Sanctions

Japan plans to tighten crypto exchange regulation to enforce sanctions

Japan plans to amend its Foreign Exchange and Foreign Trade Act to bring crypto exchanges under the purview of laws that govern banks, a government official revealed on Monday. The proposed amendment is being carried out to prevent sanctioned countries from taking evasive actions using digital assets. Chief Cabinet Secretary Hirokazu Matsuno in a press conference said that the government is planning to introduce a bill to revise the Foreign exchange laws to include crypto exchanges. Fumio Kishida, the newly elected prime minister of the country, also supported the proposed revision and called for coordinated moves with Western allies to enforce the new laws. Under the revised foreign exchange laws, crypto exchanges, just like banks, will be required to verify and flag transactions ass...

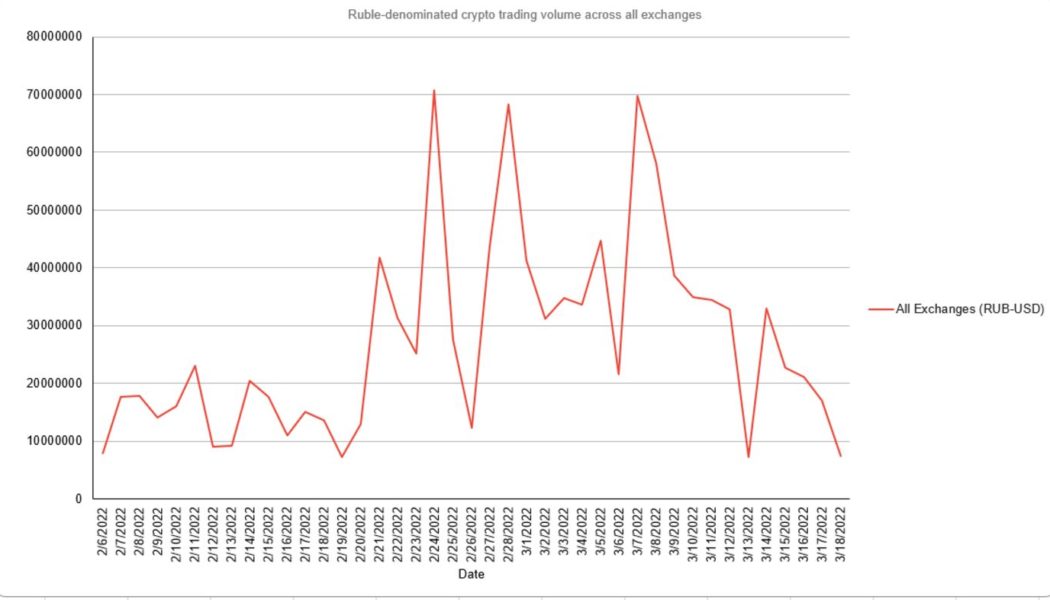

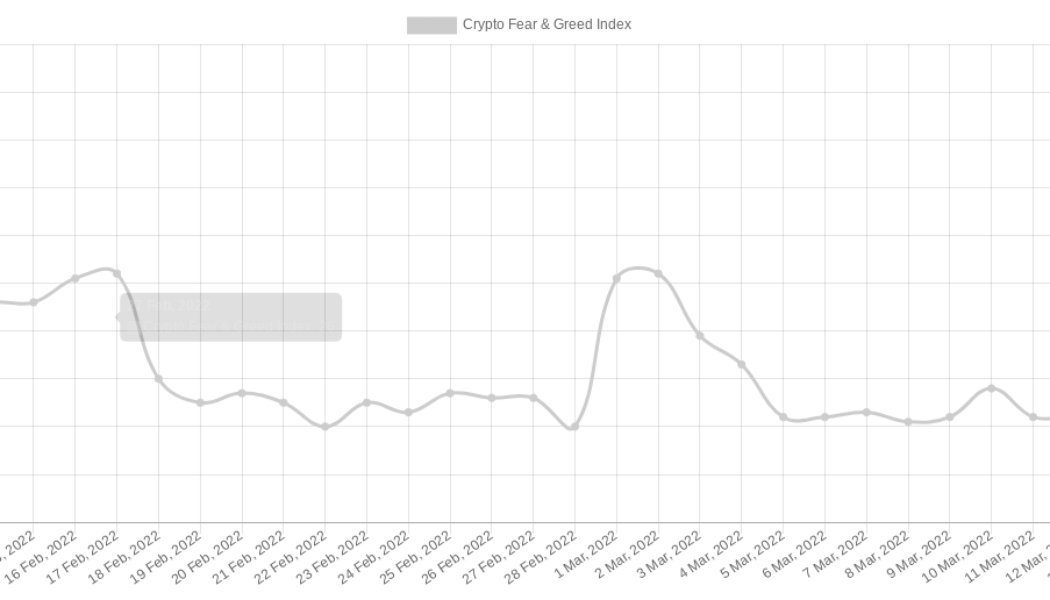

Crypto trading in rubles falls even as ECB warns again on sanctions

The President of the European Central Bank, Christine Lagarde has reiterated warnings that Russian individuals and businesses are using cryptocurrencies to skirt sanctions. However, as of March 18, daily ruble-denominated crypto trading volume was sitting at just $7.4 million, down over 50% from recent figures and a peak of $70 million on March 7, according to data from Chainalysis. This amount represents a tiny slither of the total global crypto market volume, with Bitcoin’s total daily volume generally fluctuating between $20 billion and $40 billion. In a presentation at the Bank for International Settlements Innovation Summit on Tuesday, the crypto skeptic Lagarde said that European financial authorities had seen the “volumes of rubles into stable, into cryptos, at the moment [is at] th...

