Stablecoin

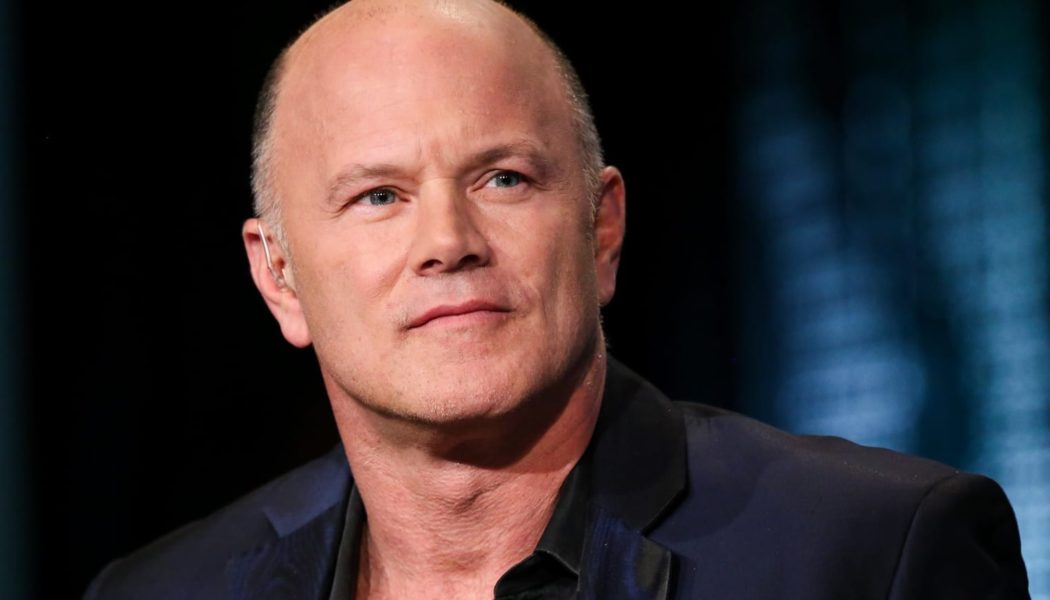

Galaxy Digital’s Novogratz finally clarifies the firm’s position following Terra crash

The Galaxy Digital CEO says the implosion is a reminder to investors to manage their risks He acknowledged that the algorithmic stable TerraUSD was a big idea that failed to live up to expectations The recent implosion of stable coin TerraUSD has demonstrated that cryptocurrencies still rank high among risk-on assets with extreme volatility. UST’s breakdown swept both retail traders and industry giants, and one CEO who’s felt the effects firsthand more than most is Galaxy Digital’s Mike Novogratz. The American investor was a recognised LUNA enthusiast before the breakdown of Terra, but he now says recent events are a reminder to remain humble in investments. Breaking a Twitter hiatus that lasted about ten days, Novogratz shared a link to a letter addressing the recent harrowing exper...

Do you have the right to redeem your stablecoin?

Stablecoins are often discussed with regard to their “stability.” It is usually questioned whether a stablecoin is sufficiently backed with money or other assets. Undoubtedly, it is a very important aspect of stablecoin value. But, does it make sense if the legal terms of a stablecoin do not give you, the stablecoin holder, the legal right to redeem that digital record on blockchain for fiat currency? This article aims to look into the legal terms of the two largest stablecoins — Tether (USDT) by Tether and USD Coin (USDC) by Centre Consortium, established by Coinbase and Circle — to answer the question: Do they owe you anything? Related: Stablecoins will have to reflect and evolve to live up to their name Tether Article 3 of Tether’s Terms of Service explicitly states: “Tether reserves th...

Terra fallout: Stablegains lawsuit, Hashed loses billions, Finder wrong and more

Fallout from the collapse of the Terra ecosystem continues to unfold with the United States-based yield generation application Stablegains facing potential legal action over its losses from the event. Users believe that Stablegain has allegedly lost up to $44 million worth of deposited funds, based on a post on a Terra forum by co-founder Kamil Ryszkowski asking for relief funding. He disclosed that a day before TerraUSD (UST) had lost its peg with the U.S. dollar, its users’ funds totaled over 47.6 million UST from 4,878 depositors. Currently, the price of UST is trading at $0.075, according to data from CoinGecko. A letter from class action law firm Erickson Kramer Osbourne (EKO) sent to Stablegains, dated May 14, demands a record of customer accounts, marketing materials and any co...

