Securities and Exchange Commission

Be ‘very wary’ of crypto proof-of-reserve audits: SEC official

A senior official from the United States Securities and Exchange Commission has warned investors to be “very wary” about relying on a crypto company’s “proof-of-reserves.” “We’re warning investors to be very wary of some of the claims that are being made by crypto companies,” said SEC’s acting chief accountant Paul Munter in a Dec. 22 interview with The Wall Street Journal. A number of crypto firms have commissioned “proof-of-reserves” audits since the collapse of crypto exchange FTX, aiming to quell concerns over their own exchange’s financial soundness. However, Munter said the results of these audits isn’t necessarily an indicator that the company is in a good financial position. “Investors should not place too much confidence in the mere fact a company says it’s got a proof-of-reserves...

4 legislative predictions for crypto in 2023

If you saw the returns in my crypto portfolio this year, you would take a pass on my predictions for the direction of the cryptocurrency market. So, I will stick to what I know and share some regulatory predictions for the crypto industry. Few legislative changes A few minor victories will logroll small legislative fixes into “must pass” bills like the defense authorization or omnibus spending bills. The top candidate would be a de minimis exemption for smaller crypto transactions to exempt users from capital gains tax liability every time they purchase a coffee with crypto. The protection for noncustodial crypto providers in Republican Representative Tom Emmer’s bill might make it in as well. On the outside, a bipartisan stablecoin bill may be possible, though Senate Democrats are still a...

My story of telling the SEC ‘I told you so’ on FTX

“I hate to say I told you so” is a phrase oft-repeated but rarely sincere. It’s a delightful feeling to claim credit for warning about a problem in advance. That’s a liberty I’m taking with federal financial regulators at the United States Securities and Exchange Commission. In January of this year, while serving as a member of the SEC Investor Advisory Committee that advises SEC Chairman Gary Gensler on crypto and other matters, I filed a petition with the SEC. I asked them to open a formal public comment about unique issues presented by crypto and other digital assets. I pointed to crypto custody and intermediary conflicts of interest as key issues the SEC should address. I called this fresh start a “Digital Asset Regulation Genesis Block” that would help the SEC improve crypto regulatio...

The fall of FTX and Sam Bankman-Fried might be good for crypto

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information,” new FTX CEO John Ray III said in a legal filing on Thursday. “From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.” Ray, who oversaw Enron’s bankruptcy in 2001, stepped in as CEO shortly after founder Sam Bankman-Fried resigned (and reportedly tried to flee to Argentina, although he denies it). He is absolutely right that FTX was brought down by a complete failure of corporate controls, but in reality, the situation is far from unprecedented. And unless ...

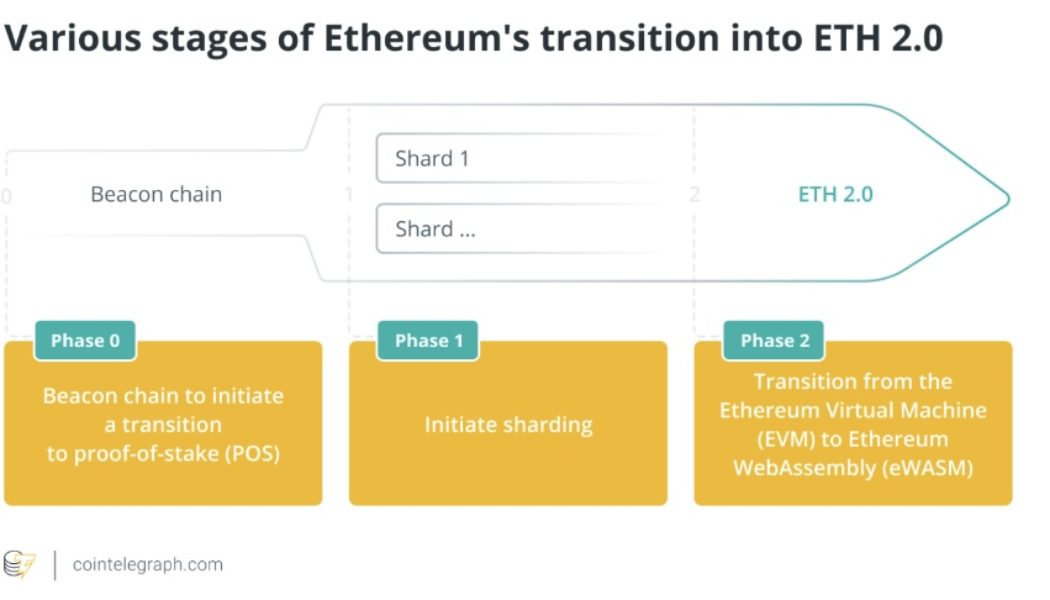

Federal regulators are preparing to pass judgment on Ethereum

Are regulators with the U.S. Securities and Exchange Commission gearing up to take down Ethereum? Given the saber-rattling by officials — including SEC Chairman Gary Gensler — it certainly seems possible. The agency went on a crypto-regulatory spree in September. First, at its annual The SEC Speaks conference, officials promised to continue bringing enforcement actions and urged market participants to come in and register their products and services. Gensler even suggested crypto intermediaries should break up into separate legal entities and register each of their functions — exchange, broker-dealer, custodial functions, etc. — to mitigate conflicts of interest and enhance investor protection. Next, there was an announcement that the SEC’s Division of Corporation Finance plans to add an O...

