Stablecoin

Untethered: Here’s everything you need to know about TerraUSD, Tether and other stablecoins

The crypto winter could be claiming more casualties among the stablecoin camp. The de-pegging of TerraUSD (UST) on Tuesday triggered market sell-offs, and now Tether (USDT) appears to be losing its footing, having slipped against the U.S. dollar. The algorithmic stablecoin UST is, as the name implies, algorithmically backed. LUNA, the ecosystem’s corresponding token, has sunk over 95% since Tuesday, while UST continues to languish around the $0.50 mark. Cointelegraph’s resident experts shared their explanations for why UST crashed in a special edition of “The Market Report” yesterday. The plan for Terraform Labs’ algorithmic stablecoin continues to roll out, but UST is still struggling. [embedded content] Data from Cointelegraph Markets Pro confirmed that various stable...

Bitcoin falls below $27K to December 2020 lows as Tether stablecoin peg slips under 99 cents

Bitcoin (BTC) fell out of its long-term trading range on May 12 as ongoing sell pressure reduced markets to 2020 levels. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Tether wobbles as UST stays under $0.60 Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it exited the range in which it had traded since the start of 2021. At the time of writing, the pair circled $26,700 on Bitstamp, marking its lowest since Dec 28, 2020. The weakness came as fallout from the Terra stablecoin meltdown continued to ricochet around crypto and beyond, with rumors claiming that even professional funds were experiencing solvency issues due to losses on LUNA and UST. “People are still processing this but this is the Lehman moment for crypto” Hearing about a lo...

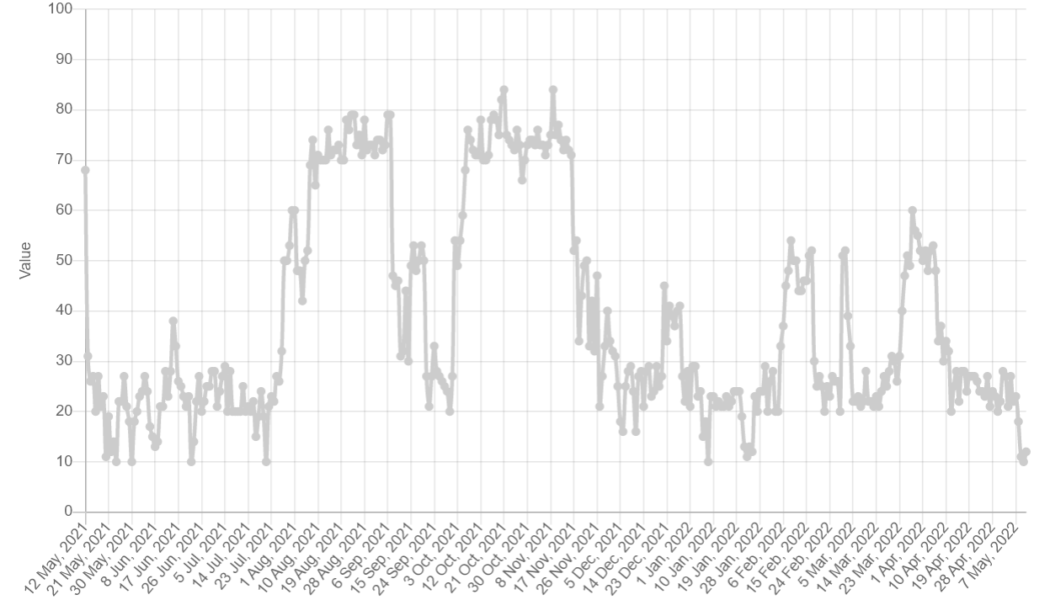

Bitcoin fights to hold $29K as fear of regulation and Terra’s UST implosion hit crypto hard

Bitcoin (BTC) price initially bounced from its recent low at $29,000 but the overall market sentiment after a 25% price drop in five days is still largely negative. Currently, the crypto “Fear and Greed Index,” which uses volatility, volume, social metrics, Bitcoin dominance and Google trends data, has plunged to its lowest level since March 2020 and at the moment, there appears to be little protecting the market against further downside. Crypto “Fear and Greed index”. Source: Alternative.me Regulation continues to weigh down the markets Regulation is still the main threat weighing on markets and it’s clear that investors are taking a risk-off approach to high volatility assets. Earlier this week, during a hearing of the Senate Banking Committee, United S...

