Solana

Price analysis 5/18: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

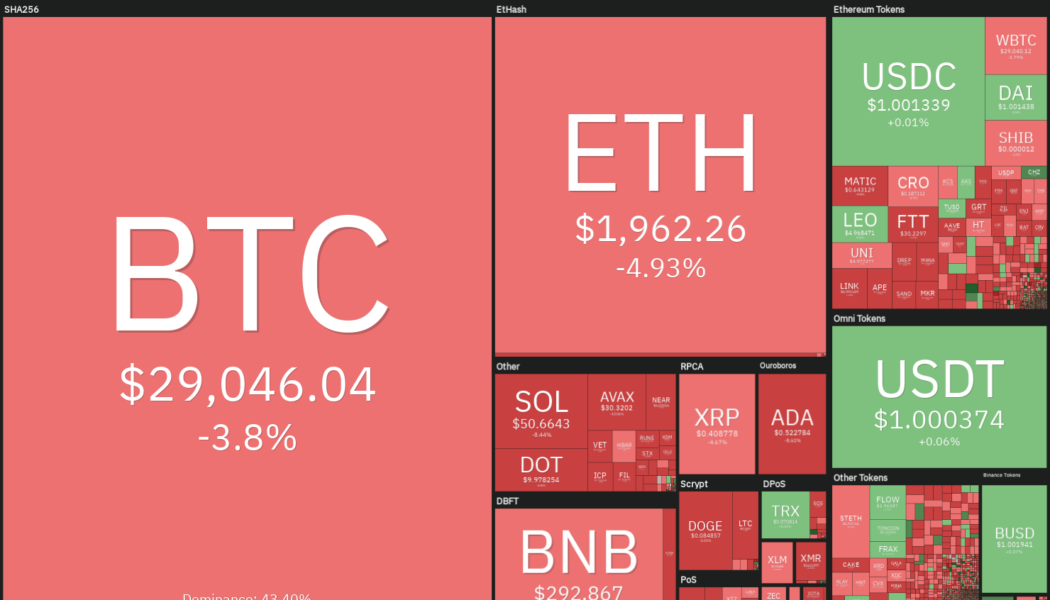

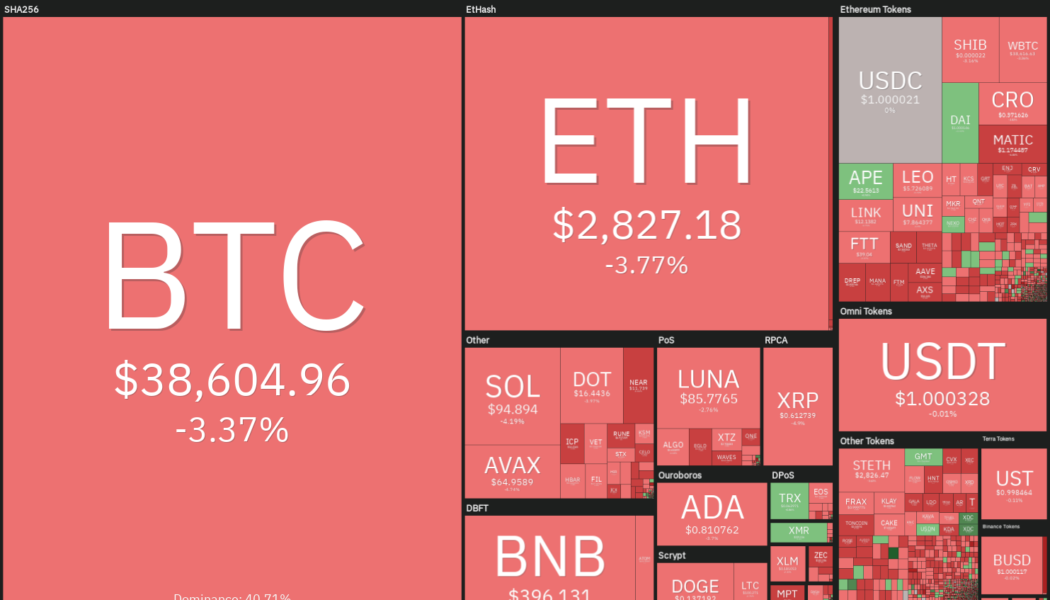

On May 17, United States Federal Reserve Chairman Jerome Powell told the Wall Street Journal that the 50-basis-point rate hikes would continue until inflation is under control. Powell’s emphasis on a hawkish policy suggests that monetary conditions are likely to remain tight in 2022, which could limit the upside in risky assets. On-chain market intelligence firm Glassnode said that historically, Bitcoin (BTC) has bottomed out when the price breaks below the realized price. However, barring the 2019 to 2020 bear market, during previous bear cycles, Bitcoin’s price stayed below the realized price for anywhere between 114 to 299 days. This suggests that if macro situations are not favorable, a quick recovery is unlikely. Daily cryptocurrency market performance. Source: Coin360 While the curre...

