stablecoins

Circle CSO lays out policy principles for stablecoins in US

Dante Disparte, Circle’s chief strategy officer and head of global policy who has previously testified at congressional hearings, has called on United States lawmakers to balance the risks with developing a regulatory path for stablecoins. In a Monday blog post, Disparte named 18 principles Circle had established as part of its effort to shape stablecoin policy in the United States. Circle, the company behind USD Coin (USDC) with a reported $54 billion in circulation, highlighted privacy concerns, “a level playing field” between banks and non-banks over a U.S. dollar-pegged digital currency, how stablecoins can coexist alongside a central bank digital currency, and the need for regulatory clarity. “Harmonizing national regulatory and policy frameworks for dollar digital currencies advances...

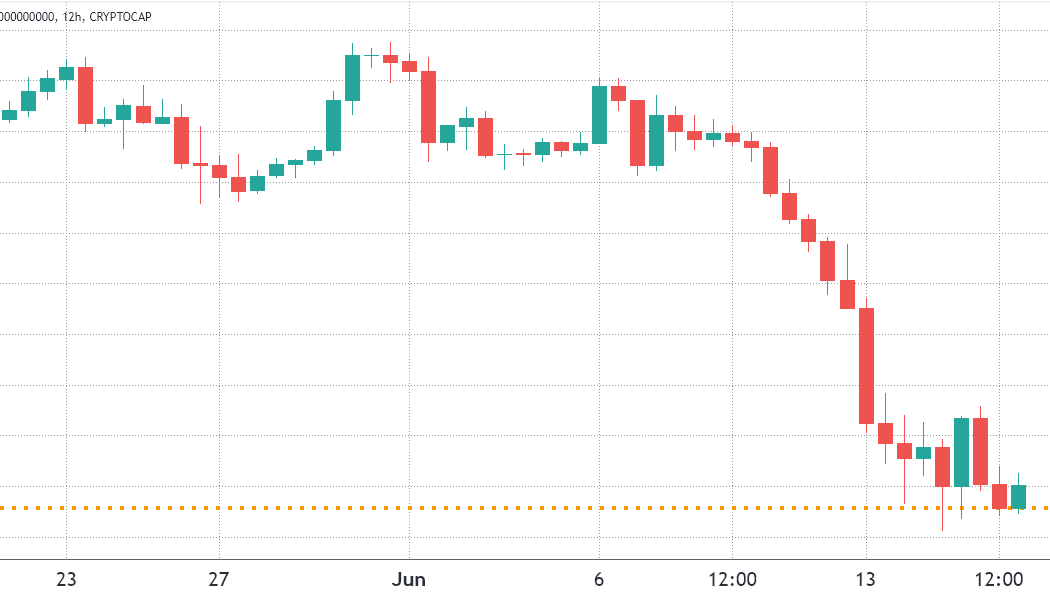

Market selling might ease, but traders are on the sidelines until BTC confirms $20K as support

The total crypto market capitalization fell off a cliff between June 10 and 13 as it broke below $1 trillion for the first time since January 2021. Bitcoin (BTC) fell by 28% within a week and Ether (ETH) faced an agonizing 34.5% correction. Total crypto market cap, USD billion. Source: TradingView Presently, the total crypto capitalization is at $890 million, a 24.5% negative performance since June 10. That certainly raises the question of how the two leading crypto assets managed to underperform the remaining coins. The answer lies in the $154 billion worth of stablecoins distorting the broader market performance. Even though the chart shows support at the $878 billion level, it will take some time until traders take in every recent event that has impacted the market. For example, the U.S...

Stablecoins highlight ‘structural fragilities’ of crypto — Federal Reserve

The Federal Reserve’s board of governors pointed to stablecoins as a potential risk to financial stability amid a volatile crypto market. In its Monetary Policy Report released on Friday, the board of governors of the Federal Reserve System said “the collapse in the value of certain stablecoins” — likely referring to TerraUSD (UST) becoming unpegged from the United States dollar in May — in addition to “recent strains” in the digital asset market suggested “structural fragilities.” The government department pointed to the President’s Working Group on Financial Markets report from November 2021, in which officials said legislation was “urgently needed” to address financial risks. “Stablecoins that are not backed by safe and sufficiently liquid assets and are not subject to appro...

Human rights activists take aim at privileged crypto critics in letter to Congress

Human rights activists from 20 countries have submitted an open letter to the United States Congress in support of a “responsible crypto policy” and praising Bitcoin and stablecoins as essential tools aiding democracy and freedom for tens of millions. The letter comes just a week after an anti-crypto open letter was sent to Congress purporting to be from the scientific community but whose lead signatures included well known crypto critics and authors from high income, democratic countries. The group of 21 activists clapping back include those from countries which have either seen recent conflict or have otherwise unstable economies such as Ukraine, Russia, Iraq, Nigeria, Venezuela, Cuba and even North Korea. The letter states: “We write to urge an open-minded, empathetic approach toward mo...

