Solana

All ‘Ethereum killers’ will fail: Blockdaemon’s Freddy Zwanzger

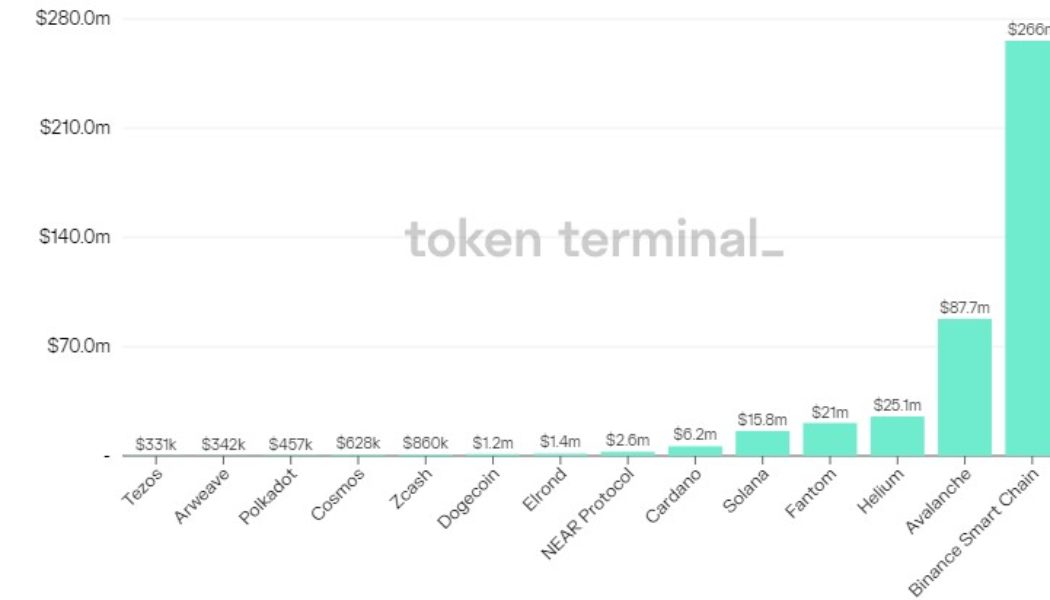

Blockdaemon’s ETH ecosystem lead Freddy Zwanzger believes Ethereum will retain its leadership position in the crypto ecosystem over the coming years due to its utility as a smart contract platform and upgrades to the network following the Merge. Speaking to Cointelegraph during the Ethereum Community Conference (EthCC) this week, Zwanzger said: “It’ll continue to be a leader. I mean, obviously, the first and most important smart contract platform, and that’s not going to change.” Blockdaemon is an institutional-grade blockchain infrastructure platform that offers node operations and infrastructure tooling for blockchain projects. The Blockdaemon employee also took aim at so-called “Ethereum killers” — competing Layer 1 blockchains — which have tried to topple Ethereum fro...

Solana and Ethereum smart contract audits, explained

As you might expect, this depends on how complex a smart contract is. According to Hacken, this can extend to $500,000 for larger projects where there are more lines of code — not least because of the additional engineering hours it’ll take. The company argues these costs pale into comparison with the economic damage that a smart contract vulnerability can bring. Hacken cites data showing that, in 2021, 80% of the incidents affecting decentralized applications related to smart contracts — with losses hitting $6.9 billion. Breaking this down even further, and we can see that the average cost per project stands at $47 million. Somehow, $500,000 looks a lot less expensive now. Overall, 60% of its clients have been based on Ethereum so far in 2022. And here&...

Price analysis 7/20: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

Bitcoin (BTC) briefly extended its recovery above $24,000 and the altcoins continued to make smart gains on July 20, but the bullish momentum of the week experienced a brief setback after Tesla’s earnings report showed the company had sold 75% of its BTC position. Although the sharp breakout of this week is a positive sign, analysts were quick to point out that a sustained recovery depends on a strong performance from Wall Street. Analyst Venturefounder pointed out that the rally was largely macro-driven and Bitcoin’s correlation with NASDAQ remained at a historical high of 91%. Bitcoin’s sharp rally in the past few days has awakened hibernating bulls who are dishing out lofty targets. Analyst TechDev projected a target of $120,000 in 2023, while Galaxy Digital CEO Mike Novogratz tol...

