SEC

Here’s why the SEC keeps rejecting spot Bitcoin ETF applications

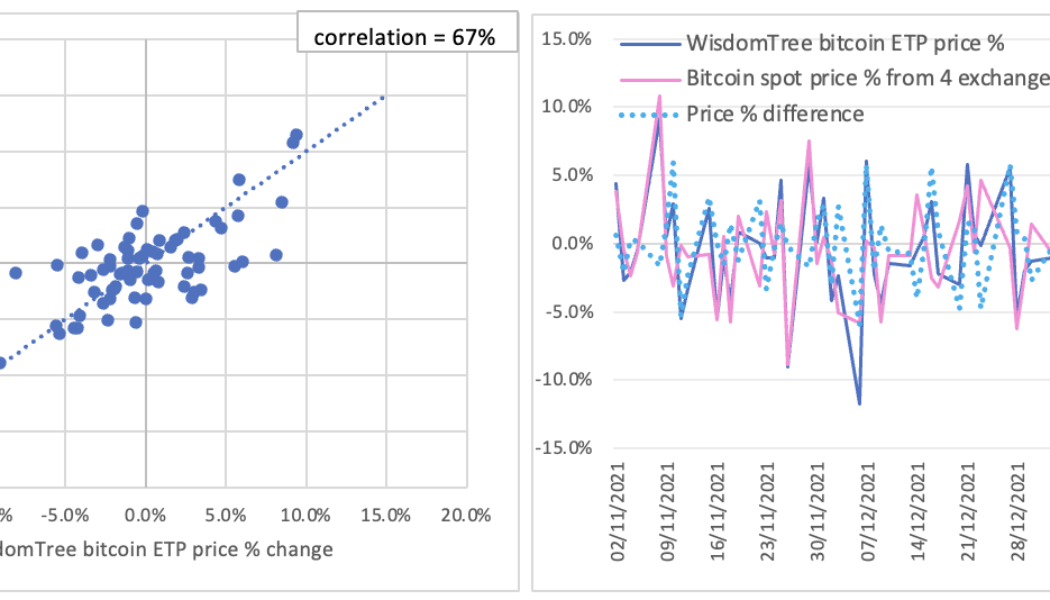

It is not the first time the U.S. Securities and Exchange Commission (SEC) rejected proposals for a Bitcoin spot exchange traded product (ETP), but efforts continue to be made by different financial institutions. The recent attempt made by Cboe BZX Exchange on Jan. 25 to list the Fidelity Wise Origin Bitcoin Trust as a Bitcoin ETP has also failed. The SEC letter published on Feb. 8 pointed out that the exchange has not met its burden to demonstrate the fund is “designed to prevent fraudulent and manipulative acts” and “to protect investors and the public interest”. Although proposals of Bitcoin spot ETPs have never been approved by the SEC and such products are not available in the U.S. market, they do exist in the European market. By investigating the prices of these ETPs traded in ...

Overwhelming support for Grayscale BTC Trust ETF conversion proposal

The U.S. Securities and Exchange Commission has allowed comments and feedback on a proposed rule change that would convert Grayscale’s Bitcoin Trust to a spot-based exchange-traded fund (ETF). A notice of filing a proposed rule change to list and trade shares of Grayscale Bitcoin Trust as a spot-based ETF has generated a long list of comments with a large majority in approval. Bloomberg’s senior ETF analyst Eric Balchunas had a look through some of the more recent comments on Feb. 15 observing that 95% are in favor of the proposed conversion. Just glancing through the many comments from ppl to the SEC re converting $GBTC to an ETF and 95% are in favor of it and most using real names and pointing to the stupefying fact that futures ETF ok but spot not. eg: pic.twitter.com/j15iNYnh8R — Eric ...

Law Decoded: Tangible wins, new menaces and the global crypto taxation drive, Feb. 1–7

Every global event or major political crisis these days can trigger a digital asset-related conversation. As China welcomes the world’s top athletes to the Beijing 2022 Winter Olympics, showing off ultra-high-tech facilities and sports infrastructure, some United States politicians have raised concerns over the Games’ potential to act as a booster to the digital yuan’s adoption. In neighboring Myanmar, the military government that had overthrown the nation’s elected leadership a year ago is now looking into launching its own digital currency, not to project economic influence but to improve the domestic payments system and the struggling economy more broadly. Below is the concise version of the latest “Law Decoded” newsletter. For the full breakdown of policy developments over the las...

Crypto strategist says XRP could blow after its SEC brawl – Here’s his argument

A top analyst has predicted that XRP will ‘rocket’ after the pending legal issues with the SEC are resolved Credible Crypto, as he is known on his socials, predicted XRP to peak the $20 to $30 range in this cycle A largely-followed crypto analyst and trader has predicted that XRP will explode after the legal matters between Ripple Labs and the US Securities and Exchange Commission (SEC) are settled. The pseudonymous crypto analyst, Credible Crypto, recently linked up with Thinking Crypto’s Tony Edwards and analysed a few coins based on their performance in the market, including the Ripple-affiliated XRP. Analyst advises getting in before its too late The crypto strategist observed that at the moment, XRP is looking bearish in the charts, and he expects its price...

Stealth rulemaking: Is proposed SEC rule with no mention of crypto a threat to DeFi?

