Stablecoin

Bitcoin bears beware! BTC holds $17K as support while the S&P 500 drops 1.5%

Bitcoin (BTC) bulls regained some control on Nov. 30 and they were successful in keeping BTC price above $16,800 for the past 5 days. While the level is lower than traders’ desired $19,000 to $20,000 target, the 8.6% gain since the Nov. 21, $15,500 low provides enough cushioning for eventual negative price surprises. One of these instances is the United States stock market trading down 1.5% on Dec. 5 after a stronger-than-expected reading of November ISM Services fueled concerns that the U.S. Federal Reserve (FED) will continue hiking interest rates. At the September meeting, FED Chairman Jerome Powell indicated that the point of keeping interest rates flat “will need to be somewhat higher.” Currently, the macroeconomic headwinds remain unfavorable and this is likely to remain ...

DAM Finance unvleis out the Moonwalkers v1 testnet

In its quest to introduce a decentralized omnichain stablecoin solution to securely address the liquidity challenges facing the broader decentralized finance (DeFi) ecosystem, DAM Finance has launched the Moonwalker v1 testnet. The Moonwalkers v1 testnet lays the foundation for DAM’s solutions and DAM is expected to introduce its solutions on the mainnet after the testnet phase. This will provide users with a wide range of assets including yield-generating collateral. Using the Moonwalker V1 testnet The Moonwalker v1 testnet has been deployed on both Ethereum’s Goerli Testnet and Moonbeam’s Moonbase Alpha, an EVM-compatible chain built on Polkadot. DAM community members will be able to mint DAM’s decentralized omnichain stablecoin d20 directly using existing stablecoins like USDC on Ethere...

