skew

This simple Bitcoin options strategy allows traders to go long with limited downside risk

Bitcoin (BTC) bulls were hopeful that the Nov. 21 dip to $15,500 would mark the cycle bottom, but BTC has not been able to produce a daily close above $17,600 for the past eighteen days. Traders are clearly uncomfortable with the current price action and the confirmation of BlockFi’s demise on Nov. 28 was not helpful for any potential Bitcoin price recovery. The cryptocurrency lending platform filed for Chapter 11 bankruptcy in the United States a couple of weeks after the firm halted withdrawals. In a statement sent to Cointelegraph, Ripple’s APAC policy lead Rahul Advani said he expects the FTX exchange bankruptcy to lead to greater scrutiny on crypto regulations.” Following the event, several global regulators pledged to focus on developing greater crypto regulat...

$15.5K retest is more likely, according to Bitcoin futures and options

Bitcoin (BTC) has been trading near $16,500 since Nov. 23, recovering from a dip to $15,500 as investors feared the imminent insolvency of Genesis Global, a cryptocurrency lending and trending company. Genesis stated on Nov. 16 that it would “temporarily suspend redemptions and new loan originations in the lending business.” After causing initial mayhem in the markets, the firm refuted speculation of “imminent” bankruptcy on Nov. 22, although it confirmed difficulties in raising money. More importantly, Genesis’ parent company Digital Currency Group (DCG) owns Grayscale — the asset manager behind Grayscale Bitcoin Trust, which holds some 633,360 BTC. Contagion risks from the FTX-Alameda Research implosion continue to exert negative pressure on the markets, but the industry is w...

Here’s how Bitcoin pro traders plan to profit from BTC’s eventual pop above $20K

Bitcoin (BTC) entered an ascending channel in mid-September and has continued to trade sideways activity near $19,500. Due to the bullish nature of the technical formation and a drop in the sell pressure from troubled miners, analysts expect a price increase over the next couple of months. Bitcoin/USD price at FTX. Source: TradingView Independent analyst @el_crypto_prof noted that BTC’s price formed a “1-2-3 Reversal-Pattern” on a daily time frame, hinting that $20,000 could flip to support soon. $BTC #Bitcoin Yes, the price action of $BTC is really boring, isn’t it? But if you look closely, a textbook “1-2-3 Reversal-Pattern” has formed in the last few days, which should finally send Bitcoin above 20k soon. pic.twitter.com/29Wa64XKQa — ⓗ (@el_crypto_pro...