Ethereum’s popularity ‘a double-edged sword’ — a16z’s State of Crypto report

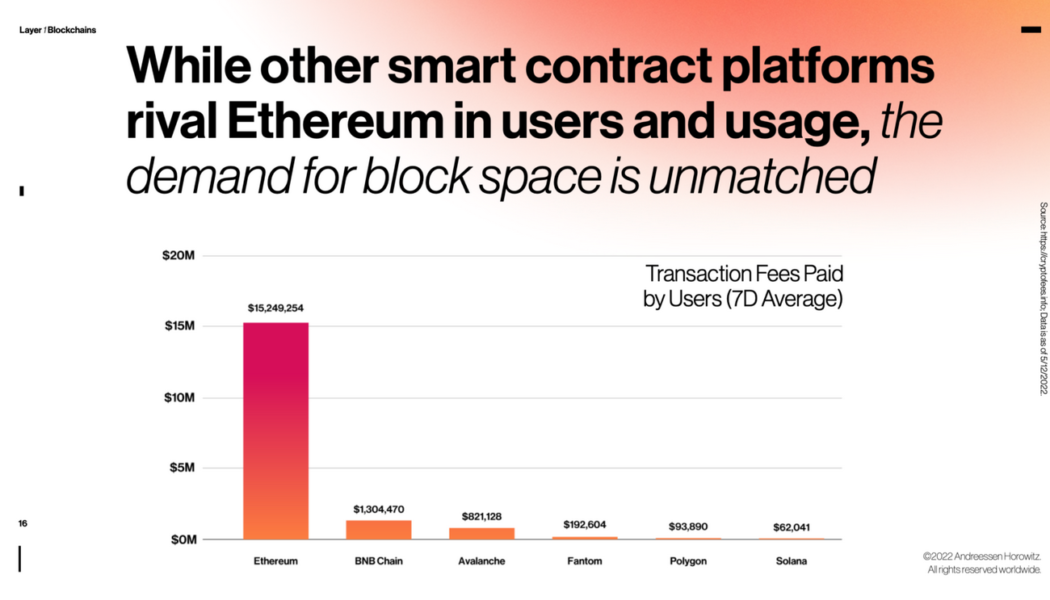

Crypto venture fund giant Andreessen Horowitz (a16z) has highlighted that development and demand on Ethereum is “unmatched” despite the network’s high transaction fees. The firm does warn, however, that its “popularity is also a double-edged sword” given Ethereum prioritizes decentralization over scaling, resulting in competing blockchains stealing market share with “promises of better performance and lower fees.” The comments came via a blog post introducing a16z’s 2022 “State of Crypto” report, with the firm’s data scientist Daren Matsuoka, head of protocol design and engineering Eddy Lazzarin, General Partner Chris Dixon, and head of content Robert Hackett all working together to provide five key takeaways from the study. Outside of Ethereum, the report focuses on topics such as Web3 de...