Price analysis 7/18: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

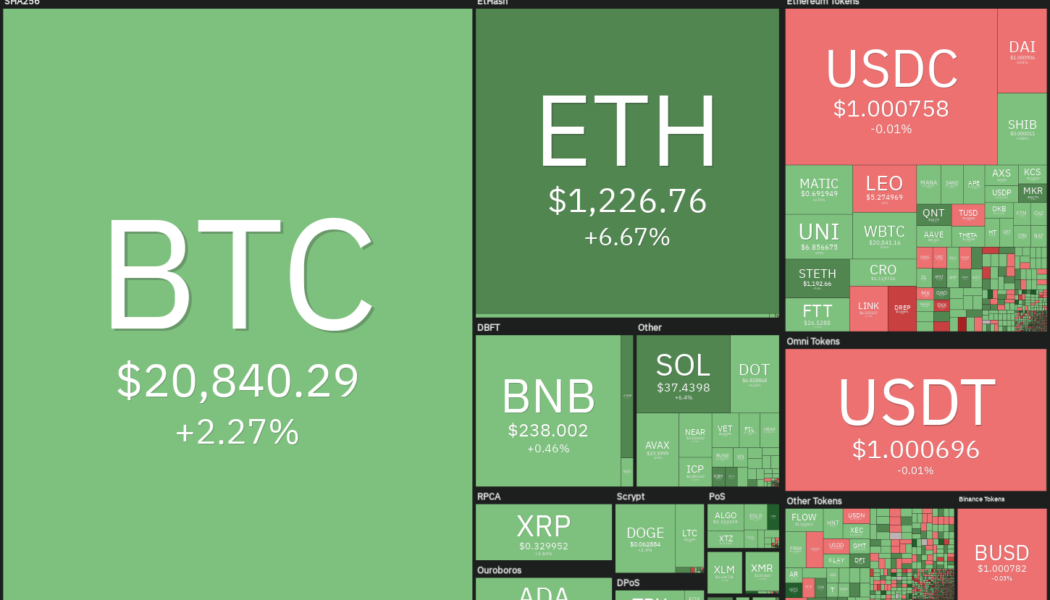

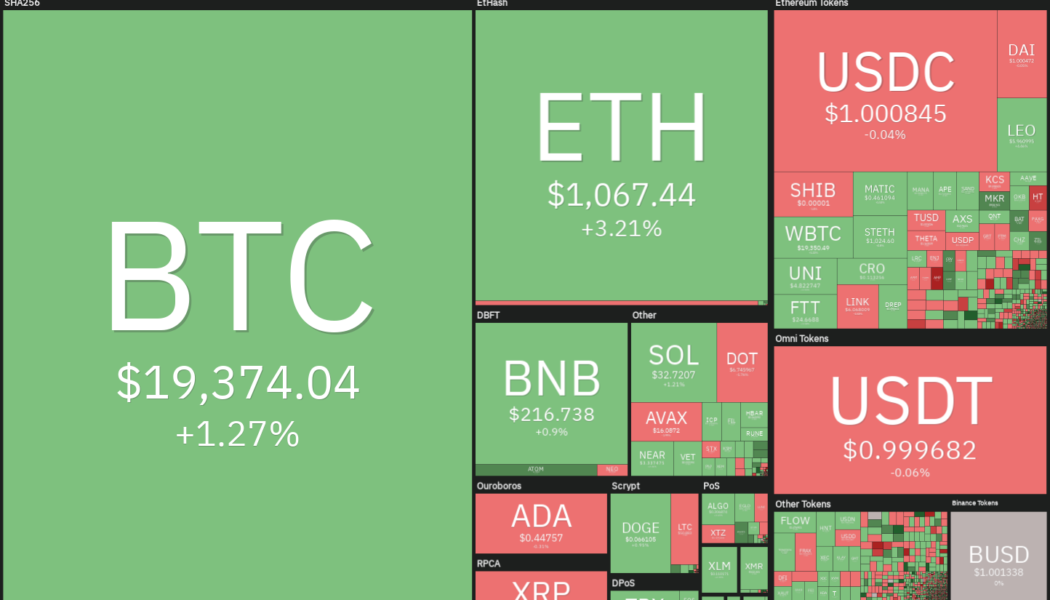

Bitcoin (BTC) rose above $22,000 and Ether (ETH) traded above $1,500 on July 18, indicating that bulls are gradually returning to the cryptocurrency markets. This pushed the total crypto market capitalization above $1 trillion for the first time since June 13, raising hopes that the worst of the bear market may be behind us. In another positive sign, more than 80% of the total Bitcoin supply denominated in the United States dollar has been dormant for at least three months, according to crypto intelligence firm Glassnode. During previous bear markets, such an occurrence preceded the end of the bear phase. Daily cryptocurrency market performance. Source: Coin360 However, a report by Grayscale Investments voices a different opinion. It suggests that the current bear market in Bitcoin started...

Price analysis 7/15: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

The recovery in the cryptocurrency markets is being led by Bitcoin (BTC), which has risen above the $21,000 level. However, BlockTrends analyst Caue Oliveira said that on-chain data shows a decline in “whale activity” since the month of May, barring the flurry of activity during the Terra (LUNA) — since renamed Terra Classic (LUNC) — collapse. A