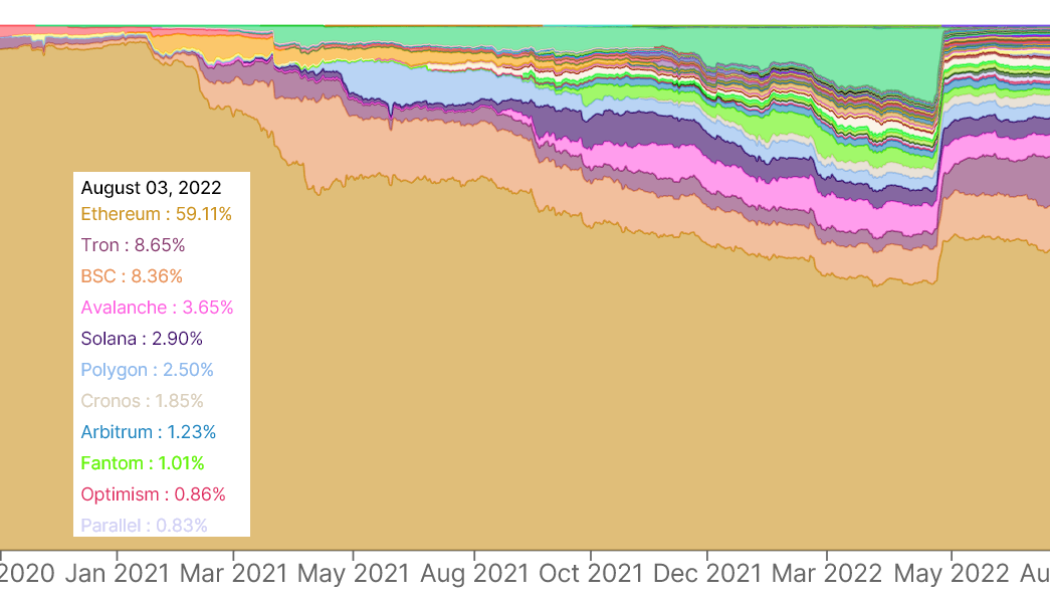

2 key Ethereum price indicators point to traders opening long positions

Ether (ETH) price has been unable to close above $1,400 for the past 29 days and it has been trading in a relatively tight $150 range. At the moment, the $1,250 support and the $1,400 resistance seem difficult to break, but two months ago, Ether was trading at $2,000. The current price range for Ether simply reflects how volatile cryptocurrencies can be. From one side, investors are calm as Ether trades 50% above the $880 intraday low on June 18. However, the price is still down 65% year-to-date despite the most exciting upgrade in the network’s sev-year history. More importantly, Ethereum’s biggest rival, BNB Chain, suffered a cross-chain security exploit on Oct. 6. The $568 million exploit caused BNB Chain to temporarily suspend all transactions on the network, which holds $5...

Bitcoin traders were ready for a hot CPI report, but BTC bears are still in control

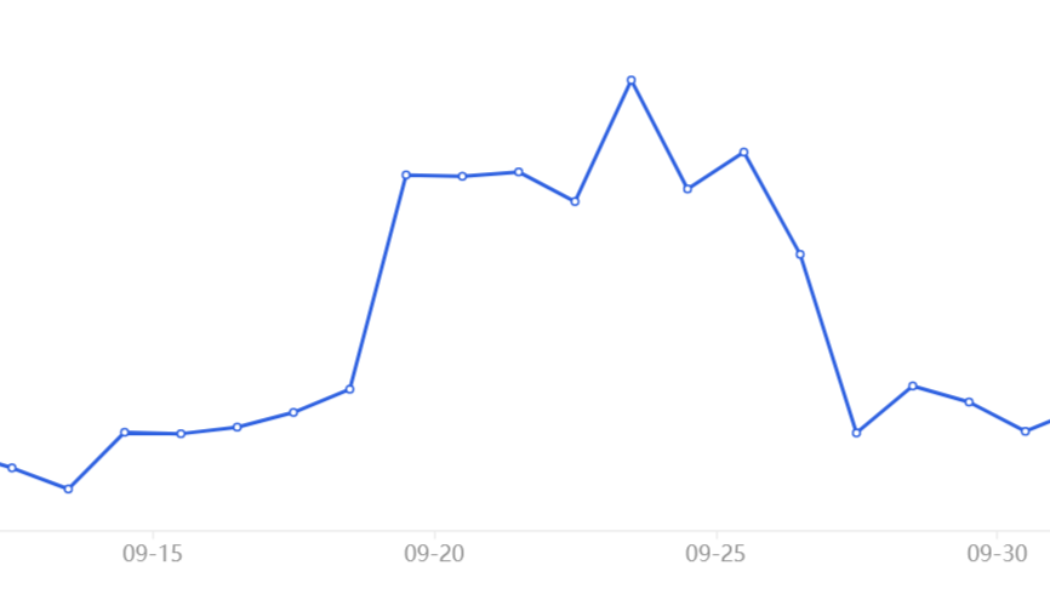

Cryptocurrency traders were caught by surprise after the Oct. 13 Consumer Price Index Report showed inflation in the United States rising by 0.6% in September versus the previous month. The slightly higher-than-expected number caused Bitcoin (BTC) to face a 4.4% price correction from $19,000 to $18,175 in less than three hours. The abrupt movement caused $55 million in Bitcoin futures liquidations at derivatives exchanges, the largest amount in three weeks. The $18,200 level was the lowest since Sept. 21 and marks an 8.3% weekly correction. Bitcoin/USD 1-hour price. Source: TradingView It is worth highlighting that the dip under $18,600 on Sept. 21 lasted less than 5 hours. Bears were likely disappointed as a 6.3% rally took place on Sept. 22, causing Bitcoin to test the $19,500 resi...

