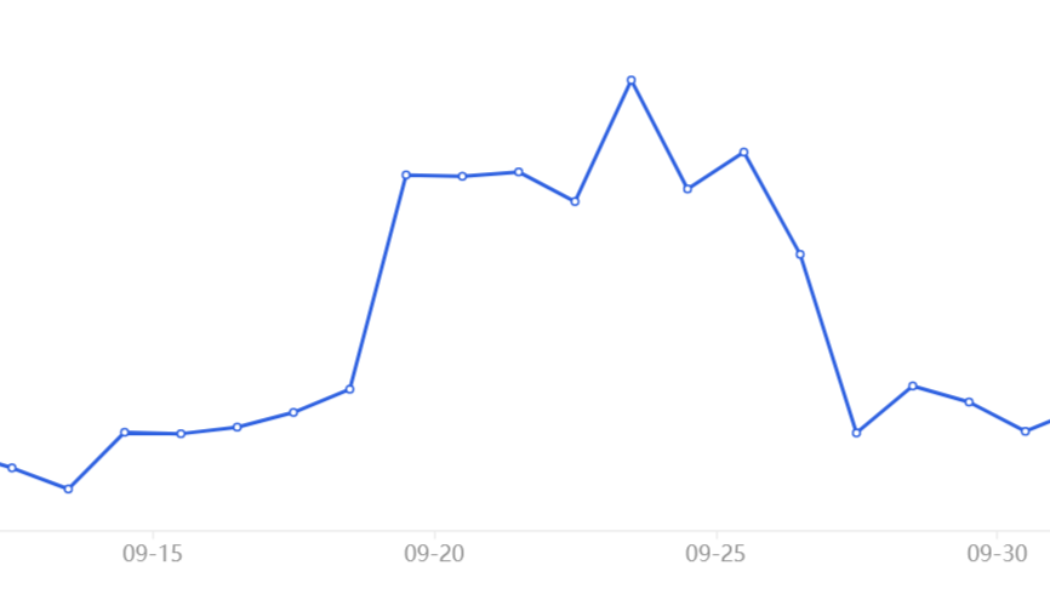

S&P500

Bitcoin fails to break the $21K support, but bears remain shy

Bitcoin (BTC) rallied on the back of the United States stock market’s 3.4% gains on Oct. 28, with the S&P 500 index rising to its highest level in 44 days. In addition, recently released data showed that inflation might be slowing down, which gave investors hope that the Federal Reserve might break its pattern of 75 basis-point rate hikes after its November meeting. In September, the U.S. core personal consumption expenditures price index rose 0.5% from the previous month. Although still an increase, it was in line with expectations. This data is the Federal Reserve’s primary inflation measure for interest rate modeling. Additional positive news came from tech giant Apple, which reported weak iPhone revenues on Oct. 27 but beat Wall Street estimates for quarterly earnings and margin. M...