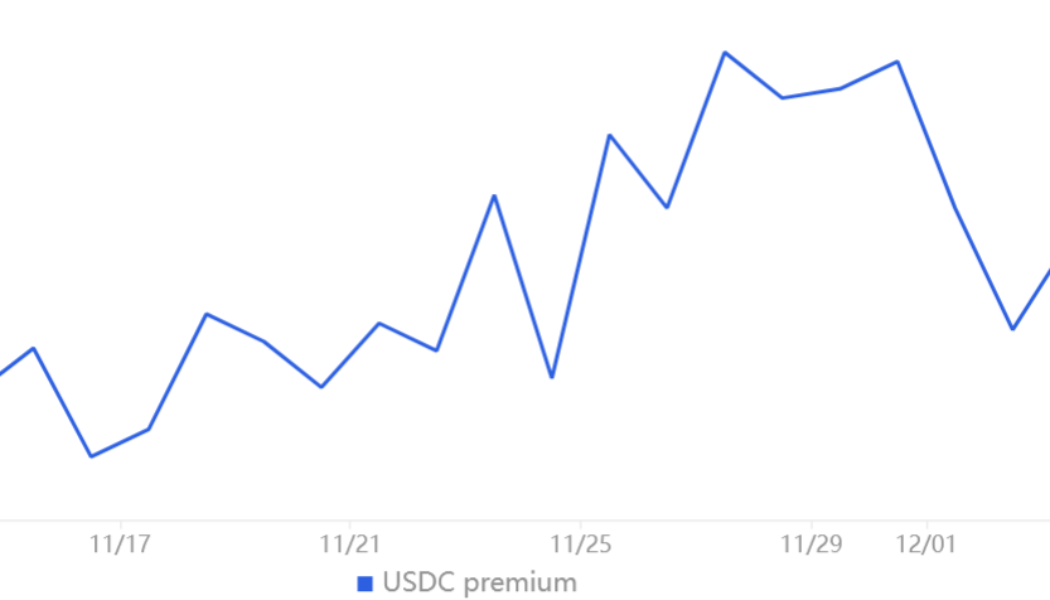

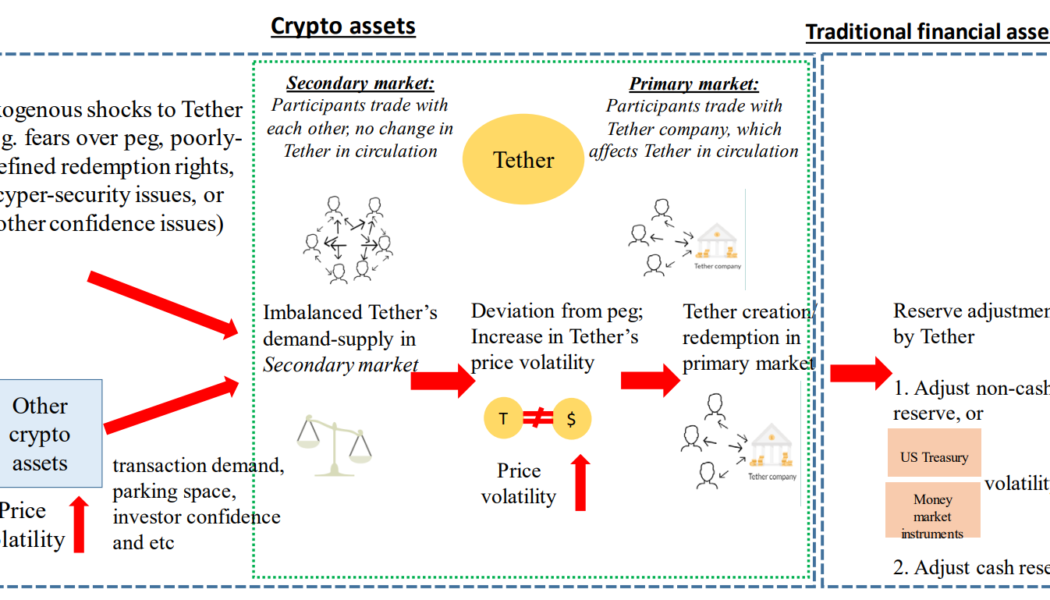

Hong Kong believes stablecoin volatility can spillover to traditional finance

The fall of crypto giants this year reignited questions about the stability of cryptocurrencies and their impact on fiat ecosystems. Hong Kong Monetary Authority (HKMA) assessed the situation and found that the instabilities of crypto assets, including asset-backed stablecoins, can potentially spill over to the traditional financial system. The HKMA assessment on asset-backed stablecoins pointed out the risks of liquidity mismatch, negatively impacting their stability during “fire-sale” events. A fire sale event relates to a momentary price fluctuation when investors can purchase stablecoins cheaper than their market price — a phenomenon noticed during the Terra (LUNA) crash. According to Hong Kong’s central bank, the interconnection of crypto assets has made the crypto ecosystem more vuln...

Terra Labs, Luna Guard commission audit to defend against allegations of misusing funds

The Luna Foundation Guard (LFG) and Terraform Labs (TFL) commissioned a technical audit of their efforts to defend the price of TerraUSD (UST) between May 8 and 12, 2022. The audit was intended to answer “allegations posed in social media” about the fate of funds transferred during efforts to defend the UST dollar peg, according to the LFG blog. The audit found that LFG spent 80,081 Bitcoins (BTC) and $49.8 million in stablecoins (about $2.8 billion at the time) to defend the UST peg. That was consistent with what LFG indicated in its tweets on May 16. In addition, TFL spent $613 million to defend the peg. The audit was conducted by U.S. consulting firm JS Held. LFG concluded that the audit results show there was no misuse of funds and no funds were used to benefit insiders. Furthermo...

Canada to examine crypto, stablecoins, and CBDCs in new budget

The Canadian federal government is set to launch a consultation on cryptocurrencies, stablecoins, and Central Bank Digital Currencies (CBDCs) as revealed in its new mini-budget. The government’s “2022 Fall Economic Statement” released on Nov. 3 by Deputy Prime Minister Chrystia Freeland works as a fiscal update in conjunction with its main yearly budget. The statement included a small section on “Addressing the Digitalization of Money” that outlined the government’s crypto plans. It said the rise in cryptocurrencies and money digitalization is “transforming financial systems in Canada and around the world” and the country’s financial system regulation “needs to keep pace.” The statement opined that money digitalization “poses a challenge to democratic institutions around the world” h...

Singapore MAS proposes to ban cryptocurrency credits

The Monetary Authority of Singapore (MAS) is introducing proposals to better regulate the cryptocurrency industry in the aftermath of the bankruptcy of the Singaporean crypto hedge fund Three Arrows Capital (3AC). The central bank of Singapore has issued two consultation papers on proposals for regulating the operations of digital payment token service providers (DPTSP) and stablecoin issuers under the Payment Services Act. Published on Oct. 26, both consultation papers aim to reduce risks to consumers from crypto trading and improve standards of stablecoin-related transactions. The first document includes proposals for digital payment token (DPT) services or services related to major cryptocurrencies like Bitcoin (BTC), Ether (ETH) or XRP (XRP). According to the authority, “any form of ...

