Stablecoin

What are the worst crypto mistakes to avoid in 2022? | Find out now on The Market Report

“The Market Report” with Cointelegraph is live right now. On this week’s show, Cointelegraph’s resident experts discuss the worst mistakes you should avoid making in crypto. But first, market expert Marcel Pechman carefully examines the Bitcoin (BTC) and Ether (ETH) markets. Are the current market conditions bullish or bearish? What is the outlook for the next few months? Pechman is here to break it down. Next up: the main event. Join Cointelegraph analysts Benton Yaun, Jordan Finneseth and Sam Bourgi as they talk about the worst crypto mistakes to avoid making in 2022. First up, we have Bourgi, who thinks investors should avoid “analysis paralysis.” In other words, don’t overanalyze. Make decisions based on firm conviction. Don’t just look at the price of a coin or token you’re interested...

Kevin O’Leary says Bitcoin can’t crash as it is now a store of value

Shark Tank host Kevin O’Leary is confident Bitcoin price will never collapse to zero The TV personality and entrepreneur has invested in Gold, Bitcoin and several other altcoins In a Monday interview with Kitco’s Michelle Makori, TV personality Kevin O’Leary asserted that the price of Bitcoin will never reach zero. The Canadian businessman defended his take, arguing that the crypto asset, now 13 years old, has secured its place in the financial space as a store of value. O’Leary compared Bitcoin to gold in this regard, adding that he has invested an equal fraction of his portfolio in both assets. “Bitcoin is never going to zero. This is a personal opinion. There are enough people around the world that see it as a store of value, me included. It is a 5% weighting in my portfolio, just like ...

Terra price key support level breaks after 30% weekly drop — more pain for LUNA ahead?

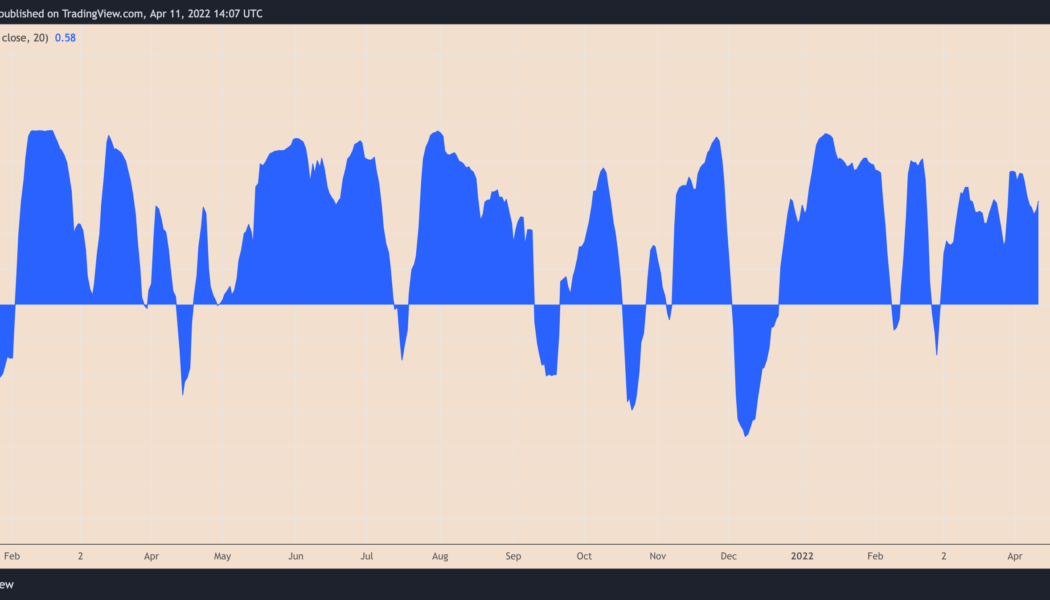

Terra (LUNA) price slid on April 11 as a broader correction across crypto assets added to the uncertainties concerning its token burning mechanism. Bitcoin (BTC) and Ether (ETH) led to a decline in the rest of the cryptocurrency market, with LUNA’s price dropping by over 8% to nearly $91.50, and about 30% from its record high of $120, set on April 6. The overall drop tailed similar moves in the U.S. stock market last week after the Federal Reserve signaled its intentions to raise interest rates and shrink balance sheets sharply to curb rising inflation. Arthur Hayes, the co-founder of BitMEX exchange, said Monday that Bitcoin’s correlation with tech stocks could have it run for $30,000 next. In other words, LUNA’s high correlation with BTC so far this year puts it at risk...

