Smart Contracts

Astar (ASTR) price doubles as the network prepares to add 15 new projects in April

Following the successful completion of its initial parachain auctions, the Polkadot (DOT) ecosystem has begun to gain traction with the cryptocurrency community as the first chains begin to come online and integrate with Ethereum (ETH). Astar (ASTR) is one such Polkadot-based project that finished off the month of March on a hot streak after the multi-chain smart contract platform attracted the attention of retail and institutional crypto investors. Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $0.107 on March 22, the price of ASTR has climbed 104% to a daily high at $0.208 on April 1 as demand for the token increased 20-fold. ASTR/USDT 4-hour chart. Source: TradingView Three reasons for the rally include the completion of a $22 million funding...

Crypto Biz: Do you believe in Ethereum killers? Put your money where your mouth is, March 18–24

While crypto markets are still in a state of “fear,” as evidenced by Bitcoin’s Fear & Greed Index, the industry as a whole is giving us reasons to be bullish. Large venture funding rounds, growing adoption of decentralized governance models and new institutional-grade product offerings suggest that crypto is more than just daily chart patterns. This week’s Crypto Biz newsletter looks at a new Grayscale product that’s giving accredited investors more ways to bet on the so-called “Ethereum killers.” We also document two funding stories and draw your attention to the latest developments surrounding El Salvador’s Bitcoin (BTC) bond. Grayscale launches smart contract fund for Ethereum competitors Grayscale Investments, the world’s largest digital asset manager, has officially launched...

Bottomed out? MINA rises 75% nine days after hitting its worst level to date

MINA, a utility token backed by a “lightweight” smart contracts platform of the same name, continued its upside move nine days after rebounding from $1.58, its lowest level to date. The coin rallied by about 75% to reach $2.75 as of March 24 as traders weighed a high-profile funding rounds involving the sale of $92 million worth of MINA tokens to Three Arrows Capital, FTX Ventures, and other venture capitalists. MINA/USD daily price chart featuring its correlation with Bitcoin. Source: TradingView An overall recovery sentiment across the crypto market also assisted in pushing MINA’s price higher, since altcoins typically move in tandem with Bitcoin (BTC). Additionally, Coinbase’s announcement on March 23 to add MINA support to its crypto exchange may have ...

