Southern Africa

COVID-19 Boosts Demand for Human-Centered Digital Design

Sourced from TTEC.com If there is one thing that COVID-19 has highlighted; it is the importance of people in the economic value chain. Sandton-based business management consultant Immersion Group says that one of the emerging trends they’re seeing is that more organisations are seeking human-centred design experts to enhance or improve digital customer experiences, breaking down barriers that may be hindering their ability to satisfy their customers. Organisations are now facing urgent decisions as they pivot to accommodate the many unexpected circumstances, and when these challenges risk affecting the bottom line; it’s crucial that organisations rapidly take stock of what is working and what isn’t working when prioritising digital experiences that put the customer first. From onboarding t...

Xiaomi Launches the Redmi Note 9S in South Africa

Xiaomi has launched the Redmi Note 9S – a new mid-range device – which features a powerful processor, striking symmetrical design, an outstanding quad-camera setup and long-lasting battery. The Redmi Note 9S is equipped with the Qualcomm Snapdragon™ 720G chipset, which consists of an octa-core CPU with a 2.3GHz maximum clock speed, Adreno 618 GPU and 8nm process technology. It’s also said to offer an unparalleled user experience through its advanced AI technology and power-efficiency improvements. As the first smartphone in the Redmi Note lineup to feature a Z-axis linear vibration motor, this device enables faster acceleration, resulting in better haptic feedback compared to traditional motors. Its 5020mAh high-capacity battery keeps users fully powered throughout the day, even dur...

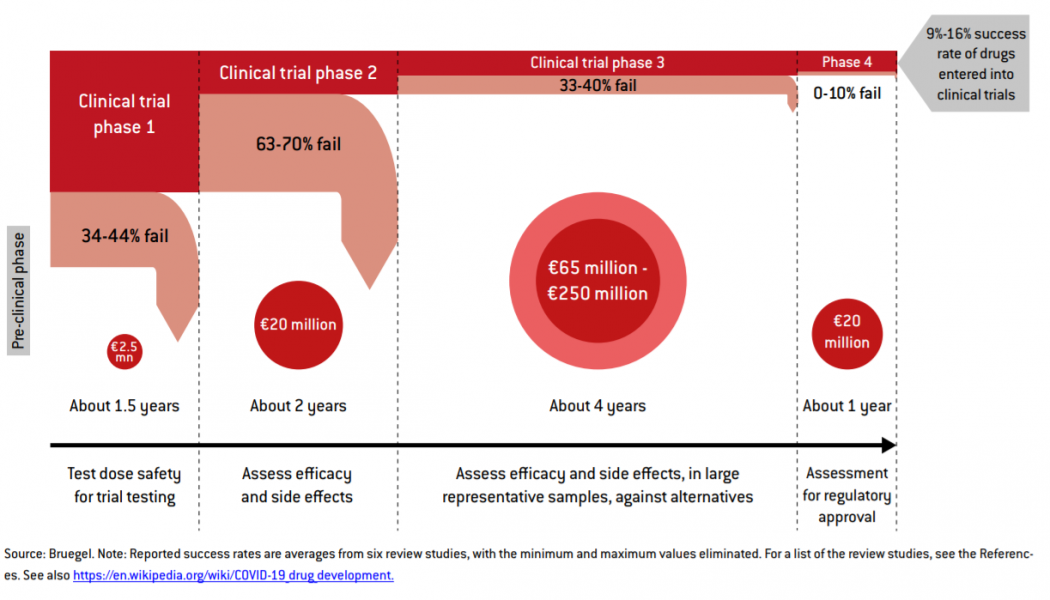

E-Health Framework in Development for South Africa

South Africa’s healthcare organisations are currently on a journey to providing comprehensive and accessible healthcare services to all its citizens, in both the private and public healthcare ecosystems. However, the finalisation of legislation and standards that govern this sector has not been without challenges. The aim is to ensure that South Africa’s healthcare organisations – like their counterparts across the globe – comply with legislations and adhere to standards that support the transformation of the healthcare ecosystem. This through information and technology with various benchmarking and standards frameworks has resulted in the creation of the National Health Insurance (NHI) Bill, aimed at achieving specific strategic objectives in the delivery of healthcare. As an adjunct to t...

