Short

Ethereum price weakens near key support, but traders are afraid to open short positions

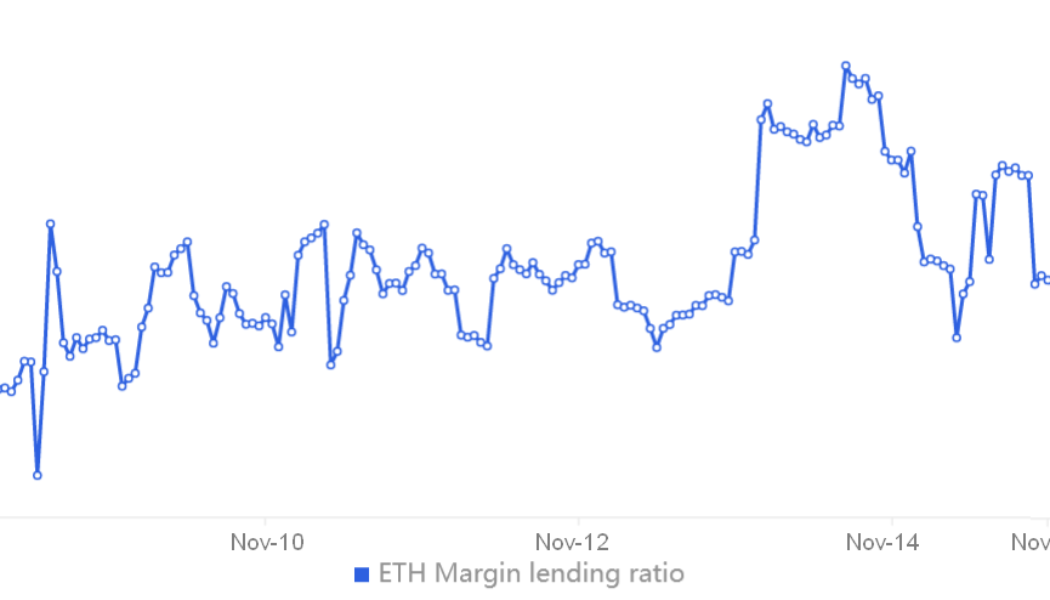

Ether (ETH) has been stuck between $1,170 to $1,350 from Nov. 10 to Nov. 15, which represents a relatively tight 15% range. During this time, investors are continuing to digest the negative impact of the Nov. 11 Chapter 11 bankruptcy filing of FTX exchange. Meanwhile, Ether’s total market volume was 57% higher than the previous week, at $4.04 billion per day. This data is even more relevant considering the collapse of Alameda Research, the arbitrage and market-making firm controlled by FTX’s founder Sam Bankman-Fried. On a monthly basis, Ether’s current $1,250 level presents a modest 4.4% decline, so traders can hardly blame FTX and Alameda Research for the 74% fall from the $4,811 all-time high reached in November 2021. While contagion risks have caused investors to drai...

How Bitcoin’s strong correlation to stocks could trigger a drop to $8,000

The Bitcoin (BTC) price chart from the past couple of months reflects nothing more than a bearish outlook and it’s no secret that the cryptocurrency has consistently made lower lows since breaching $48,000 in late March. Bitcoin price in USD. Source: TradingView Curiously, the difference in support levels has been getting wider as the correction continues to drain investor confidence and risk appetite. For example, the latest $19,000 baseline is almost $10,000 away from the previous support. So if the same movement is bound to happen, the next logical price level would be $8,000. Traders are afraid of regulation and contagion On July 11, the Financial Stability Board (FSB), a global financial regulator including all G20 countries, announced that a framework of recommendations for the crypt...

Any dip buyers left? Bulls are largely absent as the total crypto market cap drops to $1.65T

The total crypto market capitalization has been trading within a descending channel for 24 days and the $1.65 trillion support was retested on May 6. The drop to $1.65 trillion was followed by Bitcoin (BTC) reaching $35,550, its lowest price in 70 days. Total crypto market cap, USD billion. Source: TradingView In terms of performance, the aggregate market capitalization of all cryptocurrencies dropped 6% over the past seven days, but this modest correction in the overall market does not represent some mid-capitalization altcoins, which managed to lose 19% or more in the same time frame. As expected, altcoins suffered the most In the last seven days, Bitcoin price dropped 6% and Ether (ETH) declined by 3.5%. Meanwhile, altcoins experienced what can only be described as a bloodbath. Below ar...

