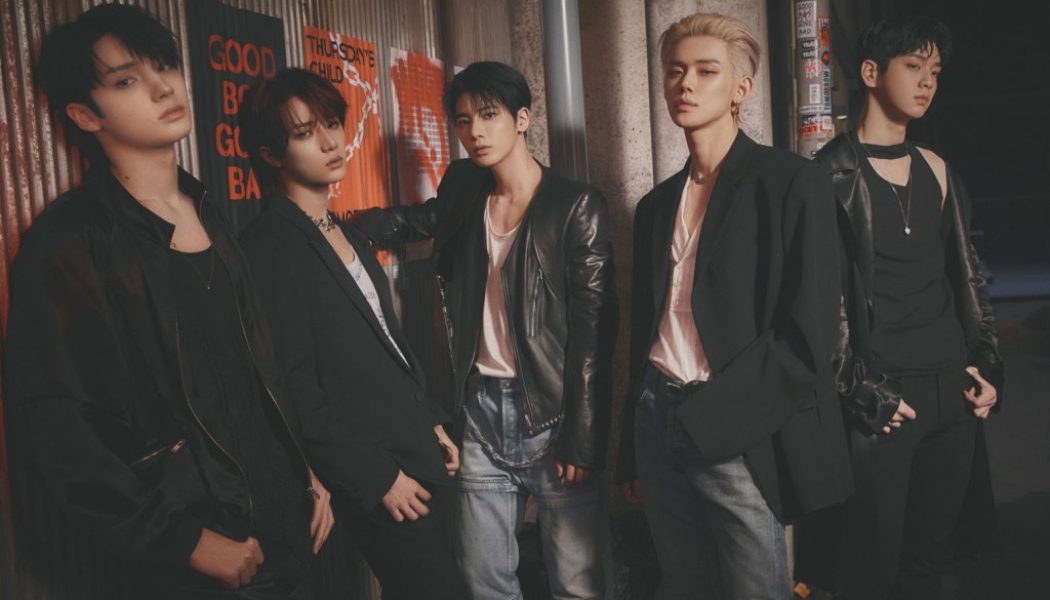

SM Entertainment

Apple Music’s Price Hike Boosts Music Stocks

Universal Music Group, Hipgnosis Songs Fund and other music stocks got a much-needed boost on Tuesday (Oct. 25) following news of Apple Music’s price hike, as investors bet it would trigger a wave of streaming subscription cost increases. Universal Music Group’s stock closed 11.6% higher, Hipgnosis Songs Fund Ltd ended up 7.8% and Korean music companies SM Entertainment and HYBE finished the trading day 4.8% and 4.4% higher, respectfully, on Tuesday. On Monday, Apple announced that it was raising the standard U.S. and U.K. individual plan price to $10.99 from $9.99. This 10% price hike — Apple’s first — comes amid high inflation and a darkening economic environment in many global markets. If Apple can raise prices at a time like this, that is a sign the music industry can charge more ...

The Ledger: Buying Into the K-Pop Craze Just Got Less Risky for US Investors

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. An exchange-traded fund, or ETF, focused on Korean music started trading on the NYSE Arca exchange on Thursday, giving American investors a means to buy shares of companies that trade on exchanges in South Korea. But the ETF stands out for another reason: a bundle of K-pop stocks will carry less risk than standalone companies that rely on dozens of labels, each with a handful of top artists as well as deep catalogs. Trading under the aptly named ticker KPOP, the ETF includes the stocks of 30 corporations, including several music companies: HYBE, the home of K-pop megastars BTS and up-and-coming acts Tomorrow X Together ...