survey conducted in China shows that most participants believe that Bitcoin could fall much further. About 40% of the participants said they would buy Bitcoin if the price dropped to $10,000. Only 8% of the voters showed interest in buying Bitcoin if it drops to $18,000. Daily cryptocurrency market performance. Source: Coin360 Millionaire investor Kevin O’Leary told Cointelegraph that crypto markets are likely to witness “massive volatility” and en...

Price analysis 7/13: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, LEO

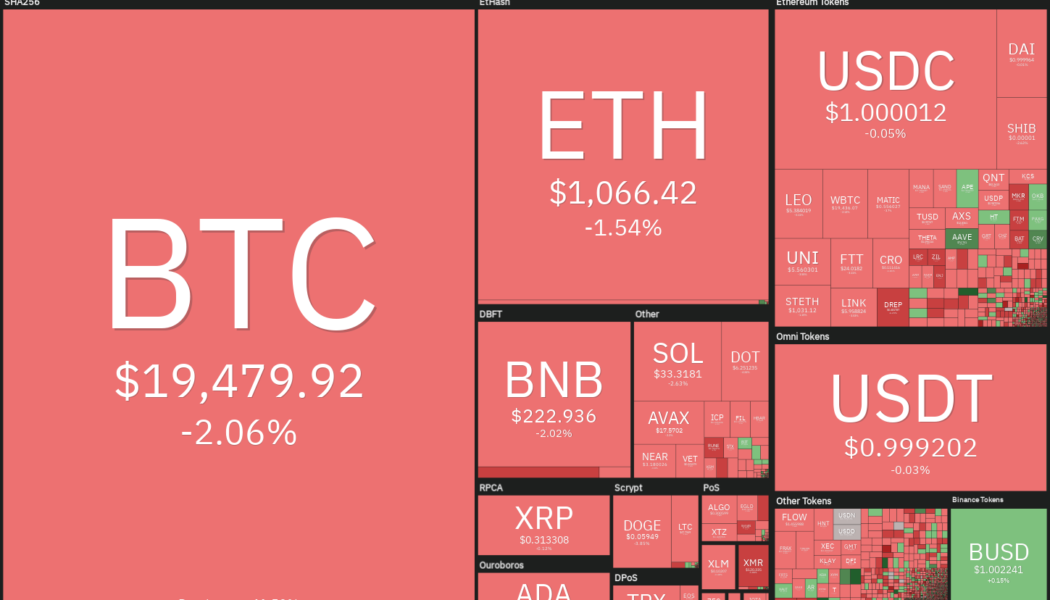

The United States Consumer Price Index soared to 9.1% in June, exceeding expectations of an 8.8% rise year-on-year. Currently, the Fed funds futures point to an 81 basis points rate hike for July, suggesting that some participants anticipate a 100 basis points hike. Several on-chain indicators have been pointing to a likely bottom in Bitcoin (BTC) but the analysts from market intelligence firm Glassnode are not convinced that the low has been made. In “The Week On-Chain” report on July 11, the analysts said that the market may have to fall further “to fully test investor resolve, and enable the market to establish a resilient bottom.” Daily cryptocurrency market performance. Source: Coin360 While the short term remains bearish, strategists are confident about its long-term prospects. ...

