Startups

How Blockchain and Crypto Can Lessen Financial Exclusion in Developing Countries

/* custom css */ .tdi_4_8ce.td-a-rec-img{ text-align: left; }.tdi_4_8ce.td-a-rec-img img{ margin: 0 auto 0 0; } While the COVID-19 crisis has reversed the recent global poverty reduction, according to the UN and other experts, it has also sped up financial inclusion via mobile financial services apps provided by crypto, blockchain and FinTech startups. Many people worldwide take for granted the services billions of others struggle to access. In their book “Financial Exclusion and the Poverty Trap,” authors Pamela Lenton and Paul Mosley assert that one of the main causes of poverty is financial exclusion, which they define as the inability to access finance from mainstream banks. /* custom css */ .tdi_3_d8d.td-a-rec-img{ text-align: left; }.tdi_3_d8d.td-a-rec-img img{ margin: 0 auto 0 0; } ...

HealthTech Startups in Africa Reach All-Time High

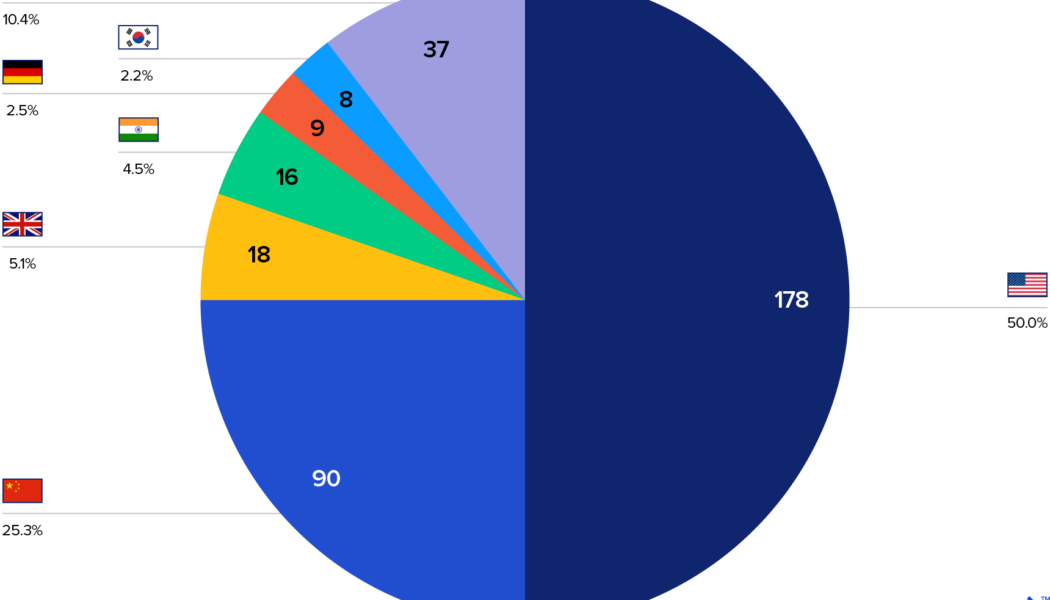

Sourced from Getty Images. There are currently 180 actively operating health-tech focussed startups across the African continent, according to the High Tech Health: Exploring the African E-health Startup Ecosystem Report 2020 report, released by Disrupt Africa. According to the report, this number of startups has grown by 56.5 per cent over the last three years and has seen significant investment despite the COVID-19 pandemic as more than half of all funding to have gone into the space in the past five years was transacted in the first half of 2020. So far this year, e-health startups have raised over US$90 million. “Interest in the e-health space in Africa has accelerated in the last 18 months, and with the advent of the COVID-19 pandemic, there is a sudden spotlight on e-health startups,...