Scalability

App-specific blockchains remain a promising solution for scalability

App-specific blockchains, or appchains, are specifically designed to support the creation and deployment of decentralized applications (DApps). In an appchain, each app runs on its separate blockchain, linked to the main chain. This allows for greater scalability and flexibility, as each app can be customized and optimized for its specific use case. Appchains are also an alternative solution for scalability to modular blockchains or layer-2 protocols. Appchains present similar characteristics to modular blockchains, as it is a type of blockchain architecture that separates the data, transaction processing and consensus processing elements into distinct modules that can be combined in various ways. These can be thought of as “pluggable modules” that can be swapped out or combined depending ...

Celestia Foundation raises $55M for modular blockchain architecture

Celestia Foundation announced on Oct. 18 that it had raised $55 million in a funding round led by Bain Capital Crypto, Polychain Capital, Placeholder, Galaxy, Delphi Digital, Blockchain Capital, NFX, Protocol Labs, Figment, Maven 11, Spartan Group, FTX Ventures, Jump Crypto, and angel investors; Balaji Srinivasan, Eric Wall, and Jutta Steiner. Celestia is building a modular blockchain architecture with the hope of solving challenges inherent when deploying and scaling blockchains. The company suggested that it intends to build infrastructure that will make it easy for anyone with the technical know-how to deploy their own blockchain at minimal expense. The company indicated that its modular blockchain architecture will focus on improving scalability, shared security, and sovereignty issues...

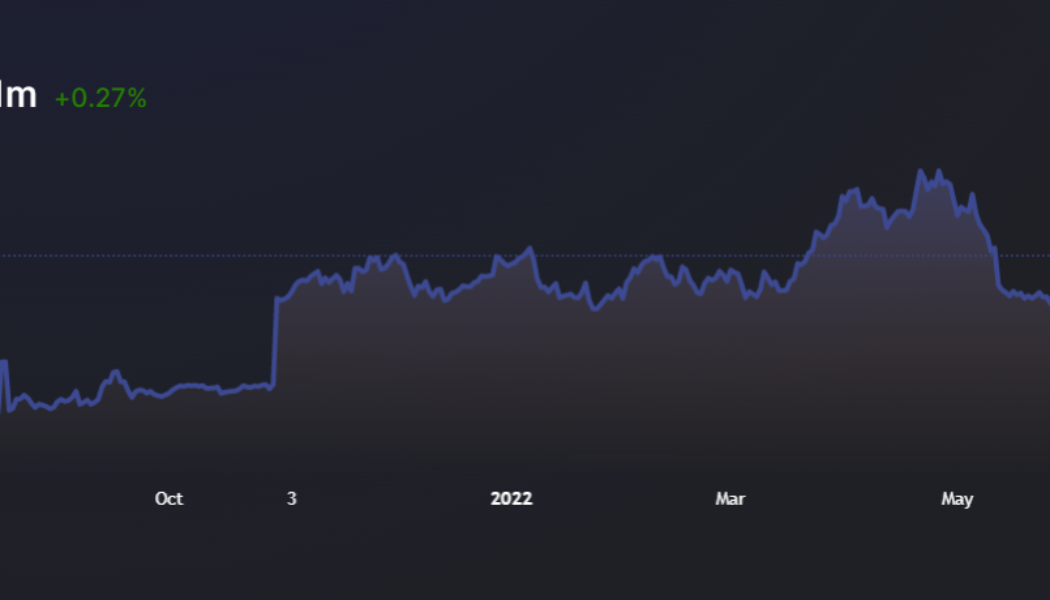

Helium devs propose ditching its own blockchain for Solana

Internet of Things (IoT) blockchain network Helium could transition to the Solana blockchain following a new HIP 70 governance proposal launched on Aug. 30. The Helium core developers said the need to “improve operational efficiency and scalability” was required in order to bring “significant economies of scale” to the network. The Helium network operates by users installing a Helium Hotspot to provide decentralized wireless 5G network coverage for internet users in their area. Helium uses a unique consensus mechanism — proof-of-coverage to verify network connectivity and distribute HNT tokens to Helium Hotspot providers when coverage is verified. The proposal comes as Helium developers have emphasized the need to fix a number of technical issues in order to improve the network’s cap...

