Securities

Coinbase CEO: Regulate centralized actors but leave DeFi alone

Coinbase CEO Brian Armstrong has pushed for stricter regulations on centralized crypto actors but says decentralized protocols should be allowed to flourish given that open-source code and smart contracts are “the ultimate form of disclosure.” Armstrong shared his views on cryptocurrency regulation in a Dec. 20 Coinbase blog where he proposed how regulators can help “restore trust” and move the industry forward as the market continues to recover from the damage done by FTX and its shock collapse. But decentralized protocols aren’t part of that equation, the Coinbase CEO emphasized. “Decentralized arrangements do not involve intermediaries [and] open-source code and smart contracts are “the ultimate form of disclosure,” Armstrong explained, adding that on-chain, “transparency is built in by...

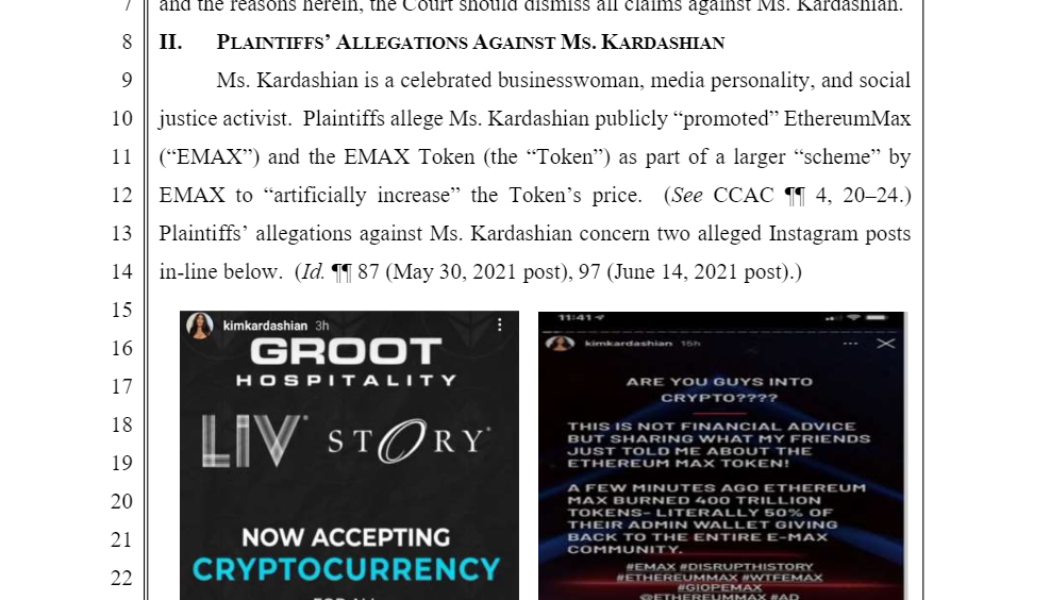

Kim Kardashian pays SEC $1.26 million to settle EthereumMax charge

American socialite Kim Kardashian will pay $1.26 million in penalties for her involvement in the promotion of a cryptocurrency scheme called EthereumMax (EMAX). The United States Securities and Exchange Commission (SEC) announced the charges against Kardashian on Oct. 3 for “touting on social media a crypto asset security offered and sold by EthereumMax” without disclosing the payment received for her promotional involvement. Kardashian has agreed to settle the charges and pay $1.26 million in penalties, disgorgement and interest and is set to cooperate with further investigations by the SEC into the EthereumMax project. The announcement noted that Kardashian failed to disclose a $250,000 payment she had received to publish a post on her Instagram profile promoting EMAX to...

GameFi developers could be facing big fines and hard time

Are cryptocurrency games innocent fun? Or are they Ponzi schemes facing an imminent crackdown by regulators in the United States? Tokens related to cryptocurrency games — known colloquially as “GameFi” — were worth a cumulative total of nearly $10 billion as of mid-August, give or take a few billion. (The number may vary depending on whether you want to include partially finished projects, how you count the number of tokens that projects technically have in circulation, and so on.) In that sense, whether the games are legal is a $10 billion question that few investors have considered. And that’s an oversight they may soon regret. That’s because a bipartisan consensus appears to be forming among legislators in the U.S. that the industry needs to be shut down. They haven’t addressed the issu...

SEC listing 9 tokens as securities in insider trading case ‘could have broad implications’ — CFTC

Caroline Pham, one of five commissioners with the United States Commodity Futures Trading Commission, or CFTC, has expressed concerns about the possible implications of a case the U.S. Securities and Exchange Commission, or SEC, brought against a former product manager at Coinbase. In a Thursday statement, Pham said the SEC complaint against former Coinbase product manager Ishan Wahi, his brother Nikhil Wahi and associate Sameer Ramani “could have broad implications” beyond the case, given its labeling nine tokens as “crypto asset securities” falling under regulatory body’s purview. The complaint alleged that the Wahis and Ramani engaged in insider trading by using confidential information Ishan obtained from Coinbase with regard to which tokens would be listed on the exchange, in ord...

