Scams

Florida govt warns against auto warranty scammers asking crypto payments

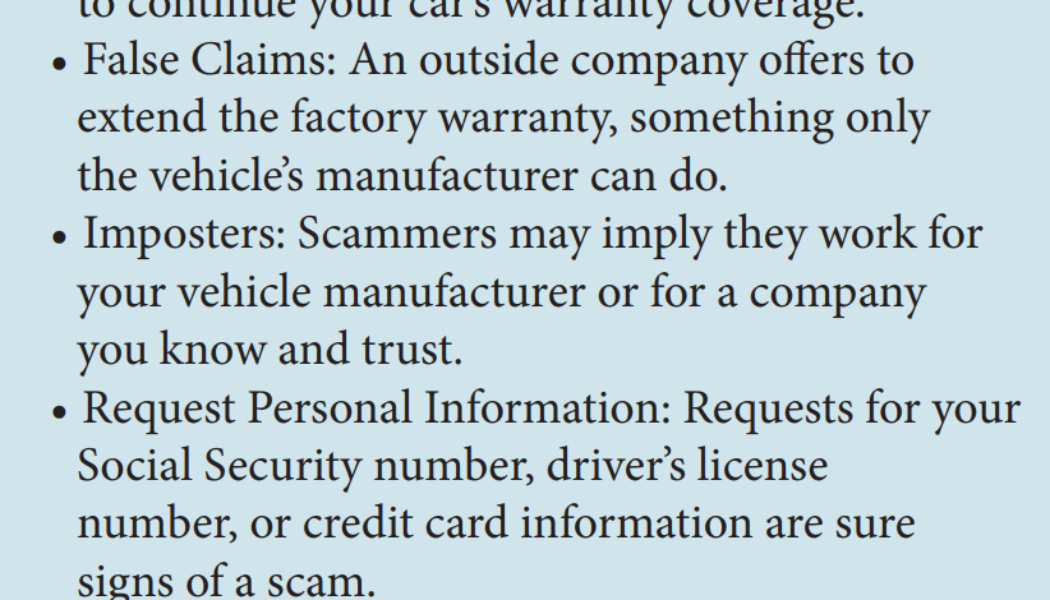

The Florida Department of Agriculture and Consumer Services (FDACS) issued a warning sharing insights into identifying robocall scam marketing auto warranties, which includes being asked to pay for the services via gift cards and cryptocurrencies. Consumer complaints against increasing robocall scams — wherein scammers use prerecorded calls to market and sell fraudulent services — led the Enforcement Bureau to order phone companies to avoid carrying robocall traffic. Regardless of the methods used by scammers to contact potential victims, the FDACS newsletter highlighted five red flags that indicate scams. Five red flags for identifying scams. Source: fdacs.gov Stressing on some of the go-to payment methods often being recommended by the scammers, the announcement read: “Payment...

Only 50 or so profiles out of 7,000 Binance employees on LinkedIn are real, says CZ

