SPX

‘Get ready’ for BTC volatility — 5 things to know in Bitcoin this week

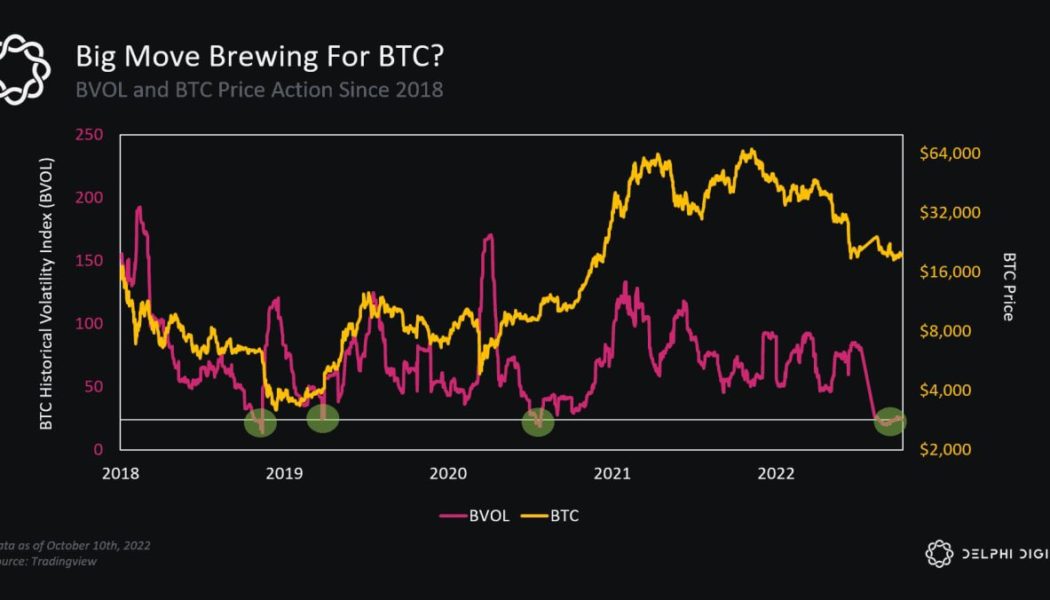

Bitcoin (BTC) starts a new week keeping everyone guessing as a tiny trading range stays in play. A non-volatile weekend continues a familiar status quo for BTC/USD, which remains just above $19,000. Despite calls for a rally and a run to lower macro lows next, the pair has yet to make a decision on a trajectory — or even signal that a breakout or breakdown is imminent. After a brief spell of excitement seen on the back of last week’s United States economic data, Bitcoin is thus back at square one — literally, as price action is now exactly where it was at the same time last week. As the market wonders what it might take to crack the range, Cointelegraph takes a look at potential catalysts in store this week. Spot price action has traders dreaming of breakout For Bitcoin traders, it is a ca...

Bitcoin rebounds over $41K after painting a ‘bullish hammer’ — Can BTC hit $64K next?

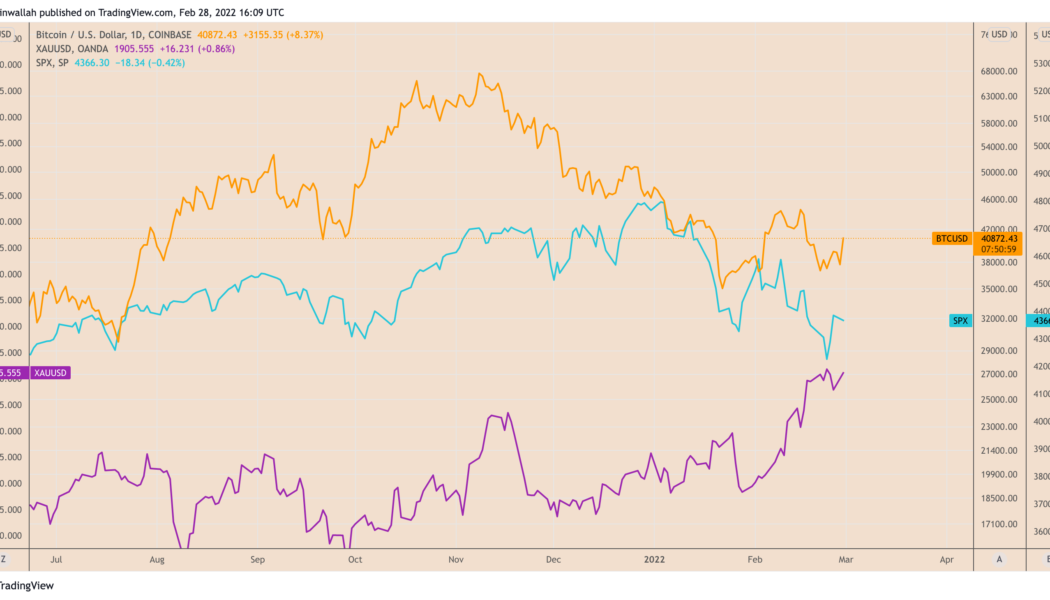

Bitcoin (BTC) rallied above $41,000 on Feb. 28 in a new sign of buying sentiment returning after last week’s brutal selloff across the risk-on markets, including the S&P 500. BTC’s price jumped by over 9% to reach $41,300, in part, as traders reacted to the ongoing development in the Russia-Ukraine crisis. In doing so, the cryptocurrency briefly broke its correlation with the U.S. stock market indexes to perform more like safe-haven gold, whose price also went higher in early trading on Feb. 28. BTC/USD versus XAUUSD and S&P 500 daily price chart. Source: TradingView Bitcoin downtrend exhausting — analyst Johal Miles, an independent market analyst, spotted “significant buying pressure” in the market, adding that its downtrend might be heading towards exhaust...