SEC

U.S. Congressman calls for ‘Broad, bipartisan consensus’ on important issues of digital asset policy

In a letter to the leadership of the United States House Financial Services Committee, ranking member Patrick McHenry took a jab at “inconsistent treatment and jurisdictional uncertainty” inherent in U.S. crypto regulation and called for the Committee to take on its critical issues. McHenry, a Republican representing North Carolina, opened by mentioning that the Committee’s Democrat Chairwoman Maxine Waters is looking to schedule additional hearings addressing matters pertinent to the digital asset industry. He further stressed the need for identifying and prioritizing the key issues and achieving a “broad, bipartisan consensus” on the matters affecting the industry that holds immense promise for the financial system and broader economy. Citing the confusion that the industry faces due to ...

SEC rejects MicroStrategy‘s Bitcoin accounting practices: Report

Business intelligence firm MicroStrategy reportedly acted contrary to the Securities and Exchange Commission’s (SEC‘s) accounting practices for its crypto purchases. According to a Bloomberg report, a comment letter from the SEC released Thursday showed that the regulatory body objected to MicroStrategy reporting information related to its Bitcoin (BTC) purchases based on non-Generally Accepted Accounting Principles (GAAP). The business intelligence firm has been reporting that it used these methods of calculating figures for its BTC buys, excluding the “impact of share-based compensation expense and impairment losses and gains on sale from intangible assets.” Essentially, this negates some of the effects of the volatility of the crypto market. GAAP rules are seemingly not design...

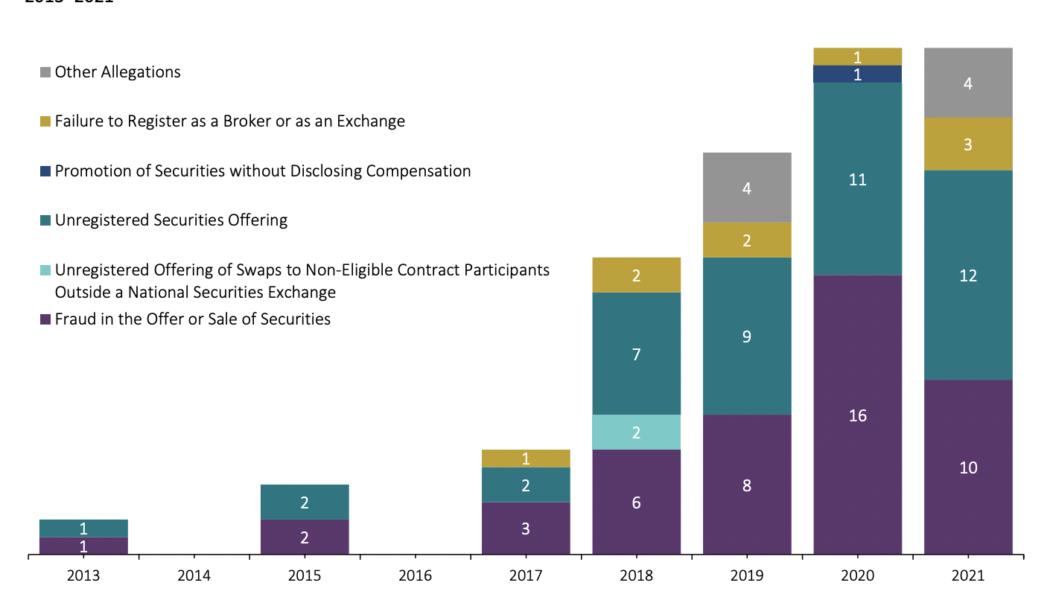

The SEC has issued $2.4B in crypto-related penalties since 2013

The Securities and Exchange Commission (SEC) has issued a total of approximately $2.35 billion in penalties against participants in the digital asset marketplace since 2013 according to a Jan 19 report by Cornerstone Research. The report, SEC Cryptocurrency Enforcement: 2021 Update, found that the SEC brought a total of 97 enforcement actions worth $2.35 billion between 2013 and the end of 2021. Fifty eight of the total of 97 were actions litigations and the remaining 39 were administrative proceedings. Of the total $2.35 billion raised by the litigations, $1.71 billion was charged in litigation and $640 million in administrative proceedings. Allegations in SEC Cryptocurrency Litigations. Source: Cornerstone Research. The majority of those charged were “firm respondents only,” racking up $...

The SEC has issued $2.4B in crypto-related penalties since 2013

The Securities and Exchange Commission (SEC) has issued a total of approximately $2.35 billion in penalties against participants in the digital asset marketplace since 2013 according to a Jan 19 report by Cornerstone Research. The report, SEC Cryptocurrency Enforcement: 2021 Update, found that the SEC brought a total of 97 enforcement actions worth $2.35 billion between 2013 and the end of 2021. Fifty eight of the total of 97 were actions litigations and the remaining 39 were administrative proceedings. Of the total $2.35 billion raised by the litigations, $1.71 billion was charged in litigation and $640 million in administrative proceedings. Allegations in SEC Cryptocurrency Litigations. Source: Cornerstone Research. The majority of those charged were “firm respondents only,” racking up $...

