Sam Bankman-Fried

FTX showed the value of using DeFi platforms instead of gatekeepers

The rapid implosion of FTX has led general investors and crypto believers alike to question the validity of crypto and, indeed, predict its end. But, an understanding of history points not to crypto’s demise but rather a move toward new technology and growth. Financial markets move, as Willie Nelson once said, in phases and stages, circles and cycles. Companies develop ideas, grow quickly, ignite unwarranted investor euphoria and then implode — only to seed the ground for the next company, the next idea and the next growth phase. Crypto is no different. In 2010, an unknown person famously used Bitcoin (BTC) to buy pizza. After its initial launch, market capitalization grew to more than $12 billion when Mt. Gox’s 2014 hack and bankruptcy precipitated crypto’s first bear market. The ma...

My story of telling the SEC ‘I told you so’ on FTX

“I hate to say I told you so” is a phrase oft-repeated but rarely sincere. It’s a delightful feeling to claim credit for warning about a problem in advance. That’s a liberty I’m taking with federal financial regulators at the United States Securities and Exchange Commission. In January of this year, while serving as a member of the SEC Investor Advisory Committee that advises SEC Chairman Gary Gensler on crypto and other matters, I filed a petition with the SEC. I asked them to open a formal public comment about unique issues presented by crypto and other digital assets. I pointed to crypto custody and intermediary conflicts of interest as key issues the SEC should address. I called this fresh start a “Digital Asset Regulation Genesis Block” that would help the SEC improve crypto regulatio...

FTX fiasco means coming consequences for crypto in Washington DC

On Nov. 11, while the rest of the country was celebrating Veteran’s Day, Sam Bankman-Fried announced that FTX — one of the world’s largest cryptocurrency exchanges by volume — had filed for bankruptcy. Lawmakers and pundits quickly latched onto the rapid disintegration of FTX to call for more regulation of the crypto industry. “The most recent news further underscores these concerns [about consumer harm] and highlights why prudent regulation of cryptocurrencies is indeed needed,” said White House Press Secretary Karine Jean-Pierre. It remains unclear what exactly transpired at FTX. Reports indicating that between $1 billion and $2 billion of customer funds are unaccounted for are deeply troubling. Widespread consumer harm and indications of corporate impropriety only increase the likelihoo...

SBF’s lawyers terminate FTX representation due to conflicts of interest

Paul, Weiss, the law firm backing FTX CEO Sam Bankman-Fried (SBF) amid bankruptcy, renounced representing the entrepreneur, citing a conflict of interest. The decision to withdraw from representation after SBF’s tweets were found to disrupt the law firm’s reorganization efforts. Starting Nov. 14, SBF published a series of tweets that amassed extensive attention across Crypto Twitter. The move, however, sparked speculations that the cryptic tweets were used to distract bots from noticing concurrently deleted tweets. While no ill-intent could be concluded, Paul, Weiss attorney Martin Flumenbaum believed that SBF’s “incessant and disruptive tweeting” was negatively impacting the reorganization efforts: “We informed Mr. Bankman-Fried several days ago, after the filing of the FTX bankruptcy, th...

Bankrupt crypto exchange FTX begins strategic review of global assets

As part of the recent bankruptcy filing, the defunct crypto exchange FTX, along with 101 of the 130 affiliated companies, announced the launch of a strategic review of their global assets. The review is an attempt to maximize recoverable value for stakeholders. FTX, at the time led by CEO Sam Bankman-Fried (SBF), filed for Chapter 11 bankruptcy on Nov. 11 after being caught misappropriating user funds. The bankruptcy filing sought to cushion the losses of stakeholders connected to FTX and affiliated companies, a.k.a FTX debtors. 1/ Sharing a Press Release issued early today – FTX launches strategic review of its global assets. Text below (and link). https://t.co/wxz9MYnXrn — FTX (@FTX_Official) November 19, 2022 FTX debtors are in talks with financial services firm Perella Wein...

I predicted FTX’s collapse a month before it happened

The collapse of FTX has shown that where there’s smoke, there’s fire. In a year filled with jaw-dropping unveilings, none compare to the bewildering fall of Sam Bankman-Fried’s FTX exchange. While many were stunned, there were a few tell-tale signs that may have indicated not everything was peachy-perfect over at FTX headquarters. These issues began to compound and, on Oct. 5, I published a detailed commentary about my decision to begin pulling funds out of FTX and short FTT. Im taking all of my capital out of @FTX_Official and going short $FTT FTX has been swinging and missing all year long on so many activations AND Something shady is going on at FTX. Here’s 12 reasons why I’m completely out on the FTX mafia and @SBF_FTX: [1/20] pic.twitter.com/ECrhQn5Rjx — Ishan B (@Ishanb22...

Ripple to consider deals for FTX assets: Brad Garlinghouse

Ripple CEO Brad Garlinghouse is reportedly interested in buying certain parts of collapsed crypto exchange FTX. On the sidelines of Ripple’s Swell conference in London — was held on Nov. 16 and 17 — Garlinghouse told The Sunday Times that former FTX CEO Sam Bankman-Fried called him two days before the company filed for bankruptcy as he sought to round up investors to rescue the business. Our 6th annual #RippleSwell is underway! I took the stage this morning with @cnbcKaren to discuss all things Ripple, crypto utility, macroeconomic factors affecting crypto, and much more. A thread… pic.twitter.com/EDHW3nyka8 — Brad Garlinghouse (@bgarlinghouse) November 16, 2022 The Ripple CEO said that during the call, the two discussed if there were FTX-owned businesses that Ripple “would want to own.” “...

