Solana

Exotic Markets Interview: Generating yield by selling optionality

It has been a turbulent time in the cryptocurrency markets recently. With the macro climate worsening to the point that we have more bearish sentiment than at any time since the Great Financial Crisis, coupled with the now-infamous UST debacle that saw a stablecoin worth $18 billion vanish into thin air, investors are fighting an intensely risk-off environment. It is precisely this environment that highlights how vital diversification and portfolio allocation is. This is part of the thesis behind Exotic Markets, who we interviewed last week following the launch of a Dual Currency Note (DCN) on the Solana network. In short, this product allows investors to generate yield by selling upside. Investors receive upside in their preferred currency, while avoiding the need for wrapped ...

3 reasons Ethereum price risks 25% downside in June

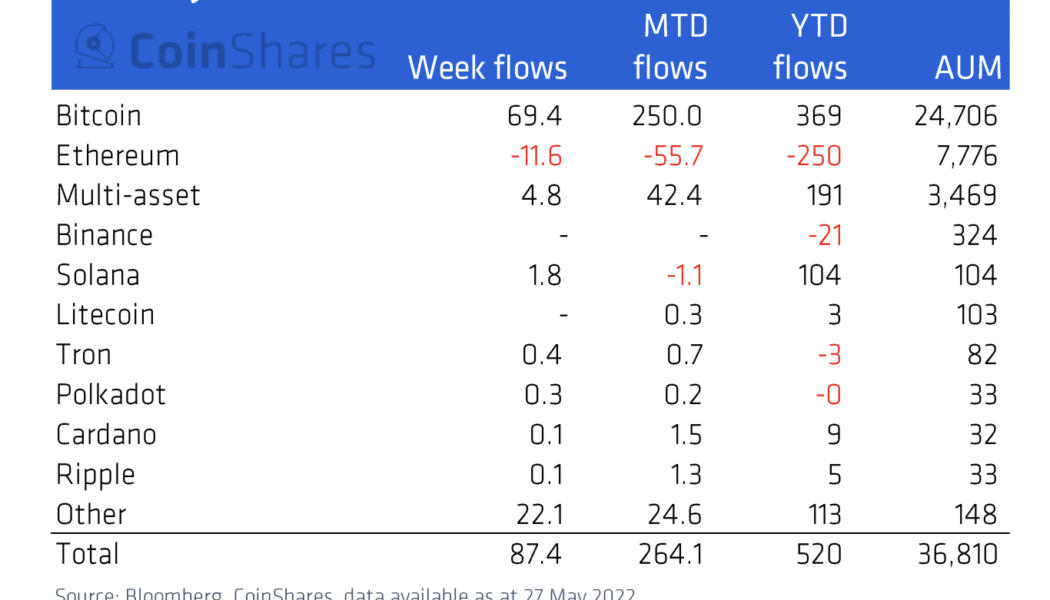

Ethereum’s native token Ether (ETH) has dropped more than half of its value in 2022 in dollar terms, while also losing value against Bitcoin (BTC) and now remains pinned below $2,000 for several reasons. What’s more, ETH price could face even bigger losses in June due to another slew of factors, which will be discussed below. Ethereum funds lose capital en masse Investors have withdrawn $250 million out of Ethereum-based investment funds in 2022, according to CoinShares’ weekly market report published May 31. The massive outflow appears in contrast to other coins. For instance, investors have poured $369 million into Bitcoin-based investment funds in 2022. Meanwhile, Solana and Cardano, layer-one blockchain protocols competing with Ethereum, have attracted $104 million and ...

Is Solana a ‘buy’ with SOL price at 10-month lows and down 85% from its peak?

