Securities

DMO: Nigerian roads financed with Sukuk not repaying debt as planned

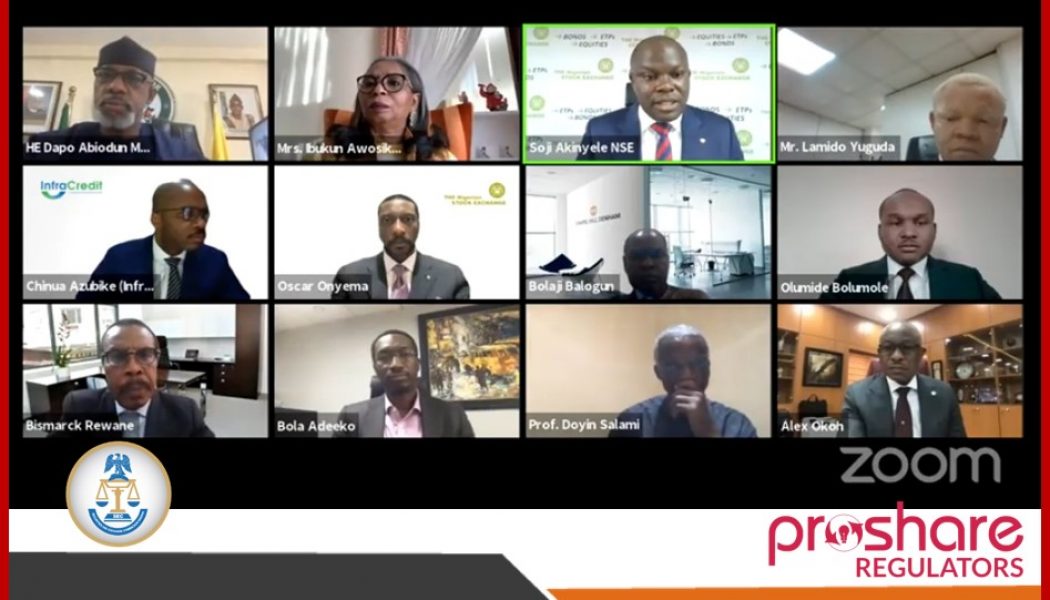

File Photo The Debt Management Office (DMO) has decried the country’s debt service to revenue ratio, describing it as a major issue of concern. Patience Oniha, the Director-General of DMO, said this in Abuja on Thursday at the fifth Budget Seminar (webinar) organised by the Securities and Exchange Commission (SEC). The theme of the budget seminar was, “Financing Nigeria’s Budget and Infrastructure Deficit through the Capital Market.” Oniha stressed the need for infrastructure built with borrowed funds to generate revenue to service the debts. According to her, “We have done the Sukuk, for instance, but the government is the one servicing the debt of those Sukuk. “They (the debts) are not being serviced with revenue from those sources (infrastructure). “I think that when we are talking abou...

WSJ: China’s Ant Group plans revamp amid regulator pressure

China’s Ant Group Co Ltd is planning to refashion itself as a financial holding company under the supervision of China’s central bank in the face of regulatory pressure, the Wall Street Journal reported on Wednesday. The fintech affiliate of Alibaba Group Holding Ltd has submitted an outline of a restructuring plan, which could be finalised before China goes into the week-long lunar new year holiday in mid-February, the Wall Street Journal said, citing sources. Chinese regulators had asked Ant to consider folding up most of its financial businesses into a holding company that would be subject to more stringent capital requirements, two sources told Reuters in December. The country’s central bank, People’s Bank of China, has said Ant controls a range of financial institutions, including sec...

Nigerian government borrows over N2 trillion from bond investors in 2020

Leveraging on excess liquidity that persisted in the banking system and the near zero yields on treasury bills (TBs), the Federal Government, through the Debt Management Office (DMO), raised N2.1 trillion from investors in its monthly bond issuance programme in 2020. This represents 33 percent, year-on-year, (y/y) increase when compared with the N1.58 trillion raised by the DMO in 2019. The N2.1 trillion raised in 2020 also represents 31 percent more than the N1.6 trillion funding target for the DMO under the Revised 2020 Budget. Meanwhile, the monthly bond auctions conducted by the DMO in 2020 recorded 275 percent oversubscription, reflecting scramble for the high yielding FGN bonds by investors. Newsmen report on monthly bond auction results show that the DMO offered N1.825 trillion wort...

NBS: N319.99 trillion e-payments recorded in Q3 2020

A total volume of 2,781,526,188 transactions valued at N319.99trn was recorded in the third quarter of this year based on data on electronic payment channels in the Nigeria banking sector, the Nigerian Bureau of Statistics has said. It disclosed this in its latest Selected Banking Sector Data which focused on sectorial breakdown of credit, e-payment channels and staff strength of Deposit Money Banks. The bureau said Real Time Gross Settlement transfers dominated the volume of transactions recorded. RTGS systems are specialist funds transfer systems where the transfer of money or securities takes place from one bank to any other bank on a real-time and on a gross basis. The NBS said 1,799,199 volume of online transfer transactions valued at N116.06trn were recorded in Q3 2020. In terms of c...

Governor Obaseki, PDP mourn ex-Edo speaker

Edo State Governor Godwin Obaseki and the state chapter of the Peoples Democratic Party have mourned the death of former Speaker of the state House of Assembly, Alhaji Zakawanu Garuba. Garuba (54), who was speaker between 2007 and 2009, was said to have died in Abuja in the early hours of Saturday after a brief illness. Obaseki, in a statement, said the former Speaker’s passing was “a deep personal loss to him.” According to him, “I received the news of the passing of Rt. Hon. Zakawanu Garuba with a heavy heart. He was an outstanding Nigerian and a good man. He worked for the good of the people and contributed his quota to the development of his immediate community and the state. “As Executive Commissioner, Corporate Services & Supervising Executive Commissioner, Operations at the Secu...

- 1

- 2