Shiba Inu

Nifty News: Price drops on ‘Cryptohouse’ with NFT decor, mint your personality as an NFT and more

Waning interest in a North Hollywood crypto-themed home A crypto-friendly house in North Hollywood, Los Angeles, is seemingly struggling to sell, as the property has seen its price reduce three times in a little over four months. The so-called “Cryptohouse,” as stated on the glowing neon sign in its kitchen, was listed for sale at $1.2 million in October 2022. As of Jan. 5, its asking price is now $949,000. The impressive custom neon sign never lets you forget just where you are. Image: Zillow The four-bed, three-bath home sees the listing agents boasting in the property description of its spacious and flowing floor plan ideal for “savvy investors.” For unknown reasons, the description doesn’t mention its tasteful wallpaper choices, which include multiple nonfungible tokens (NFTs) f...

Shiba Inu devs to launch Shibarium L2 network beta

The developers of the dog-themed token Shiba Inu (SHIB) posted an update to inform its community about its upcoming beta release of Shibarium — a layer-2 network that will run on top of the Ethereum mainnet. In the announcement, SHIB developers shared information about layer-2 blockchains. They highlighted that Shibarium is being developed to provide a tool to allow the community to build and grow the project and fulfill its founder’s vision. While some believe creating Shibarium is a way to increase the memecoins price, the developers noted that this wasn’t the goal. They wrote: “Patience is key, and some see Shibarium as a price-pumping tool, but that is not the project’s focus and never has been.” Instead, the developers mentioned that the goal of the new update in its infras...

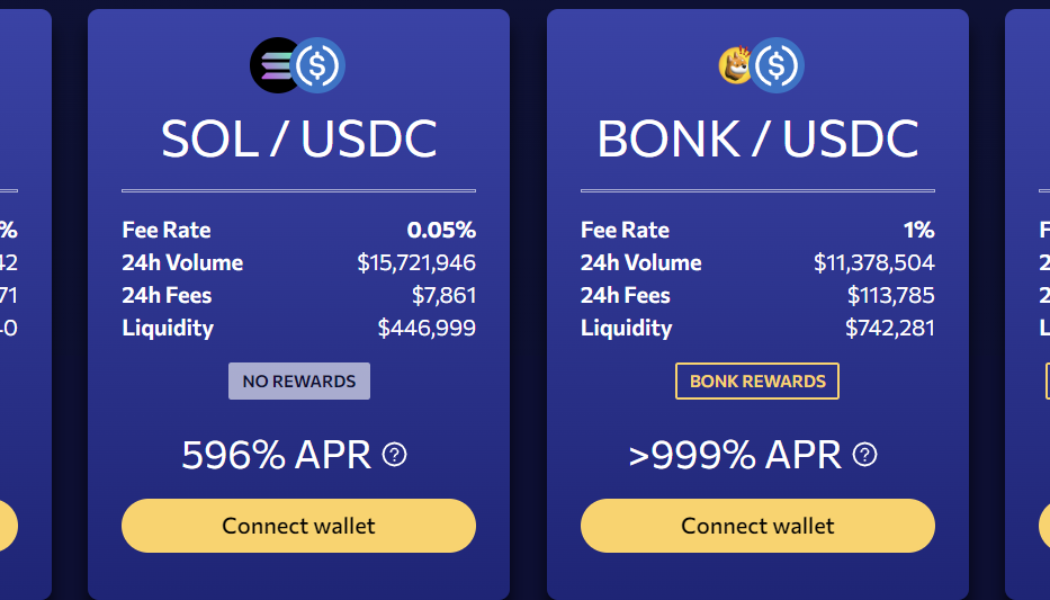

Bonk token goes bonkers as traders chase after high yields in the Solana ecosystem

Bonk, a meme token modeled after Shiba Inu (SHIB) that launched on Dec. 25, is skyrocketing and some traders believe the token’s trading volume is potentially driving Solana’s (SOL) price up. Over the past 48 hours, SOL price has gained 34%, and in the past 24 hours, Bonk has climbed 117%, according to data from CoinMarketCap. While the wider crypto market remains suppressed, traders are hoping that Bonk could present new opportunities during the downturn. According to the project’s website, Bonk is the first dog token on the Solana blockchain. Initially, 50% of the token supply was airdropped to Solana users with a mission to remove toxic Alameda-styled token economics. The airdrop resulted in more than $20 million in trading volume according to the Solana decentralized exchange Orc...

