Stablecoin

Interoperability-focused Stargate Finance (STG) aims to kick off DeFi 3.0

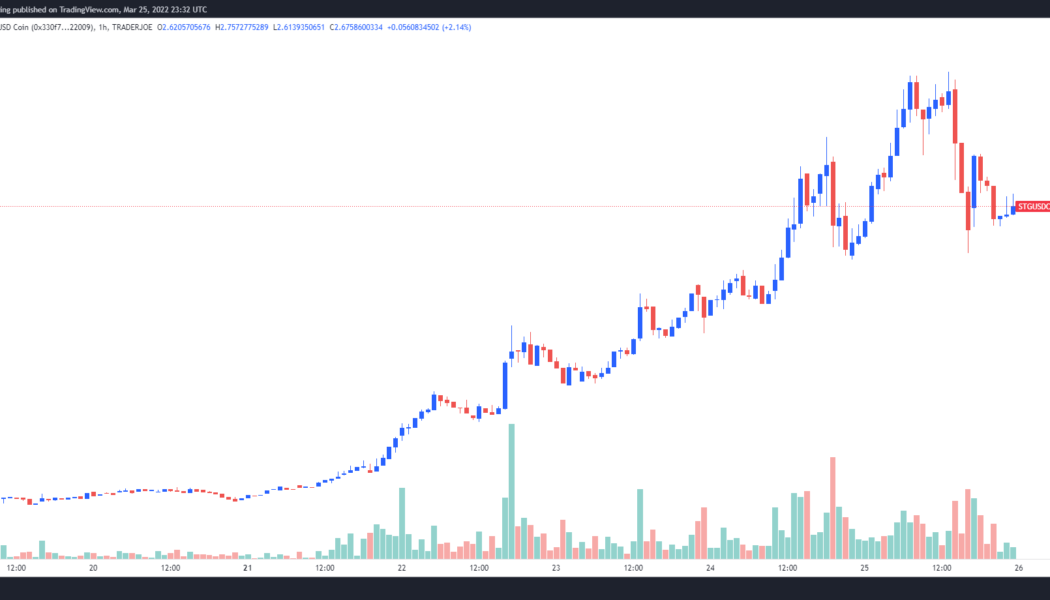

“Stargate Finance” has been trending on Twitter for the past week and while it’s too early to call for a full-blown DeFi bull market, traders have been shoveling funds into the project, which claims to be a “composable omni-chain native asset bridge.” Data from Cointelegraph Markets Pro and TradingView shows STG was listed on exchanges on March 17 and its price has climbed 438% from a low of $0.665 to a high of $3.58 on March 25. STG/USDC 1-hour chart. Source: TradingView Here’s a look at some of the developments with the protocol that have attracted DeFi users and boosted the price of STG ahead of its initial community auction. Cross-chain composability Interoperability has been a growing theme across the cryptocurrency ecosystem and this theme continues to expand as inv...

Australian bank ANZ mints the first Australian dollar-backed stablecoin

ANZ bank minted and transferred 30 million A$DC tokens, in a pilot test, before redeeming them into fiat The bank, one of the big four in Australia, leveraged its EVM compatible smart contract to mint the A$DC stablecoin In what is the first event of its like in Australia, Melbourne-headquartered big four bank ANZ today announced the minting of A$DC stablecoin. A$DC IS the first-ever stablecoin pegged on the Australian dollar. The minted tokens were availed via crypto-asset investment platform Zerocap to the Victor Smorgon Group that wanted to invest in crypto markets. “An ANZ-issued Australian dollar stablecoin is a first and important step in enabling our customers to find a safe and secure gateway to the digital economy,” ANZ Banking Services Lead Nigel Dobson said. “S...

Bitcoin hovers at $43K on Wall Street open amid growing fever over Terra’s $3B BTC buy-in

Bitcoin (BTC) showed signs of wanting higher levels still on March 22 as Wall Street trading saw a return above $43,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Terra co-founder: ‘Most of’ $3 billion still unpurchased Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it continued its newly confident stride to three-week highs. The pair had already gained thanks to encouraging macro signs from China, but it was news from within that really set the pace on the day. In a Twitter Spaces conversation with infamous Bitcoin pundit Udi Wertheimer, Do Kwon, co-founder of Blockchain protocol Terra, revealed that he planned to back his new TerraUSD (UST) stablecoin with BTC in addition to Terra’s LUNA token. “Haven’t been fo...

THORChain quietly outperforms crypto market in Q1 — Can RUNE price break $10 next?

