SOL

Solana joins ranks of FTT, LUNA with SOL price down 97% from peak — Is a rebound possible?

Solana (SOL), the cryptocurrency once supported by Sam Bankman-Fried, pared some losses on Dec. 30, a day after falling to its lowest level since February 2021. Solana price down 97% from November 2021 peak On the daily chart, SOL’s price rebounded to around $10.25, up over 20% from its previous day’s low of approximately $8. SOL/USD weekly price chart. Source: TradingView Nevertheless, the intraday recovery did little to offset the overall bear trend — down 97% from its record peak of $267.50 in November 2021, and down over 20% in the past week. But while the year has been brutal for markets, Solana now joins the ranks of the worst-performing tokens of 2022, namely FTX Token and LUNA, which are down around 98%. FTT (red) vs. LUNA (green) vs. SOL (blue) ...

Magic Eden follows OpenSea with NFT royalty enforcement tool

Magic Eden, a Solana-based nonfungible token (NFT) marketplace, has become the latest platform to release a tool allowing creators to enforce royalties on their collections. It follows the announcement of a similar tool from rival NFT marketplace OpenSea in early November. According to a Dec. 1 statement, the open-source royalty enforcement tool is built on top of Solana’s SPL token standard and is called the Open Creator Protocol (OCP). This will allow royalty enforcement for new collections that opt-in to the standard starting Dec. 2. Lu previously floated the idea of NFTs designed to enforce royalties at Solana’s Breakpoint 2022 conference on Nov. 5, citing the need for NFT creators to have a “sustained revenue model.” Creators who use OCP will also be able to ban marketplaces tha...

Ongoing Solana-based wallet hack seeing millions drained

An ongoing, widespread hack has seen as much as $8 million in funds drained so far across a number of Solana-based hot wallets. At the time of writing, Solana (SOL) is currently trending on Twitter as countless users are either reporting on the hack as it unfolds, or are reporting to have lost funds themselves, warning anyone with Solana-based hot wallets such as Phantom and Slope wallets to move their funds into cold wallets. Blockchain investigator PeckShield on August 2 said the widespread hack is likely due to a “supply chain issue” which has been exploited to steal user private keys behind affected wallets. It said the estimated loss so far is around $8 million. #PeckShieldAlert The widespread hack on Solana wallets is likely due to the supply chain issue exploited t...

Is Solana a ‘buy’ with SOL price at 10-month lows and down 85% from its peak?