SADV ISP Appoints New MD

SA Digital Villages (SADV) ISP has appointed telecommunications industry veteran, Junaid Munshi as its new managing director – effective 01 June 2020. The company recently became a standalone entity after its fibre network division was absorbed by Vumatel in April of this year. SADV ISP says that the appointment signals the company’s focus and commitment to delivering world-class Internet access to its customers. Munshi, who brings more than two decades of experience in telecommunications – spanning four countries, will be instrumental in driving customer uptake and delivering growth across the business Speaking on his new appointment, Munshi says “I am super excited to be joining the team at SADV. I believe that we have a unique opportunity to establish a new digital dawn for all South Af...

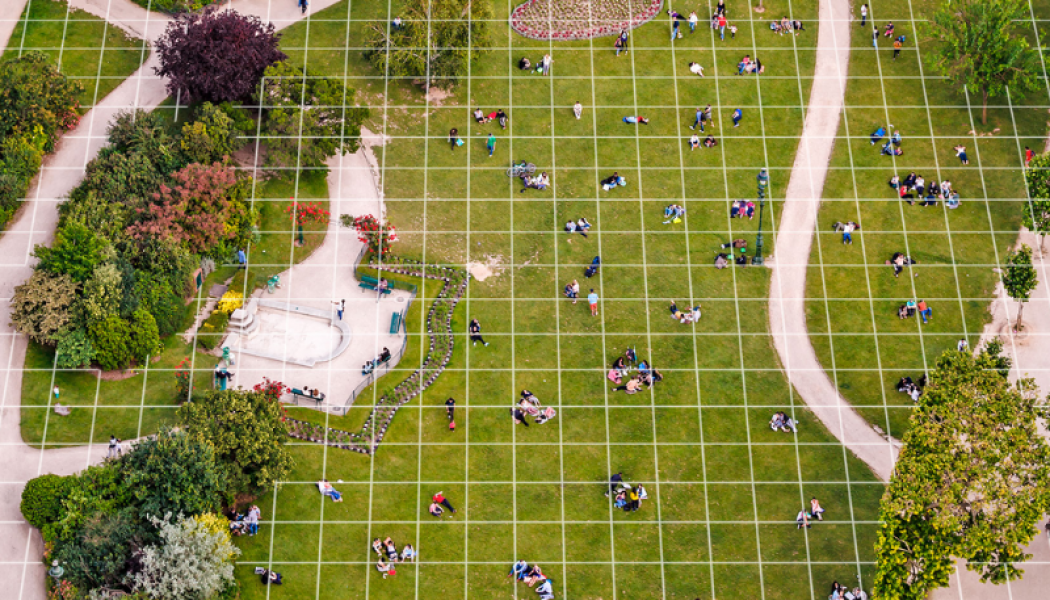

Cashless and Contactless Payments Beyond COVID-19

The emergence of COVID-19 has made the need for digitising payments more critical than ever before and for this to be a success, electronic payments need to offer similar benefits to those afforded by cash. Globally, economies are in various stages of development having either started developing, replaced or are busy replacing daily batch payment systems with real-time systems that execute payments in seconds with the flexibility to meet the needs of the future digital economy. The drive towards digital payments and lowering the reliance on cash is not new to South Africa’s payments market. There are several mechanisms already in place to enable this and banks, card companies, fintechs and retailers are all involved in rolling out digital, non-touch payment mechanisms. Contactless cards us...

How Lockdown has Highlighted the Benefits of Remote Banking

Sourced from Innovation Village. The advantages of digital transacting over other modes of banking have been highlighted by the lockdown. Although banking remotely has been gaining ground in South Africa long before the lockdown, the limitations on physical movement imposed by the lockdown have given online and mobile banking a significant boost. The current environment will most likely see more people opt for digital banking platforms. This is confirmed by a recent Nielsen syndicated study on the impact of COVID-19 on consumer behaviour in South Africa, which reports that 37% of South Africans say they are shopping and transacting more online. “Apart from being more convenient, digital banking and shopping are cheaper than traditional channels. The lockdown and its effect on the economy h...