Sam Bankman-Fried

Crypto Fraudster Sam Bankman-Fried Says Diddy Is “Kind” Behind Bars

While we're glad to hear that Diddy is in good spirits while behind bars, we just hope that Fried doesn't end up getting shaken down for some "chon chon" at some point on some 'Blood In Blood Out' sh*t. Just sayin'.

Sam Bankman-Fried Found Guilty In FTX Fraud Case

Sam Bankman-Fried could face over 100 years in prison according to federal sentencing guidelines, although experts expect less time.

Sam Bankman-Fried Found Guilty In FTX Fraud Case

Sam Bankman-Fried could face over 100 years in prison according to federal sentencing guidelines, although experts expect less time.

Former FTX US president raises $5M for new crypto software firm

Brett Harrison departed FTX US roughly two months before FTX Group filed for bankruptcy, citing “cracks” in his relationship with SBF. News Own this piece of history Collect this article as an NFT The former head of FTX US is launching a new cryptocurrency software company and has raised $5 million from several investors, according to Bloomberg. Brett Harrison, who served as president of FTX US between May 2021 and September 2022, has received backing from Coinbase Ventures and Circle Ventures to launch a new software startup. SALT Fund, Motivate VC, P2P Validator, Third Kind Venture Capital, Shari Glazer of Kalos Labs and Anthony Scaramucci also participated in the seed round. His new startup, dubbed Architect, will develop trading software for large institutions looking...

Crypto Biz: SBF’s newest Excel spreadsheet reveals all

Large enterprise businesses spend tons of money keeping track of their financial dealings — think accountants, financial analysts, consultants and enterprise-grade accounting software. Sam Bankman-Fried, meanwhile, used Microsoft Excel. On Jan. 17, in another sloppy Excel spreadsheet, SBF revealed that FTX US was solvent. The Excel file purportedly showed customer balances, bank deposits and assets held in cold storage. “S&C forgot to include bank balances” of roughly $428 million, SBF said, referring to FTX’s former legal counsel Sullivan & Cromwell. “Once you add those back in, you get in the neighborhood of my prior balance sheet” of around $350 million, he said. This week’s Crypto Biz explores the “Herculean investigative effort” to identify billions in liquid FTX assets....

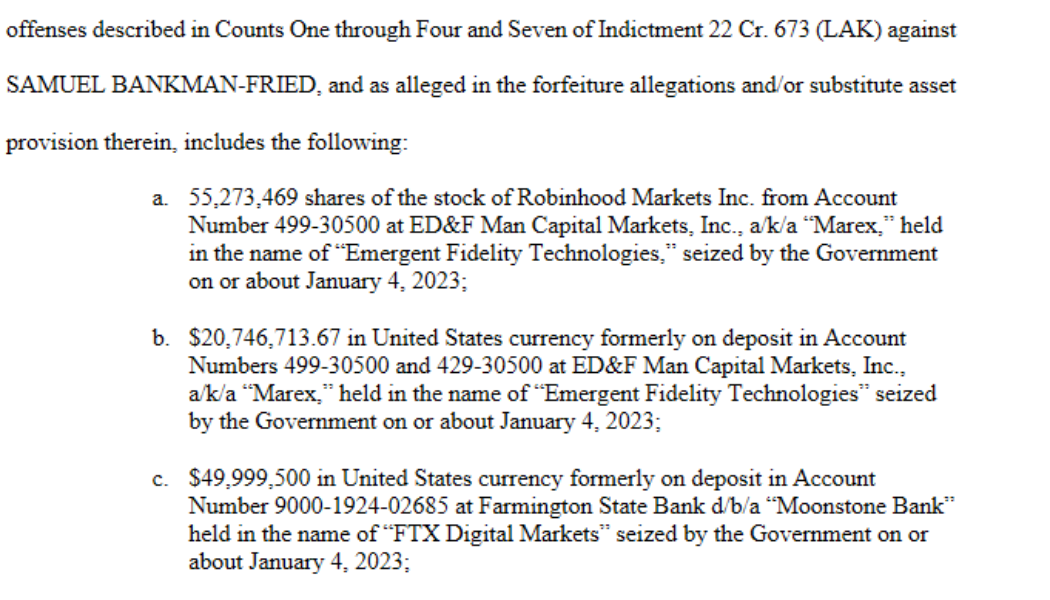

SBF to forfeit $700M worth of assets if found guilty of fraud

According to new court filings, disgraced FTX founder Sam Bankman-Fried (SBF) will be subject to the forfeiture of roughly $700 million worth of assets if he were to be found guilty of fraud. In a court document filed on Jan 20, U.S. federal prosecutor Damian Williams outlined that the “government respectfully gives notice that the property subject to forfeiture” covers a long list of assets across fiat, shares and crypto. The filings state that most of the assets were seized by the government between Jan.4 and Jan. 19, while it is also looking to lay claim to “all monies and assets” belonging to three separate Binance accounts. Looking at the list of seized assets, the biggest allocations include 55,273,469 Robinhood (HOOD) shares worth roughly $525.5 million at the time of writing, $94.5...

