Scaling

Optimism and Arbitrum flip Ethereum in combined transaction volume

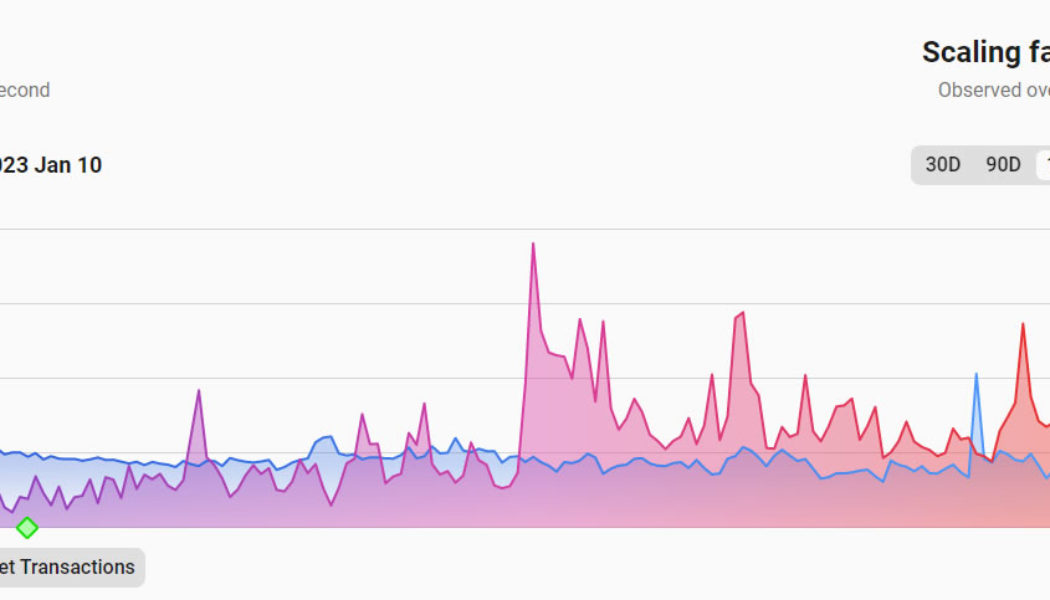

Ethereum layer-2 on-chain activity has been increasing to the extent that the leading two networks now process more transaction volume than mainnet Ethereum. Layer-2 networks Arbitrum and Optimism have seen an increase in transactions over the past three months. Comparatively, aside from a few spikes, transactions on the Ethereum network have declined by around 33% since late October, according to Etherscan. This has enabled the two L2s combined to flip Ethereum for this metric, according to Dune Analytics data. The chart shows Ethereum processed over 1.06 million transactions on Jan. 10, whereas Arbitrum and Optimism combined processed over 1.12 million transactions. Additionally, Optimism has now surpassed Arbitrum in terms of daily transactions following a steady uptrend in activity sin...

Polygon gains 83% in a month, but data show project has been losing traction

Polygon (MATIC) had a promising July, gaining an impressive 83% in 30 days. The smart contract platform uses layer-2 scaling and aims to become an essential Web3 infrastructure solution. However, investors question whether the recovery is sustainable, considering lackluster deposits and active addresses data. MATIC/USD on FTX. Source: TradingView According to Cointelegraph, Polygon rallied after being selected for the Walt Disney Company’s accelerator program to build augmented reality, nonfungible token (NFT) and artificial intelligence solutions. Polygon announced on July 20 plans to implement a zero-knowledge Ethereum Virtual Machine (zkEVM), which bundles multiple transactions before relaying them to the Ethereum (ETH) blockchain. In a recent interview with Cointelegraph, Polygon...

Avalanche (AVAX) price drops 45% in a month and data points to further downside

Avalanche (AVAX) is down 45% in 30 days and in the same time the cryptocurrencies’ total market capitalization shrank by 29%. Despite the recent downturn, this decentralized application (DApp) platform remains a top contender in the layer1 and layer2 race and it ranks high in terms of smart contract deposits and active addresses. Yet, the lackluster token price is still causing investors to rethink whether the network remains a “serious” competitor. AVAX token/USD at FTX. Source: TradingView The brutal sell-off on risk assets caused AVAX to test the $14.80 support multiple times, while the current market capitalization stands at $4.8 billion. It’s important to also note that the network’s total value locked (TVL) holds an impressive $3.2 billion. As a comparison, Solana (SOL) o...