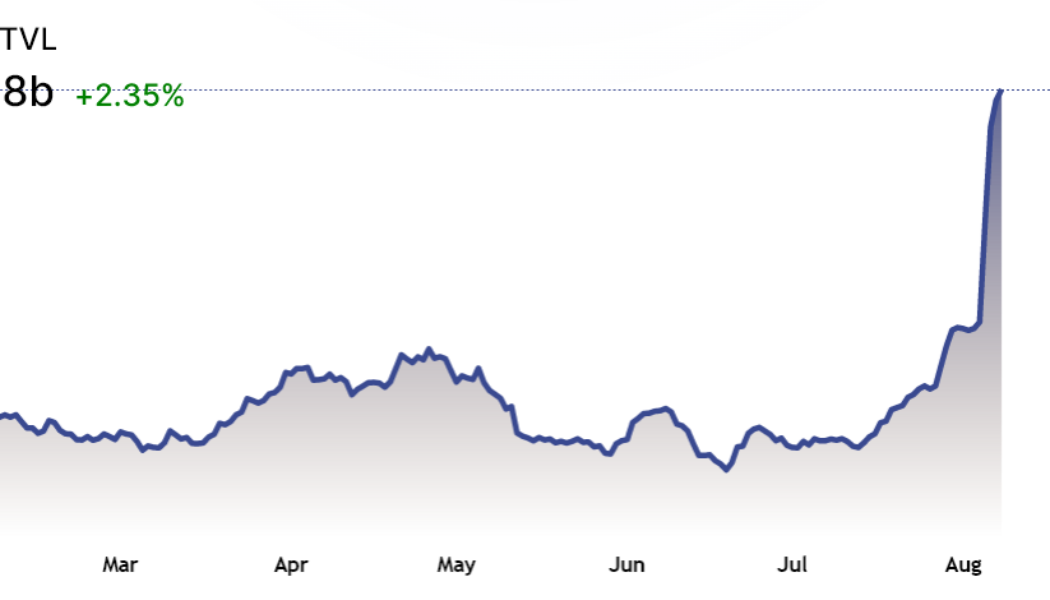

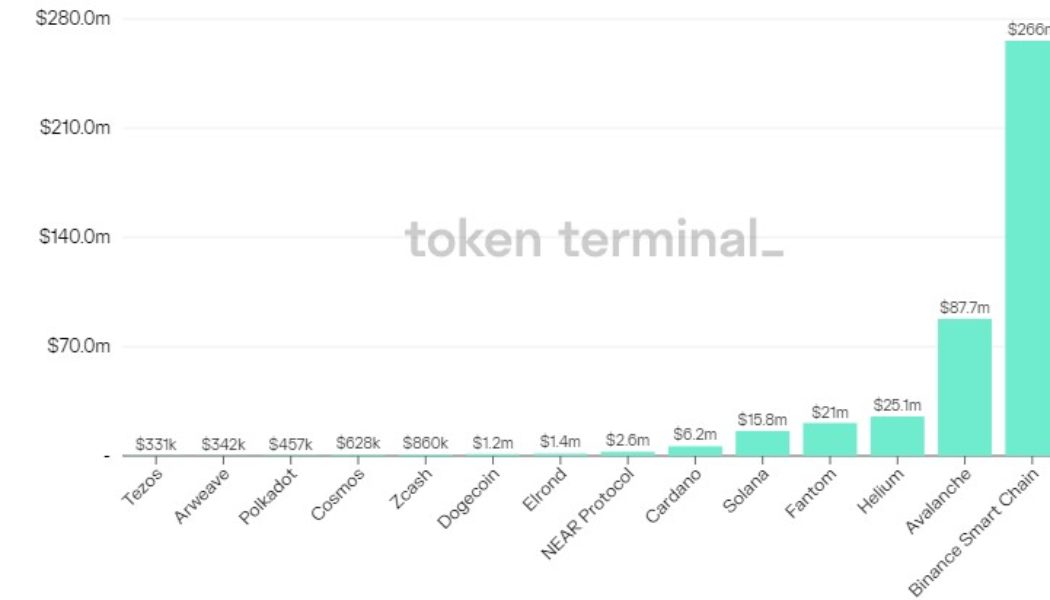

Total value locked in DeFi dropped by 66%, but multiple metrics reflect steady growth