‘I’ve never paid with crypto before’: How digital assets make a difference amid a war

The ongoing conflict in Ukraine has become a stress test for crypto in many tangible ways. Digital assets have emerged as an effective means of directly supporting humanitarian efforts, and the crypto industry, despite enormous pressure, has largely proved itself a mature community — one ready to comply with international policies without compromising the core principles of decentralization. But there is another vital role that crypto has filled during these tragic events: It is becoming more and more familiar to those who have found themselves cut off from the payment systems that had once seemed unfailing. Traditional financial infrastructures don’t usually work well during military confrontations and humanitarian crises. From hyperinflation and cash shortages to the destruction of ATMs,...

xASTRO staking and upcoming ‘Terra wars’ send Astroport price to new highs

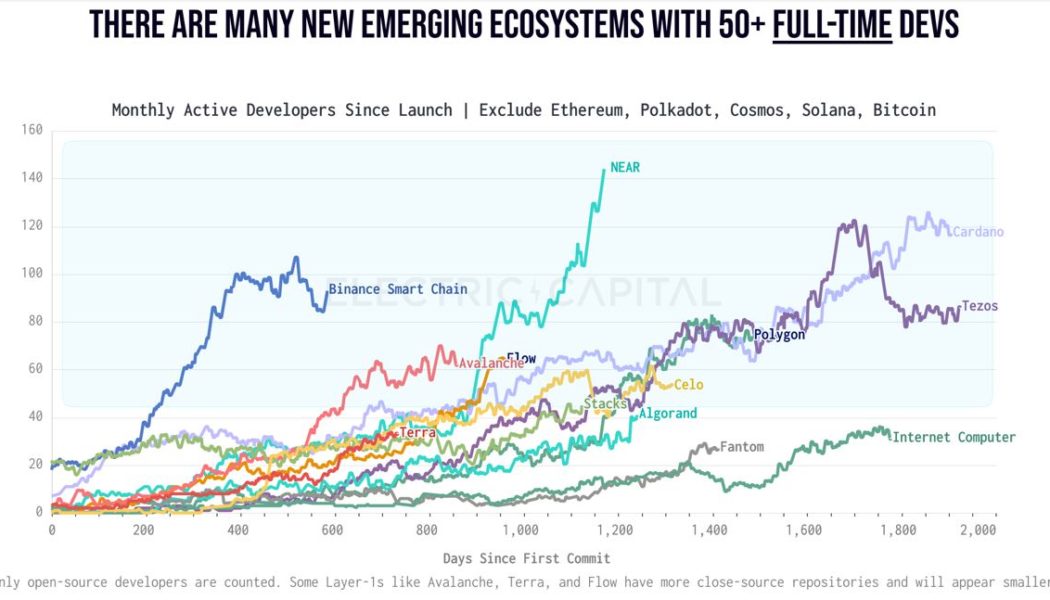

Projects that launch on up-and-coming blockchain networks can often benefit from a low competition environment that allows them to attract new users and liquidity at a faster rate than crowded networks like Ethereum. A recent example of this is Astroport (ASTRO), an automated market maker (AMM) on the Terra (LUNA) network that has seen an influx of activity alongside the increased attention that is being focused on the Terra ecosystem and its Terra USD (UST) stablecoin. . Data from CoinGecko shows that since hitting a low of $1.28 on March 7, the price of ASTRO has exploded 194% to hit a new all-time high of $4.80 on April 5. ASTRO/USDT 4-hour chart. Source: TradingView Three reasons for the price appreciation seen in ASTRO include the increased attention the Terra ecosystem ha...

Terra buys $200M in AVAX for reserves as rival stablecoins emerge

Terraform Labs (TFL) and the Luna Foundation Guard (LFG) have announced they have purchased a combined $200 million worth of AVAX tokens from the Avalanche Foundation. TFL, the company responsible for the development of the Terra blockchain, swapped $100 million worth of Terra’s native token, LUNA for AVAX tokens, in order to “strategically align ecosystem incentives”, according to Terra’s twitter. LFG, a non-profit organization mandated to build reserves for Terra’s algorithmic stablecoin UST, used its own holdings of UST to purchase an additional $100 million worth of AVAX from the Avalanche Foundation. These purchases are meant to reinforce the stability of Terra’s native UST stablecoin, which currently has a market cap of $16.7 billion. Do Kwon, the founder of Terraform Labs, tol...

