Staking

3 reasons why Ethereum price can hit $4K in April

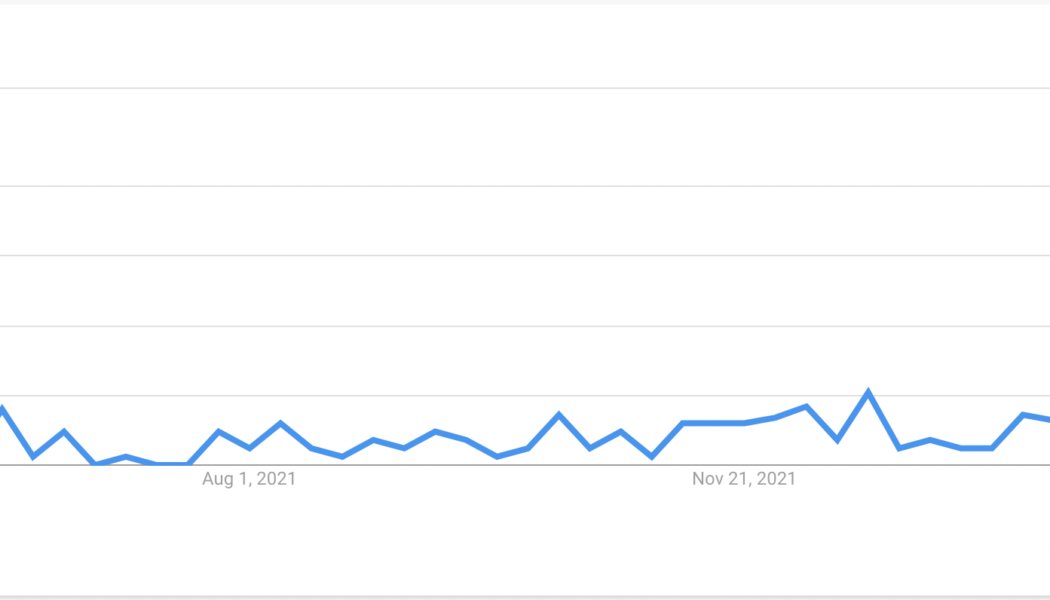

Three market catalysts suggest that Ethereum’s native token Ether (ETH) is well-positioned to reach $4,000 this month. Google searches for “Ethereum merge” spike Internet users’ interest in Ethereum’s upcoming network upgrade, dubbed “the Merge,” surged substantially in the week ending April 2, Google Trends’ data shows. Searches for the keyword “Ethereum Merge” reached a perfect Google Trends score of 100 on a 12-month timeframe with most traffic coming from the U.S., Singapore, Canada, and Australia. Internet trend score for the keyword ‘Ethereum Merge.’ Source: Google Trends Merge, also called ETH 2.0, refers to the Ethereum network’s full transition to Proof-of-Stake (PoS) from Proof-of-Work (PoW),...

ETH price hits $3K as major crypto fund adds over $110M Ethereum to Lido’s staking pool