THORChain (RUNE) could continue its upward momentum in the coming weeks even as it treads inside a classic bearish reversal structure. RUNE’s price has rebounded strongly by over 165% four weeks after testing its multi-month horizontal level support near $3.15. What’s more, its upside retracement has opened up possibilities about an extended bull run toward $11.50, about 45% above the current price level near $7.89, as shown in the chart below. RUNE/USD weekly price chart featuring descending triangle setup. Source: TradingView The $11.50-level coincides with RUNE’s multi-month falling trendline resistance, forming a descending triangle, a bearish setup, in conjunction with the lower horizontal support. That could have RUNE’s price correct again to $3.15 after reach...

Altcoin Roundup: DeFi token prices are down, but utility is on the rise

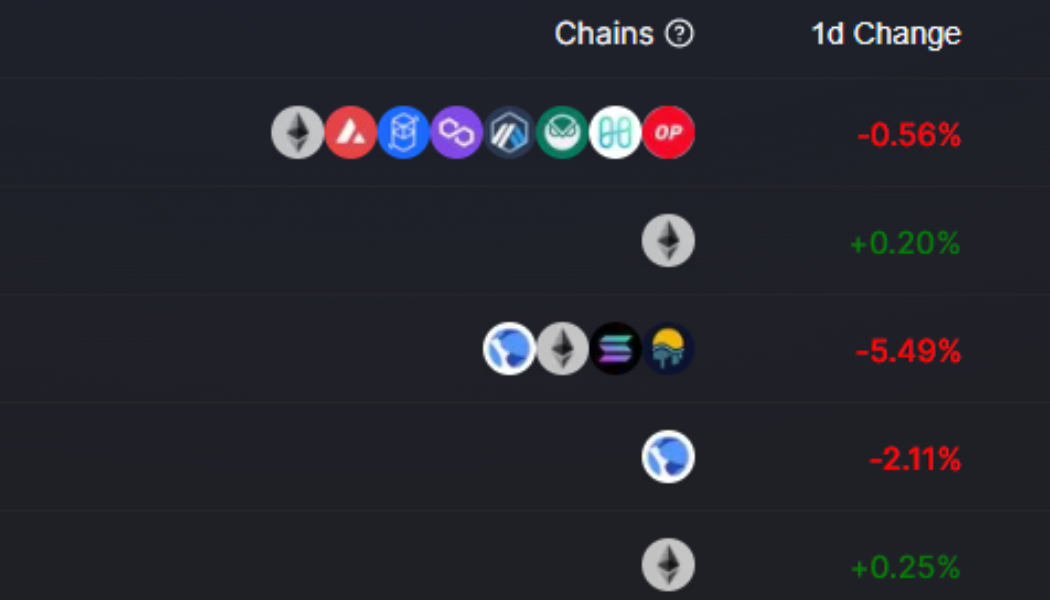

The decentralized finance (DeFi) sector has been sitting in the backseat since whipping up a frenzy in the summer of 2020 through the first quarter of 2021. Currently, investors are debating whether the crypto sector is in a bull or bear market, meaning, it’s a good time to check in on the state of DeFi and identify which protocols might be setting new trends. Here’s a look at the top-ranking DeFi protocols and a review of the strategies used by users of these protocols. Stablecoins are the foundation of DeFi Stablecoin-related DeFi protocols are the cornerstone of the DeFi ecosystem and Curve is till the go-to protocol when it comes to staking stalbecoins. Top 5 protocols by total value locked. Source: Defi Llama Data from Defi Llama shows four out of the top five protocols in terms of to...

Stablecoins will remain relevant even with the dawn of the CBDCs era, says Tether CTO

CBDCs will leverage private blockchains for tech infrastructure They, however, won’t be issued on private chains like stablecoins are at present Chief Technology Officer at Tether, Paolo Ardoino, has dismissed concerns that central bank digital currencies (CBDCs) will affect the currently offered private stablecoins. Ardoino was speaking in regards to the debate that has been happening in recent months, as more countries are declaring ambitions in CBDCs. CBDCs will power bank activities Explaining his view, Ardoino engaged his Twitter followers with the perspective that CBDCs are not built to digitise fiat currencies since most transactions in the modern day are already digital. Rather, he argued that these government-controlled digital currencies would essentially replace legacy pay...