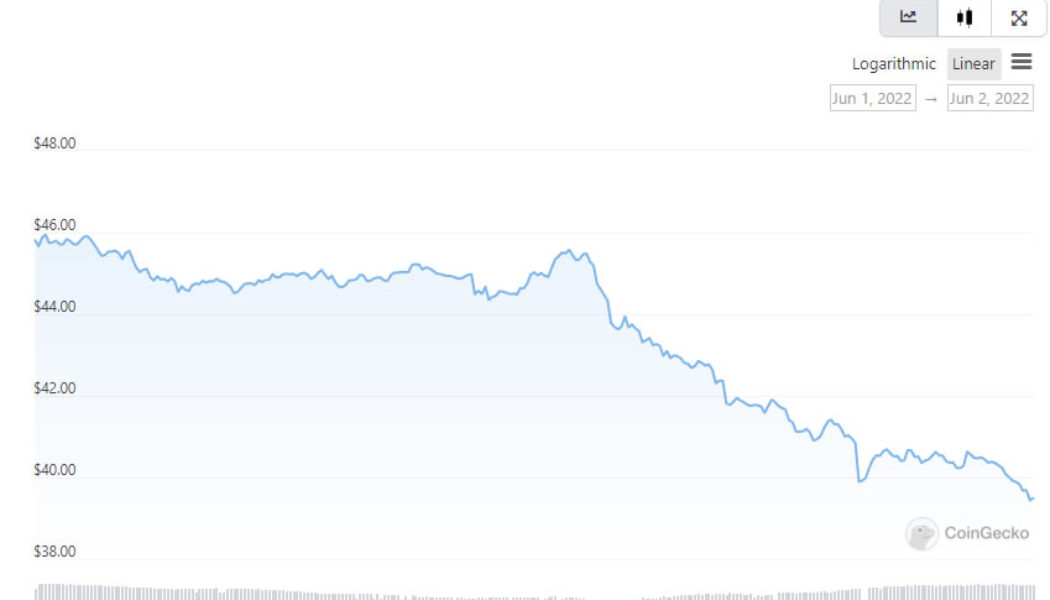

Solana’s (SOL) price dropped on June 3, bringing its net paper losses down to 85% seven months after topping out above $260. SOL price fell by more than 6.5% intraday to $35.68, after failing to rebound with conviction from 10-month lows. Now sitting on a historically significant support level, the SOL/USD pair could see an upside retracement in June, eyeing the $40-$45 area next, up around 25% from today’s price. SOL/USD daily price chart. Source: TradingView 60% SOL price decline ahead? However, a rebound scenario is far from guaranteed and Solana faces headwinds from trading in lockstep with Bitcoin (BTC), the top cryptocurrency (by market cap) that typically influences trends across the top altcoins. Notably, the weekly correlation coefficient between BTC and SO...

Alchemy announces support for Solana Web3 applications the day after blockchain halted

In an announcement published by Alchemy just one day after the Solana network temporarily halted on June 1, the Web3 development platform and infrastructure provider announced its support for the controversial blockchain. Caused by a bug that made it impossible to reach network consensus, the Solana blockchain was halted for approximately four hours on Wednesday. This isn’t the first time the system has been compromised, as normal functionality has been halted five times already this year. That didn’t seem to be a problem for Alchemy, which gives developers the ability to use its software and infrastructure in Solana-built applications. Now reportedly valued at $10.2 billion, the company is the creator of a Web3 API called Alchemy Supernode and a development suite used for monitoring and d...

Total crypto market cap risks a dip below $1 trillion if these 3 metrics don’t improve

The total crypto market capitalization has ranged from $1.19 trillion to $1.36 trillion for the past 23 days, which is a relatively tight 13% range. During the same time, Bitcoin’s (BTC) 3.5% and Ether’s (ETH) 1.6% gains for the week are far from encouraging. To date, the total crypto market is down 43% in just two months, so investors are unlikely to celebrate even if the descending triangle formation breaks to the upside. Total crypto market cap, USD billion. Source: TradingView Regulation worries continue to weigh investor sentiment, a prime example being Japan’s swift decision to enforce new laws after the Terra USD (UST) — now known as TerraUSD Classic (USTC) — collapse. On June 3, Japan’s parliament passed a bill to limit stablecoin issuing to licensed banks, registered money t...

Reliably unreliable: Solana price dives after latest network outage

The Solana network is not having a good year, having suffered full or partial outages at least seven separate times over the past 12 months. A bug has knocked the Solana blockchain offline again as block production halted at 16:55 UTC on June 1. This latest outage lasted around four and a half hours as validator operators managed to restart the mainnet at around 21:00 UTC, according to the incident report. Validator operators successfully completed a cluster restart of Mainnet Beta at 9:00 PM UTC, following a roughly 4 and a half hour outage after the network failed to reach consensus. Network operators an dapps will continue to restore client services over the next several hours. — Solana Status (@SolanaStatus) June 1, 2022 Solana Labs co-founder Anatoly Yakovenko explained what happened ...