Kim Kardashian Paying $1.26M to SEC Over Crypto Promotion

Kim Kardashian has agreed to pay $1.26 million to settle Securities and Exchange Commission charges that she promoted a cryptocurrency on Instagram without disclosing she’d been paid $250,000 to do so. The SEC said Monday that the reality TV star and entrepreneur has agreed to cooperate with its ongoing investigation. The SEC said Kardashian failed to disclose that she was paid to publish a post on her Instagram account about EMAX tokens, a crypto asset security being offered by EthereumMax. Kardashian’s post contained a link to the EthereumMax website, which provided instructions for potential investors to purchase EMAX tokens. “The federal securities laws are clear that any celebrity or other individual who promotes a crypto asset security must disclose the nature, source, and amount of ...

IOTA co-founder: Lummis-Gillibrand is a blessing for the crypto industry

There’s never a good time for a crypto winter, but it would be difficult to envision a worse time than right now. Even before 70% of Bitcoin’s (BTC) value evaporated seemingly overnight, things were not going great in the court of public opinion. Negative sentiment was everywhere; a Twitter account documenting crypto bros taking it on the chin racked up hundreds of thousands of followers. Now the biggest crypto exchanges in the world are laying off full-time employees by the thousands, and the self-proclaimed “Cryptoqueen” has landed a spot on the United States Federal Bureau of Investigation’s Ten Most Wanted Fugitives list for defrauding investors out of $4 billion. Oof. The prosecution rests. It’s easy to brush off crypto’s public-facing PR woes as being exactly that: an image problem. ...

Crypto developers should work with the SEC to find common ground

Regulators are tasked with balancing between protecting consumers and creating environments where entrepreneurs and the private sector can thrive. When markets face distortions, perhaps due to an externality or information asymmetry, regulation can play an important role. But regulation can also stifle entrepreneurship and business formation, leaving society and its people worse off. The United States Securities and Exchange Commission has been particularly hostile against cryptocurrency companies and entrepreneurs. For example, SEC Chairman Gary Gensler has remarked that he views Bitcoin (BTC) as a commodity but that many other “crypto financial assets have the key attributes of a security.” He reiterated the line in an explosive Aug. 19 op-ed penned for The Wall Street Journal, arguing t...

SEC charges 11 individuals over $300M crypto ‘pyramid scheme’

The Securities and Exchange Commission (SEC) has charged 11 individuals for their alleged role in the creation of a “fraudulent crypto pyramid scheme” platform Forsage. The charges were laid in a United States District Court in Illinois on August 1, with the SEC alleging that the founders and promoters of the platform used the “fraudulent crypto pyramid and Ponzi scheme” to raise more than $300 million from “millions of retail investors worldwide.” The SEC complaint states that Forsage was modeled such that investors would be financially rewarded by recruiting new investors to the platform in a “typical Ponzi structure,” which spanned multiple countries including the United States and Russia. According to the SEC, a Ponzi scheme is an investment fraud th...

Ripple counsel slams SEC for trying to bulldoze and bankrupt crypto

Ripple general counsel Stu Alderoty has slammed the United States Securities and Exchange Commission (SEC) for trying to “bully, bulldoze, and bankrupt” crypto innovation in the U.S. in the name of expanding its own regulatory territory. “By bringing enforcement actions–or threats of potential enforcement–the SEC intends to bully, bulldoze, and bankrupt crypto innovation in the U.S., all in the name of impermissibly expanding its own jurisdictional limits.” Alderoty shared his views on June 13 amidst an ongoing lawsuit between Ripple and the regulator, which he says is part of the “SEC’s assault on all crypto in the U.S.” by treating every cryptocurrency as a security. “Like a hammer wanting everything to be a nail, the SEC is keeping everything murky so it can argue every crypto is ...

SEC’s Hester Peirce says new stablecoin regs need to allow room for failure

Commissioner Hester Peirce — also known as the Securities and Exchange Commission’s (SECs) “crypto mom” — has backed a regulatory framework for stablecoins that allows “room for there to be failure.” Speaking at an online panel on May 12 hosted by financial think-tank the Official Monetary and Financial Institutions Forum (OMFIF) Peirce, who has long been an advocate for crypto, was asked to shed light on the actions being taken by U.S. regulatory bodies in regard to cryptocurrency. “One place we might see some movement is around stablecoins,” Peirce answered, “that’s an area that has gotten a lot of attention this week.” “It’s been one area within crypto that’s really had quite a moment and there’s a lot of stablecoin use and therefore people are thinki...

- 1

- 2