G7 financial officials call on Financial Stability Board to step up crypto regulation—report

The top financial officials from the Group of Seven (G7) largest advanced industrial economies has called on the Financial Stability Board to speed up crypto-asset regulation, Reuters reported Thursday, citing a copy of a communique it had obtained. The officials from Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States were meeting in Koenigswinter, Germany, following a G7 foreign ministers’ meeting earlier in the week. “In light of the recent turmoil in the crypto-asset market, the G7 urges the FSB (Financial Stability Board)…to advance the swift development and implementation of consistent and comprehensive regulation,” The turmoil referred to was the de-pegging of the TerraUSD (UST) stablecoin that began May 8 and sent shockwaves throughout...

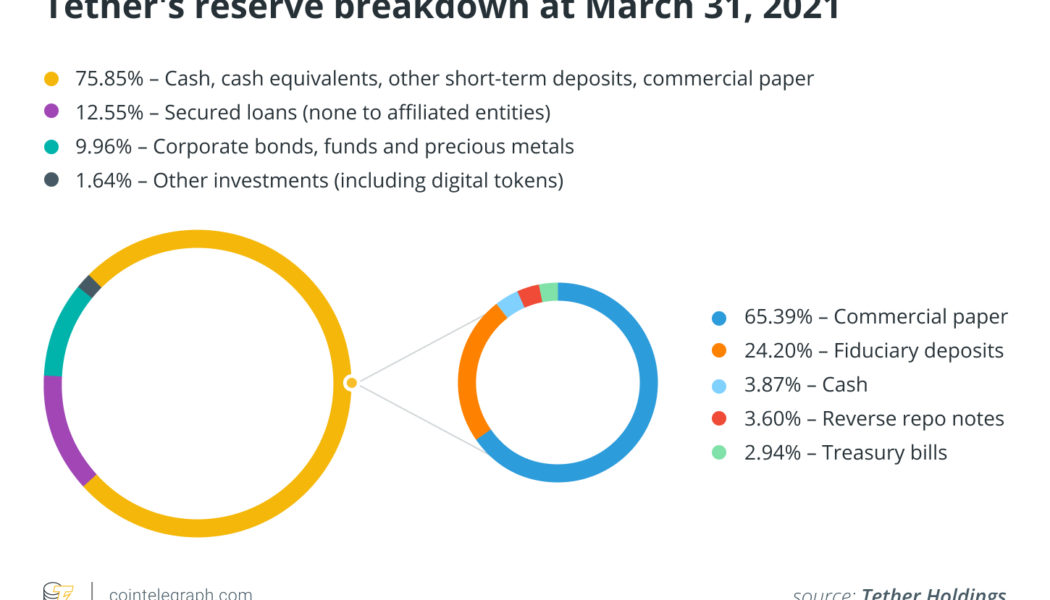

Tether reports 17% decrease in commercial paper holdings over Q1 2022

USDT Stablecoin issuer Tether (USDT) has reported it cut its reserves allocation to commercial paper investments and increased that of United States Treasury bills over the first quarter of 2022. In a Thursday blog post, Tether reported its reserves were “fully backed,” seemingly in an effort to assuage many users’ fears around USDT briefly depegging from the dollar on May 12. According to the stablecoin issuer, its commercial paper holdings over Q1 2022 decreased 17% from roughly $24 billion to $20 billion, with an additional 20% reduction to be reflected in the firm’s next quarterly report. Tether also increased investments in money market funds and U.S. Treasury bills by 13% over the same quarter, from roughly $34.5 billion to $39 billion. “Tether has maintained its stability through mu...

Was Terra’s UST cataclysm the canary in the algorithmic stablecoin coal mine?

The past week has not been an easy one. After the collapse of the third-largest stablecoin (UST) and what used to be the second-largest blockchain after Ethereum (Terra), the depeg contagion seems to be spreading wider. While UST has completely depegged from the U.S. dollar, trading at sub $0.1 at the time of writing, other stablecoins also experienced a short period where they also lost their dollar peg due to the market-wide panic. Tether’s USDT stablecoin saw a brief devaluation from $1 to $0.95 at the lowest point in May. 12. USDT/USD last week from May. 8–14th. Source: CoinMarketCap FRAX and FEI had a similar drop to $0.97 in May. 12; while Abracadabra Money’s MIM and Liquity’s LUSD dropped to $0.98. FRAX, MIM, FEI and LUSD price from May. 9 – 15th. Source: CoinMarketCap A...