Grayscale launches smart contract fund for Ethereum competitors

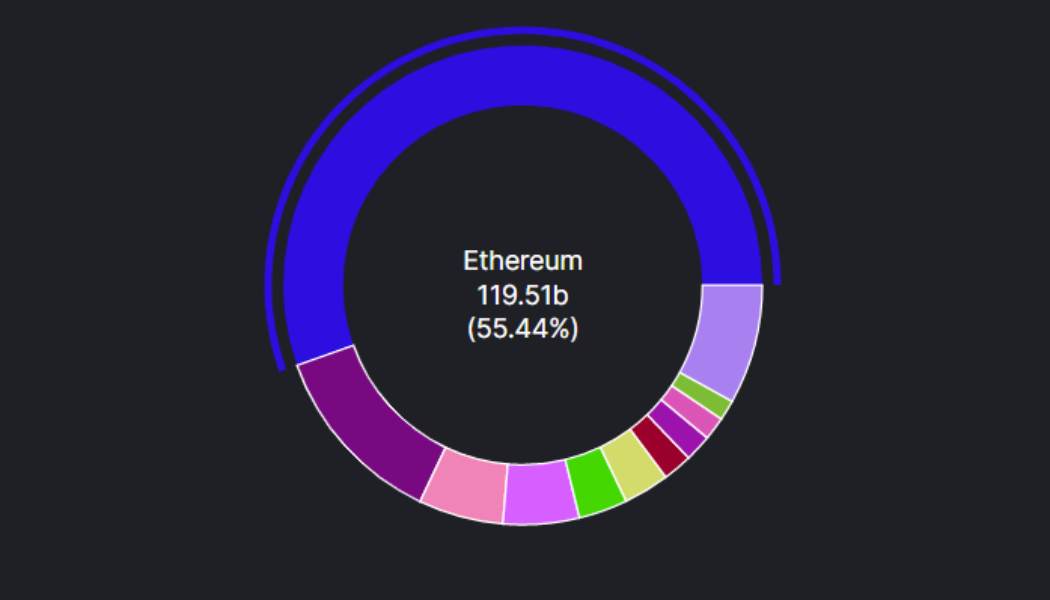

Digital asset manager Grayscale Investments has unveiled a new cryptocurrency fund dedicated to smart contract platforms excluding Ethereum, underscoring growing investor appetite for alternative blockchain networks. The Grayscale Smart Contract Platform Ex-Ethereum Fund, also known by the ticker symbol GSCPxE, is the company’s 18th investment product. The fund will provide exposure to seven smart contract platforms at the following weightings: Cardano (ADA): 24.63% Solana (SOL): 24.27% Avalanche (AVAX): 16.96% Polkadot (DOT): 16.16% Polygon (MATIC): 9.65% Algorand (ALGO): 4.27% Stellar (XLM): 4.06% Grayscale said the new fund is now open for daily subscription by accredited investors. Ethereum’s dominance as the premier smart contract platform is being challenged by competitors that...

Hashdex to launch Web3 and smart contracts ETF on Brazil’s stock exchange B3

Hashdex, a global crypto-focused asset manager, has revealed the launch of its Web3 Exchange Traded Fund (ETF) with a new announcement. As per a report by Cointelegraph Brazil, the new ETF will be available on B3, Brazil’s main stock exchange, and will give investors a secure and diversified way to invest in Web3 and its underlying smart contract platforms. The new ETF’s reserve period started Monday, March 14, 2022, and runs until Friday, March 25, 2022. Hashdex’s co-founder and CEO Marcelo Sampaio said the company believes that Web3 represents the future of the internet and is a further indication of blockchain technology’s potential. He added that: “The WEB311 ETF not only provides exposure to the smart contract platforms underpinning Web3, but serves as an...

Stacks price plunges hard after rallying 70% in a day — more STX losses ahead?

Stacks (STX) pared a considerable portion of the gains it made on March 10 as the euphoria surrounding its $165 million pledge to support Bitcoin (BTC) projects showed signs of fading. STX’s price dropped by over 30% to reach a level as low as $1.33 on Friday when measured from its week-to-date high of $1.94. The selloff, in part, appeared technical as the $1.94-top fell in the same range that served as solid support between October 2021 and January 2022, only to flip later to become a resistance area. STX/USD daily price chart. Source: TradingView It also appears that traders spotted selling opportunities due to STX’s long wick candlestick on March 10. Stacks rallied by as much as 73% into the day while forming a disproportionally long bullish wick on the daily chart that hint...

DeFi detective alleges this ‘suspicious’ smart contract code may put dozens of projects at risk

According to famed decentralized finance (DeFi) detective Zachxbt, 31 nonfungible token (NFT) projects may be at risk due to “suspicious code.” In a lengthy Twitter thread published Tuesday, the DeFi detective first raised the issue of NFT project Thestarlab, which was allegedly compromised for 197.175 Ether (ETH), worth $580,325 at the time of publication. Zachxbt quoted fellow blockchain investigator MouseDev, who came to the following conclusion after reviewing the code behind Thestarlab: “The smart contract [for this project] can never truly be renounced or transferred—only an additional owner. The original deployer will always be considered the owner. This means if they still have the private key of the deployer, they can pull the money, even though...

Altcoin Roundup: JunoSwap, Solidly and VVS Finance give DeFi a much-needed refresh

Decentralized finance (DeFi) was the talk of the town in early 2021, but it has since taken a back seat to more appealing sectors like nonfungible tokens (NFTs), memecoins and blockchain gaming. Now that cross-chain bridges and interoperability have allowed for the easier migration of assets to competing chains, a new class of DeFi protocols is arising to challenge those left from 2021. Here’s a look at three DeFi projects that have launched on some of the up-and-coming layer-1 blockchain networks, catching the eye of the crypto community. VVS Finance VVS Finance is the largest DeFi protocol on the Cronos network, a project that emerged out of the Crypto.com ecosystem which has since been fully rebranded to Cronos (CRO). The goal of VVS Finance is to offer instant swaps with low fees...