The aggregate total value locked (TVL) in the crypto market measures the amount of funds deposited in smart contracts and this figure declined from $160 billion in mid-April to the current $70 billion, which is the lowest level since March 2021. While this 66% contraction is worrying, a great deal of data suggests that the decentralized finance (DeFi) sector is resilient. The issue with using TVL as a broad metric is the lack of detail that is not shown. For example, the number of DeFi transactions, growth of layer-2 scaling solutions and venture capital inflows in the ecosystem are not reflected in the metric. In DappRadar’s July 29 Crypto adoption report, data shows that the DeFi 2Q transaction count closed down by 15% versus the previous quarter. This figure is far less concerning...

Ethereum will outpace Visa with zkEVM Rollups, says Polygon co-founder

zkEVM Rollups, a new scaling solution for Ethereum, will allow the smart contract protocol to outpace Visa in terms of transaction throughput, said Polygon co-founder Mihailo Bjelic in a recent interview with Cointelegraph. Polygon recently claimed to be the first to implement a zkEVM scaling solution, which aims at reducing Ethereum’s transaction costs and improving its throughput. This layer-2 protocol can bundle together several transactions and then relay them to the Ethereum network as a single transaction. The solution, according to Bjelic, represents the Holy Grail of Web3 as it offers security, scalability and full compatibility with Ethereum, which means developers won’t have to learn a new programing language to work with it. “When you launch a scaling solution,...

The Merge is Ethereum’s chance to take over Bitcoin, researcher says

Ethereum researcher, Vivek Raman, is convinced that Ethereum’s (ETH) upcoming transition to a proof-of-stake system will enable it to take over Bitcoin’s (BTC) position as the most prominent cryptocurrency. “Ethereum does have, just from an economic perspective and because of the effect of the supply shock, a chance to flip Bitcoin,” said Raman in an exclusive interview with Cointelegraph. [embedded content] The Merge, a long-awaited upgrade that will complete Ethereum’s transition from a proof-of-work to a proof-of-stake system, is set to take place in September. In addition, The Merge will transform Ethereum’s monetary policy, making the network more environmentally sustainable and reducing ETH’s total supply by 90%. “After The Merge, Ether...

