sport

Ferrari cuts ties with crypto sponsor ahead of 2023 Formula One season

Scuderia Ferrari, the racing division of luxury carmaker Ferrari, joined the growing list of Formula One racing teams to end partnerships with their cryptocurrency sponsors. Ferrari exited its multi-year partnership deals with Velas Blockchain and chip manufacturing giant Snapdragon, resulting in a cumulative $55 million loss for the Italian team ahead of the 2023 season. The Ferrari-Velas partnership from 2021 — set at $30 million a year — was aimed at increasing fan engagement through nonfungible tokens (NFTs) and other shared initiatives. However, the team was noncompliant with the clauses that permit Velas to create NFT images, according to RacingNews365. On November 2022, Mercedes, too, bore a loss of $15 million after suspending its partnership with FTX as the crypto exchange filed f...

Web3 projects aim to create engagement between fans and sports leagues

The multi-billion-dollar sports industry is undergoing a digital transformation and Web3 elements are likely to play a major role. This notion was highlighted in Deloitte’s “2022 Sports Industry Outlook” report, which predicts an acceleration in the blending of real and digital worlds, along with growing markets for nonfungible tokens (NFTs) and immersive technologies. According to the report, such advances may lead to a significant increase in fan engagement. This is an important point to consider, given that fan engagement has long served as the backbone for ensuring sponsor revenue, ticket and merchandise sales, along with the overall popularity of a sports league. Yet as technology advances, sports fans have expressed interest in forming deeper relationships with sports leagues. ...

NFT space bridges passions for tennis legend Maria Sharapova

Tennis legend Maria Sharapova appeared at the Binance Blockchain Week Paris 2022 to share her interest in nonfungible tokens (NFTs). During an exclusive interview with Cointelegraph, Sharapova mentioned that “she is exposing herself to this new world of crypto and Web3,” noting that the sector will help her better engage with her fans. Sharapova was also one of the strategic investors behind MoonPay’s Series A financing round, yet she mentioned that she aims to bridge her personal experiences to the digital world moving forward. Maria Sharapova (right) with Cointelegraph senior reporter Rachel Wolfson (left) at Binance Blockchain Week Paris 2022. Source: Rachel Wolfson Cointelegraph: What are you doing here today at Binance Blockchain Week Paris? Maria Sharapova: I’m crypto curious and wou...

Influential celebrities that joined the crypto club over the past year

The inclusive crypto ecosystem has become home to numerous A-list celebrities over the years — primarily driven by the nonfungible tokens (NFT) hype of 2021. However, despite the prolonged bear market and an evident dip in cryptocurrency prices, celebrities continue to pour in support for the crypto market. Over the past year, celebrities have started exploring sub-ecosystems beyond NFTs, trying to diversify their presence across trading, gaming and other investment avenues. In this light, here’s an overview of some of the most influential celebrities that got into crypto over the past year and how well-prepared they are for the next bull run. Connor McGregor partners with Tiger.Trade UFC superstar Connor McGregor, one of the highest-paid athletes, recently partnered with Tiger.Trade...