Neo users explain why they’ve held on to the project despite China’s heavy crypto crackdown

It’s been a wild ride for Neo investors in the past few years, especially as China began to incrementally introduce harsher crypto regulations applicable to the project, which has been dubbed by some as “Ethereum of China.” But despite the odds, the community appears to be resilient, with a dedicated society of developers worldwide and bourgeoning decentralized finance, or DeFi, hub that came into prominence via the launch of the Neo N3 mainnet last year. As told by Neo investors Lucas and Jiří, who spoke to Cointelegraph, they were not expecting such a “huge drop in price” for Neo. Nevertheless, they decided to hold their Neo tokens through all the price turmoil, citing the project developers’ dedication to its underlying technology. Luc...

Altcoin Roundup: 3 portfolio trackers NFT and DeFi investors can use to stay organized

The cryptocurrency ecosystem has seen a tremendous amount of growth over the past couple of years, as the introduction of decentralized finance (DeFi) and the popularity of nonfungible tokens (NFT) have led to an explosion of projects on more than a dozen blockchain networks. The rapidly growing ecosystem means investors have to keep track of multiple wallet addresses, making portfolio trackers a popular option for traders needing to manage a diverse multichain portfolio. Here are three portfolio-tracking decentralized applications, or DApps, crypto traders can use to help monitor their investments. Zapper Zapper supports the basic management of cryptocurrencies held on 11 different networks including Ethereum, Polygon, BNB Chain, Fantom, Avalanche and Optimism. The basic layout of t...

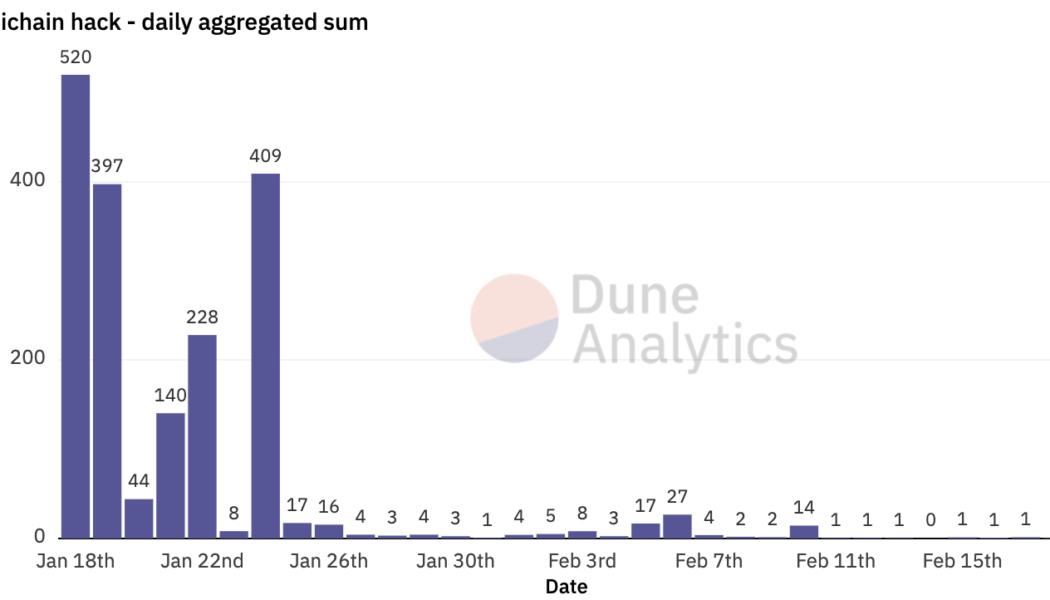

Multichain recovers $2.6M stolen funds, to reimburse losses on condition

After a month-long fight against an ongoing exploit, cross-chain router protocol Multichain announced the recovery of nearly 50% of the total stolen funds, worth nearly $2.6 million of cryptocurrencies. The team has also released a compensation plan to reimburse the users’ losses. On Jan. 10, blockchain security expert Dedaub alerted Multichain about two vulnerabilities in its liquidity pool and router contracts — affecting eight cryptocurrencies including wrapped ETH (WETH), wrapped BNB (WBNB), Polygon (MATIC) and Avalanche (AVAX). 1/3 We recently identified the “phantom functions” code pattern, which would have led to likely the largest crypto hack ever. Your code may be vulnerable! You need to check for the pattern in your Solidity/EVM code! https://t.co/pxRqCQFbnS — Dedaub ...