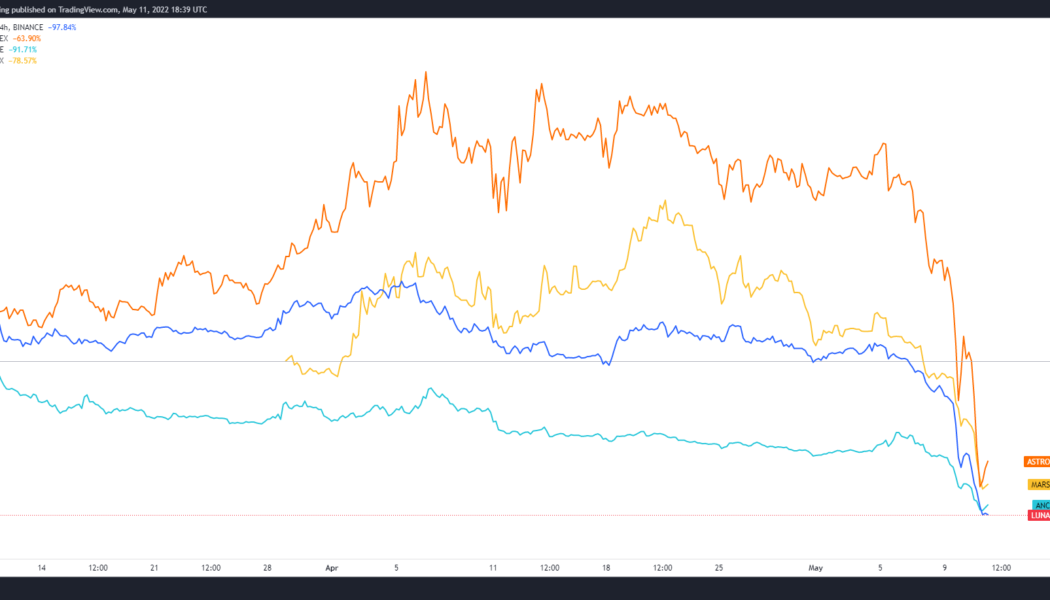

Terra contagion leads to 80%+ decline in DeFi protocols associated with UST

The knock-on effect of the collapse of Terra (LUNA) and its TerraUSD (UST) stablecoin have spread wide across the cryptocurrency market on May 11 as projects with any kind of association with the DeFi ecosystem have seen their prices hammered. The forced selling of the Bitcoin (BTC) holdings backing a portion of UST also influenced BTC’s current drop to $29,000 and analysts fear that DeFi platforms that have liquidity pools primarily comprised of UST and LUNA will collapse. LUNA, ANC, ASTRO and MARS in USDT pairings. 4-hour chart. Source: TradingView Terra-based protocols suffer Projects with the direst of outlooks are those that are hosted on the Terra protocol including Anchor Protocol (ANC), Astroport (ASTRO) and Mars Protocol (MARS). As shown in the chart above, ...

De-pegged UST sends LUNA tumbling: Token price down almost 95% in the last 24 hours

LUNA has seen an extended downturn as investors rush to sell off The token has lost more than 90% on the day, sinking below $2.00 Crypto markets are seeing the worst of volatility caused by their correlation with stock markets, which are, on the other hand reacting to the US Federal Reserve’s aggressive monetary policy against inflation. However, some are feeling the pinch more than others, and the Terra ecosystem is one such network as it is barely holding on for survival in this bear market. Terra’s LUNA token has seen a large-scale sell-offs as holders rush to cut their losses and dump the asset. This comes after the LUNA/USD pair plunged to single-digit figures – a month after hitting as high as $120 in early April. CoinMarketCap data shows that LUNA is trading below at $2.0...