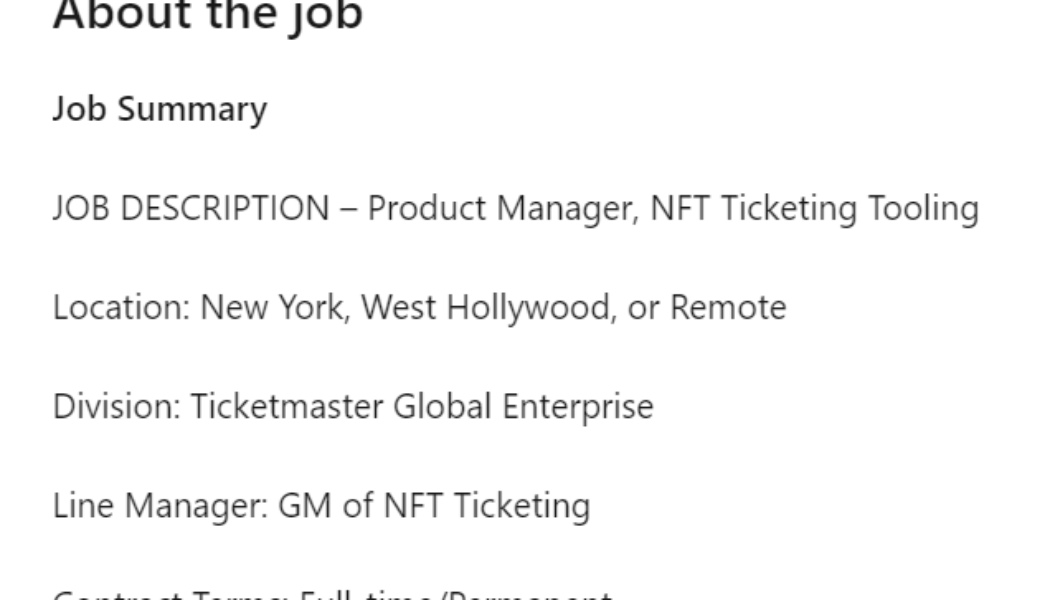

Ticketmaster scouts productization of enterprise NFTs beyond ticketing

A new job posting by America’s biggest ticketing company, Ticketmaster, reveals mainstream interest in exploring new revenue streams using nonfungible tokens (NFTs). Over the past two years, artists, musicians and the sports industry helped thrust the NFT ecosystem into the limelight as the technology served its purpose as a powerful fan engagement tool. Conversely, most of the general public boarded the hype train seeking profits via reselling collectibles in the secondary markets. With the NFT hype eventually slowing down by mid-2022, entrepreneurs and companies are looking for new use cases beyond collectibles. A study conducted by Big 4 accounting firm Deloitte in May 2022 highlighted the untapped potential of the crypto ecosystem to open up newer markets for the sports industry:...

How NFTs can boost fan engagement in the sports industry

Nonfungible tokens (NFTs) have grown a lot in popularity since the release of CryptoKitties in 2017, with the sector expected to move over $800 billion in the next two years. Some of the most well-known use cases for NFTs are picture-for-proof projects such as the Bored Ape Yacht Club and play-to-earn gaming projects. NFTs have also attracted attention from the sports industry, with professional sports leagues setting up their own platforms for fans to engage with their favorite teams or players, but that will be discussed later in this story. NFTs are unique and non-interchangeable pieces of code stored on the blockchain. These strings of alpha-numerical code can be linked to assets such as artwork or digital and physical goods. NFTs are created through a process known as minting, a...

