Solana

Solana unveils Google partnership, smartphones, Web3 store at Breakpoint

During the ecosystem’s annual gathering at Breakpoint 2022 in Libson, Solana made a series of launch announcements as it prepares to go mainstream. Cointelegraph’s ground team — present during the conference — shared insights into Solana’s roadmap, which includes the launching of smartphones, decentralized application (DApp) stores and a partnership with Google Cloud, among others. Good morning from @SolanaConf Come say hi if you see us with our Cointelegraph merch Follow this thread to get more updates you on this lovely event! pic.twitter.com/4m2jNaTSNS — Cointelegraph (@Cointelegraph) November 5, 2022 Solana Breakpoint, a four-day conference scheduled from Nov. 4 to Nov. 7, attracted 13,000 people in just one of the four venues it’s being held simultaneously. QR Code giveaways and GeoNF...

The market is hot, but Solana is not — Data explains why SOL price is lagging

Solana (SOL) has been in a steady downtrend for the past 3 months, but some traders believe that it may have bottomed at $26.80 on Oct. 21. Lately, there’s been a lot of speculation on the causes for the underperformance and some analysts are pointing to competition from Aptos Network. Solana price at FTX, USD. Source: TradingView The Aptos blockchain launched on Oct. 17 and it claims to handle three times more transactions per second than Solana. Yet, after four years of development and millions of dollars in funding, the debut of the layer-1 smart contract solution was rather unimpressive. It is essential to highlight that Solana presently holds an $11.5 billion market capitalization at the $32 nominal price level, ranking it as the seventh largest cryptocurrency when excluding sta...

BNB Chain cools off after 24% surge, but strong fundamentals could back the next BNB rally

After an impressive 23.7% rally between Oct. 25 and Oct. 31, Binance’s BNB (BNB) coin has faced a strong rejection from the $330 resistance. Is it possible that the two-day 6% sell-off from the $337.80 peak could indicate that further trouble is ahead? Let’s take a look at what the data shows. BNB 12-hour chart on Binance, USD. Source: TradingView Analysts pinned the recent rally to the Oct. 28 news that Binance invested $500 million in Twitter. However, the network’s deposits and decentralized application (DApp) metrics have not accompanied the improvement in sentiment. The strong upward movement was largely based on reports that Binance was preparing to assist Twitter in eradicating bots. The speculation emerged after billionaire Elon Musk raised the $44 billion required to complete...

Solana-based protocol seeking to decentralize ride-sharing raises $9M

The ride-sharing industry is poised for another paradigm shift with Web3 protocols, allowing new companies and drivers to bid for rides using a matching algorithm, according to the Decentralized Engineering Cooperation (DEC) — the company behind the Solana-based protocol TRIP that enables mobility-based applications. According to DEC, on the TRIP platform, companies and riders can collaborate and compete in a shared marketplace. The protocol also rewards the most active participants with a stake in its governance for both drivers and customers. The first company to operate on TRIP is Teleport, a decentralized ride-sharing application set to be launched in December and run by the parent company DEC. On Oct. 27, DEC announced a $9 million seed round co-led by Foundation Capital and Road Capi...

Price analysis 10/21: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, MATIC

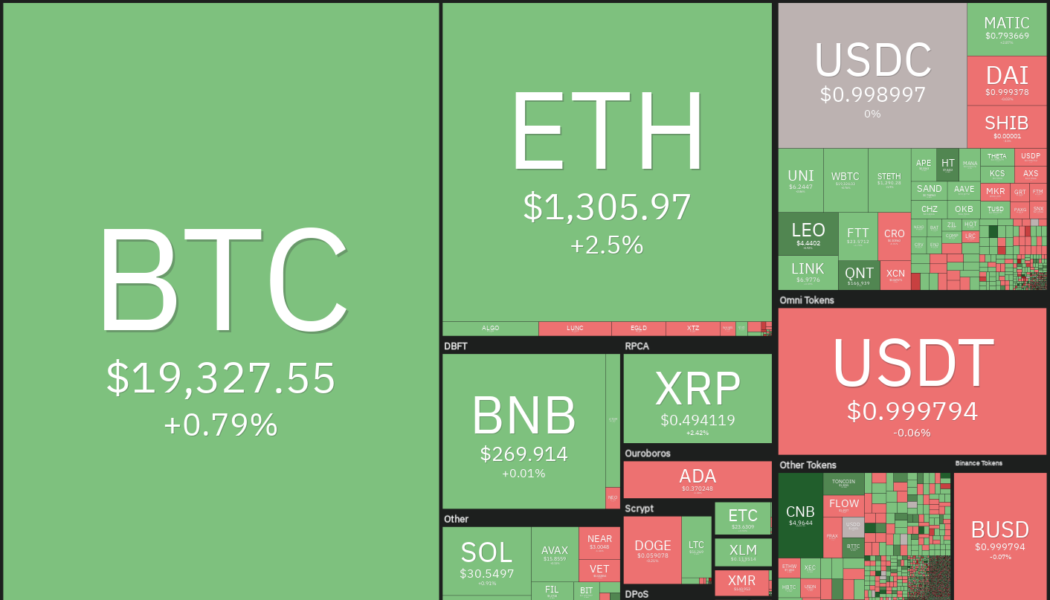

The 10-year Treasury yield in the United States rose to its highest level since 2008. Although this type of rally is usually negative for risky assets, the U.S. stock markets recovered ground after the Wall Street Journal reported that some officials of the Federal Reserve were concerned about the pace of the rate hikes and the risks of over-tightening. While it is widely accepted that the U.S. will enter a recession, a debate rages on about how long it could last. On that, Tesla CEO Elon Musk recently said on Twitter that the recession could last “probably until spring of ‘24,” and added that it would be nice to spend “one year without a horrible global event.” Daily cryptocurrency market performance. Source: Coin360 Bitcoin’s (BTC) price has witnessed a massive drop from its all-time hig...

