SEC

SEC could approve spot Bitcoin ETFs as early as 2023 — Bloomberg analysts

Eric Balchunas and James Seyffart, exchange-traded fund (EFT) analysts for Bloomberg, said that a proposed rule change with the United States Securities and Exchange Commission (SEC) could be the catalyst for the regulatory body approving a spot Bitcoin ETF in mid-2023. In a Thursday tweet, Balchunas said crypto platforms could fall under the SEC’s regulatory framework if the commission were to approve the amendment to change the definition of “exchange” proposed in January. The rule change would amend the Exchange Act to include platforms “that make available for trading any type of security” — seemingly including cryptocurrencies, making their investment vehicles more palatable for the regulator. “Once crypto exchanges are compliant, the SEC’s primary reason for denying spot Bitcoi...

SEC pushes decisions on WisdomTree’s and One River’s applications for spot Bitcoin ETFs

The United States Securities and Exchange Commission has extended its window to approve or disapprove spot Bitcoin (BTC) exchange-traded fund (ETF) applications from asset managers WisdomTree and One River. According to separate Friday filings, the SEC will push the deadline for approving or disapproving a rule change allowing shares of the WisdomTree Bitcoin Trust and One River Carbon Neutral Bitcoin Trust to be listed on the Cboe BZX Exchange and New York Stock Exchange Arca, respectively. The regulator said it would extend its window for the decision on WisdomTree’s Bitcoin investment vehicle to May 15 and One River’s to June 2. The spot BTC ETF application from WisdomTree followed the SEC rejecting a similar offering from the asset manager in December 2021 after several delay...

Exodus crypto wallet starts trading on SEC-registered platform

Major software cryptocurrency wallet Exodus has gone public on the digital asset securities firm Securitize Markets following a $75 million crowdfund capital raise. Exodus’ shares started trading on Securitize on Wednesday, allowing investors from all across the United States and international investors from more than 40 countries to trade the Exodus Class A common stock. Trading under the ticker symbol EXOD, the Exodus Class A common stock is digitally represented on the Algorand blockchain via common stock tokens. Tokenized shares in @Exodus_io are now trading on Securitize Markets. Retail investors included! With 24-7 order placement, 8am-8pm ET trading hours, near-instant deposits and promotional $0 fee trading, get started here: https://t.co/h55WEoAQMr pic.twitter.com/JasA5C7Qbx — Sec...

Congress members concerned SEC stifling innovation with crypto scrutiny

In a bipartisan letter put forward by Republican Minnesota Congressman Tom Emmer, a cohort of Congress members has written to Securities and Exchange Commission (SEC) Chairman Gary Gensler, challenging the regulator’s scrutiny of cryptocurrency firms and expressing concern that “overburdensome” investigation may be suffocating the crypto industry. They suggest the SEC is drowning companies in paperwork in contravention of the SEC’s stated aims and mandated jurisdiction. Emmer tweeted to his 51,000 followers: “My office has received numerous tips from crypto and blockchain firms that SEC Chair @GaryGensler’s information reporting ‘requests’ to the crypto community are overburdensome, don’t feel particularly… voluntary… and are stifling innovation.” This is why I sent a bipartisa...

Commissioner Allison Lee announces her departure from the SEC

Securities and Exchange Commissioner Allison Herren Lee announced that she would be stepping down from her post at the end of her term in June. In a Tuesday announcement, Lee said that she will remain in the role until her successor has been confirmed. The SEC commissioner has spent less than three years at her current position, having been sworn in in 2019 to serve out the remainder of a five-year term expiring in June. With her departure, Lee, a Democrat who replaced former commissioner Kara Stein, will create a second vacancy at the SEC, with another left open by Republican Elad Roisman, who announced he would be leaving in January. Commissioner Hester Peirce, known to many in the space as the “Crypto Mom,” is currently the sole Republican on the five-member commission....

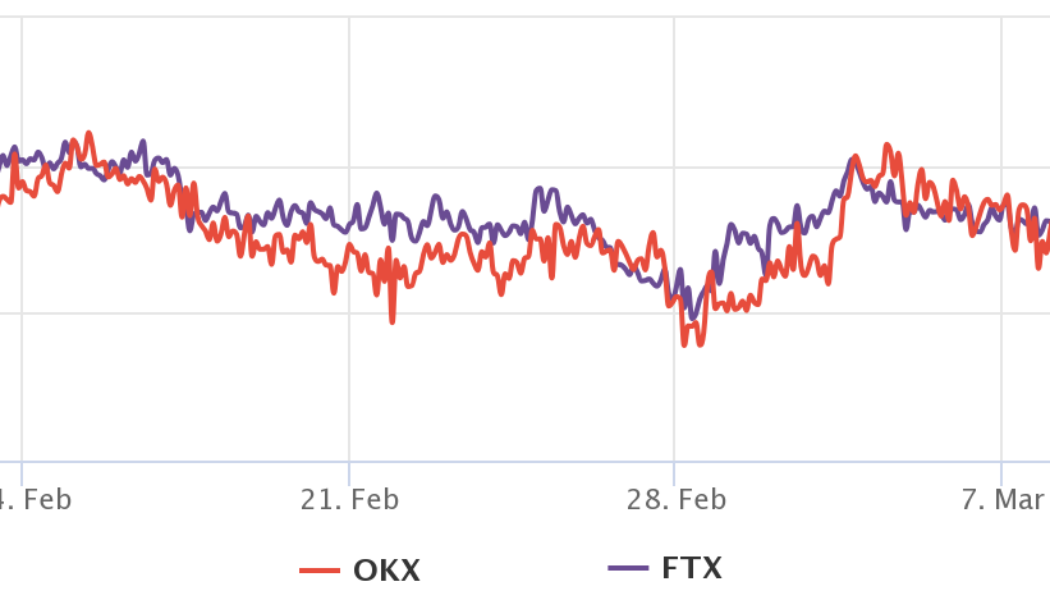

Bitcoin derivatives metrics reflect traders’ neutral sentiment, but anything can happen