Here’s why Ric Edelman believes a third of US adults will be invested in Bitcoin by next year

The financial author detailed in his latest publication that he is optimistic the US SEC will finally give the green light to a Bitcoin ETF In an interview on CNBC’s Halftime Report, the founder of Edelman Financial Engines backed his projection that a third of American adults will be bitcoin holders by the end of the year. Edelman, author of several books in the personal finance space, penned in his latest book titled The Truth About Crypto his predictions for the crypto sector this year. Edelman weighs in on bitcoin adoption and spot bitcoin ETF decision Notable among his predictions is that the number of American adults that own bitcoin will grow from nearly a quarter to a third. Edelman noted that the bitcoin adoption rate is high, and many people are being drawn to digital asset...

SEC files complaint against operator of ‘unregistered’ $33M Crowd Machine ICO

The United States Securities and Exchange Commission (SEC) has filed a suit against Australian Craig Derel Sproule for the allegedly “fraudulent and unregistered” sale “of digital asset securities” in an Initial Coin Offering his company conducted in 2018. The SEC alleges in a Jan. 6 complaint that Sproule’s company, Metavine, Inc. which operated the ICO for Crowd Machine (CMCT) from Jan. to April 2018, sold unregistered securities, never made the project operational and “materially misrepresented how it intended to use ICO proceeds.” In total, the SEC says Sproule raised at least $33 million dollars, but that he now lacks “sufficient capital to fund continued operations.” The reason for his lack of funds goes to the core of the SEC’s case. A Jan. 6 announcement from the SEC regarding the ...

SEC delays decision on NYDIG Bitcoin ETF for another 60 days

The commission previously punted two other Bitcoin ETF products for an additional 45 days The US Securities and Exchange Commission on Tuesday revealed that it had pushed the deadline for reviewing the spot ETF proposal from technology and financial services firm NYDIG for another 60 days. The regulator explained that it saw it appropriate to delay the decision to either approve or reject the application until March 15th. The extended period, according to the commission, would provide enough time to review and make a determination on the ETF. “The Commission finds that it is appropriate to designate a longer period within which to issue an order approving or disapproving the proposed rule change so that it has sufficient time to consider the proposed rule change and the iss...

How the Democratic Party didn’t stop worrying and fearing crypto in 2021

As 2022 is kicking off, America nears the first anniversary of Joe Biden’s presidency. Following the tenure’s ambitious start, the last few months witnessed some serious tumult around the overall health of the United States economy, the administration’s handling of the COVID-19 pandemic, and the tense debate around Biden’s opus magnum — the $1.7 trillion Build Back Better infrastructure legislation plan. But even as the Democrats’ ability to maintain undivided power after the 2022 midterm elections can raise doubts, the party’s prevailing view of crypto has become more consolidated than ever. The incumbent president’s party will be setting the tone of the regulatory discussion for at least three more years, so a thorough look at the fundamental premises and potential directions of its emer...

SEC chair has a new senior adviser for crypto

United States Securities and Exchange Commission (SEC) chair Gary Gensler has added a new staff member who will offer advice related to crypto policymaking and interagency work. In a Thursday announcement, the SEC said Corey Frayer would be joining Gensler’s executive staff as a senior adviser on the agency’s oversight of cryptocurrencies. Frayer has worked as a professional staff member of the Senate Banking Committee as well as a senior policy adviser for the House Financial Services Committee with Representatives Maxine Waters and Brad Miller. Frayer’s appointment to the SEC chair’s executive staff came alongside those of Philipp Havenstein, Jennifer Songer and Jorge Tenreiro, who will be working as operations counsel, investment management counsel and enforcement counsel, respect...

Law Decoded: Three regulatory trends of 2021, Dec. 20–27

It is that time of the year: Singular events must be abandoned in favor of end-of-year, big-picture narratives and yearly lessons learned. As many governments across the globe finally had to face the rapidly mainstreaming realm of digital finance, the year is packed with developments in crypto policy and regulation that are impossible to fit into a neat little summary. However, it is possible to try and distill several major trends that have come to the fore during the past 12 months, and that will keep shaping the relationship among societies, state power and the crypto space as we roll into 2022. Below is the concise version of the latest “Law Decoded” newsletter. For the full breakdown of policy developments over the last week, register for the full newsletter below. U.S. Congress notic...

Crypto regulation is coming, but Bitcoin traders are still buying the dip

Looking at the Bitcoin chart from a weekly or daily perspective presents a bearish outlook and it’s clear that (BTC) price has been consistently making lower lows since hitting an all-time high at $69,000. Bitcoin/USD on FTX. Source: TradingView Curiously, the Nov. 10 price peak happened right as the United States announced that inflation has hit a 30-year high, but, the mood quickly reversed after fears related to China-based real estate developer Evergrande defaulting on its loans. This appears to have impacted the broader market structure. Traders are still afraid of stablecoin regulation This initial corrective phase was quickly followed by relentless pressure from regulators and policy makers on stablecoin issuers. First came VanEck’s spot Bitcoin ETF rejection by the U.S....