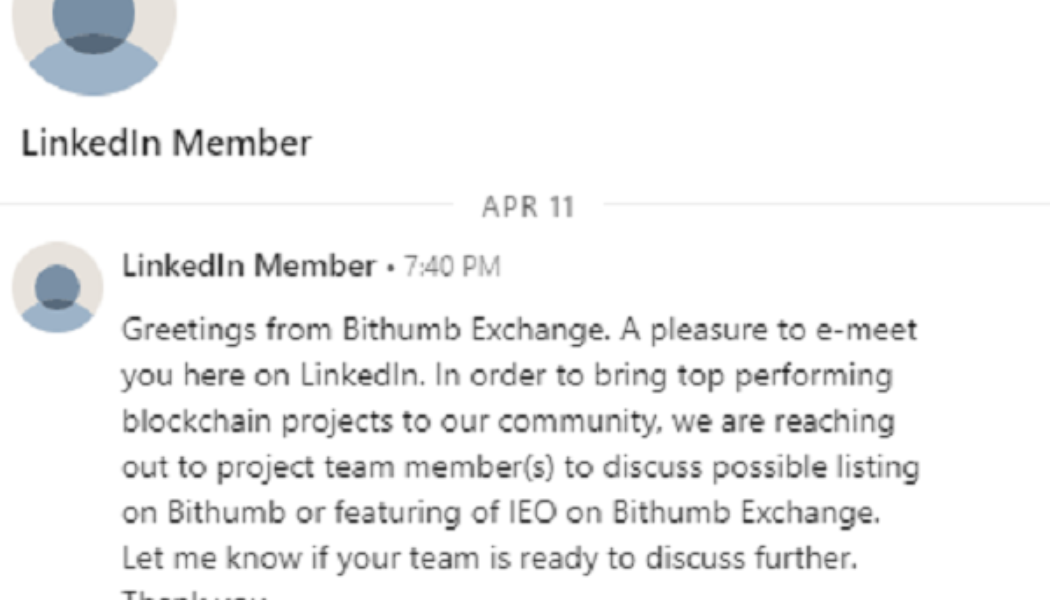

According to a Sunday Twitter post by Binance CEO Changpeng Zhao, also known as CZ, only about 50 out of 7,000 users claiming to be employees of the world’s largest cryptocurrency exchange on Linkedin are real. The crypto executive lamented the lack of a real-ID authentication system on Linkedin, saying: “I wished LinkedIn had a feature to let the company verify people. So, many “hey, I am responsible for listing” scammers on LinkedIn. Be careful.” The LinkedIn crypto scam typically begins as an unsolicited request from an apparent crypto exchange executive to project stakeholders regarding a potential token listing. Profiles are cleverly crafted to show years of experience in the industry, along with, multiple connections, sometimes up to 500-plus, to derive ...

Solana and Ethereum smart contract audits, explained

As you might expect, this depends on how complex a smart contract is. According to Hacken, this can extend to $500,000 for larger projects where there are more lines of code — not least because of the additional engineering hours it’ll take. The company argues these costs pale into comparison with the economic damage that a smart contract vulnerability can bring. Hacken cites data showing that, in 2021, 80% of the incidents affecting decentralized applications related to smart contracts — with losses hitting $6.9 billion. Breaking this down even further, and we can see that the average cost per project stands at $47 million. Somehow, $500,000 looks a lot less expensive now. Overall, 60% of its clients have been based on Ethereum so far in 2022. And here&...

CertiK shares security tips following third BAYC security compromise in six months

On June 4, the popular nonfungible token, or NFT, project Bored Ape Yacht Club (BAYC) suffered its third security compromise this year. Nearly 142 Ether (ETH) ($250,000) worth of NFTs was stolen after hackers gained access to the Discord account of a BAYC community manager and posted a message with a link to a fake website. The link advertised a limited-time free-NFT giveaway to users who connected their wallets, which were then drained of NFTs. During two prior occasions in April, hackers breached BAYC’s Discord and Instagram pages and managed to siphon 91 NFTs, worth over $1.3 million at the time of the second attempt, via a phishing link. As told by blockchain security firm CertiK, hackers quickly moved stolen funds to obfuscation platform Tornado Cash, making it imposs...

Hacker tastes own medicine as community gets back stolen NFTs

The tales of traders getting scammed out of their nonfungible tokens (NFTs) were quite common at the peak of the NFT boom. However, in an interesting turn of events, the Solana community came together to “scam” a scammer in order to get back some stolen NFTs. It all started with the Discord channel hack of cross-chain gaming development studio Uncharted NFT, where scammers managed to drain out 109 user wallets. The scammers got away with 150+ SOL tokens and 25 World of Solana (WOS) NFTs, including three rare and highly valuable digital collectibles. 2/It all began when @UnchainedNFT_ Discord got hacked two days ago. A hacker drained the wallet of 109 users for a total of 150+ $SOL. The most affected person was a WOS whale with 25 WOS NFTs that got stolen. This whale also owned 3 top ...