FTX VCs liable to ‘serious questions’ around due diligence — CFTC Commissioner

Amid ongoing investigations around the defunct crypto exchange FTX, the Commodity Futures Trading Commission (CFTC) questions the due diligence conducted by institutional investors and their accountability regarding the loss of users’ funds. CFTC Commissioner Christy Goldsmith Romero stated that VCs that had to write down their investments in millions of dollars to nearly zero raises “serious questions” about the due diligence conducted over the last year, speaking to Bloomberg. CFTC Commissioner Christy Goldsmith Romero questioning the VCs that once backed FTX. Source: Bloomberg She raised concerns about FTX CEO John Ray’s revelations in court about not having any records and controls over the exchange’s financials. I’m glad Mr. Ray is finally paying lip service to turning the excha...

FTX bankruptcy lawyer: debtors face ‘assault by Twitter’ stemming from Sam Bankman-Fried

James Bromley, one of the lawyers representing debtors in FTX’s bankruptcy case, has criticized social media activity against his law firm promulgated by posts from former CEO Sam Bankman-Fried. In a Jan. 20 hearing in the District of Delaware, lawyers spoke on motions dealing with potential conflicts of interest between Sullivan & Cromwell, the law firm tasked with the investigation of FTX’s bankruptcy, and the crypto exchange. Bromley, a partner at Sullivan & Cromwell, pushed back against the narrative that the law firm would be unable to act as a disinterested examiner given it had previously provided legal services to FTX and one of its former partners, Ryne Miller, went on to become the FTX US lead counsel. On Jan. 19, former FTX chief regulatory officer Daniel Friedberg filed...

FTX-linked Moonstone bank to exit the crypto space

Moonstone Bank, a rural Washington state bank that received an estimated $11.5 million investment from FTX’s sister company, Alameda Research, says that it will be exiting the crypto space and returning to its “original mission” as a community bank. In a Jan. 18 statement, the bank said that the change in strategy comes as a result of “recent events in the crypto assets industry and the changing regulatory environment surrounding crypto asset businesses.” As part of the bank’s initiative to “return to its roots,” it said that it will no longer use the name Moonstone Bank and will be rebranding and re-adopting the Farmington State Bank name, known in the local community for 135 years. According to the bank, the change is estimated to take effect in the coming weeks and loca...

FTX CEO says he is exploring rebooting the exchange: Report

John Ray, who took over as CEO of cryptocurrency exchange FTX prior to bankruptcy proceedings, has reportedly set up a task force to consider restarting FTX.com. According to a Jan. 19 report from the Wall Street Journal, Ray said everything was “on the table” when it came to the future of FTX.com, including a potential path forward with rebooting the exchange. FTX Trading, doing business as FTX.com, was one of roughly 130 companies under FTX Group that filed for Chapter 11 bankruptcy in November 2022. Ray reportedly was considering reviving the crypto exchange as part of efforts to make users whole. FTX reported on Jan. 17 that it had identified roughly $5.5 billion of liquid assets in its investigations, with more than $3 billion owed to its top 50 creditors. According to the FTX CEO, he...

FTX profited from Sam Bankman-Fried’s inflated coins: Report

Sam Bankman-Fried, the former CEO of the FTX crypto exchange, used his influence in the crypto industry to inflate some coins prices through a coordinated strategy with FTX’s sister company, Alameda Research, a New York Times report claimed on Jan. 18. As a way to keep FTX and the companies under its umbrella profitable, Bankman-Fried allegedly approached developers behind projects, insisting that they make their trading debuts on the exchange’s platform. Following that, the report claimed, Alameda Research would buy some of these freshly listed coins to raise their value. Bankman-Fried thenallegedly relied on his popularity to advertise the projects and persuade the crypto community to invest in these “Samcoins.” As a result, Alameda appeared to be in a stronger position than it actually ...

FTX fallout: SBF trial could set precedent for the crypto industry

After the collapse of major cryptocurrency exchange FTX in November 2022, former CEO Sam “SBF” Bankman-Fried was arrested by Bahaman authorities on Dec. 12. Just a day later, the United States Securities and Exchange Commission and Commodity Futures Trading Commission filed charges against him for allegedly defrauding investors and violating securities laws. On Dec. 22, Bankman-Fried was granted bail on a $250 million bond paid by his parents against the equity in their house. The bail order added that he would require “strict pretrial supervision,” including mental health treatment and evaluation. The former CEO faces eight criminal counts in the United States, which could result in 115 years in prison if convicted. Bankman-Fried had been under house arrest at his parent’s home in Califor...