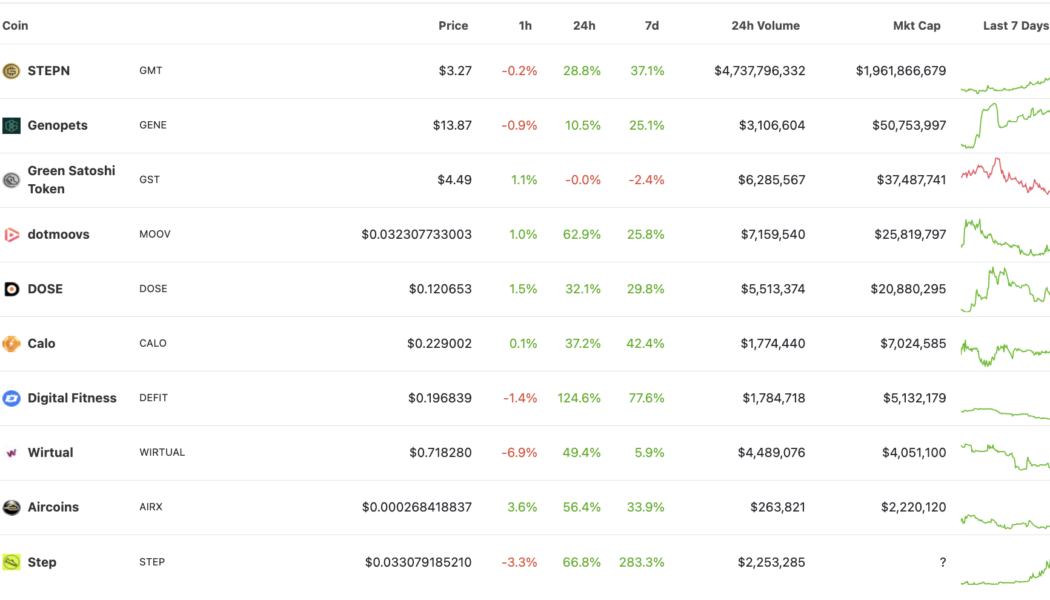

Solana’s STEPN hits record high as GMT price skyrockets 34,000% in over a month

STEPN (GMT), a so-called “move-to-earn” token using the Solana (SOL) blockchain, has soared incredibly since its market debut in March. GMT’s price jumped from $0.01 on March 9 to a record high of $3.45 on April 19 — a 34,000% upside move in just 41 days (data from Binance). Its massive uptrend appeared primarily due to the hype surrounding decentralized finance (DeFi) projects that reward users in tokens for staying active. For instance, the prices of GMT and its top rivals, including Genopets (GENE) and dotmoovs (MOOV), exploded massively on a 24-hour adjusted timeframe, data on CoinGecko shows. Nonetheless, STEPN remained the most valuable move-to-earn (M2E) project, with its market capitalization closing in on $2 billion. The performance of M2E tokens featu...