Crypto spam increases 4000% in two years: LunarCrush

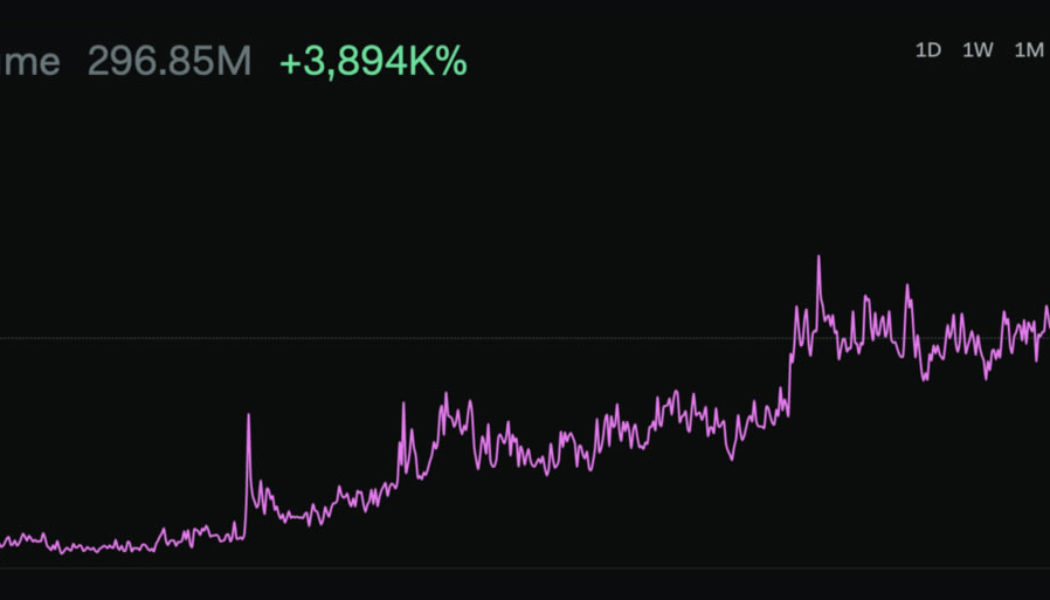

Spam and bots have been the bane of anyone that uses the internet for years, but recently this digital scourge has ramped up activity in the crypto sector in a big way. Crypto intelligence provider LunarCrush has revealed spam in the cryptosphere has increased by an astonishing 3,894%. The firm has been collecting crypto-specific social data since 2019, and says not only is spam at an all-time high, it’s also “the fastest growing metric on social media.” The findings were published in a May 25 report, stating that “more spam accounts than you would think are actually people.” For this reason, it is often a challenge for software to detect and flag spam. Spam Volume collected by LunarCrush over the previous 2 years Twitter is the social media platform of choice for the crypto industry...

3 red flags that signal a crypto project may be misleading investors

Satoshi Nakamoto left a large pair of shoes to fill after releasing the code for Bitcoin (BTC) to the world, helping to establish the network, then vanishing without so much as a trace. Over the years, the crypto ecosystem has seen many developers and protocol creators rise in stature to become crypto messiahs for faithful holders who eventually have their best-laid plans end in catastrophe when the protocol is hacked, rugged or abandoned by whimsical developers. 2022 is hardly halfway complete and the year has already seen a particularly bad stretch of good intentions gone awry, which have collectively helped plunge the market into bear-market territory. Here’s a closer look at each of these instances to help provide insight into how similar outcomes can be avoided in the future. So...

NFT scams: How to avoid becoming a victim

When you’re an active NFT trader, you can’t avoid all the scams in the world of nonfungible tokens. The most common NFT scams are phishing, counterfeit NFTs and pump-and-dumps. The year 2021 was a breakthrough for nonfungible tokens (NFTs). But when something gets popular like decentralized finance (DeFi) and the newest version of the Web called Web3, there are also risks involved. Follow the money is advice you don’t have to give hackers twice. Last year, hackers took home $14 billion from crypto-related hacks and still, cryptocurrency crime numbers have risen 79% — and the risk is not over yet. But how do NFT traders protect themselves from getting scammed? First of all, educate yourself. By understanding the most common NFT sca...