Binance suspends LUNA and UST withdrawals

Binance, a crypto exchange, has announced that it has suspended the withdrawal of UST and LUNA stablecoins temporarily due to bottleneck processes. This comes after the TerraUSD (UST) stablecoin de-pegged from the US dollar causing its price and that of LUNA to drop drastically. LUNA, for instance, has dropped by more than 85% today. In an official announcement issued yesterday, Binance said: ‘’Withdrawals for LUNA and UST tokens on the Terra (LUNA) network were temporarily suspended on 2022-05-10 at 02:20 AM (UTC) due to a high volume of pending withdrawal transactions. This is caused by network slowness and congestion. Binance will reopen withdrawals for these tokens once we deem the network to be stable and the volume of pending withdrawals has reduced. We will not notify users in a fur...

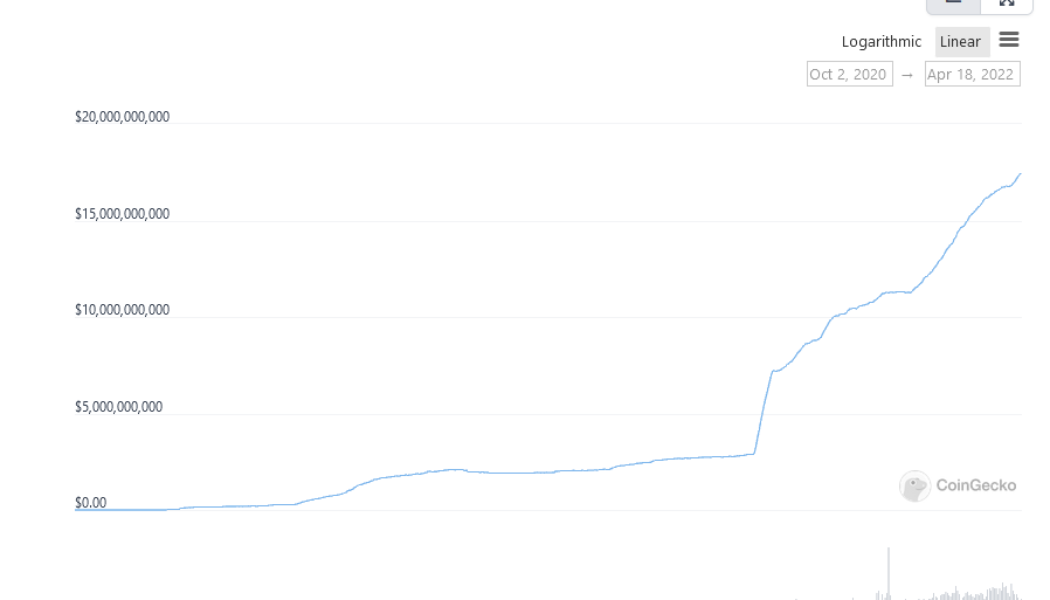

The Fed cites its concern about stablecoins in its latest Financial Stability Report

The United States Federal Reserve Board released its semiannual Financial Stability Report on Monday. The report points to the volatility on commodities markets brought on by the Russian invasion of Ukraine, the spread of the omicron variant of COVID-19 and “higher and more persistent than expected” inflation as sources of instability. Stablecoins and some types of money market funds were singled out in the report and noted to be prone to runs. According to the Fed, stablecoins have an aggregate value of $180 billion, with 80% of that amount represented by Tether (USDT), USD Coin (USDC), and Binance USD (BUSD). They are backed by assets that may lose value or become illiquid during stress, leading to redemption risks, and those risks may be exacerbated by a lack of transparency, the centra...