Price analysis 7/4: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, LEO, SHIB

The crypto markets have remained relatively stable over the weekend and on July 4, which is a holiday for the United States financial markets due to Independence Day. Although Arthur Hayes, former CEO of derivatives platform BitMEX, was expecting a “mega crypto dump” around July 4, it has not materialized. The drop in Bitcoin’s (BTC) volatility in the past few days has resulted in the squeezing of the Bollinger Band’s width. This indicates a possible increase in volatility in the next few days, according to popular analyst Matthew Hyland. Daily cryptocurrency market performance. Source: Coin360 Meanwhile, crypto investors seem to be waiting for clues from the U.S. equities markets and the U.S. dollar. Bitcoin’s correlation coefficient with the dollar in the week ending July 3 slumped to 0....

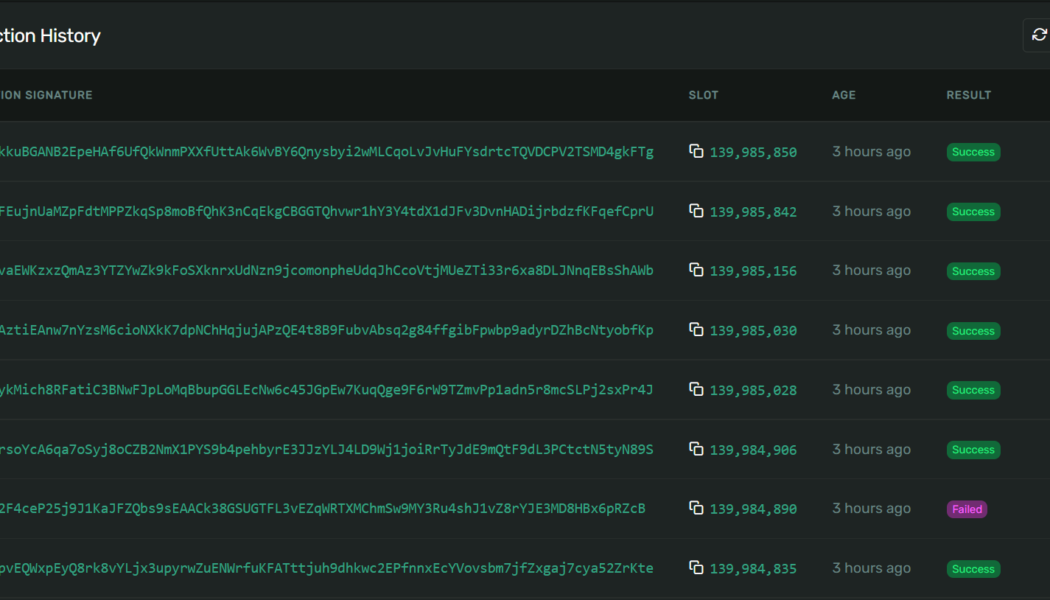

Crema Finance shuts liquidity protocol on Solana amid hack investigation

Crema Finance, a concentrated liquidity protocol over the Solana blockchain, announced the temporary suspension of its services owing to a successful exploit that has drained a substantial but undisclosed amount of funds. Soon after realizing the hack on its protocol, Crema Finance suspended the liquidity services to refrain the hacker from draining out its liquidity reserves — which include the funds of the service provider and investors. Attention! Our protocol seems to have just experienced a hacking. We temporarily suspended the program and are investigating it. Updates will be shared here ASAP. — CremaFinance (@Crema_Finance) July 3, 2022 Speaking to Cointelegraph about the matter, Henry Du, the co-founder of Crema Finance confirmed the commencement of the investigation. He state...