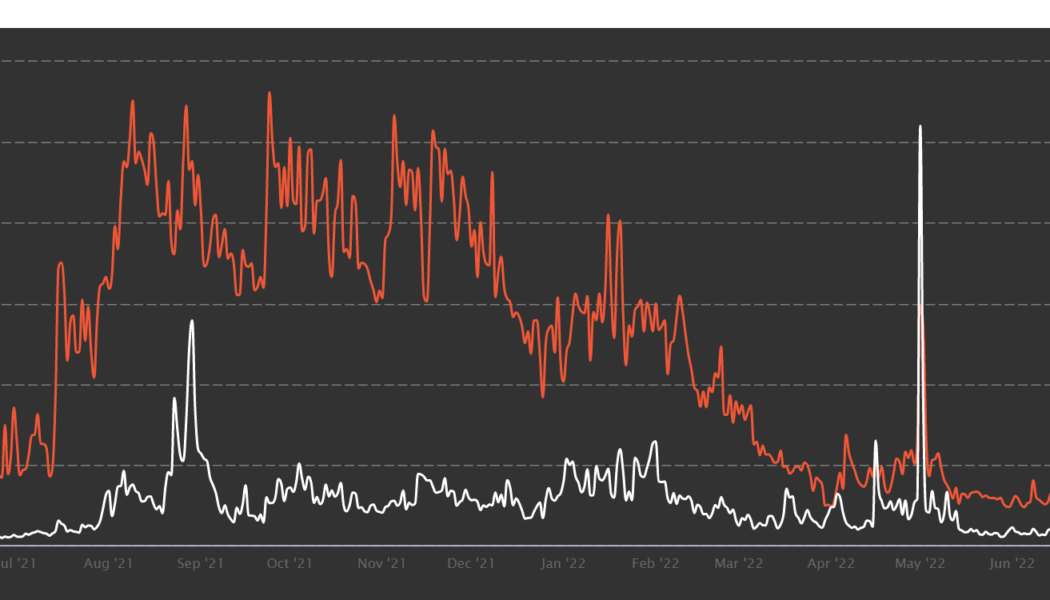

Fans seek trust and better understanding of sports NFT market: Research

The heavy involvement of the sports ecosystem is what expedited nonfungible tokens’ (NFT) mainstream adoption as the teams and players leveraged the technology for fan engagement. However, sports fans revealed their interest in moving beyond the hype and making investments based on knowledge about NFTs and trust in the issuers. The prolonged crypto winter razed off the inflated floor prices across the NFT ecosystem, inadvertently changing investor sentiment and forcing users to rethink their long-term investment strategies. A study released by the National Research Group (NRG) revealed an openness among sports fans to learn about NFTs as they await a greener market. Number of daily NFT sales between June 2021-June 2022. Source: NonFungible In June 2022, NFT sales plummeted to one-year lows...

Blockchain, crypto set to take sports industry beyond NFT collectibles

Bitcoin (BTC) has been attributed as the most prominent blockchain use case, showing the technology’s prowess in successfully delivering an immutable and truly decentralized ledger over the past 13 years. Adding to the years of innovations since then— that saw the introduction of altcoins, non-fungible tokens (NFT), decentralized finance (DeFi) and more, a study conducted by fintech giant Deloitte highlighted the untapped potential of the crypto ecosystem to open up newer markets for the sports industry. Fan tokens and NFTs were first introduced to the sports industry to increase fan engagement via collectibles and voting mechanisms. However, Deloitte, one of the Big 4 accounting firms, envisions the industry further embracing crypto and blockchain technology over the coming years: “A nexu...

Beyond collectibles: How NFTs are revamping the ticketing industry

The concept of nonfungible tokens (NFT) came into existence in 2015, and it first got some traction in 2017 when many prominent digital collectibles such as CryptoPunks and EtherRock were created. NFTs got early traction among premier sports clubs but burst into mainstream popularity after digital artist Beeple’s artwork was sold as an NFT for over $69 million. The Beeple event caught the attention of the world and proved to be a breakout movement for the NFT ecosystem. Today, most of the mainstream household brands, premium sports and clothing brands, celebrities, sports stars and influencers have got involved in the NFT frenzy. While many believed the hype and frenzy around the market would become the cause of its downfall, the NFT ecosystem has seen a rapid expansion beyond the di...

ESPN and Tom Brady’s Autograph ink multi-year NFT deal

ESPN and Autograph, the nonfungible token (NFT) platform co-founded by Tom Brady, announced a multi-year partnership on Wednesday that kicks off with a documentary release and an NFT collection. A 10-part ESPN+ documentary series called “Man in the Arena: Tom Brady” chronicles the milestones of the NFL legend’s career through a psychological and emotional lens. The docuseries is produced by Religion of Sports, a media company in which Brady is also a co-founder. Autograph and Religion of Sports designed the “Man in the Arena: Tom Brady Collection” to be ESPN’s first series of NFT collectibles. Dropping at the same time on Wednesday, the documentary is available to subscribers across the Disney streaming bundle — ESPN+, Hulu and Disney+ while the NFT collec...