Silence from Do Kwon says it all amid UST crisis

Do Kwon is the founder of Terra and the face of the ecosystem. He is also extremely active on Twitter, frequently discussing Luna, UST and the merits of the algorithmic peg. Tone Well, I say discussing, but it’s normally far from a discussion. He often takes a very aggressive line with accounts enquiring about the sustainability of the peg, the long-term viability of Anchor and many other (valid) questions about the experiment that is UST. 6/ On depeg risk – I’ve grown quite tired of arguing with idiots on Twitter on whether UST can remain stable in bear. So soon I will propose creating multi billion dollar reserves in decentralized assets (BTC and others) in an attempt to save myself time. More to follow. — Do Kwon 🌕 (@stablekwon) November 20, 2021 Yesterday, his UST stablec...

Nouriel Roubini oversees the development of tokenized dollar replacement

Economist and cryptocurrency critic Nouriel Roubini is heading up the development of a tokenized asset to combat fears of rampant economic stagnation and inflation. Roubini has long been a skeptic of the cryptocurrency space, which makes his own foray into the world of digitized financial instruments intriguing. In his role as co-founder and chief economist of Dubai-based investment firm Atlas Capital Team LP, Roubini is helping with the roll-out of a set of financial instruments to launch a security token that will act as a “more resilient dollar.” As initially reported by Bloomberg, Atlas Capital CEO Reza Bundy and Roubini outlined initial plans for the firm’s new products, primarily driven by the current state of the global economy. The Dubai-based firm will work with Web3 developer Mys...

Binance temporarily suspends LUNA, UST withdrawals citing network congestion

As the crypto community still tries to decipher Terra’s ongoing pegging-de-pegging fiasco in relation to its stablecoin offering TerraUSD (UST), major crypto exchange Binance temporarily suspended the withdrawals for Terra (LUNA) and UST on Tuesday. The market value of UST, Terra’s stablecoin offering, recently fell below the expected $1.00 price point as LUNA’s price witnessed a sharp decline owing to a major selloff. At the same time, the BTC/UST trading pair on Binance reached highs of more than $42,000, while other Bitcoin dollar markets struggled to preserve $30,000, as reported by Cointelegraph. Which has caused a massive surge in BTCUST (Not Bitcoin valued in dollars, but valued in the UST stablecoin). pic.twitter.com/Xn7qcy4VMZ — Blockchain Backer (@BCBacker) May 10, 202...

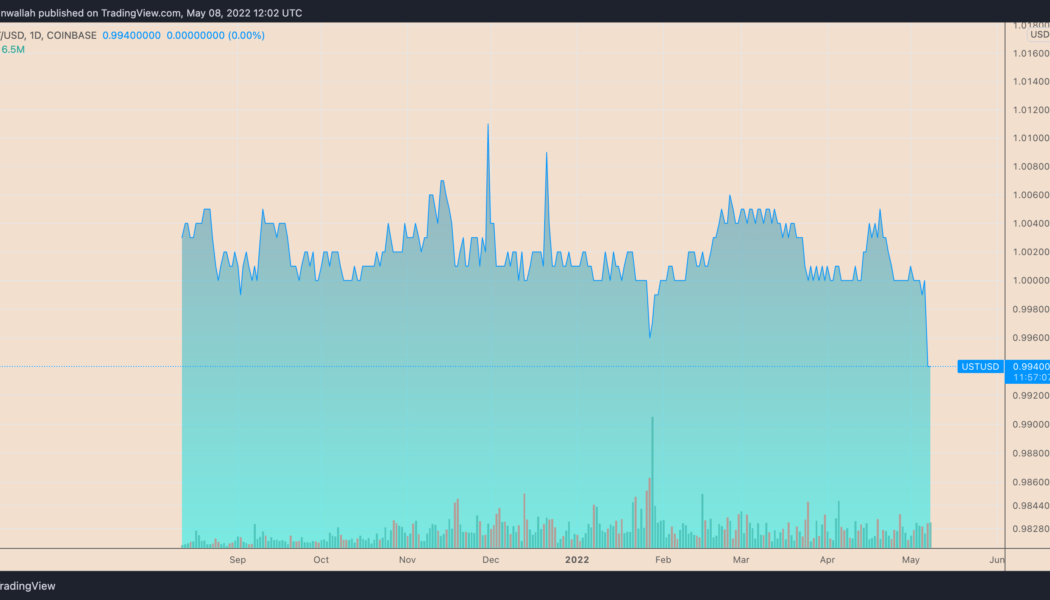

LUNA drops 20% in a day as whale dumps Terra’s UST stablecoin — selloff risks ahead?