Central Bank of Russia tightens P2P transactions monitoring, including those in crypto

The Central Bank of Russia (CBR) recommended that the nation’s commercial banks ramp up monitoring users’ transactions that could be aimed at circumventing CBR’s “special economic measures to counter the outflow of foreign currency abroad,” local media reported on Thursday. The recommendation includes closer oversight over crypto trading, which is named among the vehicles for withdrawing capital from Russia. The letter, sent to the banking organizations by CBR’s vice chairman Yuri Isaev on Wednesday, directs them to pay closer attention to the instances of their clients’ “unusual behavior.” This includes “abnormal” transactional activity and uncommon patterns of expenditures. Any withdrawals of money via digital currencies should also attract increased attention, the letter spec...

Central Bank of Russia issues digital asset license to Sberbank in apparent policy reversal

Less than two weeks after the Central Bank of Russia, or CBR, reiterated its position proposing to ban the issuance, mining and circulation of cryptocurrencies in Russia, it appears to have reevaluated its policy. In a press release published on Thursday, the CBR added the country’s biggest lender, Sberbank, to its register of information system operators for digital financial assets. As reported by local news outlet Tass, the CBR stated: “Inclusion in the registry allows companies to issue digital financial assets and exchange them between users within their platforms.” Sberbank’s blockchain platform is based on a distributed ledger technology, which can, theoretically, protect against information tampering. Legal entities on Sberbank will soon be able to issue digital financia...