Mango Markets exploiter said actions were ‘legal,’ but was it?

The $117 million Mango Markets exploiter has defended that their actions were ‘legal,’ but a lawyer suggests that they could still face consequences. Self-described digital art dealer Avraham Eisenberg, outed himself as the exploiter in a series of tweets on Oct. 15 claiming he and a team undertook a “highly profitable trading strategy” and that it was “legal open market actions, using the protocol as designed.” I believe all of our actions were legal open market actions, using the protocol as designed, even if the development team did not fully anticipate all the consequences of setting parameters the way they are. — Avraham Eisenberg (@avi_eisen) October 15, 2022 The Oct. 11 exploit worked through Eisenberg and his team manipulating the value of their posted collateral — the platforms’ n...

Price analysis 10/14: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, MATIC

The United States Consumer Price Index (CPI) increased 8.2% annually in September, beating economists’ expectations of an 8.1% rise. The CPI print lived up to its hype and caused a sharp, but short-term increase in volatile risk assets. The S&P 500 oscillated inside its widest trading range since 2020 and Bitcoin (BTC) also witnessed a large intraday range of more than $1,323 on Oct. 13. However, Bitcoin still could not shake out of the $18,125 to $20,500 range in which it has been for the past several days. Daily cryptocurrency market performance. Source: Coin360 Both the U.S. equities markets and Bitcoin tried to extend their recovery on Oct. 14 but the higher levels attracted selling, indicating that the bears have not yet given up. Could the increased volatility culminate wit...

Barely halfway and October already the biggest month in crypto hacks: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. October is historically associated with the bulls, but in 2022, the month has also become the leader in crypto hacks as barely halfway through, and the DeFi ecosystem has already seen nearly a dozen hacks resulting in losses of hundreds of millions of dollars. The largest hack occurred on Solana’s DeFi platform Mango Markets on Oct. 11, resulting in a loss of over $100 million worth of crypto. The hacker has now come out to demand $70 million in USD Coin (USDC) stablecoin as a bounty to return the stolen crypto. In another hack, TempleDAO was exploited for $2 million on the same day as Mango Market’s exploit. Movi...

Price analysis 9/30: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

The United States equities markets have been under a firm bear grip for a large part of the year. The S&P 500 and the Nasdaq Composite have declined for three quarters in a row, a first since 2009. There was no respite in selling in September and the Dow Jones Industrial Average is on track to record its worst September since 2002. These figures outline the kind of carnage that exists in the equities market. Compared to these disappointing figures, Bitcoin (BTC) and select altcoins have not given up much ground in September. This is the first sign that selling could be drying up at lower levels and long-term investors may have started bottom fishing. Daily cryptocurrency market performance. Source: Coin360 In the final quarter of the year, investors will continue to focus on the inflat...

Price Analysis 9/26: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

The United Kingdom is in focus following the British pound’s fall to a new all-time low against the United States dollar. The sell-off was triggered by the aggressive tax cuts announced by Prime Minister Liz Truss’s government. The 10-year gilt yields have soared by 131 basis points in September, on track for its biggest monthly increase since 1957, according to Reuters. The currency crisis and the soaring U.S dollar index (DXY) may not be good news for U.S. equities and the cryptocurrency markets. A ray of hope for Bitcoin (BTC) investors is that the pace of decline has slowed down in the past few days and the June low has not yet been re-tested. Daily cryptocurrency market performance. Source: Coin360 That could be because Bitcoin’s long-term investors do not seem to be panicking. Data f...

Price analysis 9/23: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

The S&P 500 index has declined about 5% this week while the Nasdaq Composite is down more than 5.5%. Investors fear that the Federal Reserve’s aggressive rate hikes could cause an economic downturn. The yield curve between the two-year and 10-year Treasury notes, which is watched closely by analysts for predicting a recession, has inverted the most since the year 2000. Among all the mayhem, it is encouraging to see that Bitcoin (BTC) has outperformed both the major indexes and has fallen less than 4% in the week. Could this be a sign that Bitcoin’s bottom may be close by? Daily cryptocurrency market performance. Source: Coin360 On-chain data shows that the amount of Bitcoin supply held by long-term holders in losses reached about 30%, which is 2% to 5% below the level that coinci...

Helium migrates its blockchain to Solana following T-Mobile partnership

On Thursday, the Helium Foundation announced that it would be moving its mainnet to the Solana blockchain following a community vote. According to the proposal, proof-of-coverage and Data transfer mechanisms will be moved to Helium Oracles. It’s official! The HIP 70 vote has ended. #Helium will be moving to the @Solana blockchain! pic.twitter.com/V2WIajou7R — Helium (@helium) September 22, 2022 Meanwhile, Helium’s tokens and governance will relocate to that of the Solana blockchain. As told by developers, the benefits of the move would include more of its native token HNT available to subDAO reward pools, more consistent mining, more reliable data transfer, more utility for HNT and subDAO tokens, and more ecosystem support. Helium is a blockchain wireless communications protocol...