SEC

US lawmaker says crypto regulation from SEC is ‘needed now’

John Hickenlooper, a United States Senator representing Colorado, has penned a letter to Gary Gensler urging the Securities and Exchange Commission chair to establish “clear rules” for the crypto market. In an Oct. 13 letter, Hickenlooper called on the SEC to take action on regulatory issues including identifying the cryptocurrencies that will be considered sasecurities, establishing registration guidelines for trading platforms, and “determining what disclosures are necessary for investors to be properly informed.” According to the senator, the lack of a coordinated regulatory framework from the government has led to uneven enforcement, while the SEC is the agency “well positioned to offer regulatory guidance.” “Given the complexity of these issues, and recognizing that some digital asset...

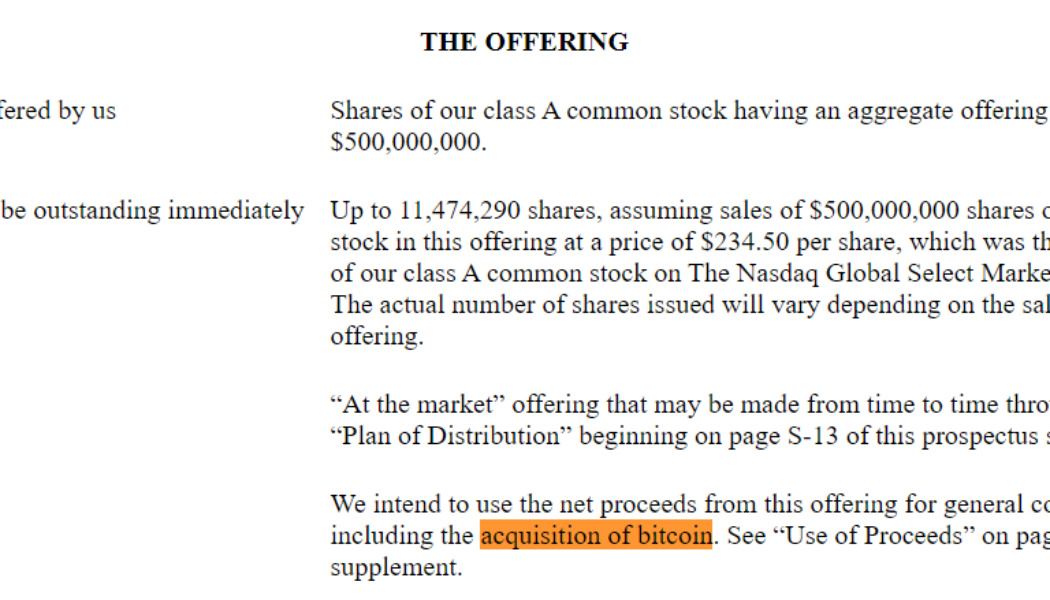

Nasdaq needs clear regulations to launch crypto exchange, says VP

Nasdaq, the American stock exchange, has no immediate plans of launching a crypto exchange until there’s better regulatory clarity from policymakers, said Tal Cohen, the company’s executive vice president. In an interview with Bloomberg, Cohen said that the retail side of the crypto market is fairly saturated and there are enough crypto exchanges catering to the needs of retail investors. He added that his firm would continue its focus on crypto custody services that were launched on Sept. 20. Cohen also shed some light on other crypto-related services that the exchange is working on, namely building execution capabilities on the platform to move and transfer assets. The world’s second-largest stock exchange might be hesitant to launch a crypto exchange in the United States, but the f...

How Crypto Twitter reacted to Kim Kardashian’s $1.26M SEC fine

The crypto community reacted with a mix of disbelief and amusement after reality star Kim Kardashian was fined for promoting the cryptocurrency EthereumMax (EMAX). The United States Securities and Exchange Commission (SEC) fined Kardashian $1.26 million on Oct. 3, for “touting on social media” about the EMAX without disclosing she was paid $250,000 to post about it. Kardashian has neither admitted to nor denied the SEC’s allegations, but settled the charges and agreed to not promote any cryptocurrency assets until 2025. SEC chairman Gary Gensler tweeted the fine was a reminder that celebrity endorsement of investment opportunities doesn’t “mean those investment products are right for all investors.” Today @SECGov, we charged Kim Kardashian for unlawfully touting a crypto securi...

US Treasury recommends lawmakers decide which regulators will oversee crypto spot market

Officials with the United States Financial Stability Oversight Council, or FSOC, have recommended U.S. lawmakers pass legislation to determine which “rulemaking authority” will be responsible for regulating parts of the crypto spot market. In an Oct. 3 meeting of the FSOC, Jonathan Rose, a senior economist at the Federal Reserve Bank of Chicago, said the FSOC had released a report in accordance with President Joe Biden’s executive order on crypto, detailing potential financial stability risks of digital assets and regulatory gaps. The report identified regulatory gaps including the spot market for cryptoassets that were not securities subject to “limited direct federal regulatory” — hinting at lawmakers stepping in to prevent possible market manipulation and conflicts of interest. “While s...

