standard bank

The Real Cost of Not Engineering for Agility

Natasha Anderson, Practice Lead: Software Engineering Standard Bank Group. /* custom css */ .tdi_4_2a2.td-a-rec-img{ text-align: left; }.tdi_4_2a2.td-a-rec-img img{ margin: 0 auto 0 0; } As Practice Lead for Software Engineering, I have always seen my role as being a champion for engineering improvement, promoting collaboration and continuous learning among the engineering community in my organisation. While these foundational aspects are important to organisations that leverage technology as a business outcomes enabler, the continuous pressures of a fast-changing world, exacerbated by COVID-19’s impact on our economy has allowed me to view the relationship between engineering and business success through an additional lens, which I wish to share with you. As the pandemic unfolded in the p...

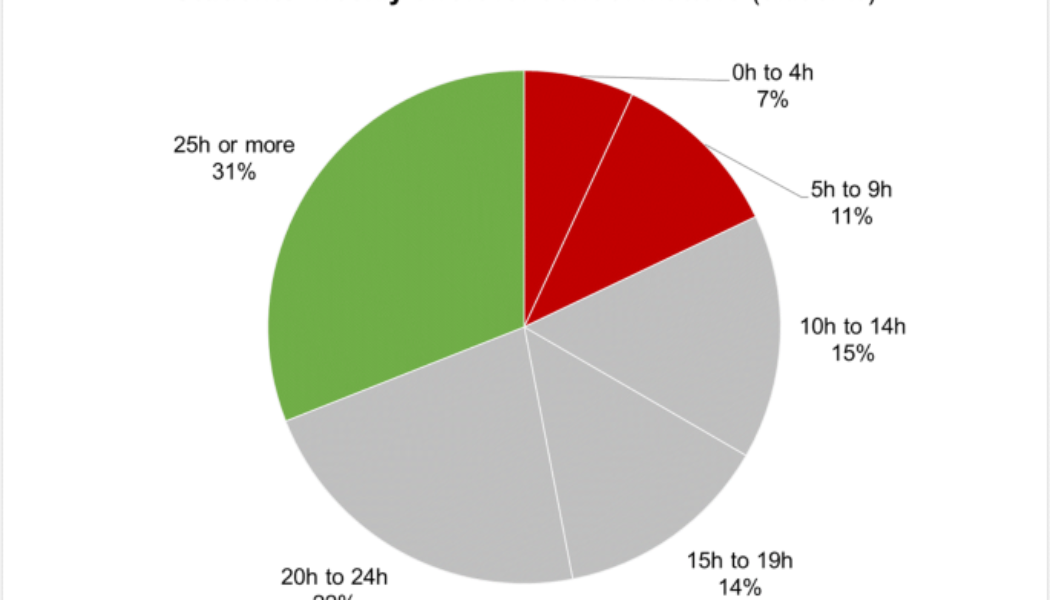

Accelerated eLearning Adoption Could Contribute to More Impactful Outcomes in the Education System for Africa

/* custom css */ .tdi_4_262.td-a-rec-img{ text-align: left; }.tdi_4_262.td-a-rec-img img{ margin: 0 auto 0 0; } The world of digital has broadened the play and fuelled greater expectations as it shifted the traditional perspectives around time and space. The proximity to the customer is incrementally getting shortened, while the expectation for service leans towards the now. Those who lay claim to the gift of intuition have even pondered the veracity in the statement that the world as we know it has come to an end. But it has, in the process, ushered in a new one that is full of possibilities and diverse opportunities. Never has there been a better time for the re-imagination of one’s destiny. The dexterity to meander the future is not and should not be exclusive as it was before. The perv...

Seplat issues $650 million oil and gas bond

Seplat Petroleum Development Company, a Nigerian independent oil and gas firm, has issued $650 million in aggregate principal amount of senior notes due in 2026. It is said to be the largest ever Nigerian oil and gas bond issuance. A senior note is a type of bond that must be repaid before most other debts in the event that the issuer declares bankruptcy. It is more secure than other bonds. The dual listed company said the five-year bond was well-received in the market with orders from high quality institutional investors. “The notes priced at a yield of 7.75%, representing a significant pricing reduction from its $350 million debut issuance in 2018, which priced at a yield of 9.50% , with a coupon of 9.25%,” a statement by the company read. “The offering was well oversubscribed with deman...

The Sustenance of Job Creation During a Digital Evolution Epoch

Tau Mashigo CTO Group IT, Standard Bank As the future pushes ahead unabated, the set of circumstances emerging spark a lot of imagination. We no longer just rely on linear cognitive capabilities that give rise to incremental change, but rather parallelised, and intertwined capabilities that result in exponential progress. The world is filling up with opportunities waiting to be discovered. The Fourth Industrial Revolution is characterised by the on-setting of new capabilities stemming from exponential developments in a multiplicity of domain technologies including robotics, artificial intelligence, nanotechnologies, quantum computing, 3D printing, superfast telecommunications, and the internet of things. While these can be leveraged independently of each other, real impact can be exp...

- 1

- 2