Price analysis 7/1: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, LEO, SHIB

Bitcoin dropped 56.2% in the second quarter of 2022, according to crypto analytics platform Coinglass. That makes it Bitcoin’s worst quarter since the third quarter of 2011 when BTC price fell by 67%. A large part of the damage was done in the month of June when Bitcoin plunged 37%, the worst monthly drawdown since September 2011. It is not all gloom and doom for crypto investors. On June 29, JPMorgan strategist Nikolaos Panigirtzoglou said that the “Net Leverage metric” suggests that crypto’s deleveraging may be on its last legs. The eagerness of crypto companies with stronger balance sheets to bail out crypto firms in distress is also a positive sign. Daily cryptocurrency market performance. Source: Coin360 Another positive view on Bitcoin came from Deutsche Bank analysts. In a recent re...

Price analysis 6/27: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

Bitcoin’s (BTC) current bear market is one of the worst, according to a report by on-chain analytics firm Glassnode. This was the first time in history that the Mayer Multiple slipped below the previous cycle’s low. Bitcoin’s fall below $20,000 on June 18 also marked the biggest loss ever booked by investors in a single day at $4.23 billion. Considering the above factors and a few other events, Glassnode believes that the capitulation in Bitcoin may have started. Bitcoin whales seem to have started their purchasing, suggesting that the bottom may be close and on June 25, analytics resource “Game of Trades” highlighted that demand from whales holding 1,000 to 10,000 Bitcoin witnessed a sharp spike in demand. Daily cryptocurrency market performance. Source: Coin360 Another sign t...

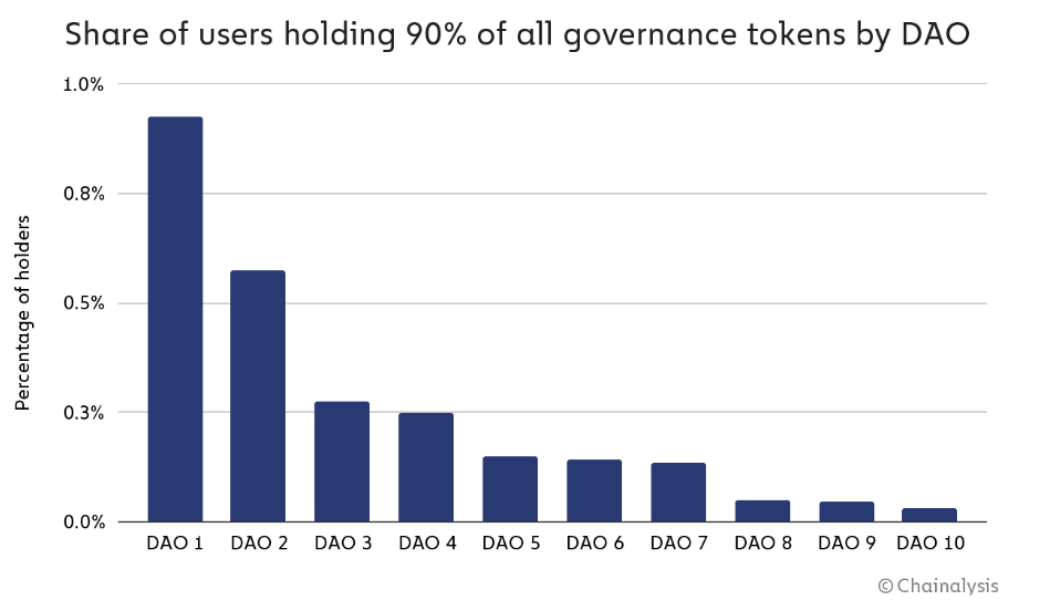

Less than 1% of all holders have 90% of the voting power in DAOs: report

Decentralized autonomous organizations (DAOs) have become a rage in the ever-expanding crypto ecosystem and are often seen as the future of decentralized corporate governance. DAOs are organizations without a centralized hierarchy, intended to work in a bottom-up manner, where the community collectively owns and contributes to an organization’s decision-making process. However, recent research data suggests that these DAOs are not as decentralized as it was intended to be. A recent report from Chainalysis analyzed the workings of ten major DAO projects and found that on average, less than 1% of all holders have 90% of the voting power. The finding highlights a high concentration of decision-making power in the hands of a selected few, an issue DAOs were created to resolve. This...