SEC

Ripple CEO: SEC case is going ‘much better than I hoped’

Ripple CEO Brad Garlinghouse is increasingly optimistic that the long-running case with the Securities and Exchange Commission (SEC) will deliver a positive result for the blockchain-based global payments company. Speaking on the main stage at Paris Blockchain Week on Thursday, Garlinghouse told attendees of the fireside chat that Ripple’s defense in the ongoing case was faring better than he expected. “The lawsuit has gone exceedingly well, and much better than I could have hoped when it began about 15 months ago.” Live from #PBWS2022, @bgarlinghouse sat down with @cnbc‘s @ryan_browne_ to talk crypto regulation, Ripple’s global traction and use cases that he sees growing across the industry. pic.twitter.com/ouQYhY3B5n — Ripple (@Ripple) April 14, 2022 The SEC filed...

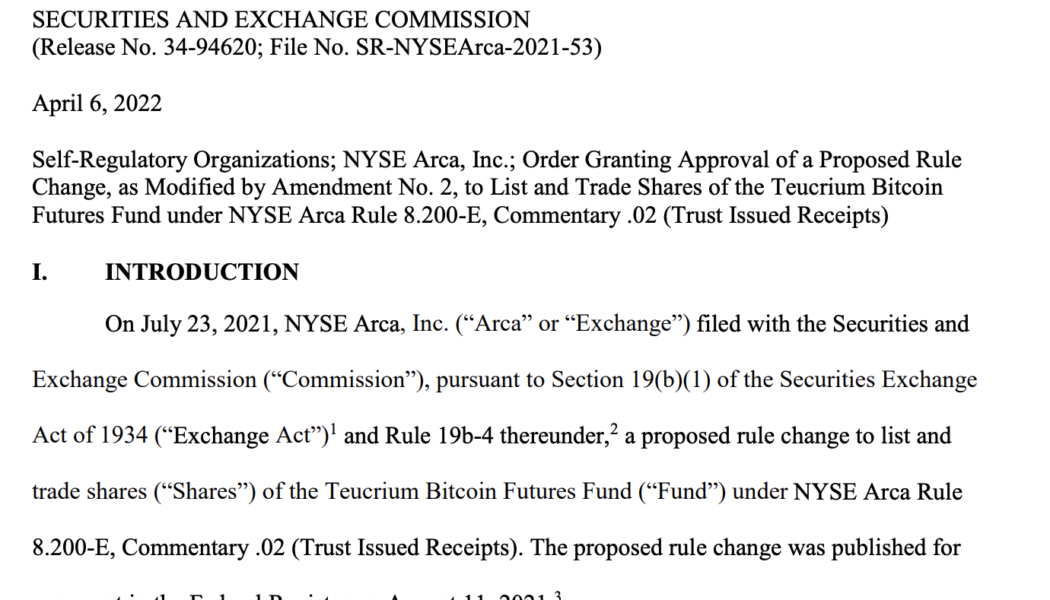

Grayscale CEO pleads Bitcoin spot ETF as SEC backs third BTC Futures ETF

Institutional investors rejoice, there is one more way to gain exposure to Bitcoin (BTC). The United States Securities and Exchange Commission (SEC) announced overnight the approval of a fourth Bitcoin futures exchange-traded fund (ETF). Fund group Teucrium is behind the most recently approved Bitcoin Futures ETF. The ETF joins a growing number of approved futures ETFs, complementing ProShares, Valkyrie, and VanEck Bitcoin Futures ETFs. The SEC filing for the Teucrium ETF. Source: SEC.gov Every Bitcoin spot ETF has been rejected to date, however, for one invested observer, the way in which the approval was made could be a boon for expectant spot investors. The plot thickens on the path to $GBTC’s spot #Bitcoin #ETF conversion… — Sonnenshein (@Sonnenshein) April 7, 2022 In a Tweet thread, G...

ProShares files with SEC for Short Bitcoin Strategy ETF

Exchange-traded funds (ETFs) issuer ProShares has filed a registration statement with the United States Securities and Exchange Commission to list shares of a Short Bitcoin Strategy ETF. In a Tuesday filing, ProShares applied with the SEC for an investment vehicle that would allow users to bet against Bitcoin (BTC) futures using an exchange-traded fund. According to the registration statement, the Short Bitcoin Strategy ETF will be based on daily investment results corresponding to the inverse of the return of the Chicago Mercantile Exchange Bitcoin Futures Contracts Index for a day. ProShares just filed for a Short Bitcoin Futures ETF. Even tho SEC rejected similar filing last year, this has shot IMO given ProShares’ perfect read on SEC w/ $BITO and the lack of issues w/ futures ETF...

SEC chair reveals a proposed joint regulatory role with the CFTC

SEC chair Gary Gensler said commodities and securities in trading platforms are currently intertwined He also blasted the market-leading stablecoins’ lack of a direct right of redemption and raised conflict of interest concerns Chairman of the US Securities and Exchange Commission (SEC) Gary Gensler spoke on a number of issues around crypto-assets and their regulation at the Penn Law Capital Markets Association Annual Conference yesterday. As usual, Gensler insisted on the need to protect the investor from losses in the crypto space, such as the $14 billion stolen last year, and the best way his commission does it is by regulation. The SEC chair suggested a stricter regulatory framework to govern market makers in crypto. Gensler is for the idea of registering crypto platforms so that...

