Stablecoin

Circle’s valuation doubles to $9B following revised merger agreement with Concord

USD Coin (USDC) operator Circle has seen its valuation double to $9 billion after the company revised its merger agreement with Concord Acquisition Corp, a special purpose acquisition company (SPAC) founded in 2020. Circle announced Thursday that it had terminated its previous business combination terms with Concord and reached a new agreement that is expected to be finalized by December 8, 2022, with the possibility of it being extended to January 31, 2023. As Cointelegraph reported, Circle and Concord first announced their merger plans in July 2022. A Circle spokesperson told Cointelegraph that the new agreement reflects a commitment from both parties to move the deal forward after it became clear that the original closing date wouldn’t be met. They explained: “It was clear that the orig...

Fireblocks completes First DAG acquisition to extend its payment offering

This is Fireblocks’ first-ever acquisition Fireblocks aims to enhance its payment offerings to acquirers and payment service providers Crypto infrastructure provider Fireblocks revealed yesterday that it had completed a deal to acquire Israeli crypto payments processor First Digital Assets Group (First DAG). The acquisition of the digital asset payments technology platform is the first-ever Fireblocks has completed. First DAG employees absorbed into the firm as part of the agreement Though specifics were not revealed at the time of the announcement, Fireblocks said that the deal was completed in cash and stocks. Two sources familiar with the matter have indicated that the price could be in the region of $100 million. Fireblocks plans to expand its current payment offering to enable p...

DeFi flashes early revival signs as retail and institutional inflows trickle in

Decentralized finance (DeFi) has had a rough go so far in 2022, and data from Messari shows the top ten-ranked DeFi assets currently down between 10% to 50% since the start of the year. Top ten DeFi tokens by market capitalization. Source: Messari A positive is, the situation may change soon as funds have began to flow back into the DeFi ecosystem following a month of declines as data shows institutional and retail funds returning to crypto markets. Data from Defi Llama shows that the total value locked in all of DeFi platforms has climbed to $211.1 billion on Feb. 11, up from a low of $185.14 billion on Jan. 31 Total value locked in DeFi. Source: Defi Llama A closer look at the individual protocols that contribute to the total TVL shows that the biggest drawdowns in TVL over the past 30 d...

DeFi flashes early revival signs as retail and institutional inflows trickle in

Decentralized finance (DeFi) has had a rough go so far in 2022, and data from Messari shows the top ten-ranked DeFi assets currently down between 10% to 50% since the start of the year. Top ten DeFi tokens by market capitalization. Source: Messari A positive is, the situation may change soon as funds have began to flow back into the DeFi ecosystem following a month of declines as data shows institutional and retail funds returning to crypto markets. Data from Defi Llama shows that the total value locked in all of DeFi platforms has climbed to $211.1 billion on Feb. 11, up from a low of $185.14 billion on Jan. 31 Total value locked in DeFi. Source: Defi Llama A closer look at the individual protocols that contribute to the total TVL shows that the biggest drawdowns in TVL over the past 30 d...

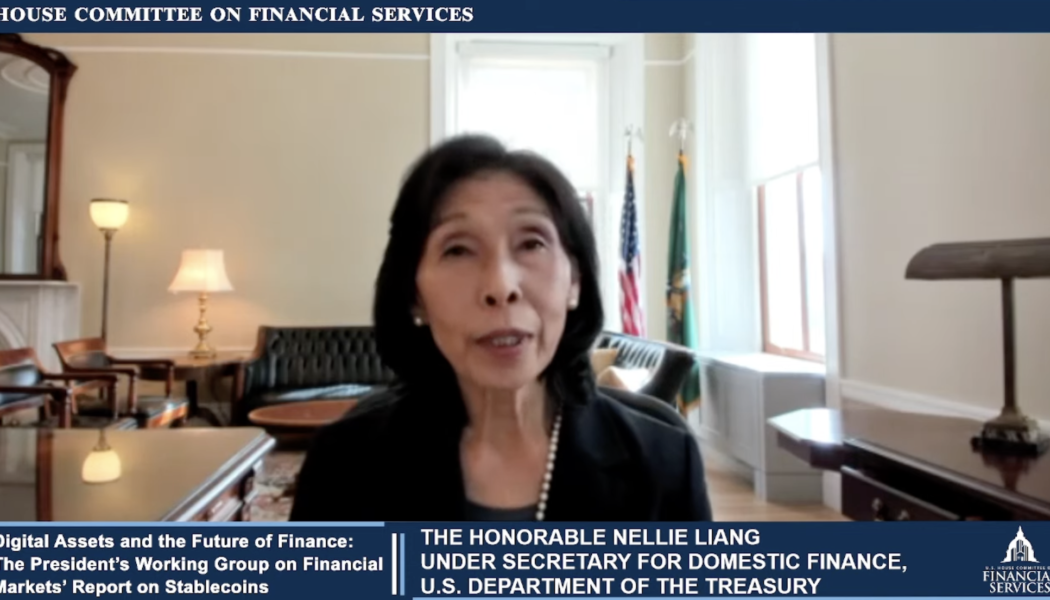

US lawmaker pushes for state-level regulations on stablecoins at hearing on digital assets

Whether regulations on stablecoins and digital assets should be addressed at the state or federal level was the topic of discussion among at least two U.S. lawmakers in a hearing for the House Committee on Financial Services. Speaking virtually at a Tuesday hearing titled “Digital Assets and the Future of Finance: The President’s Working Group on Financial Markets’ Report on Stablecoins,” North Carolina Representative and ranking committee member Patrick McHenry asked the committee to consider state-level regulatory frameworks in lieu of a comprehensive federal law on stablecoins. In response to McHenry, Jean Nellie Liang, the Under Secretary for Domestic Finance at the U.S. Treasury Department, said there was no explicit law governing stablecoins and digital assets at the federal level bu...