Price analysis 5/13: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

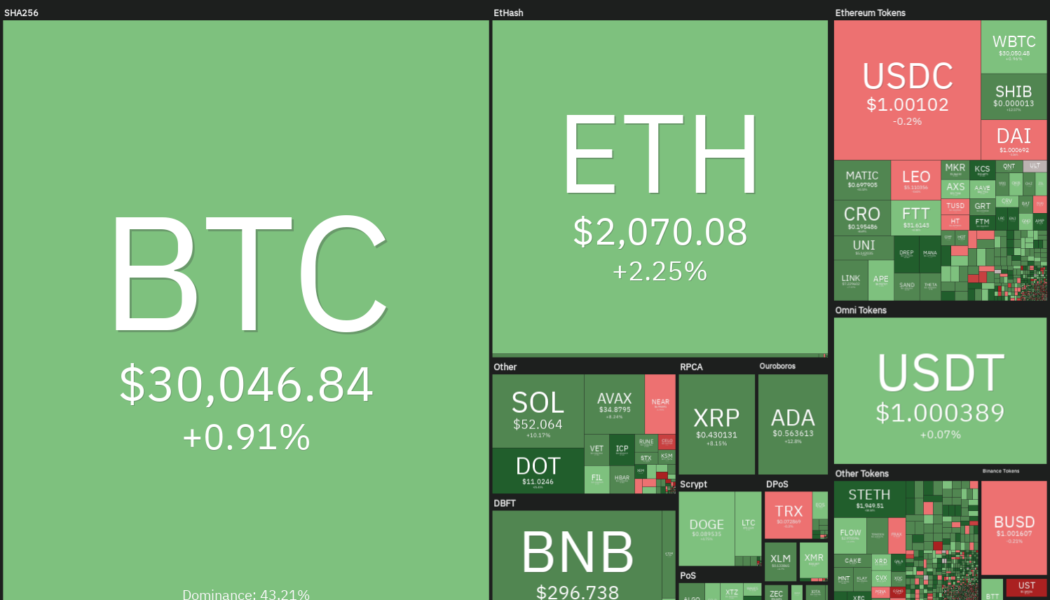

Bitcoin (BTC) rebounded sharply after dropping near its realized price of $24,000 on May 12, suggesting some bulls went against the herd and bought the dip. According to on-chain analytics platform CryptoQuant, the exchange balances declined by more than 24,335 Bitcoin on May 11 and 12, indicating that bulls may have started bottom fishing. However, macro investor Raoul Pal is not confident that a bottom has been made. In an exclusive interview with Cointelegraph, Pal said that if equity markets witness a capitulation phase, crypto markets are also likely to plunge before forming a bottom. He anticipates the current bear phase to end after the United States Federal Reserve stops hiking rates. Daily cryptocurrency market performance. Source: Coin360 Bear markets are known for sharp relief r...

Finance Redefined: DeFi protocols lost $1.6B, EU to rethink DeFi approach, and more

The past week in the decentralized finance (DeFi) ecosystem saw many new developments from an adoption perspective and protocol developments. The European Commission added a new chapter on DeFi, showing the growing impact of the nascent ecosystem, while a county in the United States State of Virginia wants to put its pension fund in a DeFi yield. DeFi exploits became the center of attention again as recent research shows that in the first two quarters of 2022, DeFi protocols have lost $1.6 billion to various exploits. Rari Fuze hacker, who got away with $80 million worth of funds, was offered a $10 million bounty. The DeFi tokens also made a bullish comeback toward the end of the past week. However, the overall weekly performance remained in the red. European Commission report suggests ret...

Ethereum risks 35% drop by June with ETH price confirming ‘ascending triangle’ fakeout

Ethereum’s native token Ether (ETH) faces the possibility of a 35% price correction in Q2 as it comes closer to breaking below its “ascending triangle” pattern. ETH price breakdown ahead? Ether’s price swung between profits and losses on May 2 while trading around $2,825, showing indecisiveness among traders about their next bias. Interestingly, the Ethereum token wobbled in the proximity of a rising trendline that constitutes an ascending triangle pattern in conjugation with a horizontal line resistance. To recap, ascending triangles are typically continuation patterns. That being said, Ether’s price was trending lower before forming its ascending triangle, raising its chances of a breakdown in the next few weeks. Another bearish sign comes from Ether&#...

Price analysis 4/29: BTC, ETH, BNB, SOL, LUNA, XRP, ADA, DOGE, AVAX, DOT

The U.S. dollar index (DXY) turned down from its 20-year high on April 29 but that has not changed the bearish price action seen in Bitcoin (BTC) and the U.S. equity markets. Equities remain under pressure and this week, Amazon stock saw its biggest intraday drop since 2014 after uncertainty over the U.S. Federal Reserve’s tightening measures placed investor sentiment back into choppy waters. If Bitcoin extends its correction, on-chain analysis platform Whalemap believes that the $25,000 to $27,000 zone may be the best place “to go all-in” on Bitcoin. Long-term investors do not appear to be panicking over the current weakness in Bitcoin and on-chain data from CryptoQuant shows that the combined BTC reserves of 21 crypto exchanges has plummeted to levels not seen since September 2...