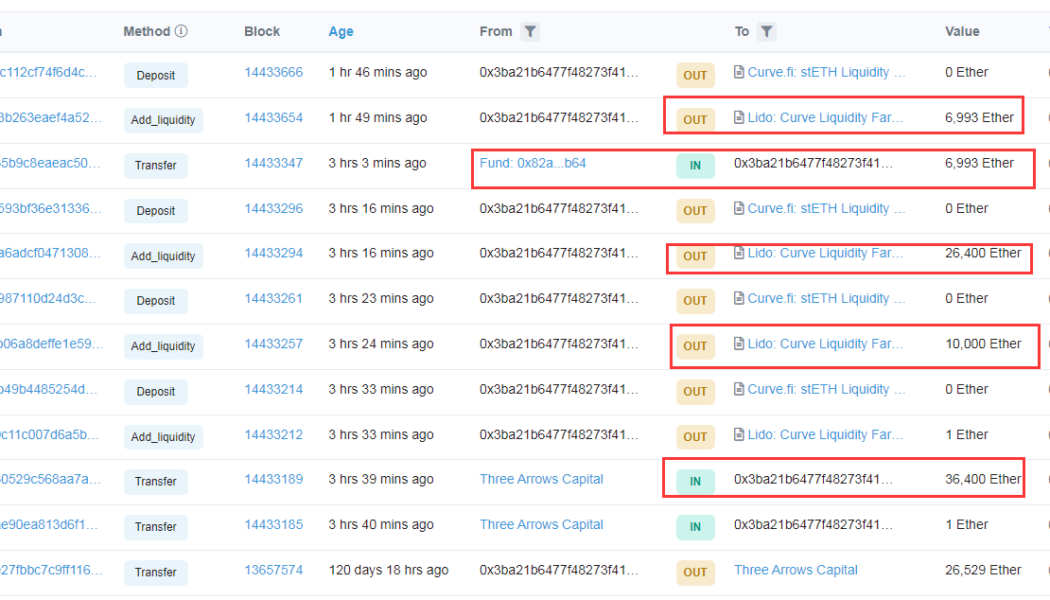

Ethereum’s native token Ether (ETH) rose above $3,000 on March 22 as fresh data suggests Three Arrows Capital staked at least $110 million worth of ETH into Lido’s liquidity pools. The Singapore-based hedge fund manager provided liquidity worth 36,401 ETH to Lido’s “Curve stETH pool” using a third-party Ether wallet, data from Etherscan shows. As a result, it became eligible to receive at least 36,401 stacked Ether (stETH) tokens from Lido: to ensure low slippage when un-staking those tokens for real ETH plus staking reward. Third-party Ethereum wallet that received ETH from Three Arrow Capital. Source: Etherscan.io Almost an hour later, another Ether address, marked with the word “fund,” sent 6,993 ETH (worth $21.12 million) to the ...