Shiba Inu developer says WEF wants to work with project to ‘help shape’ metaverse global policy

The volunteer project lead and developer for Shiba Inu known only as ‘Shytoshi Kusama’ has reported on social media that the World Economic Forum, or WEF, wants to work with the meme-based cryptocurrency on global policy. In a poll posted to Twitter on Nov. 22, Kusama said the WEF had “kindly invited” the Shiba Inu (SHIB) project to collaborate on “MV global policy.” The Shiba Inu developer seemed to be referring to policy on the metaverse. Crypto and blockchain have sometimes been under discussion at WEF events, but partnering with a popular meme token would seemingly be a first for the organization. “Yes I am serious,” said Kusama. “We would be at the table with policy makers and would help shape global policy for the MV alongside other giants like FB (bye Zuck), Sand, Decentraland etc.”...

Dogecoin trader explains why shorting DOGE now makes sense

Dogecoin (DOGE) has surged nearly 100% quarter-to-date (QTD) on hopes that Elon Musk would integrate the token onto the Twitter platform. However, DOGE’s potential to continue its uptrend in the coming weeks is low, one popular market analyst argues. Short Dogecoin hard? Independent market analyst GCR said he is moderately short on DOGE based on its price’s recent reaction to a Musk tweet. Notably, DOGE formed a local top at $0.158 on Nov. 1. The same day, Musk shared a picture of his pet Shiba Inu wearing a t-shirt with the Twitter logo. pic.twitter.com/eaIYaDRBnu — Elon Musk (@elonmusk) November 1, 2022 GCR argues that the Musk-effect is wearing off when it comes to Dogecoin’s potential integration into Twitter, meaning that most of the gains are already priced in....