Bitcoin derivatives data reflects traders’ belief that $20K will become support

Bitcoin (BTC) showed strength on Oct. 4 and 5, posting a 5% gain on Oct. 5 and breaking through the $20,000 resistance. The move liquidated $75 million worth of leverage short (bear) positions and it led some traders to predict a potential rally to $28,000. $BTC #Bitcoin Shared this descending channel 2 days ago.$BTC has managed to break through the middle line.Next target = Upper channel trendline = ~21.5k. In case of a breakout, 28k-30k are possible. pic.twitter.com/dyqMLdcXZ4 — ⓗ (@el_crypto_prof) October 4, 2022 As described by Moustache, the descending channel continues to exert its pressure, but there could be enough strength to test the upper channel trendline at $21,500. The price action coincided with improving conditions for global equity markets on Oct. 4, as the S&P 50...

Long the Bitcoin bottom, or watch and wait? Bitcoin traders plan their next move

Bitcoin (BTC) faced a 9% correction in the early hours of Sept. 19 as the price traded down to $18,270. Even though the price quickly bounced back above $19,000, this level was the lowest price seen in three months. However, pro traders held their ground and were not inclined to take the loss, as measured by derivatives contracts. Bitcoin/USD price index, 2-hour. Source: TradingView Pinpointing the rationale behind the crash is extremely difficult, but some say United States President Joe Biden’s interview on CBS “60 Minutes” raised concerns about global warfare. When responding to whether U.S. forces would defend Taiwan in the event of a China-led invasion, Biden replied: “Yes, if in fact, there was an unprecedented attack.” Others cite China’s central ...

Bitcoin price falls under $19K as data shows pro traders avoiding leverage longs

An $860 surprise price correction on Sept. 6 took Bitcoin (BTC) from $19,820 to $18,960 in less than two hours. The movement caused $74 million in Bitcoin futures liquidations at derivatives exchanges, the largest in almost three weeks. The current $18,733 level is the lowest since July 13 and marks a 24% correction from the rally to $25,000 on Aug. 15. Bitcoin/USD 30-min price. Source: TradingView It is worth highlighting that a 2% pump toward $20,200 happened in the early hours of Sept. 6, but the move was quickly subdued and Bitcoin resumed trading near $19,800 within the hour. Ether’s (ETH) price action was more interesting, gaining 7% in the 48 hours preceding the market correction. Any conspiracy theories regarding investors changing their position to favor the altcoin can be dismiss...

Hawkish Fed comments and Bitcoin derivatives data point to further BTC downside

A $750 pump on Aug. 26 took Bitcoin (BTC) from $21,120 to $21,870 in less than two hours. However, the movement was completely erased after comments from U.S. Federal Reserve Chair Jerome Powell reiterated the bank’s commitment to contain inflation by tightening the economy. Following Powell’s speech, BTC price dropped as low as $20,700. Bitcoin/USD 30-min price. Source: TradingView At Jackson Hole, Powell specifically mentioned that “the historical record cautions strongly against prematurely loosening policy.” Right after those remarks, the U.S. stock market indexes reacted negatively, with the S&P 500 dropping 2.2% within the hour. On the Bitcoin chart, the affable “Bart candle,” a reference to the shape of Bart Simpson’s head, and a descriptor of BTC’s up and down...

3 key Ether derivatives metrics suggest $1,600 ETH support lacks strength

Ether (ETH) price is up 60% since May 3, outperforming leading cryptocurrency Bitcoin (BTC) by 32% over that span. However, evidence suggests the current $1,600 support lacks strength as network use and smart contract deposit metrics weakened. Moreover, ETH derivatives show increasing sell pressure from margin traders. The positive price move was primarily driven by growing certainty of the Merge, which is Ethereum’s transition to a proof-of-stake (PoS) consensus network. During the Ethereum core developers conference call on July 14, developer Tim Beiko proposed Sept. 19 as the tentative target date for the Merge. In addition, analysts expect the new supply of ETH to be reduced by up to 90% after the network’s monetary policy change, thus creating a bullish catalyst. Ethe...