Ethereum balance on crypto exchanges falls to lowest levels since 2018

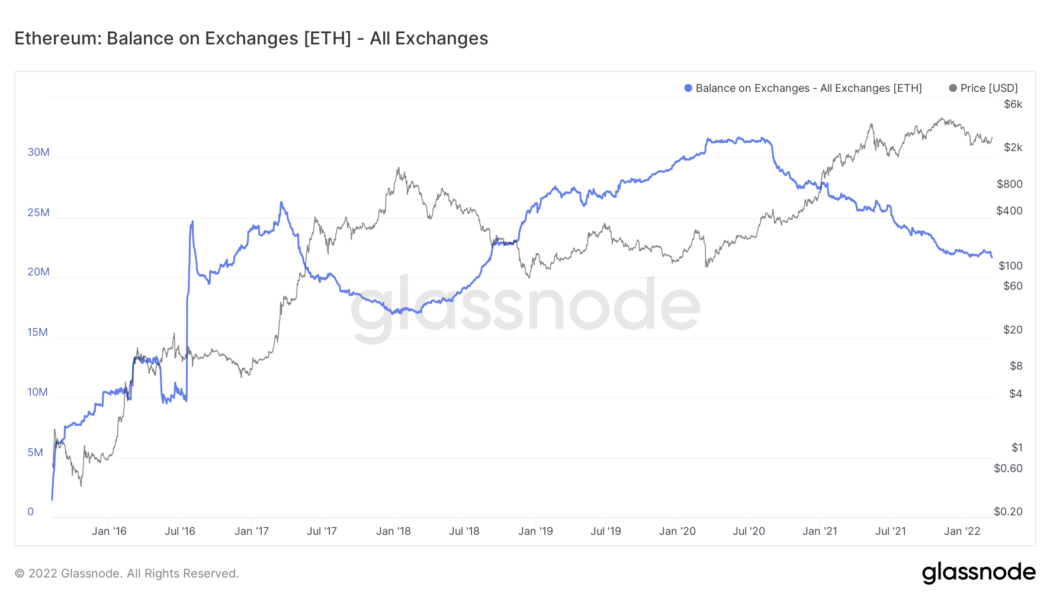

The amount of Ethereum‘s native token Ether (ETH) kept with crypto exchanges has fallen to its lowest levels since September 2018, signaling traders‘ intention to hold the tokens in hopes of a price rally in 2022. Notably, nearly 550,000 ETH — worth around $1.61 billion — have left centralized trading platforms year-to-date, according to data provided by Glassnode. The massive outflow has reduced the exchanges‘ net-Ether balance to 21.72 million ETH, down from its record high of 31.68 million ETH in June 2020. Ethereum balance on all exchanges as of March 18, 2022. Source: Glassnode Biggest weekly ETH outflow since October 2021 Interestingly, over 30% of all Ether‘s withdrawals from exchanges witnessed in 2022 appeared earlier this week, data from IntoTheBlock shows. In detail, over 180,00...

Polygon’s focus on building L2 infrastructure outweighs MATIC’s 50% drop from ATH

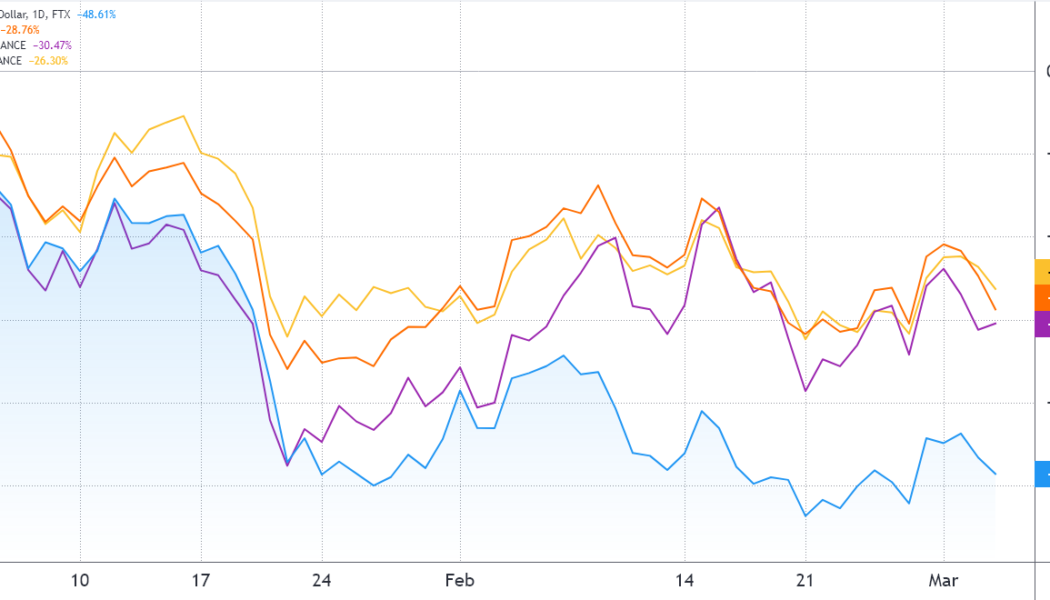

After a devastating 50% correction between Dec. 25 and Jan. 25, Polygon (MATIC) has been struggling to sustain the $1.40 support. While some argue this top-15 coin has merely adjusted after a 16,200% gain in 2021, others point to competing scaling solutions growth. MATIC token/USD at FTX. Source: TradingView Either way, MATIC remains 50.8% below its all-time high at an $11 billion market capitalization. Currently, the market cap of Terra (LUNA) stands at $37 billion, Solana (SOL) is above $26 billion and Avalanche (AVAX) is at a $19 billion market value. A positive note is that Polygon raised $450 million on Feb. 7, and the funding round was backed by some of blockchain’s most considerable venture funds, including Sequoia Capital. Polygon offers scaling and infrastructure support to Ethere...

Income generation on DeFi, explained

Modern tools can improve the earning process by diversifying asset exposure and empowering AI for quicker reaction times. Although DeFi returns appear promising, investors must continue to air on the side of caution and remember even in DeFi, “get-rich-quick” schemes do not exist. Instead, a minimum level of awareness on topics such as how the blockchain works and what an automated market maker (AMMs) is are necessary for users to deploy passive income generation methods. Furthermore, early DeFi projects required users to be highly experienced while having adequate capital at their disposal. SingularityDAO is one of the few platforms that generate yield by trading cryptocurrency assets through an AI-powered DeFi portfolio, giving users access to a diverse range of crypt...