Price Analysis 9/26: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

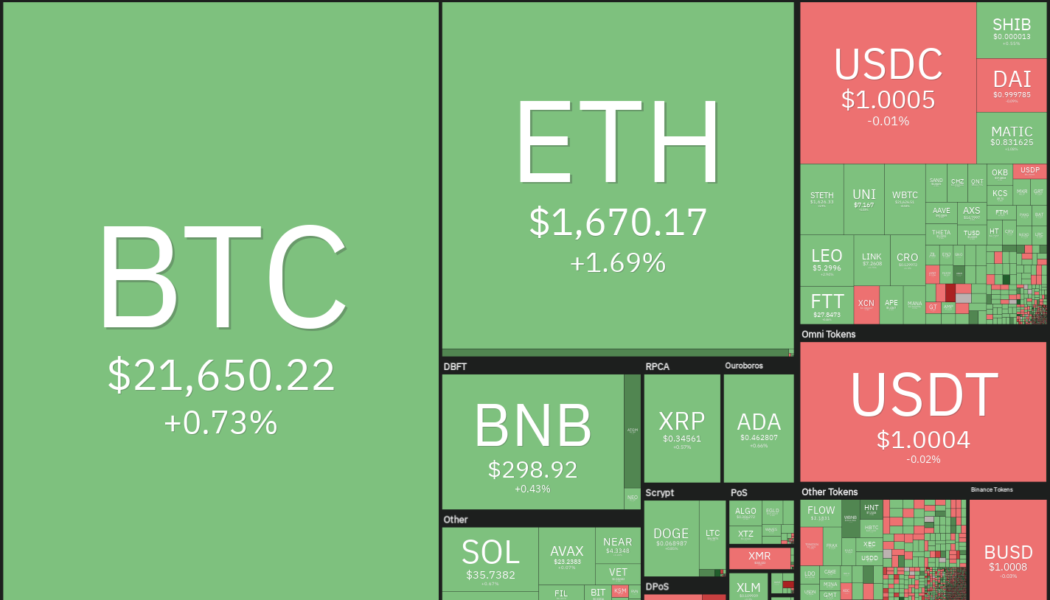

The United Kingdom is in focus following the British pound’s fall to a new all-time low against the United States dollar. The sell-off was triggered by the aggressive tax cuts announced by Prime Minister Liz Truss’s government. The 10-year gilt yields have soared by 131 basis points in September, on track for its biggest monthly increase since 1957, according to Reuters. The currency crisis and the soaring U.S dollar index (DXY) may not be good news for U.S. equities and the cryptocurrency markets. A ray of hope for Bitcoin (BTC) investors is that the pace of decline has slowed down in the past few days and the June low has not yet been re-tested. Daily cryptocurrency market performance. Source: Coin360 That could be because Bitcoin’s long-term investors do not seem to be panicking. Data f...

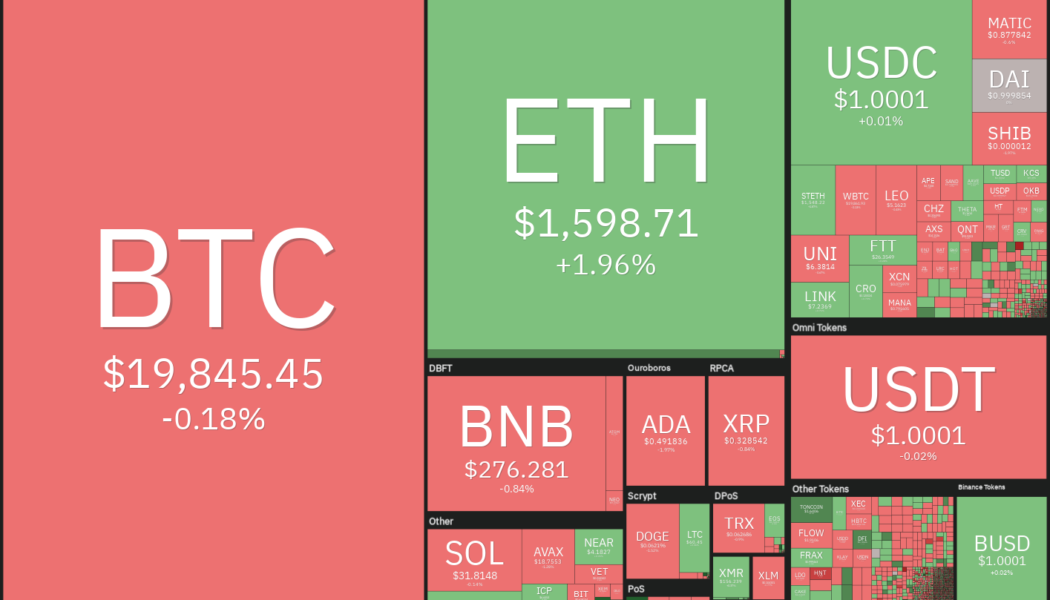

Price analysis 9/21: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

The Federal Reserve hiked rates by 75 basis points on Sept. 21 and Fed Chair Jerome Powell projected another 125 basis points increase before the end of the year. If that happens, it will take the benchmark rate to 4.4% by the end of the year, which is sharply higher than the June estimates of 3.8%. The Fed also intimated that it only expects rate cuts to be considered in 2024. The expectation of higher rates pushed the 2-year Treasury to 4.1%, its highest level since 2007. This could attract several investors who are looking for safety in this uncertain macro environment. Higher rates are also likely to reduce the appeal of risky assets such as stocks and cryptocurrencies and may delay the start of a new uptrend. Daily cryptocurrency market performance. Source: Coin360 Even though Bitcoin...