Bitcoin is discounted near its ‘realized’ price, but analysts say there’s room for deep downside

There are early signs of the “dust settling” in the crypto market now that investors believe that the worst of the Terra (LUNA) collapse looks to be over. Viewing Bitcoin’s chart indicates that while the fallout was widespread and quite devastating for altcoins, BItcoin (BTC) has actually held up fairly well. Even with the May 12 drop to $26,697 marking the lowest price level since 2020 multiple metrics suggest that the current levels could represent a good entry to BTC. BTC/USDT 1-day chart. Source: TradingView The pullback to this level is notable in that it was a retest of Bitcoin’s 200-week exponential moving average (EMA) at $26,990. According to cryptocurrency research firm Delphi Digital, this metric has historically “served as a key area for prior...

MakerDAO price rebounds as DAI holds its peg and investors search for stablecoin security

Its been a rough couple of weeks for the cryptocurrency market. Bitcoin (BTC) price is nowhere near the price estimates of most analysts, multiple stablecoins lost their peg and the demise of one of the top decentralized finance (DeFi) platforms sparked an event that resulted in $900 billion vanishing from the total crypto market capitalization. In the midst of the widespread fallout, MakerDAO (MKR) managed to turn crisis into opportunity and the collapse of TerraUSD (UST) has brought renewed attention to DAI, the longest-running decentralized stablecoin. Data from Cointelegraph Markets Pro and TradingView shows that as the collapse of Terra (LUNA) price accelerated from May 9 to May 12, MKR climbed 66.2% from a low of $952 on May 12 to its current value of $1,587. MKR/USDT 1-da...

UK Treasury en route to legalizing stablecoins amid Terra’s UST crash

United Kingdom’s Department of Treasury, or Her Majesty’s Treasury, has reportedly decided to go ahead with regulating stablecoins as legal tender. While welcomed by the crypto community, the decision comes as a shocker due to its proximity to the recent fall of one of the most popular algorithmic stablecoin, TerraUSD (UST). A local report from The Telegraph highlighted the Treasury’s intent to regulate stablecoins across Britain, which was revealed during the Queen’s Speech. During the speech, Prince Charles announced the introductions of new legislation across various sectors, including measures to drive economic growth to improve living standards in the region, adding: “A bill will be brought forward to further strengthen powers to tackle illicit finance, reduce economic crim...

$1.9T wipeout in crypto risks spilling over to stocks, bonds — stablecoin Tether in focus

The cryptocurrency market has lost $1.9 trillion six months after it soared to a record high. Interestingly, these losses are bigger than those witnessed during the 2007’s subprime mortgage market crisis — around $1.3 trillion, which has prompted fears that creaking crypto market risk will spill over across traditional markets, hurting stocks and bonds alike. Crypto market capitalization weekly chart. Source: TradingView Stablecoins not very stable A massive move lower from $69,000 in November 2021 to around $24,300 in May 2022 in Bitcoin’s (BTC) price has caused a selloff frenzy across the crypto market. Unfortunately, the bearish sentiment has not even spared stablecoins, so-called crypto equivalents of the U.S. dollar, which have been unable to stay as “stable” a...

No rescue for Terra: Swiss asset manager denies $3B LUNA/UST bail-out talks

GAM Investments has quashed fake news reports that surfaced on Friday that claimed the Swiss asset manager would invest some $3 billion to aid in the recovery of the Terra ecosystem, including LUNA and TrueUSD (UST) stablecoin. An announcement published on May 12 claimed that the firm was engaging in talks with Terraform Labs to assist in recovery attempts after Terra’s algorithmic stablecoin UST lost its $1 peg — causing a cataclysmic crash of the acclaimed blockchain protocol which had become a darling of the Decentralized Finance space. Cointelegraph has confirmed with GAM Investments that the press release was fabricated — with head of communications and investor relations Charles Naylor categorically labeling the release as fake news – which even included fake quotes from ...

SEC’s Hester Peirce says new stablecoin regs need to allow room for failure

Commissioner Hester Peirce — also known as the Securities and Exchange Commission’s (SECs) “crypto mom” — has backed a regulatory framework for stablecoins that allows “room for there to be failure.” Speaking at an online panel on May 12 hosted by financial think-tank the Official Monetary and Financial Institutions Forum (OMFIF) Peirce, who has long been an advocate for crypto, was asked to shed light on the actions being taken by U.S. regulatory bodies in regard to cryptocurrency. “One place we might see some movement is around stablecoins,” Peirce answered, “that’s an area that has gotten a lot of attention this week.” “It’s been one area within crypto that’s really had quite a moment and there’s a lot of stablecoin use and therefore people are thinki...