On Jan. 26, the United States Securities and Exchange Commission proposed amendments to Rule 3b-16 under the Exchange Act that lacks any mention of digital assets or decentralized finance, which could adversely affect platforms that facilitate crypto transactions. Some cryptocurrency advocates — including SEC Commissioner Hester Peirce — believe that the commission’s extended definition of an exchange could thrust an entire class of crypto entities under the regulator’s jurisdiction, subjecting them to additional registration and reporting burdens. How real is the threat? The proposed change The amendments proposed by the regulator dramatically expand the definition of what an exchange is while eliminating the exemption for systems that merely bring together buyers and sellers of securitie...

SEC again delays decision on Grayscale’s Bitcoin ETF

The United States Securities and Exchange Commission (SEC) has once again delayed its ruling on whether to approve Grayscale’s application for a Bitcoin (BTC) exchange-traded fund (ETF), citing familiar concerns around manipulation, liquidity and transparency. In a notice published Friday afternoon, the SEC expressed concerns about how the digital asset manager intends to convert its Grayscale Bitcoin Trust (GBTC) into a spot ETF. Namely, the regulator wasn’t convinced that Grayscale’s proposal was designed to prevent alleged fraud and manipulation in the Bitcoin market. The SEC has invited the public to comment on these issues, giving interested parties 21 days to respond in writing. The SEC has just delayed their decision on whether GBTC can convert to a bitcoin ETF. — Pomp (@APomp...

SEC’s proposed rule on exchanges could threaten DeFi, says Crypto Mom

Hester Peirce, a commissioner for the U.S. Securities and Exchange Commission known by many in the space as Crypto Mom, is warning that a proposed rule from the agency could potentially affect the regulation of firms involved with decentralized finance. According to a Tuesday Bloomberg report, Peirce said that the 654-page proposal recently released by the SEC to amend the definition of “exchange” as defined by the Securities Exchange Act of 1934 could impact the digital asset space. The SEC commissioner reportedly opposed opening the proposal to public comment and said the text could impose additional regulations on decentralized finance, or DeFi, firms. “The proposal includes very expansive language, which, together with the chair’s apparent interest in regulating all things crypto, sugg...

SEC approves BSTX for blockchain settlements on traditional markets

The Boston Security Token Exchange (BSTX), a new facility of the Boston-based BOX exchange, received regulatory approval from the United States Securities and Exchange Commission (SEC) to operate as a blockchain-based securities exchange. BSTX was launched jointly by BOX and Overstock’s blockchain arm tZERO, originally seeking approval for launching publicly-traded registered security tokens. However, the SEC approval to operate as a national securities exchange allows BSTX to use blockchain technology for faster settlements in traditional markets. According to the SEC, “The Commission notes that the [BSTX] Exchange’s current proposal does not involve the trading of digital tokens and such a proposal, or any other additional use of blockchain technology.” While the SEC has previously...

Weekly Report: Crypto markets suffer mid-week blow as SEC bins another Bitcoin ETF proposal

The SEC rejected yet another crypto ETF proposal and punted on two others Reddit follows Twitter in introducing NFT avatar support Thailand regulators are looking to curtail the use of crypto in settling payments US financial markets watchdog is probing top crypto platforms over high-yield crypto products The cryptocurrency sector is reeling from a broad mid-week sell-off triggered by remarks from Fed Chair Jerome Powell on the US monetary policy. Bitcoin lost grip on the $37,000 level earlier today and is currently trading at $36,250. Ethereum has lost 3.15% in the last 24 hours and is swinging around $2,370. Cardano, Solana and Terra native tokens are also down on the day with double-digit losses over the last seven days. Terra’s LUNA has the biggest slump, dipping almost 35% since...

SEC pushes decision on ARK 21Shares Bitcoin ETF to April 3

The U.S. Securities and Exchange Commission has extended its window to approve the ARK 21Shares Bitcoin exchange-traded fund (ETF) originally proposed in July 2021. According to a Tuesday filing from the SEC, the regulatory body will push the deadline for approving or disapproving the ARK 21Shares Bitcoin ETF from Feb. 2 for an additional 60 days, to April 3. SEC Assistant Secretary J. Matthew DeLesDernier noted in the filing that it was “appropriate to designate a longer period” for the regulatory body to consider the proposed rule change, allowing the ETF to be listed on the Cboe BZX Exchange. The exchange originally filed the paperwork to apply for the ARK 21Shares Bitcoin ETF in July 2021, with the SEC able to delay its decision and open the offering to public comment for up to 180 day...

Valkyrie aims for ETF linked to Bitcoin mining firms on Nasdaq

Crypto asset manager Valkyrie has filed an application with the United States Securities and Exchange Commission to trade an exchange-traded fund (ETF) with exposure to Bitcoin mining firms on the Nasdaq Stock Market. In a Wednesday SEC filing, Valkyrie said its Bitcoin Miners ETF will not invest directly in Bitcoin (BTC) but at least 80% of its net assets would offer exposure to the crypto asset through the securities of companies that “derive at least 50% of their revenue or profits” from BTC mining or providing hardware or software related to mining. The filing added Valkyrie would invest up to 20% of the ETF’s net assets in companies holding “a significant portion of their net assets” in Bitcoin. Valkyrie launched a Bitcoin Strategy ETF in October 2021, which offered indirect exposure ...