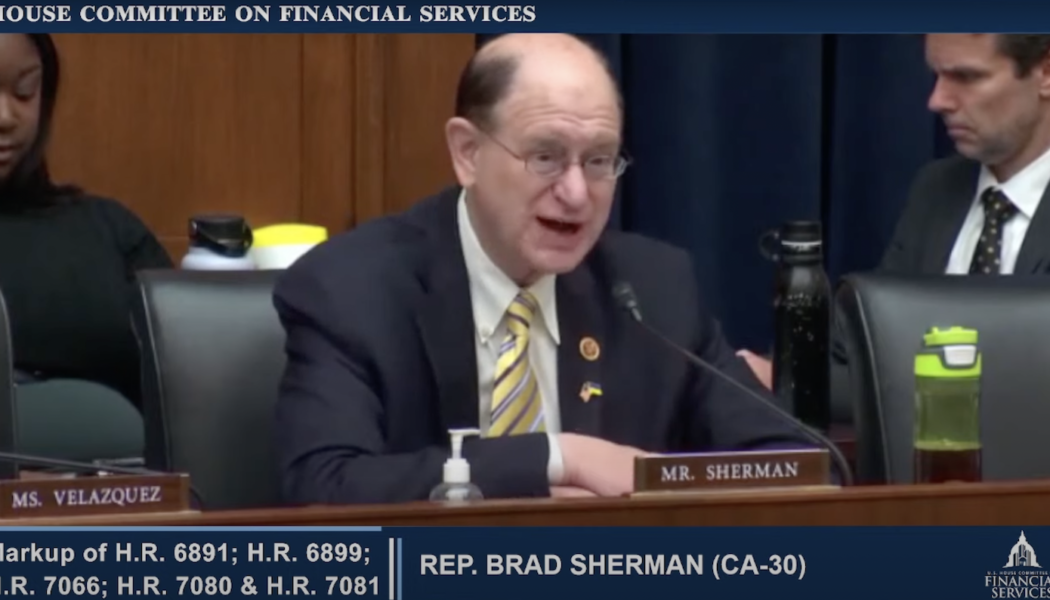

US lawmakers introduce bills that could force crypto exchanges to cut ties with Russian wallets

Representative Brad Sherman will be introducing a bill in the House aimed at cracking down on U.S. businesses handling crypto transactions for Russian banks and individuals. Speaking at a hybrid markup meeting with the House Financial Services Committee on Thursday, Sherman said he will be introducing a companion bill to Senator Elizabeth Warren’s legislation that would give the Biden administration “explicit authority to require that crypto exchanges that are subject to U.S. law stop facilitating transactions with Russian-based crypto wallets.” Warren first announced the legislation on March 8, later saying during a Senate Banking Committee hearing she will be introducing the bill on Thursday. Neither bill’s text is available through congressional records at the time of publication....

How blockchain intelligence can prevent Russia from evading sanctions

As pointed out by Caroline Malcolm, head of international policy at Chainalysis, the transparent nature of blockchain technology makes it relatively easy for crypto intelligence companies to track funds related to sanctioned entities. “We’re in quite a unique position because of the transparency and the permanency and the immutability of that public record,” explained Malcolm in an exclusive Cointelegraph interview. Governments around the world have expressed concerns that Russia could use crypto to evade sanctions imposed as a response to its military offensive against Ukraine. Addressing those concerns, Malcolm pointed out that in the last few years there has been substantial improvement in the crypto industry’s Anti-Money Laundering and counter-terrorism framewor...

Blockchain forensics firm finds millions in sanctioned crypto wallet

Blockchain security and forensics firm Elliptic has been working with authorities to expose crypto wallets affiliated with sanctioned individuals or organizations. The United Kingdom-based company has discovered a wallet with “significant crypto-asset holdings” in the millions of dollars that may be linked to sanctioned Russian officials and oligarchs. Speaking to Bloomberg on March 14, Elliptic co-founder Tom Robinson said that crypto could be used for sanctions evasion. However, it has been widely reported and generally accepted now that Russia is very unlikely to pivot to crypto assets to circumvent them. The report did not specify the exact value of the crypto in the wallet it discovered or the nature of the assets it held. Robinson added that the scale of the use of crypto is in...

Two years since the Covid crash: 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week struggling to preserve support as key macro changes appear on the horizon. In what could turn out to be a crucial week for Bitcoin and altcoins’ relationship with traditional assets, the United States Federal Reserve is set to be the main talking point for hodlers. Amid an atmosphere of still rampant inflation, quantitative easing still ongoing and geopolitical turmoil focused on Europe, there is plenty of uncertainty in the air, no matter what the trade. Add to that a failure by Bitcoin to benefit from the chaos and the result is some serious cold feet — what would it take to instil confidence? Just as it seems nothing could break the now months-old status quo on Bitcoin markets, which have been stuck in a trading range for all of 2022 so far, upcoming even...

US and EU double down on measures against Russia potentially using crypto to evade sanctions

The United States and the European Union have announced new actions targeting Russia’s economy and wealthy individuals as a report suggests Vladimir Putin’s allies have attempted to circumvent sanctions using cryptocurrency in foreign countries. In a Friday announcement, the White House said leadership from the United States, Canada, France, Germany, Italy, Japan, the United Kingdom and the European Union will take additional actions aimed at economically isolating Russia in response to President Vladimir Putin’s military invasion of Ukraine. The announcement includes banning imports of many Russian goods, banning the export of luxury goods to Russia and guidance for the U.S. Treasury Department to monitor the country’s attempts to evade existing sanctions. “Treasury’s expansive actions ag...