Finance Redefined: Samson Mow’s DeFi question, Fireblocks expands to institutional and more

The week was filled with several new project developments and key updates from leading decentralized applications (DApps) and decentralized finance (DeFi) protocols. Fireblocks has expanded its institutional access to Terra’s DeFi ecosystem and Solana partnered with the Notifi network to improve the abysmal participation rates in governance votes. We will also look into the Cointelegraph research into the Terra ecosystem’s future and see if it can sustain the current growth. Samson Mow, the former executive at Blockstream, questions the decentralized aspect of the DeFi ecosystem. Top DeFi tokens saw another week of bearish price action despite several new developments and barring a few, the majority of the tokens in the top-100 registered double-digit losses over the past week. Fireblocks ...

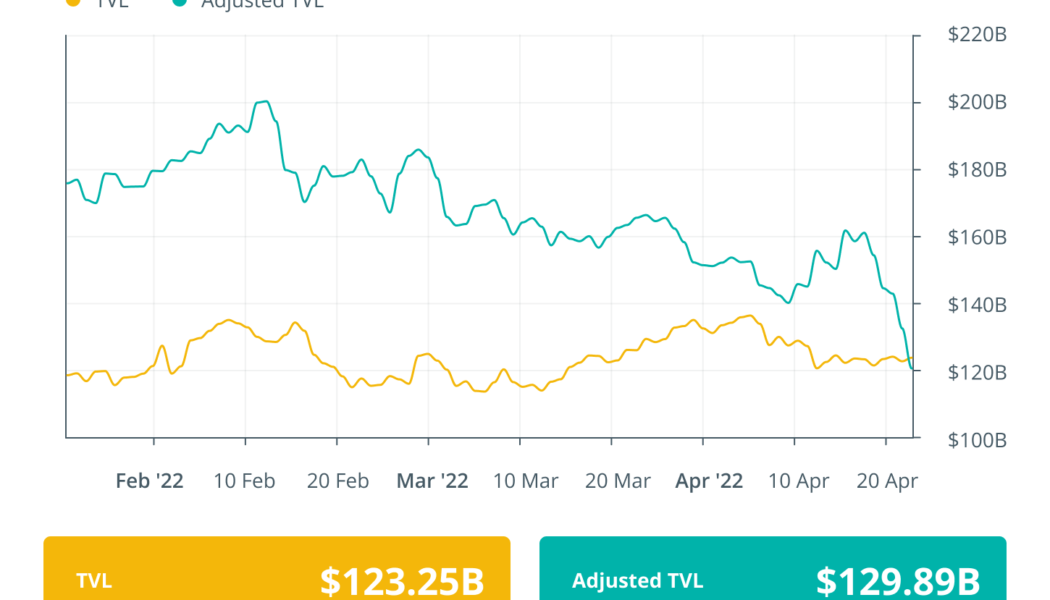

Avalanche (AVAX) loses 30%+ in April, but its DeFi footprint leaves room to be bullish

Avalanche (AVAX) price is down more than 30% in April, but despite the negative price move, the smart contract platform remains a top contender for decentralized applications due to its scalability, low-cost transactions and its large footprint in the decentralized finance (DeFi) landscape. AVAX token/USD at FTX. Source: TradingView The network is compatible with the Ethereum Virtual Machine (EVM) and unique in that it does not face the same operational bottlenecks of high transaction fees and network congestion. Avalanche was able to amass over $9 billion in total value locked (TVL) by offering a proof-of-stake (PoS) layer-1 scaling solution. This indicator is extremely relevant because it measures the deposits on the network’s smart contracts. For instance, the BNB Chain, running since S...