SEC chair: retail crypto investors should be protected

Gary Gensler, chair of the United States Securities and Exchange Commission, said the agency’s protections that apply to investors of traditional assets should extend to those in the crypto market. In prepared remarks released Monday for the Penn Law Capital Markets Association Annual Conference, Gensler said he had requested SEC staff to explore getting crypto platforms registered, having them subject to the same regulatory framework as exchanges. In addition, the SEC chair said the agency’s staff could be working towards addressing regulatory clarity in the crypto space by considering how to register platforms “where the trading of securities and non-securities is intertwined” and whether retail crypto investors should be afforded the same protections as those in traditional markets. “Cr...

SEC rejects ARK 21Shares spot Bitcoin ETF application

The United States Securities and Exchange Commission, or SEC, has officially disapproved the application for the ARK 21Shares Bitcoin exchange-traded fund (ETF). In a Thursday filing, the SEC rejected a proposed rule change from the Chicago Board Options Exchange, or Cboe, BZX Exchange to list and trade shares of the ARK 21Shares Bitcoin (BTC) ETF. The SEC said the proposed rule change, originally published for comment in the Federal Register in August 2021, would not be “‘designed to prevent fraudulent and manipulative acts and practices” nor “protect investors and the public interest.” The SEC said that the Cboe BZX Exchange had not met the requirements of listing a financial product under its rules of practice as well as those of the Exchange Act. Under these restrictions, exchanges see...

Galaxy Digital delays BitGo acquisition to later on in 2022

Cryptocurrency investment firm Galaxy Digital has not managed to finalize the acquisition of the digital asset custodian BitGo in the first quarter of 2022 as the firm originally planned. Galaxy Digital has made some changes to the terms of its acquisition of BitGo, CEO Mike Novogratz announced in an earnings call on Thursday. “We’ve adjusted the deal some, for progress that BitGo has made,” Novogratz said, noting that BitGo has hired about 150 people since the firms originally signed the deal in May last year. He added that Galaxy remains committed to “integrating BitGo and becoming an institutional crypto platform” and the companies will continue to work on integration. According to an official statement, Galaxy Digital and BitGo have renegotiated the acquisition to happen “immediately f...

New SEC guidance on accounting and disclosures rankles Commissioner Peirce

U.S. companies that safeguard their clients’ crypto-assets received new accounting guidance Thursday in the form of a Securities and Exchange Commission, or SEC, Staff Accounting Bulletin. The guidance got a strong response from SEC commissioner Hester Peirce, a steadfast crypto advocate. Staff Accounting Bulletin 121 noted the high technological, legal and regulatory risks associated with the custody of crypto-assets, relative to traditional assets. Those risks impact the operations and financial condition of companies such as Coinbase, PayPal and Robinhood, which safeguard users’ crypto-assets and allow the users to trade them on their platforms. For this reason, companies are advised to list their users’ assets on their books as liabilities as well as assets at their fair value at initi...

Grayscale considering lawsuit if SEC rules against its BTC Trust conversion

The digital assets management firm is not sparing any resources in converting its Bitcoin Trust offering to a Bitcoin ETF Grayscale CEO noted that the firm would go to all lengths to achieve the goal, including a legal battle with the SEC Pressure is mounting on the US Securities and Exchange Commission (SEC) in regards to a spot crypto ETF approval. The regulator has stood its ground, rejecting most Bitcoin ETF applications filed by asset managers and other financial institutions. The SEC recently rejected proposals from the Bitcoin-focused investment firm NYDIG and fund management company Global X. In January, the Gary Gensler-led agency punted (not the first time) on the NYDIG spot Bitcoin ETF proposal before finally delivering the blow this month. Thus far, the list of rejected spot bi...

Grayscale gears up for legal battle with SEC over Bitcoin ETF

Grayscale CEO Michael Sonnenshein said the firm is gearing up for a legal fight if Grayscale’s Bitcoin Spot ETF product is denied by the United States Securities and Exchange Commission (SEC). In an interview with Bloomberg on Tuesday, March 29, Sonnenshein was asked if he would consider the Administrative Procedure Act (APA) lawsuit option if the application for its Bitcoin Spot ETF was denied by the financial regulator. “I think all options are on the table,” he responded, highlighting the importance of continuing to advocate for investors. The next decision date for the approval or denial of the investment product is July 6, 2022, it was previously delayed in February, and was originally filed in October 2021. “The Grayscale team has been putting the full resources of our firm behind co...

Senators Lummis and Gillibrand are collaborating on a new digital assets bill

The two US senators are working on a bill addressing, among others issues, consumer protection and taxes The news of the bill being drafted follows a crypto directive recently signed by President Biden US Senators Cynthis Lummis and Kirsten Gillibrand are looking to table a bill that will touch on several issues within the digital assets industry, “Thrilled to be working with [Gillibrand] on a bipartisan framework to create clarity, establish responsible sideboards, & ensure reasonable consumer protections. With feedback, this legislation will allow the digital assets industry to innovate and flourish in America,” Lummis posted earlier today. Some of the aspects that will feature in the regulatory framework are privacy, banking, and crypto taxation, Bloomberg reports.. The forthco...