Meta calls it a wrap on Diem project, pockets $182M from its sale

Rumours about the Menlo Park-based tech company looking for a buyer of the project started circulating last week The project, formerly Libra, faced many regulatory stumbling blocks throughout its life, prompting a rebrand to Diem at some point Last week’s unconfirmed reports of Meta looking to sell assets and intellectual property under the Diem project have been verified. Yesterday, the Diem Group revealed it was abandoning the stable coin venture after agreeing to a $182 million sales deal of its technology. The Facebook-backed digital currency project was bought by Silvergate Capital, a California-based innovative financial infrastructure solutions and services provider with a keen interest in the digital currency industry. The company wrapped the deal by paying $50 million and is...

PayPal stablecoin: What it could mean for payments

PayPal confirmed on Jan. 8 it is “exploring a stablecoin” that could be called PayPal Coin after a developer found evidence of such a stablecoin within the source code of the company’s iPhone app. PayPal senior vice president of crypto and digital currencies Jose Fernandez da Ponte said at the time that if the company plans to move forward with the stablecoin, it will do so while working closely with relevant regulators — an approach that could help the fintech firm avoid the wrath of United States senators that doomed Meta’s Diem cryptocurrency project. The company has clarified that the source code found on its iPhone app was developed in an internal hackathon. When Cointelegraph contacted PayPal to learn more, a spokesperson confirmed the previous reporting but did not offer any additio...

Diem project to sell assets amid looming end, reports suggest

Diem, previously Libra, was proposed by Facebook before its rebrand to Meta The stablecoin project has not seen many good days since its launch It now seems the Diem Association has finally given up on it The Diem stablecoin project pioneered by Meta in October 2019 was mooted as a stablecoin to eventually be used across Meta’s applications. These expectations have seemingly gone to the pack. Bloomberg reports that the project executives have been speaking to investment bankers to initiate a sale of its assets and return the money to the initial investors. However, the talks are still in an early stage, and finding a buyer is not guaranteed. The group is also seeking new employment opportunities for its engineers following the imminent close of business. Worth noting, the project is ...

U.S. Congressman calls for ‘Broad, bipartisan consensus’ on important issues of digital asset policy

In a letter to the leadership of the United States House Financial Services Committee, ranking member Patrick McHenry took a jab at “inconsistent treatment and jurisdictional uncertainty” inherent in U.S. crypto regulation and called for the Committee to take on its critical issues. McHenry, a Republican representing North Carolina, opened by mentioning that the Committee’s Democrat Chairwoman Maxine Waters is looking to schedule additional hearings addressing matters pertinent to the digital asset industry. He further stressed the need for identifying and prioritizing the key issues and achieving a “broad, bipartisan consensus” on the matters affecting the industry that holds immense promise for the financial system and broader economy. Citing the confusion that the industry faces due to ...

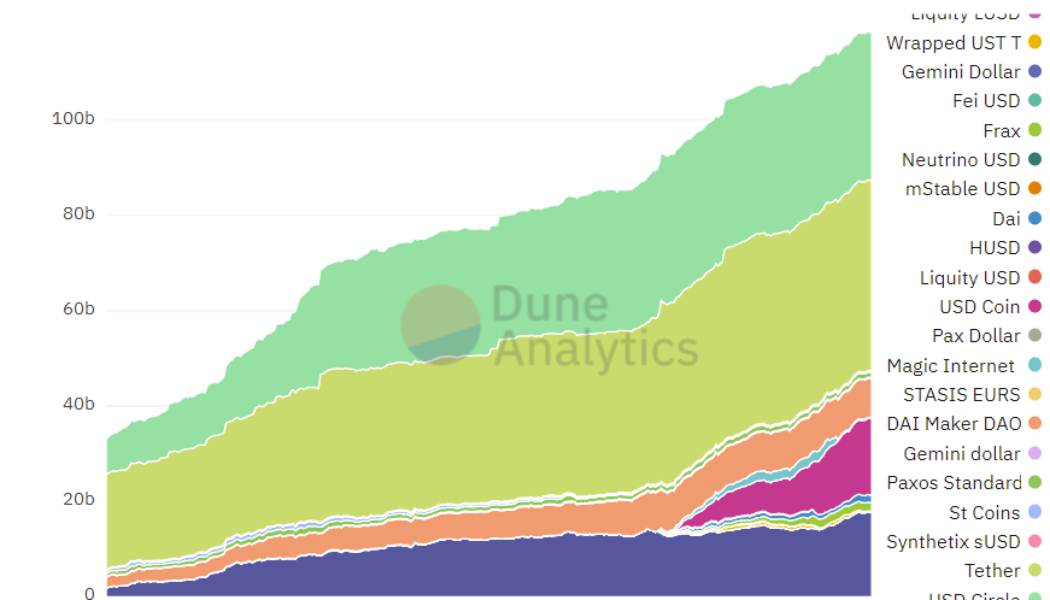

USDC flips Tether on the Ethereum network

Circle’s USD Coin (USDC) has reached a major milestone by surpassing Tether (USDT) in total supply on the Ethereum network. USDC’s current supply on Ethereum as of writing is 40.06 billion tokens, just ahead of USDT’s supply of 39.82 billion. Tether has been the most popular stablecoin since at least 2016, after originally sharing the market with BitUSD and NuBits (USNBT) stablecoins when it launched in late 2014. At that time, USDT ran on Omni. As the latter two fell into obscurity due to losing their dollar peg and shedding users, USDC emerged in 2018 as a more transparent and more regulated competitor to Tether, which has been under a cloud for years due to doubts over its backing. Although USDT is still the most popular stablecoin with a total supply of 78.5 billion, nearly 50% of the ...