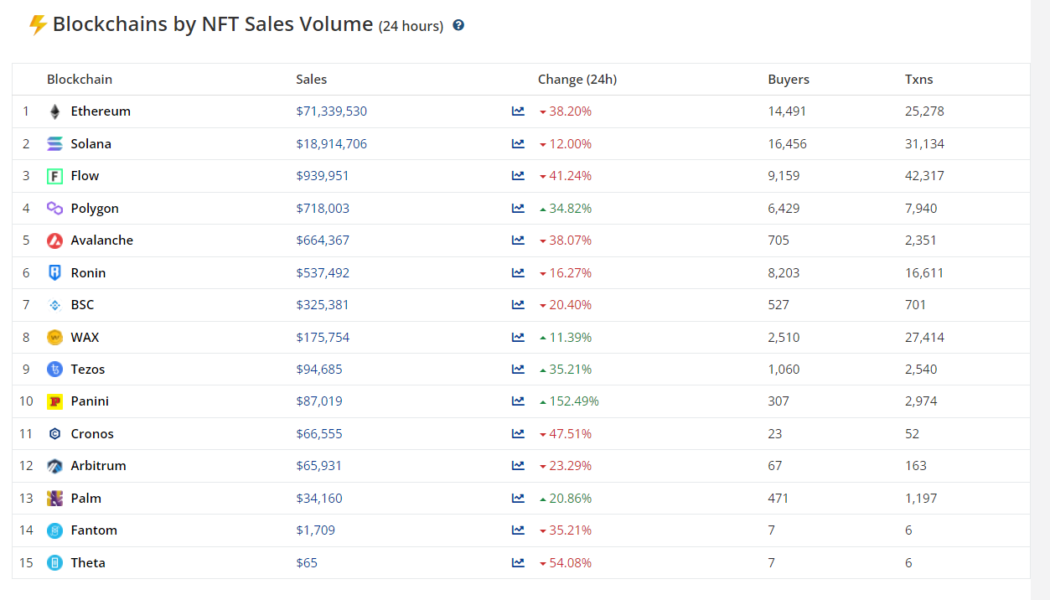

Nifty News: Solana NFT Okay Bears tops charts, South African wine NFTs rake it in and more

Okay Bears, a Solana-powered NFT, managed to top OpenSea’s 24-hour sales tracker for the first time earlier today, beating out all other Ethereum (ETH) projects on offer. It’s the first time a Solana (SOL) NFT project has reached the top spot in popular NFT marketplace OpenSea’s 24-hour sales tracker. .@okaybears No.1 on the OpenSea 24h rankings A @solana project has topped OpenSea’s market-wide 24h sales tracker for the first time! Check out the latest featured Solana collections on our dedicated SOL page: https://t.co/gteXeNRocn pic.twitter.com/1duEDQyxyn — OpenSea (@opensea) April 27, 2022 The Solana-based NFT, which features a collection of 10,000 diverse images of bears, told its Twitter followers it had sold out its collection only a day after its launch, bringing in 231,000 SO...