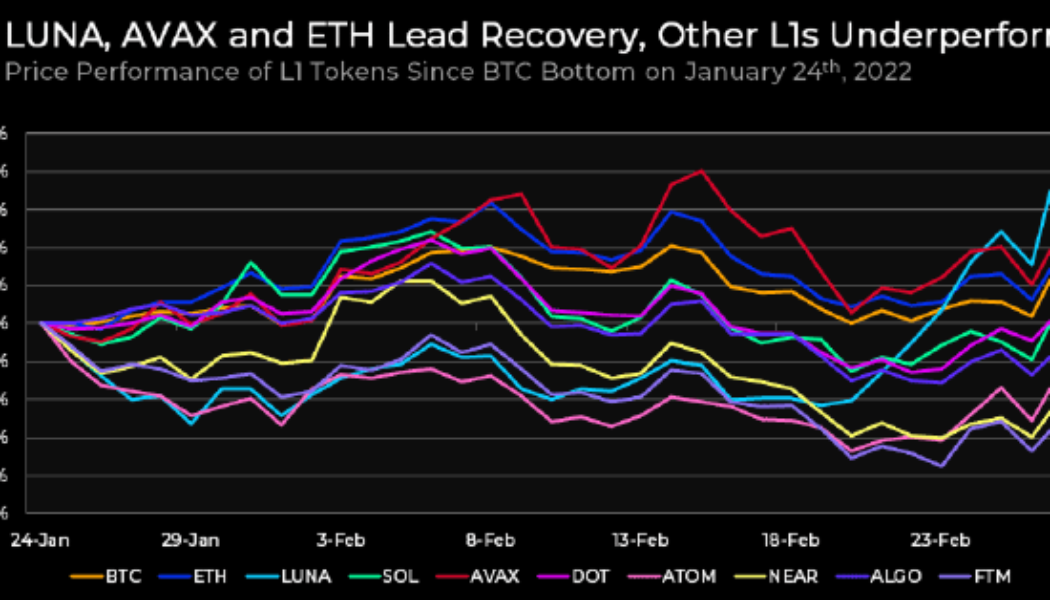

Terra, Avalanche and Osmosis lead the L1 recovery while Bitcoin searches for support

The layer-one (L1) ecosystem has received increased attention in recent months as users search for new investment opportunities in the Cosmos (ATOM), Fantom (FTM) and NEAR. Following January’s market sell-off, where Bitcoin (BTC) price dropped to bottom below $34,000, much of the L1 field has struggled to regain its momentum. Price performance of L1 tokens since Jan. 24. Source: Delphi Digital According to data from Delphi Digital, since the BTC bottom on Jan. 24, the only L1 to experience a notable gain in price include Terra (LUNA), Avalanche (AVAX) and Ethereum (ETH). Terra ecosystem growth The price growth seen in LUNA was in large part due to the announcement from the Luna Foundation Guard that it had raised $1 billion to form a Bitcoin reserve for the ecosystem’s Terra US...

Altcoin Roundup: JunoSwap, Solidly and VVS Finance give DeFi a much-needed refresh

Decentralized finance (DeFi) was the talk of the town in early 2021, but it has since taken a back seat to more appealing sectors like nonfungible tokens (NFTs), memecoins and blockchain gaming. Now that cross-chain bridges and interoperability have allowed for the easier migration of assets to competing chains, a new class of DeFi protocols is arising to challenge those left from 2021. Here’s a look at three DeFi projects that have launched on some of the up-and-coming layer-1 blockchain networks, catching the eye of the crypto community. VVS Finance VVS Finance is the largest DeFi protocol on the Cronos network, a project that emerged out of the Crypto.com ecosystem which has since been fully rebranded to Cronos (CRO). The goal of VVS Finance is to offer instant swaps with low fees...