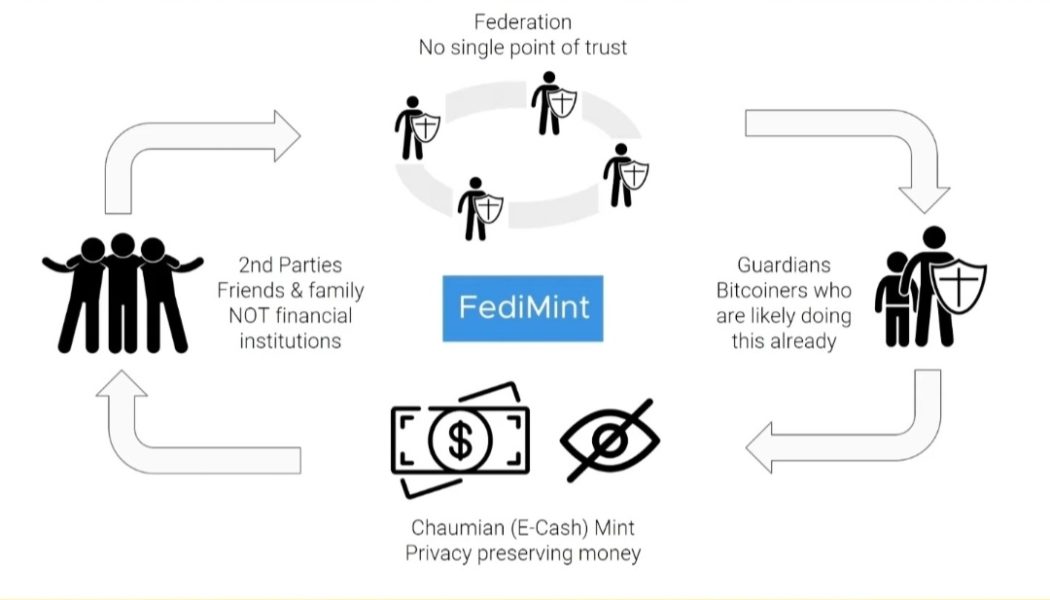

Bitcoin is for billions: Fedimint on scaling BTC in the global south

“Bitcoin is for billions, not billionaires,” a phrase first coined by investment researcher Lyn Alden, could soon become a reality, according to Fedimint. The protocol that aims to scale Bitcoin (BTC) while making it more private, has been buoyed by a $4.2 million seed round for the Fedi application. Cointelegraph spoke to Obi Nwosu, co-founder and CEO of Fedi, about the “incredible group of inspiring people who we are working with to support their activities to increase the freedoms of some of the most oppressed regions of the world,” and why the mobile app Fedi could solve issues related to scaling, custody and privacy. Lyudmyla Kozlovska, head of the Open Dialogue Foundation — which focuses on supporting people in post-soviet Europe — Farida Bemba Nabourema, a Togolese human right...

Can Cardano’s July hard fork prevent ADA price from plunging 60%?

Cardano (ADA) has started painting a bearish continuation pattern on its longer-timeframe charts, raising its likelihood of undergoing a major price crash by August. ADA price in danger of a 60% plunge Dubbed the “bear pennant,” the pattern forms when the price consolidates inside a range defined by a falling trendline resistance and rising trendline support after a strong move downside. Additionally, the consolidation moves accompany a decrease in trading volumes. Bear pennants typically resolve after the price breaks below their trendline support and, as a rule, could fall by as much as the height of the previous big downtrend, called a “flagpole,” as illustrated in the chart below. ADA/USD three-day price chart featuring “bear pennant'”setup. So...

TrueFi launches on Optimism, expanding access to on-chain credit

Unsecured lending protocol TrueFi has become the latest project to launch on Optimism, Ethereum’s popular layer-2 scaling solution, in a move that’s expected to boost demand from non-institutional lenders. By launching on Optimism, TrueFi’s lender community will have access to a faster and cheaper user experience, as well as gain exposure to a wider pool of retail lenders. “TrueFi users can now lend, borrow and launch portfolios on Optimism to enjoy dramatically reduced transaction costs and network speeds,” Rafael Cosman, co-founder of TrustToken, told Cointelegraph in a written statement. He further explained: “Since Optimism transactions are on average 77x cheaper than Ethereum, we expect greater adoption from non-institutional lenders, hopefully increasing global access to TrueFi...

Hop Protocol reveals details of Hop DAO and Optimism-style airdrop

Hop Protocol, a cross-chain bridge designed to facilitate the quick transfer of tokens between different Ethereum Layer-2 scaling solutions, has unveiled a new governance model alongside an airdrop that will see early users receive 8% of the total supply of soon-to-be-released HOP tokens. Similar to Optimism, which recently unveiled a new governance structure that will see early users airdropped 5% of the total supply of the OP token — Hop Protocol is aiming to create a community-oriented governance model, called Hop DAO, that seeks to aid Layer-2 scalability. An official date for the airdrop is yet to be announced. repost: There will be an initial supply of 1b $HOP tokens: • 8% airdropped to early users• 60.5% to the Hop treasury• 22.45% to the initial development team (3 yr vesting, 1 ye...

The birth of ‘Ethereum killers’: Can they take Ethereum’s throne?

Ethereum has proven to be a formidable force. While its major issues have spawned other coins aimed at addressing them, Ethereum looks to shed its old skin with the release of Ethereum 2.0. Despite the fact that Ethereum was created six years after Bitcoin (BTC) and the introduction of blockchain technology, the digital asset Ether (ETH) has grown to be the second most valuable cryptocurrency in terms of market capitalization, surpassing coins such as Litecoin (LTC), Ripple (XRP), Dash (DASH) and Monero (XMR), which were launched before it. The technology behind the Ethereum blockchain is the primary reason for its meteoric rise. Vitalik Buterin, the Canadian-Russian programmer and co-founder of Ethereum, explained to Business Insider that the Ethereum blockchain is intended to address Bit...

- 1

- 2