The UK has a new name for stablecoins and a new bill to regulate crypto

The United Kingdom moved forward on the Financial Services and Markets Bill on Oct. 25, hardening its vision for Bitcoin (BTC) cryptocurrency and “digital settlement assets” in the country. The Bill, proposed on Oct. 18, suggested would propose “A range of measures to maintain and enhance the U.K.’s position as a global leader in financial services, ensuring the sector continues to deliver for individuals and businesses across the country.” The Bill reasserts the U.K.’s intention to become a global cryptocurrency hub, comments echoed by Dr. Lisa Cameron, Member of Parliament and the chairperson of The Crypto and Digital Assets All-Party Parliamentary Group. In an exclusive interview with Cointelegraph over the weekend, she explained that crypto is on the lawmakers’ radar, although there is...

MakerDAO community votes to approve custody of $1.6B USDC with Coinbase

Institutional prime broker platform for crypto assets Coinbase Prime announced on Oct 24th that it had entered into a partnership with MakerDAO — the largest single holder of USDC — to become a custodian of $1.6 billion worth of the stablecoin. The MakerDAO community voted to approve this custodianship which will allow its community to earn a 1.5% reward on its USDC while holding funds with a leading institutional custodian. The program described the following yield schedule for the USDC onboarded by @MakerDAO: • 1% APY on the first 100 million USDC. • 0.1% more APY on each 100 million USDC thereafter. • Rewards are not to exceed 1.5% APY. 3/ — Maker (@MakerDAO) October 24, 2022 According to Coinbase Prime, this move will not only accrue tangible benefits to the MakerDAO community but also...

Wealthy crypto believer and incoming UK PM Rishi Sunak once commissioned a royal NFT

Rishi Sunak is set to become prime minister of the United Kingdom within days. Sunak was defeated for the top government post by Liz Truss on Sept. 5, but she resigned after 45 days in office. Indications so far are that his selection for the office is good news for the crypto industry. Sunak was chancellor of the exchequer, or head of the treasury, from early 2020 to July 5, when he resigned during a scandal that shook Boris Johnson’s government. During that time, Sunak repeatedly voiced his support for crypto. Speaking in April about proposed regulatory reform related to stablecoins, Sunak said: “It’s my ambition to make the U.K. a global hub for crypto-asset technology, and the measures we’ve outlined […] will help to ensure firms can invest, innovate and scale up in this country. This ...

Acting US FDIC head cautiously optimistic about permissioned stablecoins for payments

Acting United States Federal Deposit Insurance Corporation (FDIC) chairman Martin Gruenberg spoke Oct. 20 about possible applications of stablecoins and the FDIC’s approach to banks considering engaging in crypto asset-related activities. Although he saw no evidence of their value, Gruenberg conceded that payment stablecoins merit further consideration. Gruenberg began his talk at the Brookings Institute with an expression of frustration seemingly common among many regulators: “As soon as the risks of some crypto-assets come into sharper focus, either the underlying technology shifts or the use case or business model of the crypto-asset changes. New crypto-assets are regularly coming on the market with differentiated risk profiles such that superficially similar crypto-assets may pose sign...

Fed governor Waller says US CBDC would not enhance things the world loves about US fiat

A United States central bank digital currency (CBDC) would not enhance the qualities of the U.S. fiat dollar that foreign companies value most, U.S. Federal Reserve Board governor Christopher Waller in a speech released Oct. 14. CBDC skeptic Waller took a look at the question through the lens of national security at a symposium held at Harvard University. Waller had a more favorable view of dollar-backed stablecoin. The role of the U.S. dollar worldwide is an area where economics, CBDCs, and national security dovetail, Waller said. The indisputable primacy of the U.S. dollar in the world brings benefits to the United States and the other countries where the dollar plays a role in their economies or as a reserve currency. Just in: New speech Fed Gov. Christopher Waller – The U.S. Doll...

Rep. McHenry gives progress report on stablecoin legislation, says it’s an ‘ugly baby’

Patrick McHenry, ranking member of the United States House of Representatives Financial Services Committee, thinks the “conversation has become unmoored” regarding financial technology and needs to return to solving real-world problems. He is currently in talks over legislation that may at least bring more clarity to stablecoins. Currently, there is no U.S. federal definition of digital assets or stablecoins, McHenry said, calling the situation “retrograde.” McHenry, House Financial Services Committee Chair Maxine Waters and the Treasury Department have been in negotiations for months on legislation to regulate stablecoins “in an election year, in a divided Washington.” He spoke positively about the bipartisan nature of the legislation taking shape and tradeoffs that have been made between...