SEC

Sen. Lummis: My legislation would empower the SEC to protect consumers

The United States has been the global financial leader since World War II when the U.S. dollar became the world reserve currency. Consequently, Americans have enjoyed benefits like greater buying power, easier access to capital and low-interest rates—including on our national debt. Unfortunately, we face a growing threat to that dominance, from our national debt on the one hand and China’s ascendance and their own digital currency on the other. If the U.S. dollar lost its position as the world reserve currency, it would mean higher U.S. interest payments, more expensive debt repayments and a skyrocketing deficit. The best time to address a crisis is before it begins and the United States still has the opportunity to right our fiscal ship and set ourselves on course for continued financial ...

Brazilian SEC seeks to change its role in cryptocurrency regulation

The Brazilian Securities and Exchange Commission is reportedly pursuing changes in the country’s legal framework with regard to its regulation of cryptocurrencies. According to local media, one major concern is that the bill in question does not appear to consider tokens as digital assets or securities — and they therefore wouldn’t fall under SEC regulation. The updated position of the nation’s SEC follows the appointment of a new board and the increased relevance of the crypto sector in the country’s financial services. Brazilian lawmakers have been working on regulations for cryptocurrencies since 2015, but the Senate only approved the final version of a bill in April 2022. Once Brazil’s Congress finishes its final revisions, the bill will be sent to t...

CFTC and SEC open comments for proposal to amend crypto reporting rules for large hedge funds

The United States Securities and Exchange Commission, or SEC, and the Commodity Futures Trading Commission, or CFTC, have called for comments on a proposal which would require large advisers to certain hedge funds to report exposure to crypto. In a joint proposed rule published to the Federal Register on Sept. 1, the SEC and CFTC established a 40-day comment period for amendments to Form PF, the confidential reporting document for certain investment advisers to private funds of at least $500 million. The proposal suggested qualifying hedge funds report exposure to crypto in a different category other than “cash and cash equivalents,” as the current iteration of Form PR does not specifically mention cryptocurrencies. Members of the public have until Oct. 11 to submit comments regarding the ...

Crypto developers should work with the SEC to find common ground

Regulators are tasked with balancing between protecting consumers and creating environments where entrepreneurs and the private sector can thrive. When markets face distortions, perhaps due to an externality or information asymmetry, regulation can play an important role. But regulation can also stifle entrepreneurship and business formation, leaving society and its people worse off. The United States Securities and Exchange Commission has been particularly hostile against cryptocurrency companies and entrepreneurs. For example, SEC Chairman Gary Gensler has remarked that he views Bitcoin (BTC) as a commodity but that many other “crypto financial assets have the key attributes of a security.” He reiterated the line in an explosive Aug. 19 op-ed penned for The Wall Street Journal, arguing t...

Ripple CEO comments on Crypto Leaks, denies funding law firm to target others

Ripple CEO Brad Garlinghouse took to Twitter to deny recent explosive claims made by Crypto Leaks, an online publication focusing on corruption and fraud-related news in the crypto ecosystem. Crypto Leaks published a report on Friday containing a series of short videos from an unknown source. The report claimed that Ava Labs formed a secret pact with the law firm to use the American legal system “gangster style” to “attack and harm crypto organizations.” The same report also alleged that Ripple CEO Brad Garlinghouse funded a law firm to target competitor firms. The report claimed Roche, who founded Roche Freedman, was earlier working with Boies Schiller Flexner, a firm that was representing Ripple in its lawsuit against the United States Securities and Exchange Commission (SEC)....

GameFi developers could be facing big fines and hard time

Are cryptocurrency games innocent fun? Or are they Ponzi schemes facing an imminent crackdown by regulators in the United States? Tokens related to cryptocurrency games — known colloquially as “GameFi” — were worth a cumulative total of nearly $10 billion as of mid-August, give or take a few billion. (The number may vary depending on whether you want to include partially finished projects, how you count the number of tokens that projects technically have in circulation, and so on.) In that sense, whether the games are legal is a $10 billion question that few investors have considered. And that’s an oversight they may soon regret. That’s because a bipartisan consensus appears to be forming among legislators in the U.S. that the industry needs to be shut down. They haven’t addressed the issu...

2 metrics signal the $1.1T crypto market cap resistance will hold

Cryptocurrencies have failed to break the $1.1 trillion market capitalization resistance, which has been holding strong for the past 54 days. The two leading coins held back the market as Bitcoin (BTC) lost 2.5% and Ether (ETH) retraced 1% over the past seven days, but a handful of altcoins presented a robust rally. Crypto markets’ aggregate capitalization declined 1% to $1.07 trillion between July 29 and Aug. 5. The market was negatively impacted by reports on Aug. 4 that the U.S. Securities and Exchange Commission (SEC) is investigating every U.S. crypto exchange after the regulator charged a former Coinbase employee with insider trading. Total crypto market cap, USD billions. Source: TradingView While the two leading cryptoassets were unable to print weekly gains, traders’ appetite...

Congress will likely decide the fate of crypto jurisdiction: Lummis staffer

A United States Senator Cynthia Lummis staffer believes that U.S. Congress will have to step in and resolve the dispute between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) regarding who regulates cryptocurrencies if the matter cannot be resolved internally. The issue stems from 2014 when the CFTC first asserted jurisdiction over virtual currencies. This was later reaffirmed by a U.S. Federal Court ruling in 2018, which stated that CFTC had jurisdiction to prosecute criminals over fraud cases involving virtual currencies. However, it has been the SEC that has predominantly been investigating U.S.-based crypto exchanges and crypto assets to date. On Aug. 3, Senators Debbie Stabenow (Michigan) and John Boozman (Arkansas) introduced th...