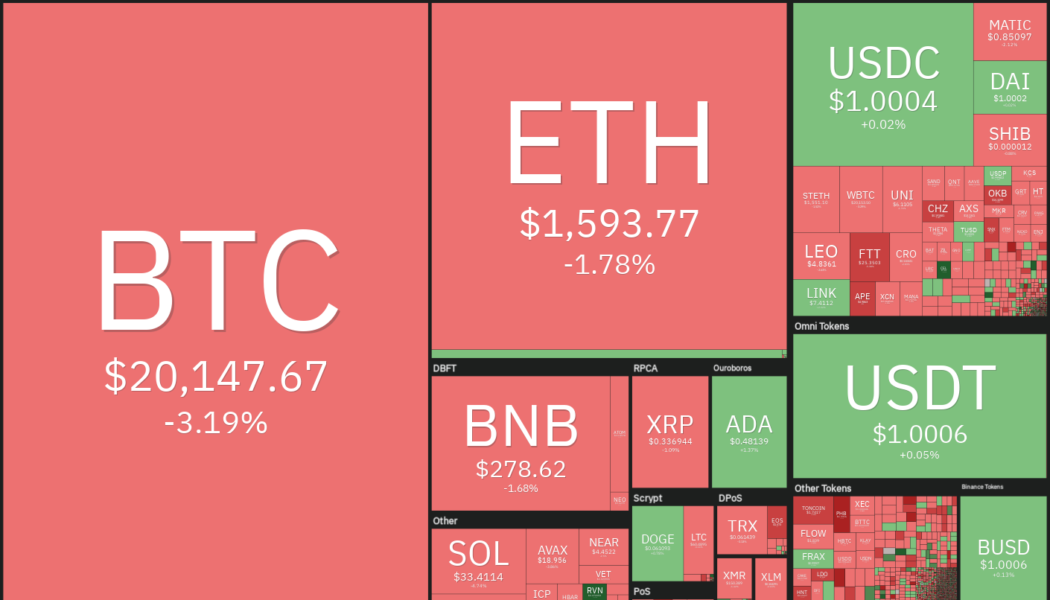

Price analysis 9/14: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

The United States equities markets and the cryptocurrency markets had been rising leading up to the Sept. 13 release of the August consumer price index data, but the rally fell apart once the data showed inflation rising, rather than falling. The negative data dashed any hope of a Federal Reserve pivot in the near term and it triggered a sharp decline in risky assets. The market capitalization of U.S. stocks plunged by about $1.6 trillion on Sept. 13 and the market cap of the cryptocurrency markets slipped below $1 trillion. Daily cryptocurrency market performance. Source: Coin360 Statistician and independent market analyst Willy Woo, believes that Bitcoin (BTC) may have to fall further before it reaches the maximum pain experienced during previous bottoms. Woo expects Bitcoin price to dec...