Terra (LUNA) has plunged significantly after witnessing a FUD attack on its native stablecoin TerraUSD (UST). The LUNA/USD pair dropped 20% between May 7 and May 8, hitting $61, its worst level in three months, after a whale mass-dumped $285 million worth of UST. As a result of this selloff, UST briefly lost its U.S. dollar peg, falling to as low as $0.98. UST daily price chart. Source: TradingView Excessive LUNA supply LUNA serves as a collateral asset to maintain UST’s dollar peg, according to Terra’s elastic monetary policy. Therefore, when the value of UST is above $1, the Terra protocol incentivizes users to burn LUNA and mint UST. Conversely, when UST’s price drops below $1, the protocol rewards users for burning UST and minting LUNA. Therefore, during UST supp...

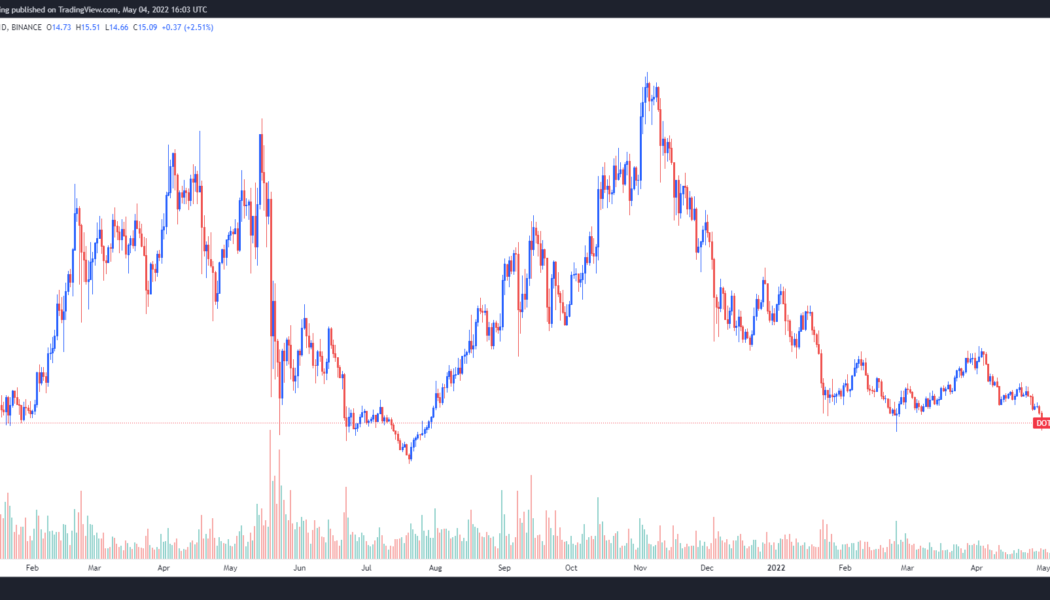

Will Polkadot (DOT) price reverse course now that cross-chain messaging is live?

Development within the Polkadot (DOT) ecosystem has been slowly unfolding over the past year and a half, and the work put in by developers is finally starting to bear fruit as parachain auctions finish and the first chains launch on the mainnet. The next phase of interoperability within the ecosystem is set to kick off now that cross-chain functionality is about to go live. This next step will allow Polkadot-based parachains to communicate with each other and transfer assets between chains. After passing community vote, v0.9.19 has been enacted on Polkadot. This upgrade included a batch call upgrading Polkadot’s runtime to enable parachain-to-parachain messaging over XCM and upgrading #Statemint to include minting assets (like NFTs) and teleports. pic.twitter.com/uqIB5di2Q1 — Polkado...