ProShares files with SEC for Short Bitcoin Strategy ETF

Exchange-traded funds (ETFs) issuer ProShares has filed a registration statement with the United States Securities and Exchange Commission to list shares of a Short Bitcoin Strategy ETF. In a Tuesday filing, ProShares applied with the SEC for an investment vehicle that would allow users to bet against Bitcoin (BTC) futures using an exchange-traded fund. According to the registration statement, the Short Bitcoin Strategy ETF will be based on daily investment results corresponding to the inverse of the return of the Chicago Mercantile Exchange Bitcoin Futures Contracts Index for a day. ProShares just filed for a Short Bitcoin Futures ETF. Even tho SEC rejected similar filing last year, this has shot IMO given ProShares’ perfect read on SEC w/ $BITO and the lack of issues w/ futures ETF...

Bitcoin rally hopes diminish as pro traders flip bearish, retail interest at 12-month lows

Bitcoin (BTC) has been trapped in a symmetrical triangle for 56 days and the trend change could last until early May, according to price technicals. Currently, the support level stands at $38,000, while the triangle resistance for daily close stands at $43,600. Bitcoin mining up, retail interest down Bitcoin/USD price at FTX. Source: TradingView The week started with a positive achievement for the Bitcoin network as the Lightning Network capacity reached a record-high 3,500 BTC. This solution allows extremely cheap and instant transactions on a secondary layer, known as off-chain processing. After cryptocurrency mining activities were banned in China in 2021, publicly-listed companies in the United States and Canada attracted most of this processing power. As a result, Bitcoin’s hash...

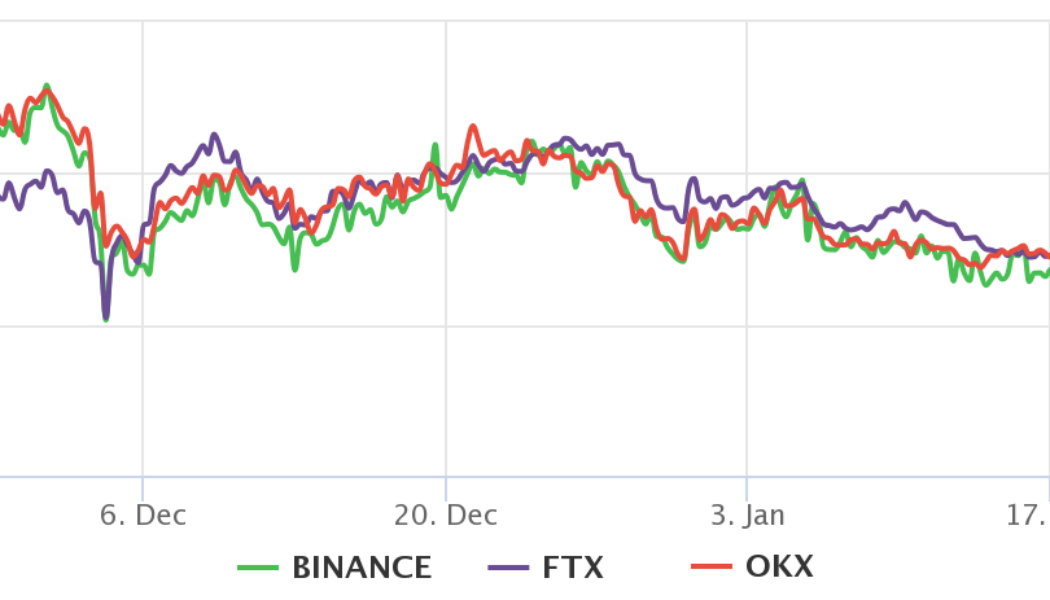

Ether drops below $3,800, but traders are unwilling to short at current levels

Even though Ether (ETH) reached a $4,870 all-time high on Nov. 10, bulls have little reason to celebrate. The 290% gains year-to-date have been overshadowed by Dec.’s 18% price drop. Still, Ethereum’s network value locked in smart contracts (TVL) increased nine-fold to $155 billion. Looking at the past couple of months’ price performance chart doesn’t really tell the whole story, and Ether’s current $450 billion market capitalization makes it one of the world’s top 20 tradable assets, right behind the two-century-old Johnson & Johnson conglomerate. Ether/USD price at FTX. Source: TradingView 2021 should be remembered by the decentralized exchanges’ sheer growth, whose daily volume reached $3 billion, a 340% growth versus the last quarter of 202...