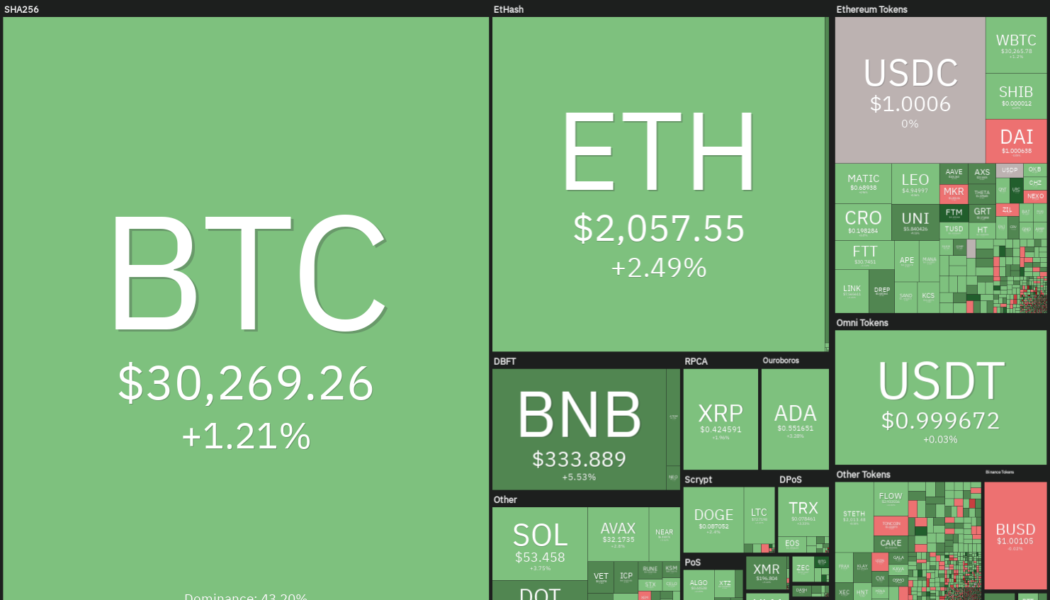

Price analysis 5/30: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

After creating the dubious record of nine successive red weekly closes, Bitcoin (BTC) is attempting to make amends by starting a price recovery to end the losing streak. Analysts have repeatedly said that investors should not fear a bear market because it is one of the best times to invest in fundamentally strong projects in preparation for the next bull phase. CryptoQuant CEO Ki Young Ju highlighted that unspent transaction outputs (UTXOs) that are older than six months reflect 62% of the realized cap, which is similar to the level seen during the March 2020 crash. Hence, Ki said that Bitcoin may be close to forming a cyclic bottom. Daily cryptocurrency market performance. Source: Coin360 In the current bearish environment, it is difficult to fathom a Bitcoin rally to $250,000 ...

Nifty News: ‘Blue-chips’ halve in value, free-to-mint Goblintown NFT volume surges

“Blue-chip” nonfungible token (NFT) collections have seen their floor prices and market capitalization slide over the past 30 days, with some of the most well-recognized projects halving in value for these key metrics. Data collected on key Ethereum NFT projects by DappRadar shows the floor prices of established collections such as CryptoPunks, Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC) and Moonbirds are at most down around 55% over 30 days. The MAYC is the worst off of the four, with the floor price diving 55% to 16.7 Ether (ETH), or $31,300 at the time of writing. The more popular BAYC has fallen over 47% to 86.7 ETH, or $163,000, and CryptoPunks by almost 49% to 45 ETH, $85,000. The only collection to gain in the month was Moonbirds, up 22% with a 19.6 ETH floor...

Hacker tastes own medicine as community gets back stolen NFTs

The tales of traders getting scammed out of their nonfungible tokens (NFTs) were quite common at the peak of the NFT boom. However, in an interesting turn of events, the Solana community came together to “scam” a scammer in order to get back some stolen NFTs. It all started with the Discord channel hack of cross-chain gaming development studio Uncharted NFT, where scammers managed to drain out 109 user wallets. The scammers got away with 150+ SOL tokens and 25 World of Solana (WOS) NFTs, including three rare and highly valuable digital collectibles. 2/It all began when @UnchainedNFT_ Discord got hacked two days ago. A hacker drained the wallet of 109 users for a total of 150+ $SOL. The most affected person was a WOS whale with 25 WOS NFTs that got stolen. This whale also owned 3 top ...