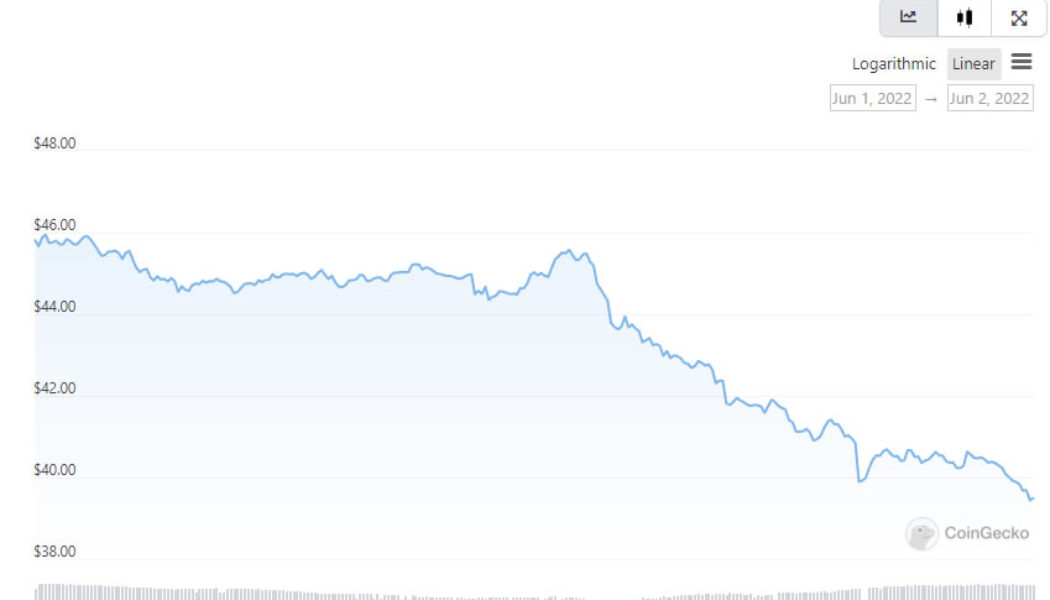

Solana’s (SOL) price dropped on June 3, bringing its net paper losses down to 85% seven months after topping out above $260. SOL price fell by more than 6.5% intraday to $35.68, after failing to rebound with conviction from 10-month lows. Now sitting on a historically significant support level, the SOL/USD pair could see an upside retracement in June, eyeing the $40-$45 area next, up around 25% from today’s price. SOL/USD daily price chart. Source: TradingView 60% SOL price decline ahead? However, a rebound scenario is far from guaranteed and Solana faces headwinds from trading in lockstep with Bitcoin (BTC), the top cryptocurrency (by market cap) that typically influences trends across the top altcoins. Notably, the weekly correlation coefficient between BTC and SO...

Reliably unreliable: Solana price dives after latest network outage

The Solana network is not having a good year, having suffered full or partial outages at least seven separate times over the past 12 months. A bug has knocked the Solana blockchain offline again as block production halted at 16:55 UTC on June 1. This latest outage lasted around four and a half hours as validator operators managed to restart the mainnet at around 21:00 UTC, according to the incident report. Validator operators successfully completed a cluster restart of Mainnet Beta at 9:00 PM UTC, following a roughly 4 and a half hour outage after the network failed to reach consensus. Network operators an dapps will continue to restore client services over the next several hours. — Solana Status (@SolanaStatus) June 1, 2022 Solana Labs co-founder Anatoly Yakovenko explained what happened ...

Nifty News: ‘Blue-chips’ halve in value, free-to-mint Goblintown NFT volume surges

“Blue-chip” nonfungible token (NFT) collections have seen their floor prices and market capitalization slide over the past 30 days, with some of the most well-recognized projects halving in value for these key metrics. Data collected on key Ethereum NFT projects by DappRadar shows the floor prices of established collections such as CryptoPunks, Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC) and Moonbirds are at most down around 55% over 30 days. The MAYC is the worst off of the four, with the floor price diving 55% to 16.7 Ether (ETH), or $31,300 at the time of writing. The more popular BAYC has fallen over 47% to 86.7 ETH, or $163,000, and CryptoPunks by almost 49% to 45 ETH, $85,000. The only collection to gain in the month was Moonbirds, up 22% with a 19.6 ETH floor...

Ethereum risks 35% drop by June with ETH price confirming ‘ascending triangle’ fakeout

Ethereum’s native token Ether (ETH) faces the possibility of a 35% price correction in Q2 as it comes closer to breaking below its “ascending triangle” pattern. ETH price breakdown ahead? Ether’s price swung between profits and losses on May 2 while trading around $2,825, showing indecisiveness among traders about their next bias. Interestingly, the Ethereum token wobbled in the proximity of a rising trendline that constitutes an ascending triangle pattern in conjugation with a horizontal line resistance. To recap, ascending triangles are typically continuation patterns. That being said, Ether’s price was trending lower before forming its ascending triangle, raising its chances of a breakdown in the next few weeks. Another bearish sign comes from Ether&#...

Solana suffers 7th outage in 2022 as bots invade the network

The Solana network suffered a seven-hour outage overnight between Saturday and Sunday due to a large number of transactions from the nonfungible token (NFT) minting bots. A record-breaking four million transactions, or 100 gigabits of data per second, congested the network causing validators to be knocked out of consensus resulting in Solana going dark at roughly 8:00 pm UTC on Saturday. It wasn’t until seven hours later on Sunday, 3:00 am UTC that validators were able to successfully restart the main network. Validator operators successfully completed a cluster restart of Mainnet Beta at 3:00 AM UTC, following a roughly 7 hour outage after the network failed to reach consensus. Network operators an dapps will continue to restore client services over the next several hours. https://t.co/ez...