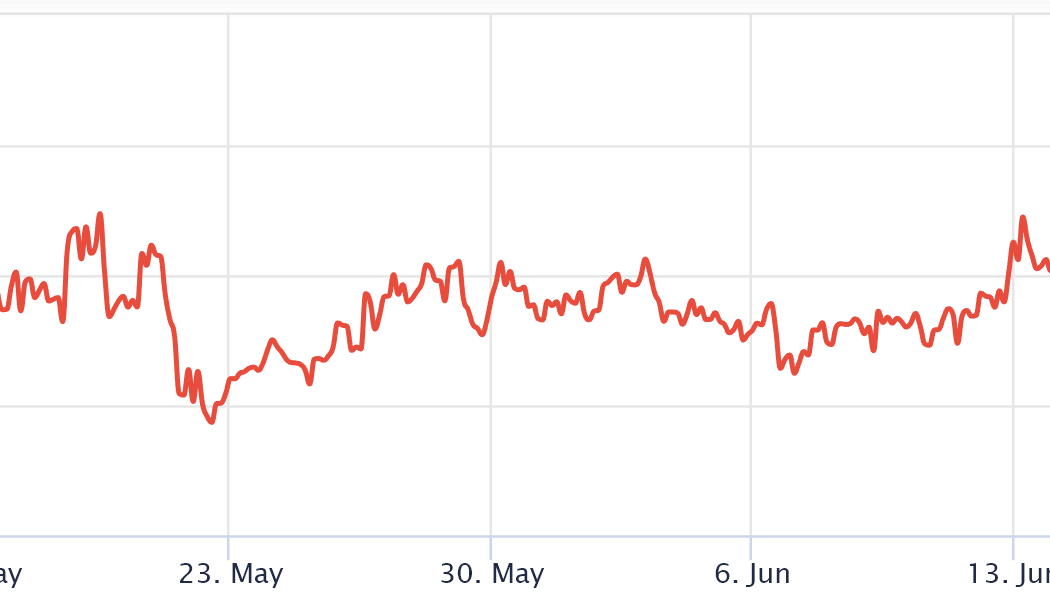

Bitcoin futures enter backwardation for the first time in a year

Bitcoin’s (BTC) month-to-date chart is very bearish, and the sub-$18,000 level seen over the weekend was the lowest price seen since December 2020. Bulls’ current hope depends on turning $20,000 to support, but derivatives metrics tell a completely different story as professional traders are still extremely skeptical. BTC-USD 12-hour price at Kraken. Source: TradingView It’s important to remember that the S&P 500 index dropped 11% in June, and even multi-billion dollar companies like Netflix, PayPal and Caesars Entertainment have corrected with 71%, 61% and 57% losses, respectively. The U.S. Federal Open Market Committee raised its benchmark interest rate by 75 basis points on June 15, and Federal Reserve Chairman Jerome Powell hinted that more aggressive tightening could b...

Ethereum price risks a drop below $1K if these key price metrics turn bearish

Ether (ETH) price is down 37.5% in the last seven days and recent news reported that developers decided to postpone the network’s migration to a proof-of-stake (PoS) consensus. This upgrade is expected to end the dependency on proof-of-work (PoW) mining and the Merge scalability solution that has been pursued for the past six years. Competing smart contracts like BNB, Cardano (ADA) and Solana (SOL) outperformed Ether by 13% to 17% since June 8 even though there was a market-wide correction in the cryptocurrency sector. This suggests that the Ethereum network’s issues also weighed on the ETH price. The “difficulty bomb,” feature was added to the code in 2016 as plans for the new consensus mechanism (formerly Eth2) were being formed. At the peak of the so-called ̶...