UN agency accepts first stablecoin donations worth $2.5M to help Ukrainian refugees

The United Nations High Commissioner for Refugees (UNHCR), a UN agency for refugees, has accepted its first-ever crypto donations toward humanitarians aid for Ukrainians fleeing the war-torn nation. UNHCR accepted $2.5 million in Binance USD (BUSD) stablecoin donations from Binance Charity that would be utilized to rehabilitate and support refugees fleeing to neighboring countries from Ukraine. According to a report from the USA for UNHCR, more than 10 million people have been displaced from their homes in Ukraine, and the agency will use crypto stablecoin charity funds to provide legal and social assistance. Marie Grey, Executive Director and CEO of USA for UNHCR said that the crypto donation will prove vital in its efforts to help as many families as possible. Grey also lauded the global...

UK defines a new plan as it seeks to become a global crypto hub

The UK will legalise the use of stablecoins to settle payments The government is also embracing NFTs, with plans to mint one this summer The Treasury Economic Secretary John Glen insisted on the need to adopt dynamic regulations The UK has shared a new plan with a series of measures toward becoming a global hub for crypto-asset technology. As per a statement published yesterday, the Chancellor of the Exchequer Rishi Sunak noted that the measures would empower firms to invest, scale and establish innovative projects in the country. “We want to see the businesses of tomorrow – and the jobs they create – here in the UK, and by regulating effectively, we can give them the confidence they need to think and invest long-term,” he noted. Stablecoins as a payment option At the top ...

SEC chair reveals a proposed joint regulatory role with the CFTC

SEC chair Gary Gensler said commodities and securities in trading platforms are currently intertwined He also blasted the market-leading stablecoins’ lack of a direct right of redemption and raised conflict of interest concerns Chairman of the US Securities and Exchange Commission (SEC) Gary Gensler spoke on a number of issues around crypto-assets and their regulation at the Penn Law Capital Markets Association Annual Conference yesterday. As usual, Gensler insisted on the need to protect the investor from losses in the crypto space, such as the $14 billion stolen last year, and the best way his commission does it is by regulation. The SEC chair suggested a stricter regulatory framework to govern market makers in crypto. Gensler is for the idea of registering crypto platforms so that...

More than three-quarters of central banks considering a CBDC: research

More than 80% of central banks are interested in launching a Central Bank Digital Currency (CBDC) or have already done so according to research conducted by accounting firm PwC. The second annual Global CBDC Index report released on Monday, April 4, measures a central bank’s level of maturity in deploying its own digital currency. The report also included an overview of stablecoins for the first time. Haydn Jones, Blockchain and Crypto Specialist at PwC U.K. stated in the report that “over 80% of central banks are considering launching a CBDC or have already done so.” The report ranks both retail CBDCs, ones that are issued for use by the general public, and wholesale CBDCs for use by financial institutions holding with the central bank, out of 100. Retail CBDCs have reached a greate...

Neutrino Dollar breaks peg, falls to $0.82 amid WAVES price ‘manipulation’ accusations

Neutrino Dollar (USDN), a stablecoin issued through Waves-backed Neutrino protocol, lost its U.S. dollar-peg on April 4 amid speculations that it could become “insolvent” in the future. USDN plunges 15% despite WAVES backing USDN dropped to as low as $0.822 on Monday with its market capitalization also diving to $824.25 million, down 14% from its year-to-date high of $960.25 million. Interestingly, the stablecoin’s plunge occurred despite Neutrino’s claims of backing its $1-peg via what’s called “over collateral,” i.e., when the total value of Waves (WAVES) tokens locked inside its smart contract is higher than the total USDN minted, also called the “backing ratio.” Neutrino Dollar price performance in the last 24 hours. Source: Co...

Bank of Japan official calls for G7 nations to adopt common crypto regulations

A senior official from the Bank of Japan (BOJ) has warned G7 nations that a common framework for regulating digital currencies needs to be put in place as quickly as possible. G7 refers to the Group of Seven, an inter-governmental political forum made up of Canada, France, Germany, Italy, Japan, the United Kingdom and the United States. The statement comes in response to the continued conflict between Russia and Ukraine, as cryptocurrencies and their potential applications for skirting economic sanctions falls under increasing scrutiny. The head of the BOJ’s payment systems department, Kazushige Kamiyama, told Reuters that using stablecoins makes it very easy to “create an individual global settlement system,” which would in turn make it easier for nation states to evade more t...