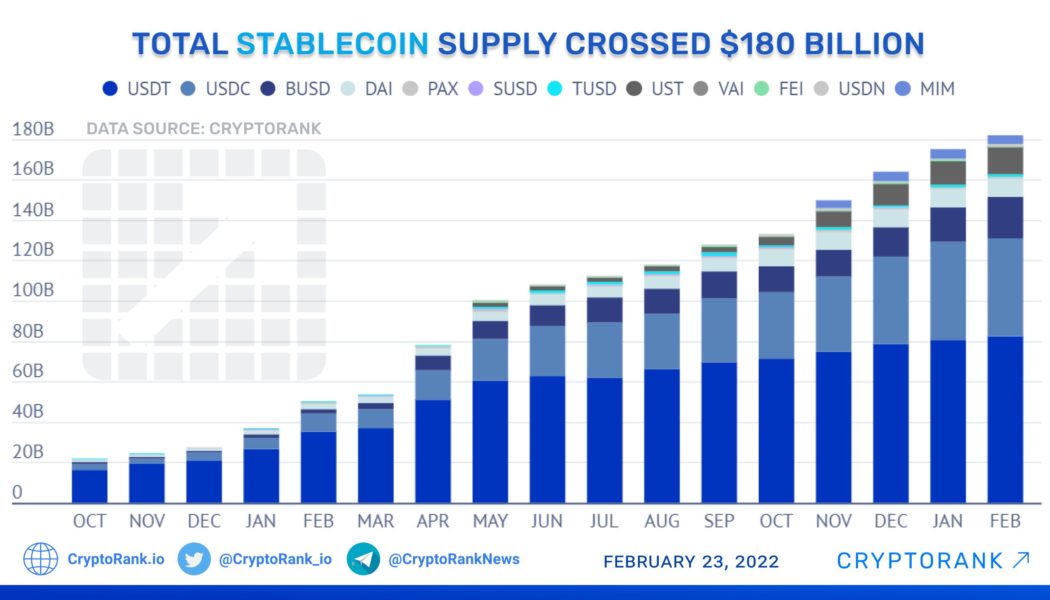

Crypto Biz: Stablecoins are serious business, Feb. 17–24

Stablecoins used to be a sort of taboo subject in the crypto community after it became common practice to criticize Tether’s reserve backing. Are you really a seasoned crypto investor if you haven’t gone down the Tether (USDT) rabbit hole? Some of those concerns were finally quelled in May 2021 when Tether passed an assurance test by disclosing its reserves for the first time. For some onlookers, the reserve breakdown created more questions than answers due to the stablecoin issuer’s oversized exposure to commercial paper. The stablecoin market has grown leaps and bounds over the past four years. While Tether remains firmly in the lead, Circle Internet Financial has surged through the rankings with the success of USDC Coin (USDC). TerraUSD (UST) is also a top player, having just received s...

Wyoming’s state stablecoin: Another brick in the wall?

For a state with a small-town feel, Wyoming moves with big-city alacrity when it comes to things crypto. According to the bipartisan bill introduced into its legislature last week, a Wyoming stablecoin could debut before the end of 2022. The announcement caught even Wyoming banker and cryptocurrency champion Caitlin Long by surprise. “Didn’t know it was coming,” tweeted the Avanti Bank CEO. It also raises some questions: Is a stablecoin really needed by Wyoming’s citizens? Is it feasible? Will it upset the state’s commercial banks including its recently chartered special purpose depository institutions (SPDIs) like Avanti which has issued a stablecoin-like product itself? Moreover, is a state-issued stablecoin even constitutional? And, aren’t there enough stablecoins around alr...

Total stablecoin supply hits $180 billion: Report

Move aside Bitcoin (BTC), stablecoins are holding the spotlight. Crypto research outlets Arcane Research and CryptoRank confirm that the stablecoin supply has hit the milestone amount of $180 billion. The growth in stablecoins continues to outpace the rest of the market, up 6% in the past 30 days. In times of market volatility, stablecoins can offer price stability, backed by specific assets or algorithms. Source: CryptoRank Over the month of February, three stablecoins entered the top 10 coins by market capitalization as Binance USD (BUSD) briefly entered. According to Arcane Research, the three largest stablecoins, Tether (USDT), USD Coin (USDC) and BUSD now account for a total of “9% of the total crypto market cap.” Plus, while volatility reigns proud, the stablecoin sup...

Luna Foundation Guard raises $1B to form UST reserve denominated in Bitcoin

The nonprofit organization focused on the open-source stablecoin network behind Terra USD, Luna Foundation Guard, has closed on a $1 billion raise through the sale of LUNA tokens. In a Tuesday tweet, Terra said Jump Crypto and Three Arrows Capital led the $1 billion round with participation from DeFiance Capital, Republic Capital, GSR, Tribe Capital and others. The platform said proceeds from the sale — $1 billion — would “go towards establishing a Bitcoin-denominated Forex Reserve for UST,” a stablecoin in the Terra ecosystem. 1/ The long awaited [REDACTED] 3 is here! The Luna Foundation Guard (LFG) has closed a $1 billion private token sale to establish a decentralized $UST Forex Reserve denominated in $BTC! — Terra (UST) Powered by LUNA (@terra_money) February 22, 2022 “One common ...