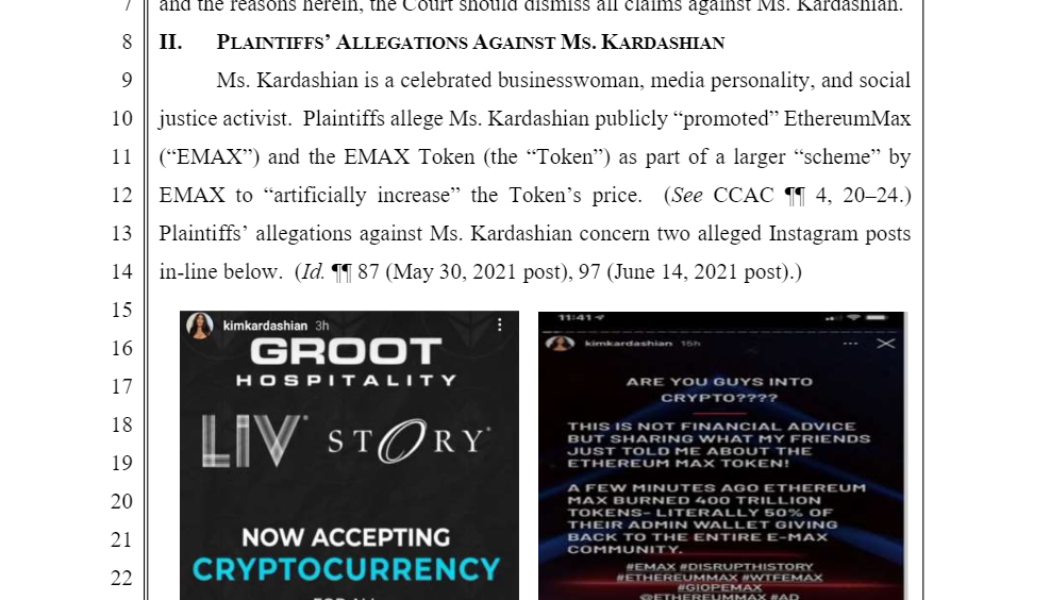

Kim Kardashian pays SEC $1.26 million to settle EthereumMax charge

American socialite Kim Kardashian will pay $1.26 million in penalties for her involvement in the promotion of a cryptocurrency scheme called EthereumMax (EMAX). The United States Securities and Exchange Commission (SEC) announced the charges against Kardashian on Oct. 3 for “touting on social media a crypto asset security offered and sold by EthereumMax” without disclosing the payment received for her promotional involvement. Kardashian has agreed to settle the charges and pay $1.26 million in penalties, disgorgement and interest and is set to cooperate with further investigations by the SEC into the EthereumMax project. The announcement noted that Kardashian failed to disclose a $250,000 payment she had received to publish a post on her Instagram profile promoting EMAX to...

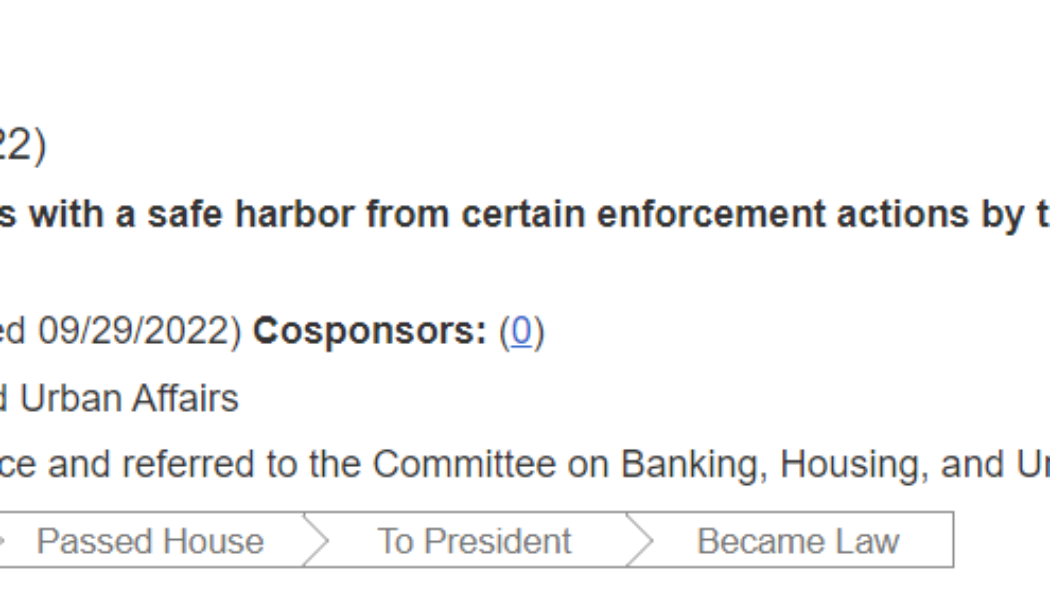

US senator bill seeks to cushion crypto exchanges from SEC enforcement actions

United States Senator Bill Hagerty, a member of the Senate Banking Committee, introduced legislation seeking a safe harbor for cryptocurrency exchanges from “certain” Securities and Exchange Commission (SEC) enforcement actions. The Digital Trading Clarity Act of 2022, introduced by Sen. Hagerty, aims to provide regulatory clarity around two primary concerns plaguing crypto exchange establishments — (i) the classification of digital assets and (ii) related liabilities under existing securities laws. A bill to provide digital asset intermediaries with a safe harbor from certain enforcement actions by the Securities and Exchange Commission, and for other purposes. Source: congress.gov Sen. Hagerty outlined an overview of the problems amid regulatory hurdles: “The current lack of regulatory c...