Ally or suspect? The war in Ukraine as a stress test for the crypto industry

It has been two weeks since Russia kicked off the first large-scale military action in Europe in the 21st century — a so-called “special operation” in Ukraine. The military conflict immediately triggered devastating sanctions against the Russian economy from the United States, the European Union and their allies and has put the crypto industry in a position that is both highly vulnerable and demanding. As the world watches closely, the crypto space must prove its own standing as a mature and financially and politically responsible community, and it must defy the allegations of being a safe haven for war criminals, authoritarian regimes and sanctioned oligarchs. Up to this point, it has been going relatively well. But despite reassurances from industry opinion leaders, some experts say that...

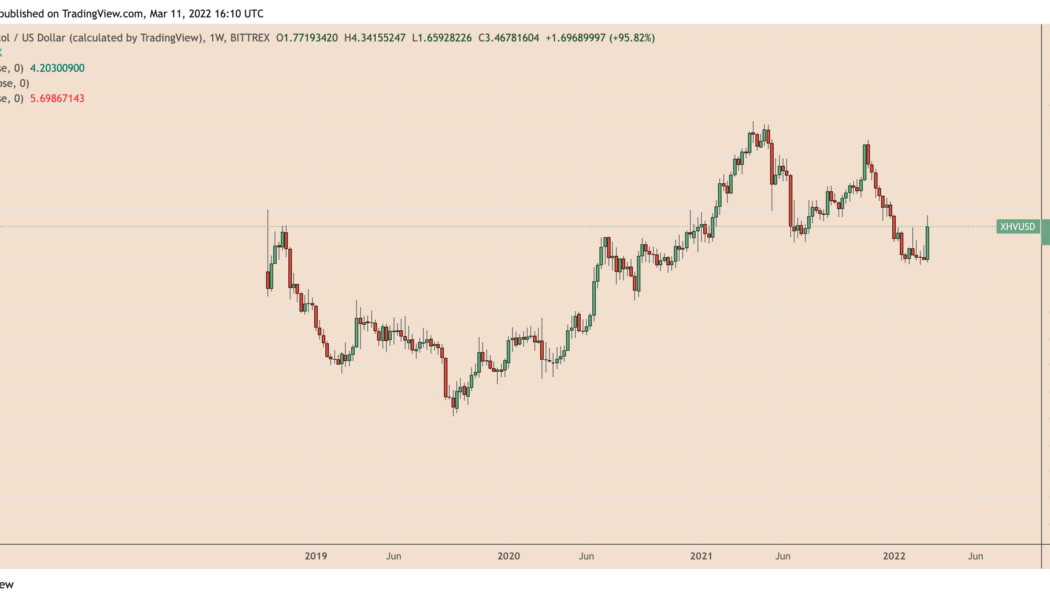

Haven Protocol (XHV) shows strong signs of bottoming out after crashing 90%

Haven Protocol (XHV) showed signs of returning to its bullish form as its price doubled in just five days of trading. What’s pumping Haven Protocol? XHV’s price surged by up to 107% week-to-date to climb above $3.60 on March 11, its highest level in more than three months. Interestingly, the move upside followed a period of aggressive selloffs that saw XHV’s value dropping from nearly $20 in November 2021 to as low as $1.60 in early February 2022 — an approximately 90% decline. XHV/USD weekly price chart. Source: TradingView Traders started returning to the Haven Protocol market against the prospects of two macroeconomic scenarios: U.S. President Joe Biden’s executive order that focuses on cryptocurrencies and hardline western sanctions on Russian oligarchs amid an ...

Bitfinex refuses to freeze crypto belonging to non-sanctioned Russians

Amid global businesses boycotting the Russian residents over military conflict in Ukraine, some companies in the cryptocurrency industry stand up for the rights of non-sanctioned Russian citizens. Bitfinex, an affiliate firm of the world’s largest stablecoin provider, Tether (USDT), will not unilaterally freeze the accounts of ordinary Russian customers as part of the global sanctions unless it’s forced to do so, a spokesperson for Bitfinex told Cointelegraph on Thursday. The representative emphasized that Bitfinex has taken appropriate action against the accounts of Russian users who have been sanctioned. “As with all our customer accounts, we work to ensure that there are no irregular movements or measures that might be in contravention of applicable international sanctions,” the s...