Bitcoin’s (BTC) last daily close above $45,000 was 66 days ago, but more importantly, the current $39,300 level was first seen on Jan. 7, 2021. The 13 months of boom and bust cycles culminated with BTC price hitting $69,000 on Nov. 10, 2021. It all started with the VanEck spot Bitcoin exchange-traded fund being rejected by the United States Securities and Exchange Commission (SEC) on Nov. 12, 2020. Even though the decision was largely expected, the regulator was harsh and direct on the rationale backing the denial. Curiously, nearly one year later, on Nov. 10, 2021, cryptocurrency markets rallied to an all-time high market capitalization at $3.11 trillion right as U.S. inflation as measured by the CPI index hit 6.2%, a 30-year high. Inflation also had negative consequences on risk ma...

VanEck files for new ETF to track crypto and gold mining companies

VanEck, an investment firm with almost $82 billion in assets under management, has submitted an application to the United States Securities and Exchange Commission (SEC) for the launch of a new exchange-traded fund (ETF) that invests in gold mining and Bitcoin (BTC) mining companies. According to the SEC document filed on Thursday, the fund will focus on securities in an index that reflects the performance of gold mining and digital assets mining firms. It would not invest in cryptocurrencies directly or through derivatives. However, there was no ticker or cost ratio mentioned in the document. VanEck ETF Trust files with the SEC-VanEck Digital Assets Mining ETF https://t.co/pSaogEzRVW — Exchangetradedfunds (@ETFsinfo) March 8, 2022 The news of VanEck‘s proposed fund comes as concerns over ...

US SEC is probing possible violations in NFT offerings

The SEC is particularly interested in fractional NFTs The regulator has, over the last few months, reportedly demanded information on the matter from certain entities Enjoying a breakout onto the scene in 2021, the NFT sector grew to become a $40 billion market. However, the US Securities and Exchange Commission, SEC, has taken note of the digital collectables and is now exploring whether they have been used in ways that violate securities laws. According to a recently published report by Bloomberg, the Commission has initiated a probe into whether NFT offerings are securities in the last few months. The news outlet said that the SEC has been sending subpoenas to creators behind some NFTs and crypto exchanges to provide information on the said product offerings. Bloomberg, citing people fa...

Crypto firms may still face SEC penalties for self-reporting securities laws violations: Report

The U.S. Securities and Exchange Commission’s enforcement director has reportedly said cryptocurrency companies will not receive amnesty for reporting themselves for possible violations of securities laws. According to a Monday report from Reuters, the SEC director of the agency’s division of enforcement, Gurbir Grewal, said the agency may view crypto companies’ conduct “more favorably” if they reach out first for self-reporting securities law violations. However, he added that though firms may face smaller penalties, they will not be completely off the hook. “Our message to [crypto companies] is not, ‘Register your product and we’ll just ignore the billions you have under management in this crypto lending product and your violations of the securities laws,’” said G...

Law Decoded: Bitcoin’s censorship resistance capacity enters the spotlight, Feb. 14–21

Amid the barrage of last week’s regulatory news, from rumors of Joe Biden’s upcoming executive order on digital assets to another round of the Russian government’s crypto tug of war, the storyline that was arguably the most consequential for the mainstream narrative on the social effects of crypto has been the one around the Canadian government’s standoff with the Freedom Convoy. The government’s invocation of emergency powers to put down a protest movement — combined with the movement’s financial infrastructure being one of the main attack vectors — has led many observers to appreciate with renewed vigor Bitcoin’s capacity to resist state financial censorship. If a government as “civilized” as Canada’s can arbitrarily cut off a group it doesn’t like from the financial system, then any sta...

US SEC is investigating two of Binance.US trading affiliates

The regulator wants to establish the relationship between Binance.US and two affiliate firms associated with Changpeng Zhao Several US authorities have in the past, on more than one occasion, probed Binance over other compliance matters The US Securities and Exchange Commission (SEC) is looking into two trading firms associated with crypto exchange Binance’s US arm. The financial markets regulator is said to be investigating the relationship between Binance.US and these firms which hold ties with Binance CEO and founder Changpeng Zhao. According to a report published by The Wall Street Journal on Tuesday, Merit Peak Ltd and Sigma Chain AG are the entities in question. The two firms trade on Binance.US as market makers. The WSJ detailed that the unnamed sources said that the regulator is se...

Grayscale Bitcoin ETF proposal sees support from the public

The US Securities and Exchange Commission (SEC) made a provision for comments from the people on the subject of Grayscale converting its BTC Trust into a spot ETF The financial watchdog has in the past publicly shown inclination towards indirect crypto ETFs as opposed to spot ETFs Earlier this month, the SEC shared its concerns on the Grayscale Bitcoin Trust exchange-traded fund (ETF) conversion proposal – mostly revolving around manipulation, fraud and investor protection. The commission also expressed its uncertainty over the propriety of Bitcoin as the underlying asset, asking the public to give its views on the same. The agency set a 21-day window for providing the comments and 14 days for replies to the shared view. The US markets regulator has since received many comments regarding t...