FCA will ‘absolutely’ consider recent stablecoin depegging when drafting crypto rules: Report

Sarah Pritchard, the executive director of markets at the United Kingdom’s Financial Conduct Authority, or FCA, reportedly said the regulator will look at the recent volatility in the crypto markets when creating rules for the space in 2022. According to a Friday Bloomberg report, Pritchard said the financial regulator will “absolutely” take into account stablecoins like TerraUSD (UST) and Tether (USDT) depegging from the U.S. dollar in drafting regulatory guidelines with Her Majesty’s Treasury for release later this year. While the USDT price only briefly dropped to $0.97 on May 12, UST’s has fallen more than 93% since May 9 to reach roughly $0.06 at the time of publication. “It really shows at front of mind the really significant issues that exist here, both in terms of a well-func...

Biden’s pick for Fed vice chair for supervision calls for congressional action on stablecoins

Michael Barr, a law professor and former advisory board member of Ripple Labs who is United States President Joe Biden’s pick for vice chair for supervision at the Federal Reserve, called for U.S. lawmakers to regulate stablecoins in an effort to address “financial stability risks.” In a confirmation hearing before the Senate Banking Committee on Thursday, Barr said innovative technologies including cryptocurrencies had “some potential for upside in terms of economic benefit” but also “some significant risks,” citing the need for a regulatory framework on stablecoins to prevent the risk of runs. Barr added that the Fed potentially releasing a central bank digital currency was an issue that required “a lot more thought and study,” echoing Fed chair Jerome Powell’s views concerning due dilig...

Bitcoin and Ethereum had a rough week, but derivatives data reveals a silver lining

This week the crypto market endured a sharp drop in valuation after Coinbase, the leading U.S. exchange, reported a $430 million quarterly net loss and South Korea announced plans to introduce a 20% tax on crypto gains. During its worst moment, the total market crypto market cap faced a 39% drop from $1.81 trillion to $1.10 trillion in seven days, which is an impressive correction even for a volatile asset class. A similar size decrease in valuation was last seen in February 2021, creating bargains for the risk-takers. Total crypto market capitalization, USD billion. Source: TradingView Even with this week’s volatility, there were a few relief bounces as Bitcoin (BTC) bounced 18% from a $25,400 low to the current $30,000 level and Ether (ETH) price also made a brief rally to $2,100 af...

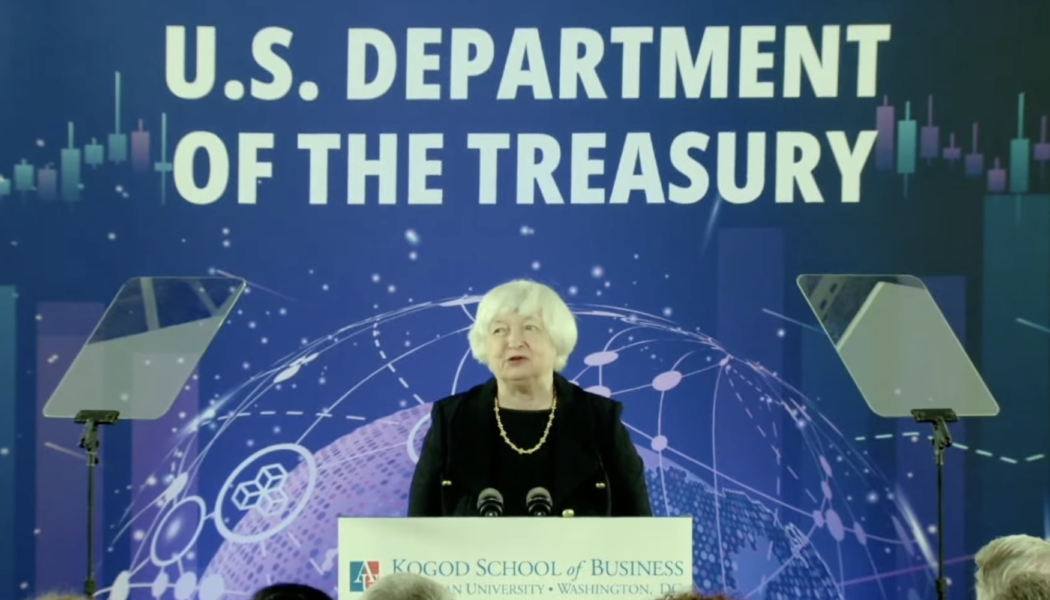

US Treasury Secretary reaffirms need for stablecoin regulation following UST crash

United States Secretary of the Treasury Janet Yellen called on U.S. lawmakers to develop a “consistent federal framework” on stablecoins to address risks to financial stability. In a Tuesday hearing of the Senate Banking Committee on the Financial Stability Oversight Council Annual Report to Congress, Yellen reiterated her previous position calling for a regulatory framework on stablecoins, citing a November report from the President’s Working Group on Financial Markets. In addition, the Treasury Secretary commented on TerraUSD (UST), the third-largest stablecoin by market capitalization, dropping to $0.67 in the last 24 hours. “I think [the situation with TerraUSD] simply illustrates that this is a rapidly growing product and that there are risks to financial stability and we need a...