Ethereum on-chain data hints at further downside for ETH price

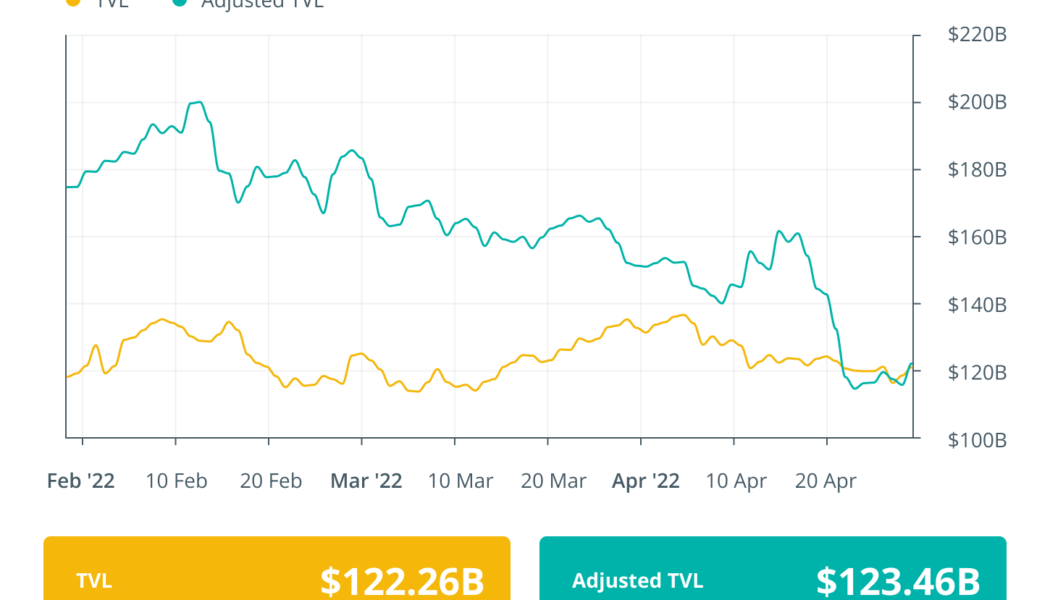

Analyzing Ether’s (ETH) current price chart paints a bearish picture, which is largely justified by the 11% drop over the past month, but other traditional finance assets faced more extreme price corrections in the same period. The Invesco China Technology ETF (CQQ) is down 31% and the Russell 2000 declined by 8%. Ether price at FTX, in USD. Source: TradingView Currently, traders fear that losing the descending channel support at $2,850 could lead to a stronger price downturn, but this largely depends on how derivatives traders are positioned along with the Ethereum network’s on-chain metrics. According to Defi Llama, the Ethereum network’s total value locked (TVL) flattened in the last 30 days at 27 million Ether. TVL measures the number of coins deposited on smart contr...

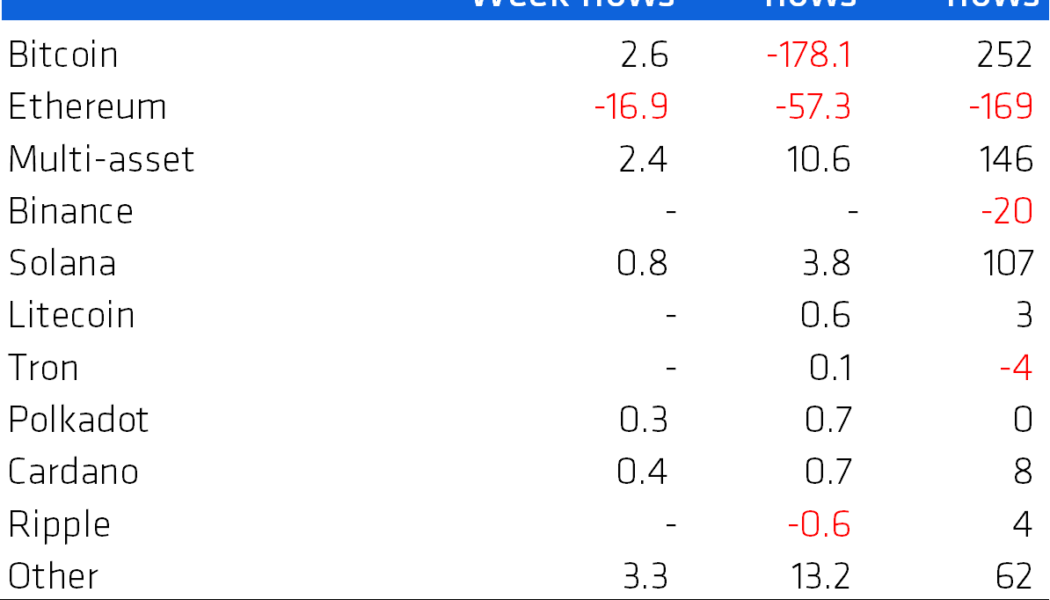

Institutional investment flows out of ETH and into competing L1 altcoins

Institutional investors have shifted their attention from Ethereum (ETH) to competing Layer 1 blockchains of late, with capital inflows for altcoin investment products increasing last week whilst Ether products posted outflows for the third week in a row. Data from CoinShares’ latest Digital Asset Fund Flows report shows that investors last week (ending April 22) loaded up on $3.5 million worth of Avalanche (AVAX), Solana (SOL), Terra (LUNA) and Algorand (ALGO) funds whilst capital outflows from Ether products totaled $16.9 million. It marks the third straight week that Ethereum products have seen outflows, bringing the total over that time to $59.3 million, equal to around 35% of the year-to-date outflows of $169 million from the second-largest blockchain. Notably, investors also favored ...

Price analysis 4/22: BTC, ETH, BNB, XRP, SOL, ADA, LUNA, AVAX, DOGE, DOT

Bitcoin (BTC) turned down sharply on April 21, maintaining its tight correlation with the U.S. equity markets, which reversed direction after U.S. Federal Reserve Chair Jerome Powell hinted that a 50 basis point rate hike was “on the table” in May. The selling has continued on April 22 as investors trim risky assets in expectation of an aggressive stance from central banks to curb surging inflation. Veteran trader Peter Brandt said in a tweet recently that the Nasdaq 100 (NDX) was showing a formation similar to the one it had made before plunging in the year 2000. If history repeats itself then the NDX could witness a sharp correction. That may be negative for the crypto markets in the short term because of the close correlation between Bitcoin and the NDX. Daily cryptocurrency market...