AVAX traders anticipate a new ATH even as Avalanche DApp use slows

Avalanche (AVAX) jumped 43.8% between March 14 and March 31 to a $97.50 daily close, which is the highest level since Jan. 5. This layer-1 scaling solution uses a proof-of-stake (PoS) model and has amassed $9 billion in total value locked (TVL) deposited on the network’s smart contracts. AVAX token/USD at FTX. Source: TradingView Subnet adoption propels the recent price rally Some analysts attribute the rally to Avalanche’s incentive program to accelerate the adoption of subnets which was announced on March 9. According to the Avalanche Foundation, subnets enable functions that are only possible with “network-level control and open experimentation.” The program will allocate up to four million AVAX, worth roughly $340 million, to fund decentralized applications focused on gaming, nonfungib...

Klaytn token down 15% in a month, but network’s TVL shows resilience

Klaytn (KLAY) had a promising start in March 2021, reaching an impressive $11 billion market capitalization following its debut. However, investors have exaggerated their expectations as the token’s current total value stands at $3 billion, down roughly 70%. KLAY/USD on Binance. Source: TradingView Although not as well known as the leading smart contract blockchains, Klaytn remains a top-35 token by capitalization rank. Moreover, the network holds $1.2 billion worth of deposits locked on smart contracts. Capital locked on smart contracts is known in the industry as total value locked, or TVL. Real use cases and strong backing Klaytn is a flexible modular network architecture created by Kakao, a publicly-traded South Korean internet giant. The Asian tech group’s shares are value...

Polygon’s focus on building L2 infrastructure outweighs MATIC’s 50% drop from ATH

After a devastating 50% correction between Dec. 25 and Jan. 25, Polygon (MATIC) has been struggling to sustain the $1.40 support. While some argue this top-15 coin has merely adjusted after a 16,200% gain in 2021, others point to competing scaling solutions growth. MATIC token/USD at FTX. Source: TradingView Either way, MATIC remains 50.8% below its all-time high at an $11 billion market capitalization. Currently, the market cap of Terra (LUNA) stands at $37 billion, Solana (SOL) is above $26 billion and Avalanche (AVAX) is at a $19 billion market value. A positive note is that Polygon raised $450 million on Feb. 7, and the funding round was backed by some of blockchain’s most considerable venture funds, including Sequoia Capital. Polygon offers scaling and infrastructure support to Ethere...

Coinbase exec says major Ethereum scaling improvements coming soon

Coinbase Chief Product Officer Surojit Chatterjee is the latest to publish his predictions for the crypto industry in 2022 and he foresees major advances in the scaling of Ethereum. Industry leaders, analysts, and investors are sharing their 2022 predictions for the crypto ecosystem, and Coinbase’s Surojit Chatterjee is confident that Ethereum will be at the forefront of Web3 and the crypto-economy as it scales. The CPO shared his predictions in a company blog post on Jan. 4 in which he stated that Ethereum scalability will improve but alternative layer 1 networks will also see traction. “I am optimistic about improvements in Eth scalability with the emergence of Eth2 and many L2 rollups.” He added that newer layer 1 networks focused on gaming and social media will also emerge. Chatterjee ...

Assembly announces $100M capital raise, receives praise from Iota co-founder Dominik Schiener

On Friday, Assembly, a decentralized layer one smart contract network built within the Iota ecosystem, announced it had raised $100 million from private investors, including LD Capital, HyperChain Capital and Huobi Ventures. The project stated that the funds will be used to accelerate the development of decentralized finance protocols, nonfungible tokens (NFTs) and play-to-earn crypto games. Iota is a blockchain designed for facilitating Internet-of-Things transactions. Its proprietary technology consists of a system of decentralized acyclic graphs that can connect to one another in multiple vectors as opposed to in-series as with a regular blockchain. As a result, one new block can validate two other blocks, leading to self-sustainable transaction verification. This allegedly leads to the...