Spooky Solana breakdown begins with SOL price facing a potential 45% drop — Here’s why

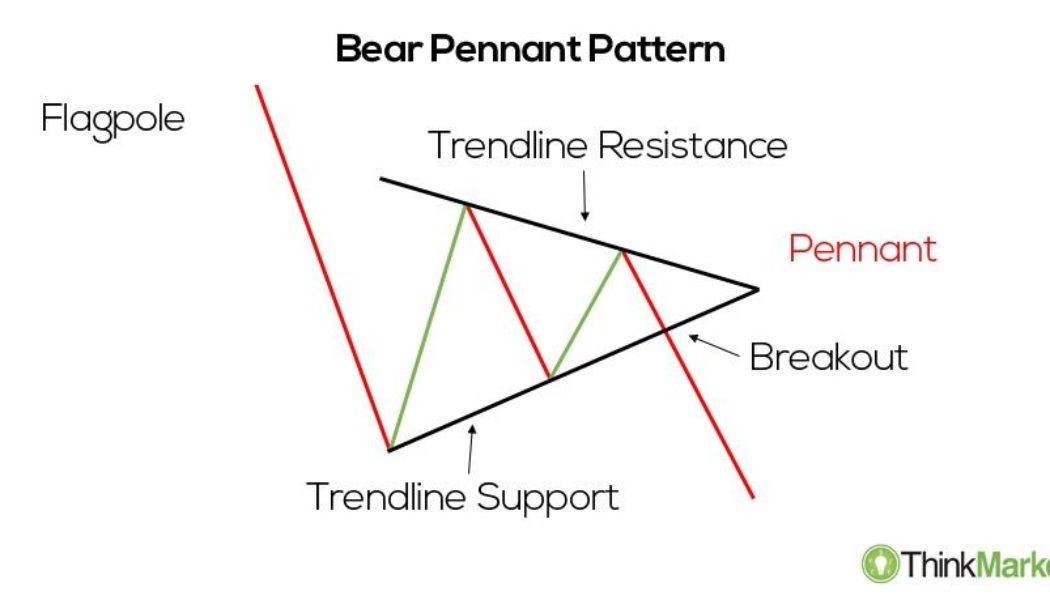

Solana (SOL) dropped on May 26, continuing its decline from the previous day amid a broader retreat across the crypto market. SOL price pennant breakdown underway SOL price fell by over 13% to around $41.60, its lowest level in almost two weeks. Notably, the SOL/USD pair also broke out of what appears to be like a “bear pennant,” a classic technical pattern whose occurrences typically precede additional downside moves in a market. In detail, bear pennants appear when the price trades inside a range defined by a falling trendline resistance and rising trendline support. Bear pennant pattern. Source: ThinkMarkets These patterns resolve after the price breaks below the lower trendline, accompanied by higher volumes. As a rule of technical analysis, traders decide the pennant’...

Crypto funds under management drop to a low not seen since July 2021

Digital asset investment products saw $141 million in outflows during the week ending on May 20, a move that reduced the total assets under management (AUM) by institutional funds down to $38 billion, the lowest level since July 2021. According to the latest edition of CoinShare’s weekly Digital Asset Fund Flows report, Bitcoin (BTC) was the primary focus of outflows after experiencing a decline of $154 million for the week. The removal of funds coincided with a choppy week of trading that saw the price of BTC oscillate between $28,600 and $31,430. BTC/USDT 1-day chart. Source: TradingView Despite the sizable outflow, the month-to-date BTC flow for May remain positive at $187.1 million, while the year-to-date figure stands at $307 million. On a more positive note, the multi-asset cat...

Price analysis 5/23: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

The United States equity markets are attempting a recovery after weeks of relentless selling. Along similar lines, on-chain monitoring resource Material Indicators expects the crypto market to recover, but they anticipate Bitcoin (BTC) to spend some time in a range before “a real breakout.” The seven-day moving average of the on-chain transaction volume tracked by Glassnode hit a nine-month low on May 23. This suggests that Bitcoin’s lackluster price action in 2022 has led to reduced participation from traders. Daily cryptocurrency market performance. Source: Coin360 While signs of a short-term recovery are visible, a sustained recovery could be difficult because the macro conditions remain challenging. International Monetary Fund managing director Kristalina Georgieva wrote in a blog post...