FTX illustrated why banks need to take over cryptocurrency

FTX — the three letters on everyone’s lips in recent days. For those active in the crypto space, it has been a shattering blow as a tumultuous year for crypto nears an end. The repercussions are severe, with over a million people and businesses owed money following the collapse of the crypto exchange, according to bankruptcy filings. With investigations into the collapse ongoing, it will certainly push forward regulatory changes, either via lawmakers or through federal agencies. While regulators may feel relieved that the scandal didn’t occur under their supervision, it highlights that there simply hasn’t been enough action taken yet by regulators across the globe toward crypto exchanges, many of whom would welcome clear frameworks by those in power. Related: Bankman-Fried misguided ...

FTX leadership pressed for information by US subcommittee chairman

The former and current CEOs of the bankrupt FTX cryptocurrency exchange have been pressed by the chair of a United States House subcommittee calling for documents relating to the exchange’s finances. “FTX’s customers, former employees, and the public deserve answers,” Raja Krishnamoorthi, Chairman of the Subcommittee on Economic and Consumer Policy wrote in a Nov. 18 letter addressed to both former FTX CEO Sam Bankman-Fried and the exchange’s current CEO John J. Ray III, who took over in the wake of FTX’s bankruptcy filings. Krishnamoorthi added the subcommittee was “seeking detailed information on the significant liquidity issues faced by FTX, the company’s abrupt decision to declare bankruptcy, and the potential impact of these actions on customers who used your exchange.” He...

FTX is done — What’s next for Bitcoin, altcoins and crypto in general?

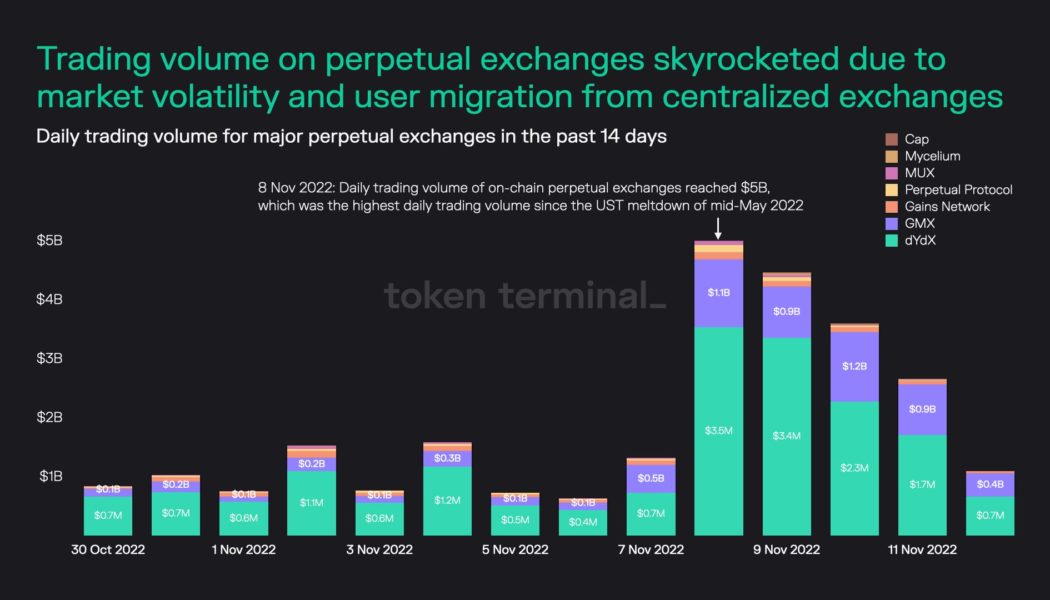

2022 was a tough year for crypto, and November was especially hard on investors and traders alike. While it was incredibly painful for many, FTX’s blowup and the ensuing contagion that threatens to pull other centralized crypto exchanges down with it could be positive over the long run. Allow me to explain. What people learned, albeit in the hardest way possible, is that exchanges were running fractional reserve-like banks to fund their own speculative, leveraged investments in exchange for providing users with a “guaranteed” yield. Somewhere across the crypto Twitterverse, the phrase “If you don’t know where the yield comes from, you are the yield!” is floating around. This was true for decentralized finance (DeFi), and it’s proven true for centralized crypto exchanges and platforms...

Crypto industry was ‘judge, jury and executioner’ for FTX: Pompliano

Prolific podcaster and cryptocurrency investor Anthony Pompliano has not lost faith in people or the crypto industry despite the disappointing conduct of former FTX CEO Sam Bankman-Fried. Bankman-Fried, once widely regarded as crypto’s “white knight” is now a pariah in the crypto industry due to — by his own admission — the “careless” mishandling of FTX customer funds and his ongoing strange behavior on Twitter. Appearing on Nov. 17 at the Texas Blockchain Summit, Pompliano was asked about how to ensure high-quality representation “in the halls of power,” responding that market forces eliminate bad people as quickly as bad businesses: “It might be a little counterintuitive, but the free market is a hell of a fucking referee. If you watch what just happened, this industry is who held the in...

DeFi Pioneer Echoes SBF in Call for Tighter Crypto Regulations

Respected former decentralized finance (DeFi) project founder and developer Andre Cronje has resurfaced after a lengthy hiatus to call for tighter regulations on the crypto sector amid the implosion of multiple firms this year. The comments echo similar sentiments to that of FTX CEO Sam Bankman-Fried (SBF), who also called for more stringent digital asset industry standards last week, including greater consumer protections, transparency and disclosures. SBF was met with strong community pushback, however, with many people accusing the CEO of trying to monopolize or censor the DeFi space, among other things. In an Oct. 25 blog post titled “The Crypto Winter of 2022,” Cronje called for greater regulation of the sector, noting that “the recent decline of the crypto-market has shown the f...