Stellar

Crypto Biz: $43T bank enters crypto — Probably nothing, right?

As crypto traders debate whether Bitcoin (BTC) is going to $25,000 or $15,000 first, the world’s largest financial institutions are laying the groundwork for mass adoption. The proverbial floodgates are unlikely to open before the United States provides a clear regulatory framework for crypto, but regulators and industry insiders are confident that guidance could come in 2023 at the earliest. In the meantime, megabanks like BNY Mellon, whose roots date back to 1784, are entering the space. This week’s Crypto Biz chronicles BNY Mellon’s foray into digital assets, JPMorgan’s ongoing experimentation with blockchain technology and Crypto.com’s new European headquarters. BNY Mellon, America’s oldest bank, launches crypto services Arguably the biggest story of the week was news of another ...

UFC fighter El Ninja to become first argentinian athlete paid in crypto

Guido Cannetti, an Argentinian Ultimate Fighting Championship (UFC) fighter, is now the first martial arts athlete in the country to receive 100% of his salary in stablecoins, amid rising inflation and Argentina’s economic deteriorating, announced the crypto payroll company Bitwage on Monday. Dubbed El Ninja, he returns to the Octagon on October 1st in the United States to face the local fighter Randy Costa. According to Bitwage, Guido will receive his payment in USDC stablecoin via the Stellar Network on Vibrant, a wallet application developed by the Stellar team specifically for Argentines experiencing inflation. As per official government figures’, inflation in the 12 months through August was 78.5% in the country, whereas prices in the first eight months of the year were up...

Top 5 cryptocurrencies to watch this week: BTC, UNI, XLM, THETA, HNT

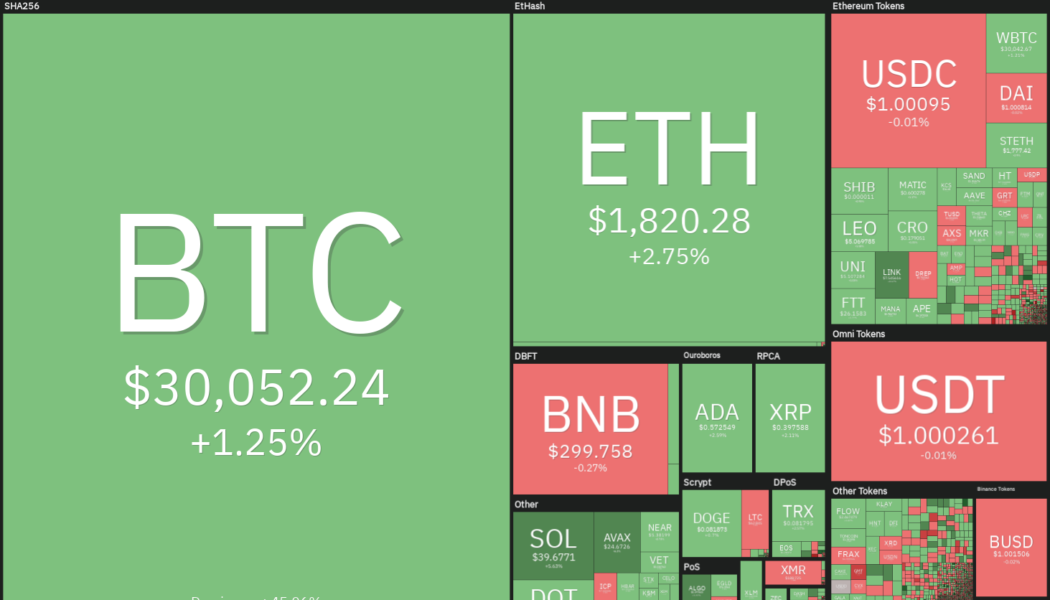

The United States equities markets witnessed a sharp comeback last week, led by the Nasdaq Composite which gained 7.5%. The S&P was up about 6.5% for the week while the Dow Jones Industrial Average managed a gain of 5.4%. Continuing its tight correlation with the equities market, the crypto markets are also attempting a relief rally. Bitcoin (BTC) has seen a modest recovery but some altcoins have risen sharply in the past week. This suggests that investors are taking advantage of the sharp fall in the price to accumulate altcoins at lower levels. Crypto market data daily view. Source: Coin360 Smaller-sized investors have been using the decline in Bitcoin to build their position to at least one Bitcoin. Glassnode data shows that the number of Bitcoin wallet addresses having more than on...