CFTC commissioner visits Ripple offices as decision in SEC case looms

Caroline Pham, one of five commissioners at the United States Commodity Futures Trading Commission, or CFTC, met with Ripple CEO Brad Garlinghouse ahead of a court decision which could affect how regulators handle XRP tokens. In a Monday tweet, Pham said she visited Ripple Labs’ offices as part of a “learning tour” involving crypto and blockchain. Garlinghouse later tweeted that the commissioner’s visit was related to “public-private engagement” — likely referring to a privately funded company like Ripple engaging with U.S. regulators. The next stop on my learning tour was visiting @Ripple Labs. Thanks @bgarlinghouse! #XRP #crypto #blockchain pic.twitter.com/ICr8H2ZE3q — Caroline D. Pham (@CarolineDPham) September 19, 2022 The timing of Pham’s visit had many on social media reacting to the...

XRP price risks 30% decline despite Ripple’s legal win prospects

Ripple (XRP) price was wobbling between profits and losses on Sept. 19 despite hopes that Ripple would eventually win its long-running legal battle against the U.S. Securities and Exchange Commission (SEC). Ripple and the SEC both agreed to expedite the lawsuit on Friday to get an answer on whether $XRP is a security or not. From the updates of the case, it sounds like it’s in the favor of @Ripple pic.twitter.com/SAyl4VLxdM — Jeff Sekinger (@JeffSekinger) September 19, 2022 Fed spoils SEC vs. Ripple euphoria The XRP/USD pair dropped by over 1% to $0.35 while forming extremely sharp bullish and bearish wicks on its Sept. 19 daily candlestick. In other words, its intraday performance hinted at a growing bias conflict among traders. XRP/USD daily price chart. Source: TradingView The inde...

Coinbase is fighting back as the SEC closes in on Tornado Cash

On Sept. 8, Coinbase announced it was bankrolling a lawsuit against the United States Treasury Department. The cryptocurrency exchange is funding a lawsuit brought by six people that challenges the sanctions on Tornado Cash. And on Sept. 9, Securities and Exchange Commission (SEC) Chair Gary Gensler announced he was working hard with Congress to create legislation to increase cryptocurrency regulations. But these two stories are not mutually exclusive. The sequence of events proves that governments are purely reactive rather than proactive when it comes to decentralized finance (DeFi). Tornado Cash was sanctioned by the Office of Foreign Assets Control (OFAC) back in August. OFAC claimed the smart contract mixer has helped to launder more than $7 billion worth of cryptocurrency since ...

White House publishes ‘first-ever’ comprehensive framework for crypto

Following President Joe Biden’s executive order on Ensuring Responsible Development of Digital Assets, federal agencies came up with a joint fact sheet on 6 principal directions for crypto regulation in the United States. It sums up the content of 9 separate reports, which have been submitted to the president to “articulate a clear framework for responsible digital asset development and pave the way for further action at home and abroad.” The fact sheet was published on the White House official website on Sept. 16, and consists of 7 sections: (1) Protecting Consumers, Investors, and Businesses; (2) Promoting Access to Safe, Affordable Financial Services; (3) Fostering Financial Stability; (4) Advancing Responsible Innovation; (5) Reinforcing Our Global Financial Leadership and Competitiven...

SEC to address growing crypto issuer filings with specialized offices

In light of the influx of filings from cryptocurrency issuers in the United States, the Securities and Exchange Commission (SEC) decided to set up two new offices this fall to provide specialized support to the seven offices currently responsible for reviewing issuer filings. Under the Division of Corporation Finance’s Disclosure Review Program (DRP), the SEC announced plans to add two offices — an Office of Crypto Assets and an Office of Industrial Applications and Services — purely focused on dealing with crypto assets and industrial applications and services, respectively. Sharing insights into the move, Renee Jones, director of the Division of Corporation Finance, stated: “The creation of these new offices will enable the DRP to enhance its focus in the areas of crypto asse...

‘We’re not giving crypto a pass’ on enforcement action, says SEC’s Gurbir Grewal

Gurbir Grewal, the enforcement director for the United States Securities and Exchange Commission, said the financial regulator will continue to investigate and bring enforcement actions against crypto firms, despite the narrative of “picking winners and losers” and “stifling innovation.” In written remarks for a Friday program hosted by the Practising Law Institute, Grewal pushed back against criticism that the SEC “somehow unfairly targeted crypto” in its enforcement actions when compared with those against financial products or traditional markets. He also hinted that the SEC had a responsibility to many “non-White and lower-income investors” drawn to crypto projects, who may feel as though the financial system and its regulators “failed, or simply ignored, them.” “It often seems c...