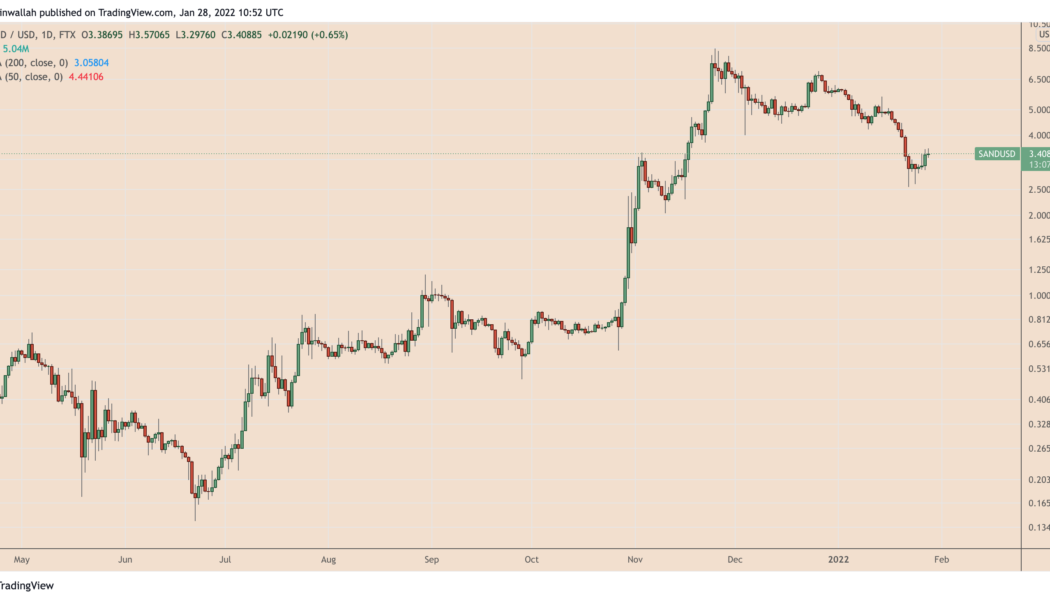

Sandbox

Nifty News: Trump NFTs surge 800%, Yuga Labs blacklists NFT exchanges and more

Trump NFTs daily sales surge by 800% Former United States President Donald Trump’s nonfungible token (NFT) trading card collection has recently witnessed a massive resurgence in daily sales volume. Compared to Jan. 17 sales volumes, Jan. 18 and 19 saw spikes of 800% and 600% respectively, according to market metrics aggregator Cryptoslam. Some pundits believe the renewed interest could be due to his imminent return to social media networks, following reports that the former president was seeking to rejoin Facebook and Twitter ahead of the 2024 presidential election campaign. NFT Watch: Trump Digital Trading Cards see 88% increase in floor price in the past 24 hours following news of his plans to return to Twitter. : https://t.co/P6W2uHx0Sr pic.twitter.com/IJogZR6yR4 — CoinGecko (@coingecko...

Qatar exploring digital banks and central bank digital currencies

The Qatar Central Bank (QCB) is reportedly investigating the possibility of launching a digital currency and issuing digital bank licenses. According to the head of the fintech section at QCB, Alanood Abdullah Al Muftah, the central bank is expected to set a direction for its future focus soon on a range of fintech verticals. Al Muftah noted that QCB will also determine whether Qatar can establish a central bank digital currency (CBDC). She explained: “Each central bank should study digital banks, considering their growing significance in the global market. We also see the direction of the market moving toward having a digital currency. However, it’s still being studied whether we’re having a digital currency or not.” While commenting on Qatar’s re...

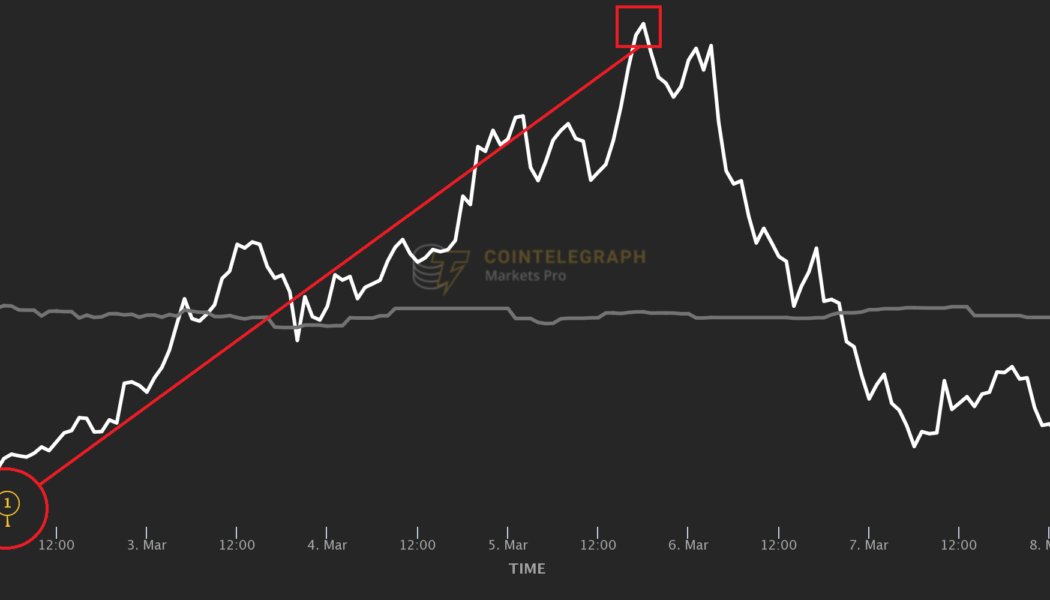

3 times in March that savvy crypto traders bought breaking news for the price of a rumor

As an old saying goes: Buy the rumor, sell the news. As a digital-native asset class, the prices of cryptocurrencies are clearly susceptible to market-moving news developments that instantly spread on the internet. Staying on top of bullish announcements can help crypto traders reap huge gains, but navigating the crypto news landscape can be daunting. Two major roadblocks get in the way: the abundance of potentially relevant information and the difficulty of making sure one is always among the first to learn the news that really matters. Extensive research shows that three types of crypto-related developments move digital asset prices most consistently: listings, staking announcements and big partnerships. This insight somewhat narrows down the scope of the developments that will most inte...

Coronavirus: CBN doubles loan disbursement to N300 billion – bank governor

The Central Bank of Nigeria (CBN) says it plans to double the Targeted Credit Facility (TCF) from the initial N149.21 billion to N300 billion following the resounding success recorded in the disbursement of the Covid-19 loans to the applicants. In his keynote address at the 2nd virtual seminar for Finance Correspondents and Editors at the weekend, the Governor said the Bank took the decision in order to accommodate many more beneficiaries as well as boost consumer expenditure which would positively stimulate the economy. He disclosed that the CBN initially created a N150 billion Targeted Credit Facility (TCF) for affected households and small and medium enterprises through the NIRSAL Microfinance Bank, adding that already, N149.21 billion has been disbursed to 316,869 beneficiaries. “Given...