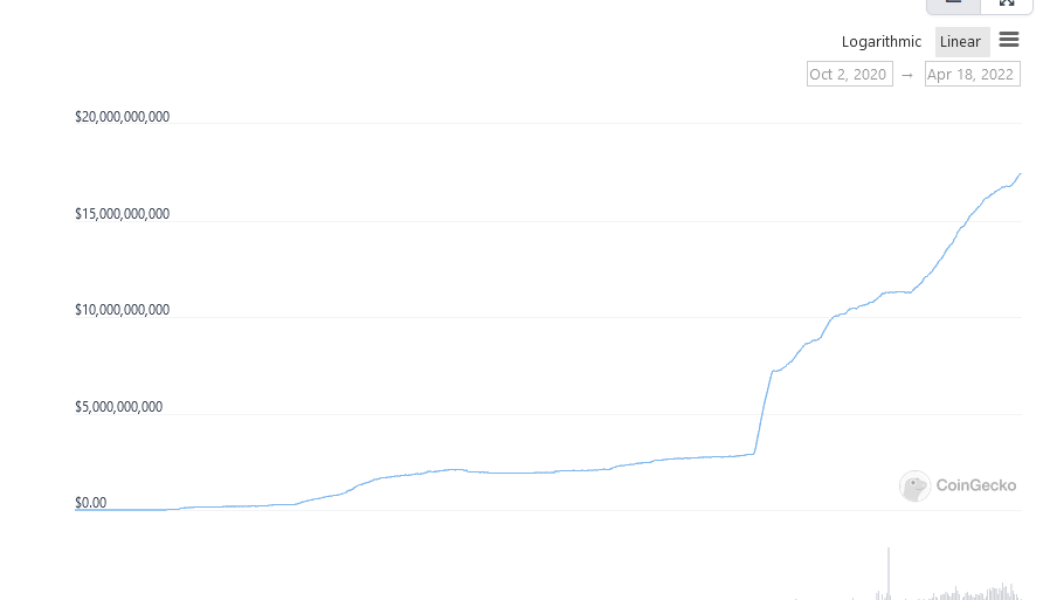

Terra’s UST flips BUSD to become third-largest stablecoin

The Terra (LUNA) blockchain’s algorithmic stablecoin Terra USD (UST) has flipped Binance USD (BUSD) to become the third-largest stablecoin on the market. UST is a USD-pegged stablecoin that was launched in September 2020. Its minting mechanism requires a user to burn a reserve asset such as LUNA to mint an equivalent amount of UST. According to Coingecko, UST’s total market capitalization has surged 15% over the past 30 days to sit at roughly $17.5 billion at the time of writing. The figure currently places UST as the third-largest stablecoin after it flipped BUSD with a slightly lower market cap of $17.46 billion. The asset now trailing only behind industry giants Tether (USDT) at $82.8 billion, and USD Coin (USDC) at $50 billion, however, the gap is quite substantial at this stage. The d...

Treasury Secretary hints at regulatory framework to address potential risks in digital asset markets

United States Treasury Secretary Janet Yellen listed stablecoins as one of the major policy concerns in the digital asset space for regulators, currently subject to “inconsistent and fragmented oversight.” Speaking to attendees at American University in Washington, D.C. on Thursday, Yellen said the Treasury Department was working with Congress to advance legislation to help ensure that “stablecoins are resilient to risks” for consumers and the U.S. financial system. According to the Treasury Secretary, while stablecoins raised “policy concerns” and issues around the coins’ reserve assets, many parts of the digital asset space present potential risks that could exacerbate inequality. “Our regulatory frameworks should be designed to support responsible innovation while managing risks and esp...

Toomey drafts bill to exempt stablecoins from securities regulations

Republican Senator Pat Toomey, the ranking member for the Senate Banking Committee, has drafted a bill proposing a regulatory framework for stablecoins in the United States. According to a draft released Wednesday, the Stablecoin Transparency of Reserves and Uniform Safe Transactions Act, abbreviated as the Stablecoin TRUST Act, proposed that the digital assets be identified as “payment stablecoins” — a convertible virtual currency used as a medium of exchange that can be redeemed for fiat by the issuer. Critically, the bill proposed that such offerings should be exempt from securities regulations by amending existing laws to ensure the definition of “security” does not include a payment stablecoin. The legislation also proposed that stablecoin issuers — which would include national t...