SBF

Sam Bankman-Fried deepfake attempts to scam investors impacted by FTX

A faked video of Sam Bankman-Fried, the former CEO of cryptocurrency exchange FTX, has circulated on Twitter attempting to scam investors affected by the exchange’s bankruptcy. Created using programs to emulate Bankman-Fried’s likeness and voice, the poorly made “deepfake” video attempts to direct users to a malicious site under the promise of a “giveaway” that will “double your cryptocurrency.” Over the weekend, a verified account posing as FTX founder SBF posted dozens of copies of this deepfake video offering FTX users “compensation for the loss” in a phishing scam designed to drain their crypto wallets pic.twitter.com/3KoAPRJsya — Jason Koebler (@jason_koebler) November 21, 2022 The video uses appears to be old interview footage of Bankman-Fried and used a voice emulator to...

FTX leadership pressed for information by US subcommittee chairman

The former and current CEOs of the bankrupt FTX cryptocurrency exchange have been pressed by the chair of a United States House subcommittee calling for documents relating to the exchange’s finances. “FTX’s customers, former employees, and the public deserve answers,” Raja Krishnamoorthi, Chairman of the Subcommittee on Economic and Consumer Policy wrote in a Nov. 18 letter addressed to both former FTX CEO Sam Bankman-Fried and the exchange’s current CEO John J. Ray III, who took over in the wake of FTX’s bankruptcy filings. Krishnamoorthi added the subcommittee was “seeking detailed information on the significant liquidity issues faced by FTX, the company’s abrupt decision to declare bankruptcy, and the potential impact of these actions on customers who used your exchange.” He...

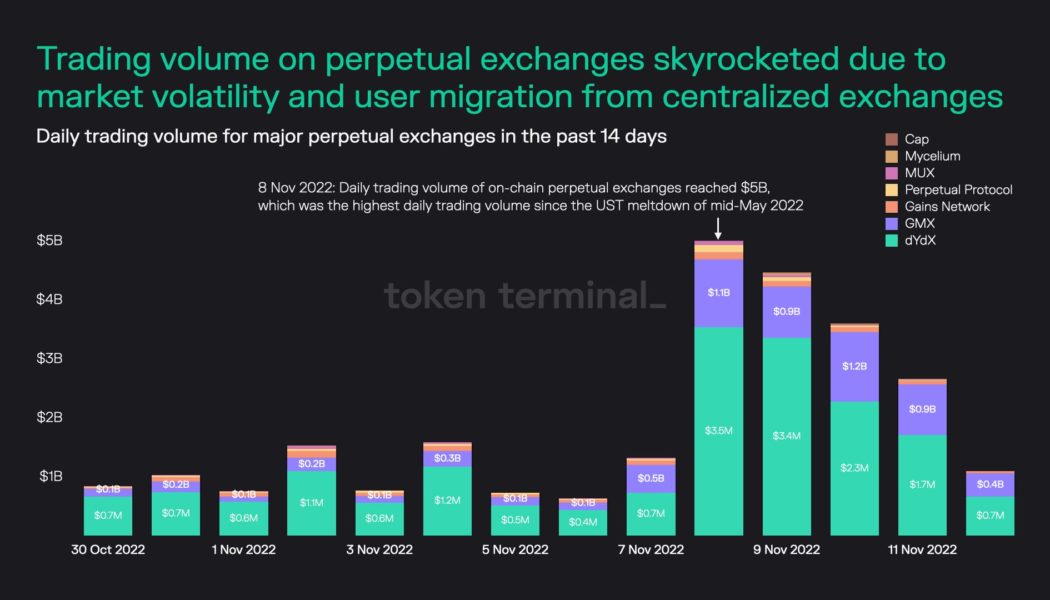

FTX is done — What’s next for Bitcoin, altcoins and crypto in general?

2022 was a tough year for crypto, and November was especially hard on investors and traders alike. While it was incredibly painful for many, FTX’s blowup and the ensuing contagion that threatens to pull other centralized crypto exchanges down with it could be positive over the long run. Allow me to explain. What people learned, albeit in the hardest way possible, is that exchanges were running fractional reserve-like banks to fund their own speculative, leveraged investments in exchange for providing users with a “guaranteed” yield. Somewhere across the crypto Twitterverse, the phrase “If you don’t know where the yield comes from, you are the yield!” is floating around. This was true for decentralized finance (DeFi), and it’s proven true for centralized crypto exchanges and platforms...

Binance to liquidate its entire FTX Token holdings after ‘recent revelations’

The CEO of cryptocurrency exchange Binance, Changpeng “CZ” Zhao, said his company will liquidate the entirety of its position in FTX Token (FTT), the native token of competing exchange FTX. In a Nov. 6 tweet, Zhao said the decision was made after “recent revelations that have came to light.” In a later tweet, CZ explained the FTT liquidation was “just post-exit risk management” referring to lessons learned from the fall of Terra Luna Classic (LUNC) and how it impacted market players. He also added “we won’t support people who lobby against other industry players behind their backs.” Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won’t pretend to make love after divorce. We are not against anyone. But we won’t supp...

Bankman-Fried ‘100%’ supports knowledge tests for retail derivatives traders

The founder and CEO of cryptocurrency exchange FTX, Sam Bankman-Fried has backed the idea of knowledge tests and disclosures to protect retail investors but said it shouldn’t just be crypto-specific. Bankman-Fried tweeted his thoughts in response to an idea floated by the Commodities Future Trading Commission (CFTC) commissioner Christy Goldsmith Romero on Oct. 15, saying the establishment of a “household retail investor” category for derivatives trading could give greater consumer protections. Romero said due to crypto, more retail investors are entering the derivatives markets and called for the CFTC to separate these investors from professional and high-net-worth individuals and have “disclosures written in a way that regular people understand or could be used when weighing ru...

Crypto conspiracy theories abound, but prop traders are just doing their job

Alameda Research is a cryptocurrency trading firm and liquidity provider founded by crypto billionaire Sam Bankman-Fried (SBF). Before founding his firm in 2017, SBF spent three years as a trader at the quantitative proprietary trading giant Jane Street Capital, which specializes in equity and bonds. In 2019, SBF founded the crypto derivatives and exchange FTX, which has quickly grown to become the fifth-largest by open interest. The Bahamas-based exchange raised $400 million in January 2022 and was valued at $32 billion. FTX’s global derivatives exchange business is separate from FTX US, another entity controlled by SBF, which raised another $400 million from investors including the Ontario Teachers Pension and SoftBank. The self-made billionaire has big dreams, like purchasing ...

Speed, scaling, regulation to play key role for crypto in 2022: FTX CEO

FTX founder and CEO Sam Bankman-Fried, also known as “SBF,” rounded off 2021 on an optimistic note. SBF waxed lyrical about the crypto market’s state in 2021 while revealing the roadmap for FTX in 2022 in a Twitter flood. In his view, there are three keystones to industry progress in 2022: regulation, scaling and transaction speeds. He proposes solutions to each puzzle piece, referencing his exchange’s involvement. On regulation, SBF states stablecoins could be better reported and audited. In line with FTX stablecoin policies, he said more transparency would solve “80% of the problems while allowing stablecoins to thrive onshore.” Meanwhile, better markets oversight and an anti-fraud-based regime for token issuances could address other regulatory gaps. Secondly, while crypto users number s...

- 1

- 2