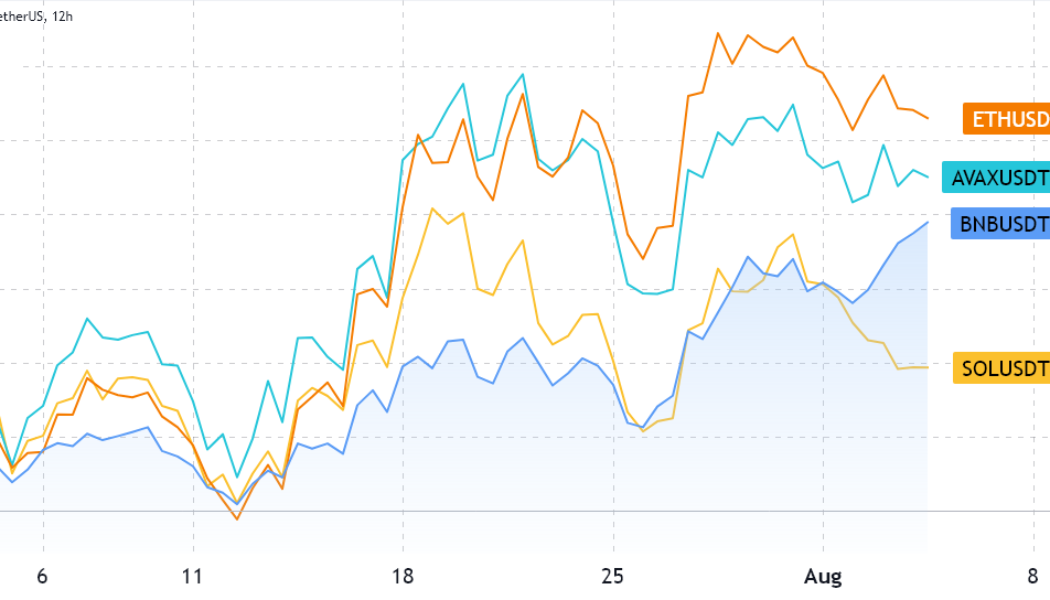

BNB rallies 39% despite smart contract deposits dropping 28% — Should investors be worried?

Cryptocurrencies’ total market capitalization bounced from $860 billion on June 30 to the current $1.03 trillion, a 20.6% relief in five weeks. Ether (ETH) might have been the absolute leader among the largest smart contract chains, but BNB managed to gain 39% over that period. BNB (blue) vs. Ether (orange), AVAX (cyan), SOL (yellow). Source: TradingView BNB token’s year-to-date performance remains negative by 43%, but the current $49.5 billion market capitalization ranks it the third largest, excluding stablecoins. Furthermore, the leading decentralized application (DApp) is PancakeSwap — 843,630 active addresses in the past seven days — which runs on BNB Chain. The token serves primarily as a utility asset within the Binance exchange ecosystem, enabling traders to earn discounts or ...

Senators Stabenow, Boozman introduce crypto bill that extends CFTC’s regulatory powers

United States Senate Agriculture Committee chair Debbie Stabenow and ranking member John Boozman introduced the Digital Commodities Consumer Protection Act bill on Wednesday. The bill has been expected for several months. Like the Digital Commodities Exchange Act (DCEA) introduced into the House of Representatives by members of the House Agriculture Committee in April, the new bill enlarges the role of the Commodity Futures Trading Commission (CFTC). The new bill is not the companion to the DCEA, however. According to the summary, the bill’s definition of digital commodities “includes Bitcoin and Ether and excludes certain financial instruments including securities,” which are regulated by the Securities and Exchange Commission (SEC). The bill mandates registration by t...

Binance US will delist AMP following SEC claim token is a security

United States-based crypto exchange Binance.US said it will be delisting the AMP token “out of an abundance of caution” of possible enforcement by federal regulators. In a Monday blog post, Binance.US said it will be closing deposits of Amp (AMP) and removing the AMP/USD trading pair on Aug. 15 following the token’s mention in a legal action from the U.S. Securities and Exchange Commission, or SEC. The federal regulator filed a complaint against a former Coinbase product manager and two individuals in July that claimed that AMP and eight other cryptocurrencies were “crypto asset securities” that fell under the SEC’s purview. “We believe that, in some circumstances, delisting an asset best protects our community from undue risk,” said Binance.US. “We operate in a rapidly evolvin...

Coinbase, Binance and Kraken under scrutiny: Law Decoded, July 25-August 1

Despite some good signs of the crypto prices recovery, last week could hardly be called bright for the market, as the major news came from the enforcers and not the regulators. According to a report from the New York Times, the United States Treasury Department’s Office of Foreign Assets Control (OFAC) has been investigating crypto exchange Kraken for allegedly allowing users based in Iran and other countries to buy and sell crypto in a potential violation of U.S. sanctions. In the other hemisphere, the Philippines’ think tank Infrawatch PH filed a twelve-page complaint calling on the local Securities and Exchange Commission (SEC) to crack down on Binance’s activities in the country. The news comes shortly after the Philippines’ Department of Trade and Industry (DTI) waved off a Bina...