Crypto influencers allegedly weaponize conspiracies to fleece QAnon followers

Two QAnon-affiliated conspiracy theorist influencers allegedly caused their followers millions of dollars in losses by running a cryptocurrency pump-and-dump scheme. The pair reportedly persuaded their thousands of followers to invest in a portfolio of cryptos, presenting a misleading mix of conspiratorial and genuine content along with claims about institutions backing the tokens to generate hype and raise the price of the portfolio. The allegations are included in an investigation by Logically, a group of data scientists and developers. It reported the two influencers running the Telegram channels “WhipLash347” and the “Quantum Stellar Initiative” (QSI) coordinated to promote lists of Stellar (XLM) altcoins which have been marked as fraudulent by the Stellar network. WhipLash347 is a Tel...

Top 5 cryptocurrencies to watch this week: BTC, ADA, XLM, XMR, MANA

The bears are trying to extend Bitcoin’s (BTC) record of nine consecutive red weekly candles to ten weeks, but the bulls are trying to avert this negative occurrence. Although sentiment remains negative, Arthur Hayes, former CEO of derivatives giant BitMEX, anticipates Bitcoin to bottom out in the range of $25,000 to $27,000. On-chain data from Glassnode shows that smart money may have started accumulating Bitcoin. The net outflows from major cryptocurrency exchanges reached 23,286 Bitcoin on June 3, the highest since May 14. Crypto market data daily view. Source: Coin360 Another positive sign of accumulation is that investment into Bitcoin exchange-traded products (ETPs) was strong in May and has only risen further in the first two days of June, according to an Arcane Research report. The...

Here are 3 altcoins that could surge once Bitcoin flips $35K to support

Bitcoin (BTC) and the wider cryptocurrency market are taking a breather after the rally on May 31. Meanwhile, most altcoins remain severely oversold, with most between 70% and 90% below their all-time highs. Total altcoin index capitalization What is clear is that fear is everywhere and blood is in the water. Risk-on markets are suffering worldwide, but it is exactly these kinds of conditions that create opportunities where professional money accumulates and adds to positions. Let’s take a look at three altcoins that could be positioned for a rebound if the broader market enters a new uptrend. ADA could be setting up for an 80% surge Cardano (ADA) has a significantly bullish update coming very soon. The much anticipated Vasil hard fork, which increases performance and adds more Plutu...

MoneyGram partners with Stellar to build a stablecoin-fiat transfer platform

The US-based financial service company is intent on capitalising on emerging market’s potential as most remittance recipients are out of the country The growth in demand for stablecoins matched with the increase in supply over the past year could be a likelihood of success The cross-border payments and money transfer giant MoneyGram has revealed its ambition to bridge the gap existing between traditional finance and crypto by providing money transfer services. The firm announced on Sunday a strategic partnership with the Stellar blockchain to build a platform that will allow users of the Stellar wallet to send the USD Coin to other users who can then cash out in fiat. This stablecoin-based platform provides users an avenue to convert stablecoins to fiat currencies. In an interview with Blo...

How to pick or analyze altcoins?

What are altcoins? The word “altcoin” is derived from “alternative” and “coin.” Altcoins refer to all alternatives to Bitcoin. Altcoins are cryptocurrencies that share characteristics with Bitcoin (BTC). For example, Bitcoin and altcoins have a similar basic framework. Altcoins also function like peer-to-peer (P2P) systems and share code, much like Bitcoin. Of course, there are also marked differences between Bitcoin and altcoins. One such difference is the consensus mechanism used by these altcoins to validate transactions or produce blocks. While Bitcoin uses the proof-of-work (PoW) consensus mechanism, altcoins typically use proof-of-stake (PoS). There are different altcoin categories, and they can best be defined by their consensus mechanisms and unique functionalities. Here are the mo...

Ukrainian bank uses Stellar to launch electronic hryvnia pilot

Tascombank, one of the oldest commercial banks in Ukraine, is launching a Stellar-based pilot for Ukraine’s national fiat currency, the hryvnia. The Stellar Development Foundation (SDF) announced on Dec. 14 a private electronic hryvnia pilot launched by Tascombank and fintech company Bitt. The electronic hryvnia pilot is being implemented under the supervision of the National Bank of Ukraine and is supported by the Ministry of Digital Transformation (MDT). Oleksandr Bornyakov, deputy minister of the MDT, said that the pilot project will provide a “technological basis for the issuance of electronic money” and is the “next key step to advance innovation of payment and financial infrastructure in Ukraine.” SDF CEO Denelle Dixon told Cointelegraph that the pilot work has already kicked off, wi...