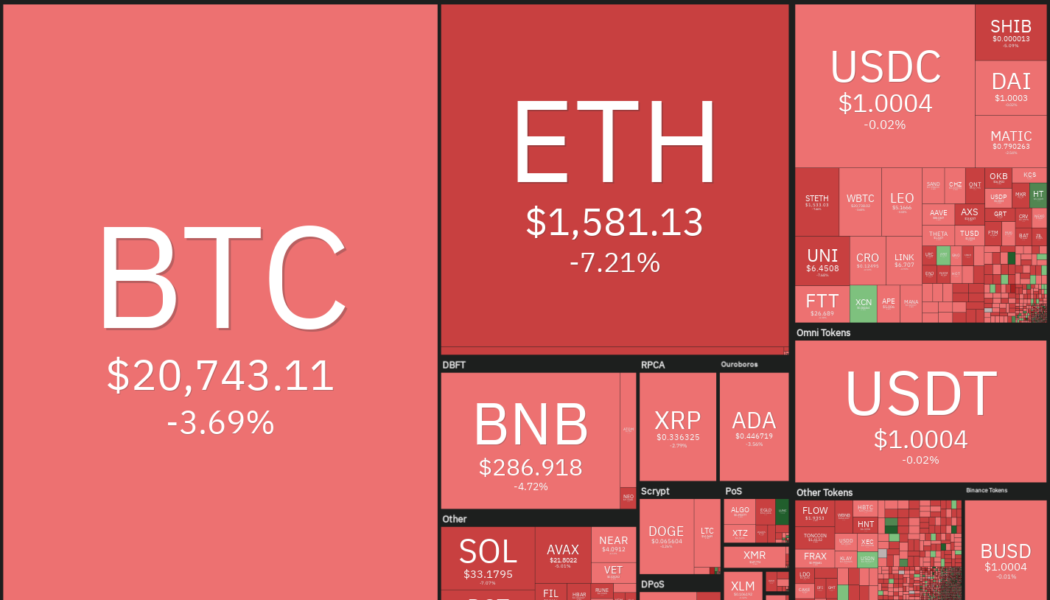

Price analysis 9/5: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

The cryptocurrency markets have been quiet over the weekend. The sideways price action continues on Sept. 5 and there are unlikely to be any fresh triggers from the United States equities markets, which are closed for Labor Day. However, the bullish picture for cryptocurrencies looks clouded as the energy crisis in Europe sent the euro to a two-decade low versus the U.S. dollar. Meanwhile, the U.S. dollar index (DXY) which has an inverse correlation with the equities markets and cryptocurrencies soared above 110 for the first time since June 2002. Daily cryptocurrency market performance. Source: Coin360 A positive sign among all the mayhem is that Bitcoin (BTC) has not given up much ground over the past few days and continues to trade near the psychological level of $20,000. This suggests ...

Price analysis 9/2: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

Nonfarm payrolls rose by 315,000 jobs in August, down from the July increase of 526,000 jobs. The report was just below the Dow Jones estimate of 318,000 jobs and the slowest monthly gain since April 2021. The S&P 500 rose in response to the report, but later erased its gains, indicating that bears continue to sell on rallies. That may be because the U.S. dollar index (DXY), which had retreated from its Sept.1 20-year high, recovered part of its losses. The bears will have to pull the DXY lower to boost the prices of stocks and thcryptocurrency markets as both are usually inversely correlated with the dollar index. Daily cryptocurrency market performance. Source: Coin360 Although Bitcoin (BTC) has dropped more than 70% from its all-time high of $69,000, several traders have held on to ...

Price analysis 8/26: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, MATIC

Federal Reserve Chairman Jerome Powell warned that the central bank will continue to use the “tools forcefully” to bring down inflation, which is close to its highest level in 40 years. He cautioned that the restrictive policy may remain for some time and warned that it could “bring some pain to households and businesses.” The United States equities markets reacted negatively to Powell’s comments with the Dow Jones Industrial Average dropping more than 600 points. The cryptocurrency markets also witnessed sharp selling with Bitcoin (BTC) and most altcoins threatening to break below their immediate support levels. Daily cryptocurrency market performance. Source: Coin360 Along with a not-so-supportive macro environment, Bitcoin’s historical data for September also presents a negative picture...

Price analysis 8/24: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, MATIC

Bitcoin (BTC) and several major cryptocurrencies have been trading sideways as traders avoid taking large bets before the United States Federal Reserve’s Jackson Hole Economic Symposium, which begins on Aug. 25. The volatility is likely to soar as investors get some clarity on the Fed’s stance in the next few days. On Aug. 23, a team led by Goldman Sachs chief economist Jan Hatzius said that Fed chair Jerome Powell could sound dovish when he speaks on Aug. 26, reiterating that the central bank may move at a slower pace in future meetings. The analysts expect the Fed to raise rates by 50 basis points in the September meeting, which would be less than the 75 bps hike done in June and July. Daily cryptocurrency market performance. Source: Coin360 Although the short-term price...