Solana TVL and price drop 50%+ from ATH, but gaming DApps could turn the tables

2022 has not been a good start for cryptocurrencies and to date, the total market capitalization has dropped by 21% to $1.77 trillion. Solana’s (SOL) correction has been even more brutal, presenting a 48.5% correction year-to-date. Solana (blue) vs. Ether (orange), AVAX (purple), BNB (yellow). Source: TradingView Solana leads the staking charts with $35 billion in value locked, which is equivalent to 74% of the SOL tokens in circulation. Multiple reasons can be identified for the underperformance, including four network outages in late 2021 and early 2022. The latest incident on Jan. 7 was attributed to a distributed denial-of-service (DDoS) attack, causing Solana Lab developers to update the code and consequently reject these types of requests. However, investors are more concerned ...

Andreessen Horowitz invests $70M in Ethereum staking protocol Lido

Ethereum staking solution Lido Finance has raised $70 million from venture capital giant Andreessen Horowitz, marking the protocol’s first funding round since May 2021. Andreessen Horowitz’s investment in Lido is intended to further support the adoption of decentralized staking solutions for Ethereum 2.0, a spokesperson for the venture capital firm said. Ethereum 2.0 marks a significant shift in the network’s consensus algorithm by ushering in the adoption of proof-of-stake (PoS) and other upgrades that could enhance scalability and reduce fees. The transition to Ethereum 2.0, which began in November 2020, is still ongoing. Excited to share that @a16z has invested $70M in @LidoFinance, one of the easiest ways to stake ETH and other PoS assets, and we used Lido to stake a portion of o...

UK tax agency cracks down on rules around DeFi lending and staking

Her Majesty’s Revenue and Customs (HMRC), the U.K.’s tax agency, on Wednesday, has released a controversial set of guidance that could affect innovation in Decentralized Finance (DeFi). The updated regulation focuses on the treatment of digital assets specifically for DeFi lending and staking in the UK, and whether returns or rewards from these services are deemed as capital or revenue for taxation purposes. Owing to the cutting edge nature of DeFi these services had fallen into a grey area with tax professionals unsure of how the existing rules apply. “The lending/staking of tokens through decentralized finance (DeFi) is a constantly evolving area, so it is not possible to set out all the circumstances in which a lender/liquidity provider earns a return from their activities and the natur...

Stader Labs announce $12.5 million strategic raise, receives praise from Terra founder Do Kwon

On Thursday, Stader Labs, a crypto firm building decentralized finance, or DeFi, products for proof-of-stake blockchain networks, announced that it raised $12.5 million in a private sale. The funding round was led by Three Arrows Capital with additional participation from Blockchain.com, Accomplice, DACM, GoldenTree Asset Management, Accel, Amber, 4RC, Figment, and anger investors. This puts Staber Labs at a valuation of $450 million. Amitej Gajjala, CEO of Stader Labs, issued the following comment regarding the development: This capital will be strategically deployed to accelerate our cross-chain expansion, as well as to nurture our growing ecosystem of third-parties developing staking applications with decentralized Stader infrastructure. Stader Labs’ two core products are Stake Po...

Eth2’s Rocket Pool reaches $350M TVL and 635 node operators in five weeks

Rocket Pool, a decentralized Ethereum 2.0 staking platform has surpassed $350 million worth of total value locked (TVL) within five weeks of its official launch. The project aims to remove the barriers to entry for Eth2 stakers and node operators. It allows any user to run a node for 16 ETH ($59,000), which is half of the 32 ETH ($119,000) required in the Eth2 deposit contract. Users with as little as 0.01 ETH can also stake their funds and receive yield. According to data from DefiLlama, Rocket Pool has surged up the decentralized finance (DeFi) staking platform rankings to sit at third with a TVL of $355.64 million at the time of writing. The project is currently behind the Keep3r Network at $584.34 million, and Lido Finance in first place with $6.04 billion. Lido Finance was launched in...

- 1

- 2