$1 million rock NFT sells for a penny in all ore nothing error

It’s a hard rock life for one crypto user. A clumsy keystroke and the actions of a sniper bot caused a million-dollar mistake on March 10. A rock valued at 444 Ether (ETH), or $1.2 million, sold for 444 Wei ($0.0012) to a bot as the seller, DinoDealer, confused WEI and ETH. In a tweet, the seller said “in one click my entire net worth of ~$1 million dollars, gone.” How’s your week? Mine? I just erroneously listed @etherrock #44 for 444 wei instead of 444 eth♂️ Bot sniped it in the same block and trying to flip for 234 eth In one click my entire net worth of ~$1 million dollars, gone Is there any hope? Am I GMI? Can snipers show mercy? pic.twitter.com/yq9Itb2Ukb — Rock dust (@dino_dealer) March 10, 2022 The “bot sniped” refers to bot sniper...

DOJ indicts BitConnect’s Indian founder for $2.4B crypto Ponzi scheme

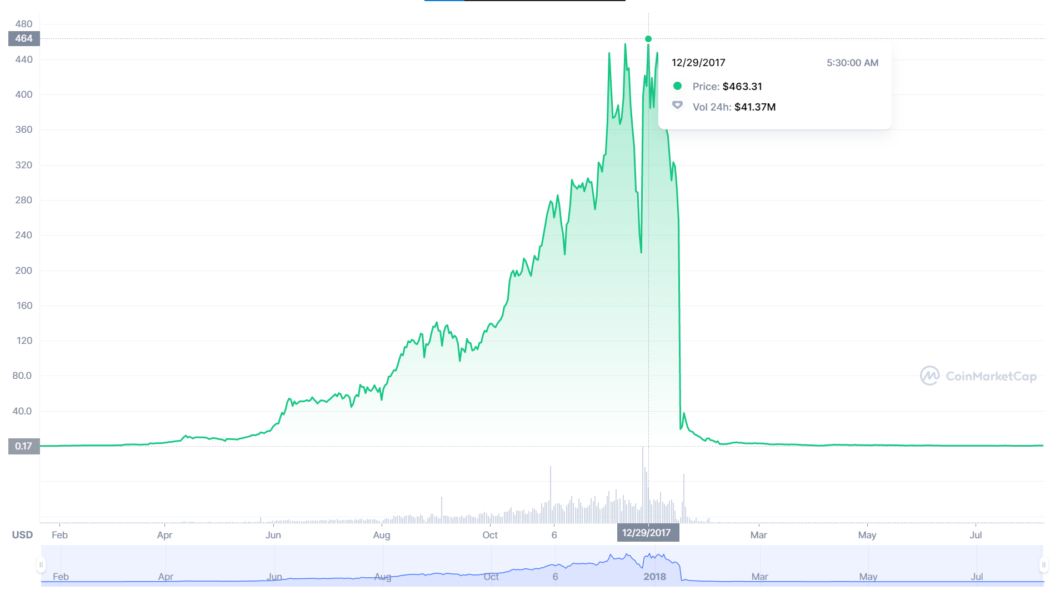

The founder of the infamous crypto exchange BitConnect, Satish Kumbhani, has been charged for allegedly misleading investors globally and defrauding them of $2.4 billion in the process. According to the Department of Justice (DOJ), a San Diego-based federal grand jury specifically charged Kumbhani for orchestrating the alleged Ponzi scheme via BitConnect’s “Lending Program”: “BitConnect operated as a Ponzi scheme by paying earlier BitConnect investors with money from later investors. In total, Kumbhani and his co-conspirators obtained approximately $2.4 billion from investors.” BitConnect (BCC) price history. Source: CoinMarketCap Back in 2017 amid the hype, BitConnect (BCC) recorded an all-time high of $463.31 in trading price, which according to the DOJ reached a peak market capitalizati...

Counterfeit NFTs result in marketplace shutdown: Experts weigh in

“Rampant” issues relating to minting counterfeit nonfungible tokens, or NFTs, have forced popular platform Cent to halt some operations. Founded in 2017, Cent kicked off as a “social network and informal platform for creative experimentation.” In 2020, the team also launched an NFT platform called Valuables to mint and auction iconic tweets. Jack Dorsey’s first tweet, “just setting up my twttr,” sold for $2.9 million on the platform in March last year. On February 6th, the platform ceased NFT trading due to “a spectrum of activity” that “shouldn’t be happening.” Cameron Hejazi, co-founder of Cent told Cointelegraph: “People in this space tend to cry ‘caveat emptor’ or ‘buyer beware’ but protecting creators from those who might steal or abuse their work —...