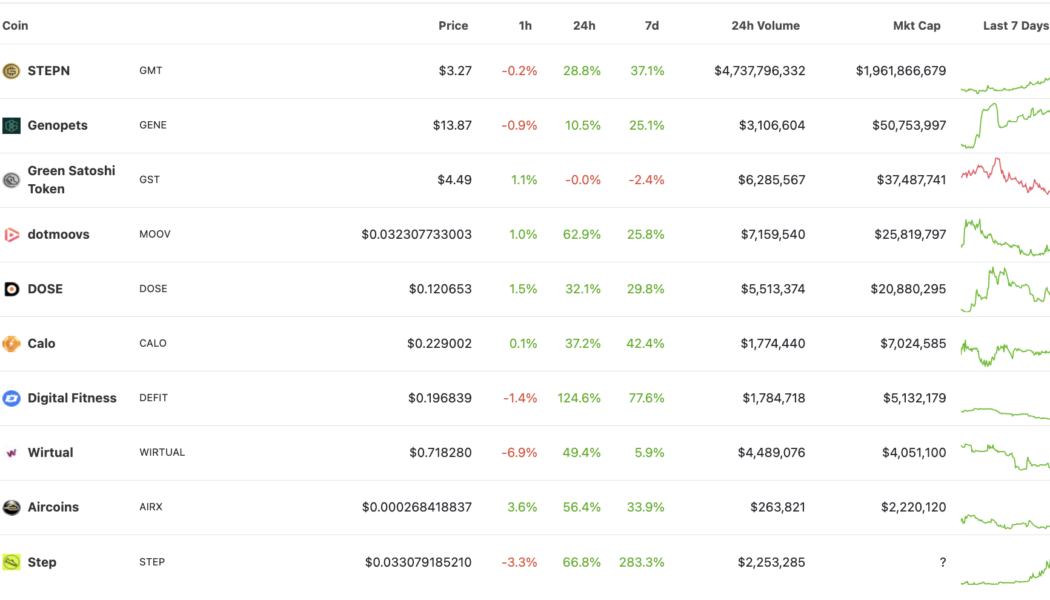

Solana’s STEPN hits record high as GMT price skyrockets 34,000% in over a month

STEPN (GMT), a so-called “move-to-earn” token using the Solana (SOL) blockchain, has soared incredibly since its market debut in March. GMT’s price jumped from $0.01 on March 9 to a record high of $3.45 on April 19 — a 34,000% upside move in just 41 days (data from Binance). Its massive uptrend appeared primarily due to the hype surrounding decentralized finance (DeFi) projects that reward users in tokens for staying active. For instance, the prices of GMT and its top rivals, including Genopets (GENE) and dotmoovs (MOOV), exploded massively on a 24-hour adjusted timeframe, data on CoinGecko shows. Nonetheless, STEPN remained the most valuable move-to-earn (M2E) project, with its market capitalization closing in on $2 billion. The performance of M2E tokens featu...

Solana risks 35% price crash with SOL price chart ‘megaphone’ pattern

Solana (SOL) risks crashing 35% in the coming days as it comes closer to painting a so-called “megaphone” pattern. SOL price “megaphone” pattern In detail, megaphone setups consist of a minimum of lower lows and two higher highs and form during a period of high market volatility. But generally, these patterns consist of five consecutive swings, with the final one typically acting as a breakout signal. SOL has been sketching a similar pattern since the beginning of 2022, with the coin undergoing a pullback after testing the megaphone’s upper trendline near $140 as resistance — the fourth wing. As a result of the pattern, the Solana token could extend its decline to test the megaphone’s lower trendline as support near $65, about 35% below today’s pri...

Solana jumps past key selloff junction: SOL price eyes $150 in April

Solana (SOL) jumped past a critical resistance level that had limited its recovery attempts during the November 2021-March 2022 price correction multiple times, thus raising hopes of more upside in April. Solana flips key resistance to support To recap, SOL’s price underwent extreme pullbacks upon testing its multi-month downward sloping trendline in recent history. For instance, the SOL/USD pair dropped by 60% two months after retracing from the said resistance level in December 2021. Similarly, it had fallen by over 40% in a similar retracement move led by a selloff near the trendline in November 2021. SOL/USD daily price chart. Source: TradingView But Solana flipped the resistance trendline as support (S/R flip) after breaking above it on March 30, accompanied by a rise in trading...

- 1

- 2