State of Crypto report

Ethereum’s popularity ‘a double-edged sword’ — a16z’s State of Crypto report

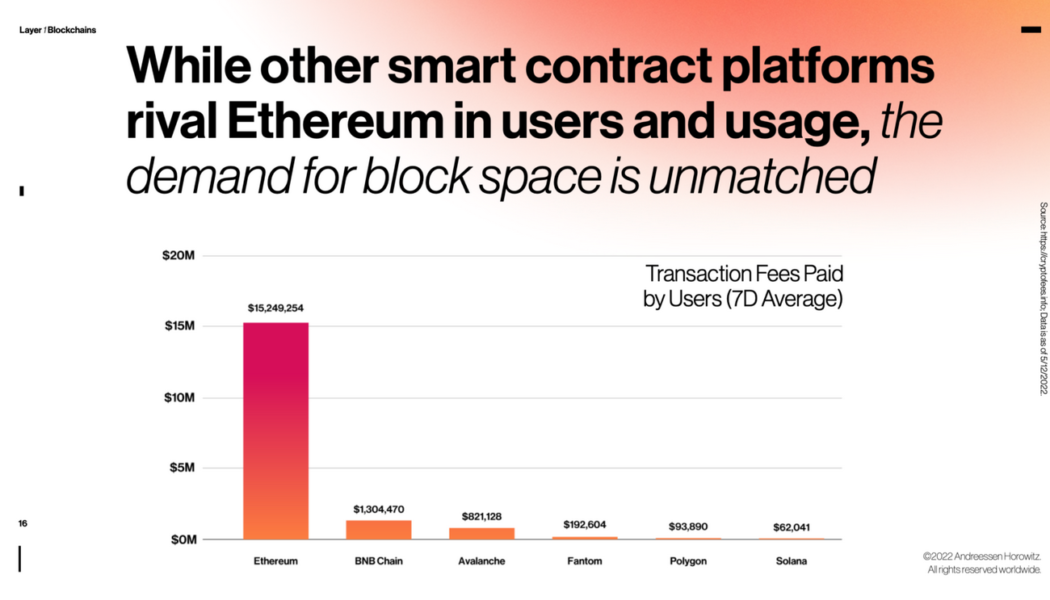

Crypto venture fund giant Andreessen Horowitz (a16z) has highlighted that development and demand on Ethereum is “unmatched” despite the network’s high transaction fees. The firm does warn, however, that its “popularity is also a double-edged sword” given Ethereum prioritizes decentralization over scaling, resulting in competing blockchains stealing market share with “promises of better performance and lower fees.” The comments came via a blog post introducing a16z’s 2022 “State of Crypto” report, with the firm’s data scientist Daren Matsuoka, head of protocol design and engineering Eddy Lazzarin, General Partner Chris Dixon, and head of content Robert Hackett all working together to provide five key takeaways from the study. Outside of Ethereum, the report focuses on topics such as Web3 de...