Ripple counsel slams SEC for trying to bulldoze and bankrupt crypto

Ripple general counsel Stu Alderoty has slammed the United States Securities and Exchange Commission (SEC) for trying to “bully, bulldoze, and bankrupt” crypto innovation in the U.S. in the name of expanding its own regulatory territory. “By bringing enforcement actions–or threats of potential enforcement–the SEC intends to bully, bulldoze, and bankrupt crypto innovation in the U.S., all in the name of impermissibly expanding its own jurisdictional limits.” Alderoty shared his views on June 13 amidst an ongoing lawsuit between Ripple and the regulator, which he says is part of the “SEC’s assault on all crypto in the U.S.” by treating every cryptocurrency as a security. “Like a hammer wanting everything to be a nail, the SEC is keeping everything murky so it can argue every crypto is ...

Euroclear invests in Fnality to advance digital ledger technology strategy

On Monday, Euroclear, a securities clearing firm that claims it has over 37.6 trillion euros in assets under custody, announced an investment into Fnality, a consortium of financial institutions focused on the regulated adoption of tokenized assets and marketplaces, for an undisclosed amount. Meanwhile, Euroclear is also focusing on developing its distributed ledger technology, or DLT, to settle digital securities against digital cash through the partnership. The solution aims to increase the speed and efficiency of post-trade operations in areas such as market issuance, collateral trades and servicing interest payments. Founded in 2019, Fnality International said that it seeks to improve the efficiency of central banks for payment settlements. Its notable shareholders include Barcla...

NY stock exchange owner ICE buys stake in tZero security token platform

The Intercontinental Exchange (ICE) has announced a strategic investment in private digital securities marketplace and crypto asset liquidity platform tZero. ICE, which owns and operates 12 global exchanges including the New York Stock Exchange (NYSE), made the announcement on Feb. 22, however, there was no mention of the terms or details of the investment other than ICE becoming a “significant minority shareholder” in tZero. It did state that as part of the investment, ICE’s Chief Strategy Officer David Goone will join tZero as its new CEO serving on the board of directors. tZero operates a blockchain-based alternative trading system (ATS) upon which companies can list tokenized versions of their stocks. The firm is fully regulated with the Securities and Exchange Commission (SEC) and act...

SEC sets deadline for crowdfunding platforms registration

File Photo The Securities and Exchange Commission has directed all existing investment crowdfunding portals/digital commodities investment platforms to note the requirements and eligibility criteria for raising funds through and/or operating a Crowdfunding Portal and comply with the registration requirements or cease operations by the 30th of June, 2021. This was contained in a notice released by the Commission on Wednesday. According to the SEC, the rules governing Crowdfunding business in Nigeria came into effect on the 21st day of January, 2021, which was part of efforts by the Commission to ensure investor protection while encouraging innovation in the conduct of securities business. “In line with the transitional provisions of the Rules, all persons/entities operating an investment cr...

Elon Musk says he is first SNL host with Asperger’s syndrome

Elon Musk kicked off his “Saturday Night Live” debut by declaring himself to be the first person with Asperger’s syndrome to host the US comedy sketch show. “Or at least, the first person to admit it,” he said. In his opening monologue, the eccentric tech entrepreneur behind Tesla and SpaceX offered an explanation for some of his past eyebrow-raising behavior. “Look, I know I say or post strange things but that’s just how my brain works. To anyone I’ve offended I just want to say, I reinvented electric cars and I’m sending people to Mars in a rocket ship,” he said. “Did you think I was also going to be a chill, normal dude?” Musk has previously drawn criticism for moves like publicly mocking the US Securities and Exchange Commission and calling a cave diver who rescued boys trapped in Thai...

Senate summons insurance firms over failure to remit N17.4 billion pension fund

The Senate Public Accounts Committee, on Monday, summoned NICON Insurance Plc, AIICO Insurance and other insurance companies over alleged failure to remit N17.4 billion fund to Pension Transitional Arrangement Directorate (PTAD). The Executive Secretary of PTAD, Dr Chioma Ejikeme, had told the panel that PTAD took over the assets and liabilities of defunct pension offices without a formal handing over. She said, “On taking over, the Directorate wrote all underwriters to make returns and remit whatever amount is in their custody into a CBN dedicated account. Some of the underwriters responded to the request while some did not. “The bank certificate of balances, accounting statements, 3 years financial statements and policy files requested by the Federal Auditor were not handed over to PTAD ...

- 1

- 2

Understanding the strength of small businesses

The number of small businesses keeps growing in the formal and informal sectors of the Nigerian economy, due to the role of small businesses as the live-wire of any economy and the backbone of major developed economies the world over. Though Nigeria rely majorly on oil and revenues derived from it, from context observation the economy is largely supported by small businesses covering almost all spheres of activities within the country, ranging from Nano, kiosk, and Micro businesses most importantly. A visible reference usually includes the vulcanizers, corner shop owners, single retail marketers, repairers, painters, business center operators, restaurants, market women, and men in the various open markets, among others. and the formal operations such as the law firms, accounting firms, con...